The average Aspiration Bank review focuses heavily on all the good they do as a company, and this one is no different.

After all, Aspiration Bank has more programs designed to help save the world than just about anyone, which is an absolutely FANTASTIC reason to use them over a normal bank.

However, you shouldn’t feel like you’re sacrificing any value in order to use a “nicer” company – Aspiration Bank has plenty of reasons why they’re a great bank regardless of all the social programs they support.

So, while this Aspiration Bank review will go over every way that both you and Aspiration can use their services to help people, it will also go over how Aspiration can improve your OWN financial situation!

About Aspiration Bank

Aspiration Bank is a financial services firm based out of Marina Del Rey, California. It was founded in 2013 by Andrei Cherny and Joseph Sanberg and officially opened up in 2015.

From the start, Aspiration wanted to do things differently. Most banks are known for being cold, heartless, corporate monsters – and Aspiration wanted to change that.

Here are some of their mission statements that can be found on their site:

“We didn’t set out to build a bank. We set out to build a better world.”

“We’re not just a company — we’re a community.”

“Big Banks and Wall Street work their hardest for the wealthiest few. At Aspiration, we work to bring the best financial solutions to everyone.”

The truly unique thing about Aspiration Bank is that those aren’t just empty statements – as we will see shortly, they actually mean what they say.

How Does Aspiration do Good?

Aspiration takes part in tons of programs designed to make the world a better place and incentivizes you to take part as well. The below diagram of the Aspiration Giving Tree does a good job summarizing the giving process at a high level:

Let’s dig deeper into some specific giving programs that Aspiration has in place.

Dimes Worth a Difference

The “Dimes Worth a Difference” program is a commitment to donate 10% of all money earned to charities designed to help improve people’s lives at the community level.

Their primary giving partner, Accion, is America’s largest nonprofit provider of microloans.

Microloans are loans up to $5,000 for people living in poverty. These loans are designed to help low-income people start a business and escape from poverty for good.

When one of these loans is given, recipients aren’t hung out to dry – they also receive mentorship and financial education designed to help them make the most of their loans. This has led to 97% of businesses started through an Accion loan remaining open for at least a year.

Aspiration Impact Measurement (AIM) Scores

Aspiration calculates an AIM score that attempts to measure how well a company does regarding taking care of People and taking care of the Planet.

In total, over 75,000 environmental, social, and governance data points across thousands of businesses are used to calculate a business’s AIM score.

Specifically, the People portion takes into account metrics like employee pay, diversity, and job safety at a given company, while the Planet portion looks at metrics such as greenhouse gas emissions and energy efficiency resulting from that company’s operations.

Aspiration heavily incentivizes you to shop at businesses with high AIM scores by giving you very high cashback rates at these businesses.

(Specific details regarding how much cashback you get will be discussed later on in this Aspiration Bank review – as promised, this review will cover both the OVERALL good that Aspiration does and the good that they can do for you.)

In addition, based on the businesses that you choose to shop at, Aspiration calculates your OWN personal AIM score. This is a great way to track how much you’re helping the world by choosing friendly places to shop.

You can easily give to charity and claim tax deductions

Ever wanted to give some money to charity, but weren’t sure where to start? Aspiration makes that process EXTREMELY easy.

Aspiration provides links to verified nonprofit organizations in each of the following categories:

- Poverty

- Clean water

- Education

- Environment

- Health

- Human rights

- Aspiration Operation Fund (for small business microloans)

They also provide a built-in tracker that tracks how much you gave to each charity. This helps when trying to claim a tax deduction: Since all the money you give is tracked and going to verified nonprofits, getting the deduction will be much simpler than usual.

Another way you can give is by taking advantage of Aspirations’s “Plant your Change” program. If turned on, Aspiration will round up every transaction to the next dollar, and donate the change that was rounded up to fund the planting of trees.

Aspiration Bank Review: Using Aspiration

Now that we know all about how Aspiration is trying to make this world a better place, let’s talk about the actual experience of using them as your bank.

Opening an account

Opening an account at Aspiration is easy.

For starters, similar to other online banks, there aren’t too many eligibility requirements – as long as you’re 18, live in the U.S, and have a Social Security number, you’re good to go.

One notable requirement to joining: You have to already have a bank account somewhere other than Aspiration. This is because Aspiration requires an initial deposit of $10 to open your account, and since this bank is online-only, that initial deposit needs to come from another bank account.

When signing up, Aspiration Bank will ask for the following information:

- Name

- Address

- Date of Birth

- Social Security Number

- Email Address

Then, Aspiration Bank reviews your information and gets back to you within a couple of days with their approval decision.

And that’s all there is to it! As you’ll see, using Aspiration Bank is a very simple and elegant process.

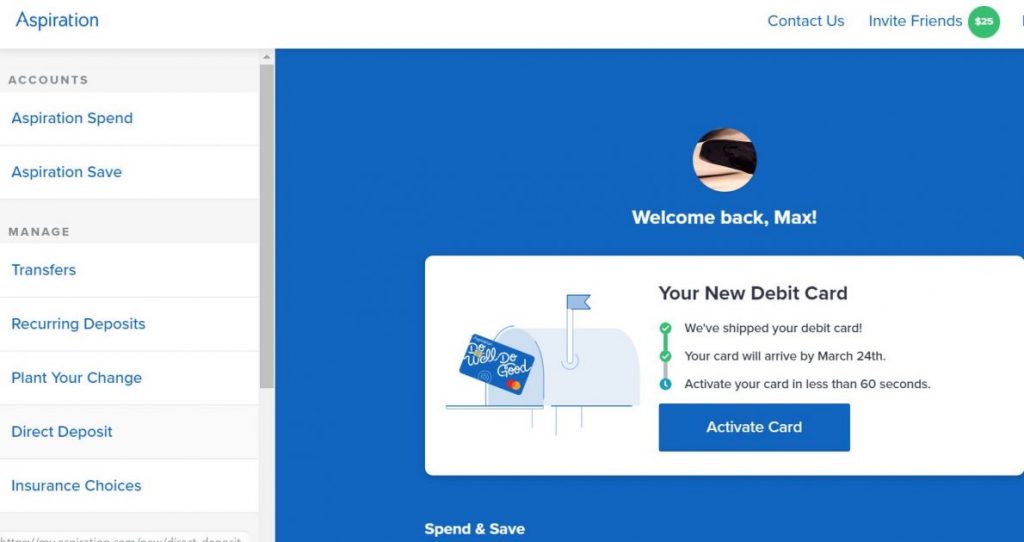

User Interface/Ease of Use

Aspiration is, in general, a breeze to use. With both a desktop option and apps for Apple and Android, you can easily use Aspiration Bank regardless of what platform you prefer.

The main screen on the desktop version shows you general information about your account, such as your current balance for each of your Aspiration accounts. This provides a quick, simple look into your finances in Aspiration Bank.

On the left side of the screen, you’ll find a menu bar that can be used to access more details. You can use this menu bar to do simple actions like:

- Look at previous transactions

- Transfer money

- Give money to charity

- View your past charity transactions

- View insurance options

- Find an ATM

In general, everything you can do with Aspiration Bank is easy to find and usually just a click or 2 away.

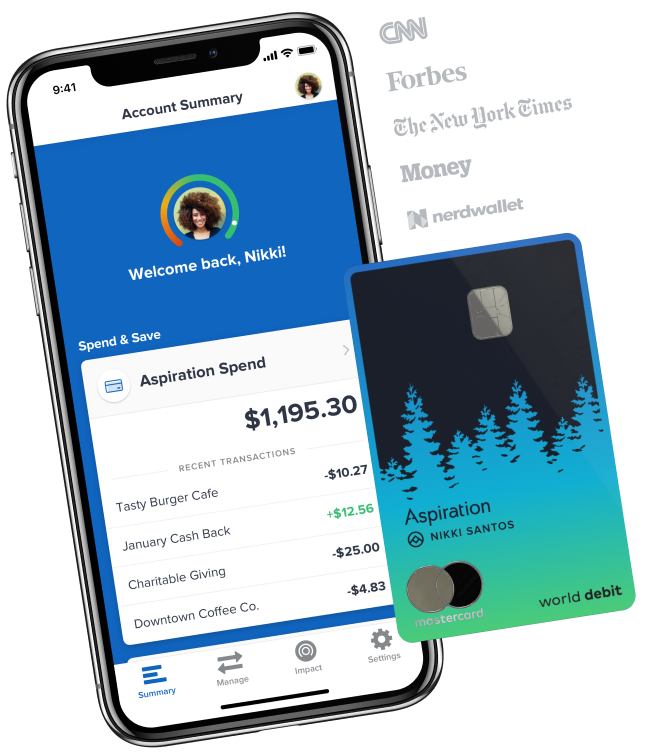

Mobile App

With the Aspiration Bank mobile app, you can:

- Deposit checks

- View account summaries Deposit checks

- Check the value of investment accounts

- Buy or Sell Aspirations’ Redwood Fund (more on this later)

- Send money using Bill Pay

When depositing checks, keep in mind that any check over $5,000 must be physically mailed to Aspirations’ partner bank – Coastal Community Bank – after depositing through the app.

One note about Bill Pay – You currently aren’t able to send money digitally. Instead, after scheduling a payment, Aspiration sends a paper check to the payee, which will obviously take much longer than a digital transaction would – expect the check to arrive in 5-7 business days.

While credit card companies and the link can digitally take OUT money from your Aspiration account, you cannot digitally choose to SEND money – at least at the moment. This is a feature that is currently being worked on, so hopefully the option will be available soon.

Aspiration Bank Review: Types of accounts

Aspiration currently has 3 account options – a Spend & Save account that acts as a joint checking/savings account, a taxable brokerage account, and an IRA.

Let’s go over each of these account types and discuss the unique features Aspiration Bank offers.

Spend and Save

These are technically 2 different accounts, but for all intents and purposes act as a single account.

Spend is Aspiration’s version of a checking account, and Save is their version of a savings account.

There’s no way to have one without the other, but while Spend has a $10 minimum balance, your Save account doesn’t have any minimum balance requirements, so you can ignore it if you’d rather keep your money elsewhere.

In addition, you get up to 50 free, instant transfers between Spend and Save each day, allowing you to take advantage of the benefits of a savings account while keeping the liquidity of a checking account.

You also get 1 free transfer to an external bank account per day, compared to the industry standard of 6-7 transfers per month that a lot of banks hold you too.

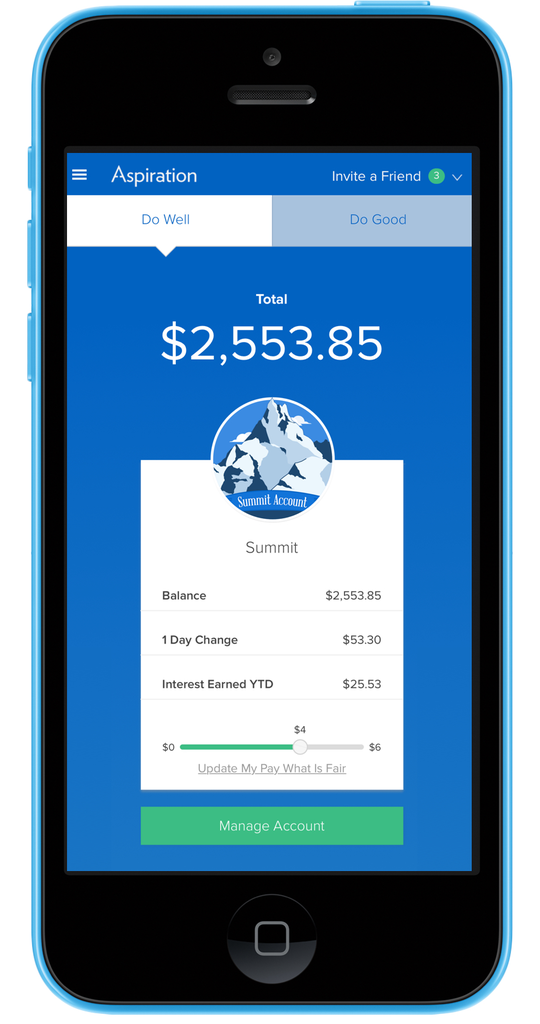

How Much Interest do I Earn with Save?

If you want to earn interest with Aspiration Save, you’ll need to pay for Aspiration Plus, which costs $3.99 per month or $44.99 per year.

Signing up for Aspiration Plus gives you access to:

- earning interest

- extra cashback

- one out of network ATM fee reimbursed per month

- Planet Protection, which automatically provides carbon offsets for every gas purchase

With Aspiration Plus, you earn .25% interest on your first $10,000, and .1% on the rest of your balance.

Additionally, if you spend $1,000 in a month, your interest will increase to 1% on your first $10,000 for that month!

Cash Back

You can receive Cash Back whenever you shop with Aspiration’s Debit card. How much Cash Back you earn depends on the company’s AIM score (discussed above).

Companies with the highest AIM scores, like Adobe Systems, Apple, and AT&T, provide .5% cashback.

However, certain companies earn even more than that.

Any company that is part of the Conscience Coalition, which is a group of companies united around the common belief that we have a responsibility to not only build strong businesses but also to help build a better world, earns 3-5% cashback with a free Aspiration account, and 10%(!!!) with Aspiration Plus.

Here’s a list of the companies in the Conscience Coalition:

5% cash back:

- Reformation

- Warby Parker

- United By Blue

- Parachute Home

- Causebox

- LOLA

4% cash back:

- TOMS

- Known Supply

- Soapbox

3% cash back:

- Arcadia Power

- Feed Projects

- This Bar Saves Lives

- Wag Walking

- Blue Apron

- Girlfriend Collective

Those numbers are what you’ll earn if you have a free Aspiration account. Aspiration Plus members will earn 10% on each of these companies, which is a HUGE incentive to do your shopping at these members whenever possible.

Aspiration Bank Review: Fees

In general, there aren’t any fees for Aspiration (other than Aspiration Plus). However, Aspiration uses a “pay what you think is fair” model, so you can choose to pay them something if you so choose.

This means there are no monthly service fees, no overdraft fees, no stop payment fees, no withdrawal fees, and no ATM fees for any ATMs in the Allpoint network.

However, there are some fringe services that you will have to pay for. Aspiration is charged for these services, and passes them on to you at cost.

Here is a list of the fees you will have to pay when using Aspiration:

- $.82 for an incoming or outgoing wire transfer

- $2.50 for incoming international and $15.00 for outgoing international wire transfers

- Returned checks ($1.15 for items $4,999.99 and less or $5.33 for items of $5,000 or greater)

- $35 expedited debit card fee.

- Mastercard charges a 1% foreign transaction fee, and Aspiration does not reimburse it.

- Out of network ATM fees. Aspiration Plus members get 1 out of network ATM fee refunded per month. International ATMs are reimbursed at a flat $4 rate, but if you’re charged more than that you can send a picture of the receipt to Aspiration and they’ll refund the rest.

Investment Accounts

Another type of account you can get with Aspiration is an investment account.

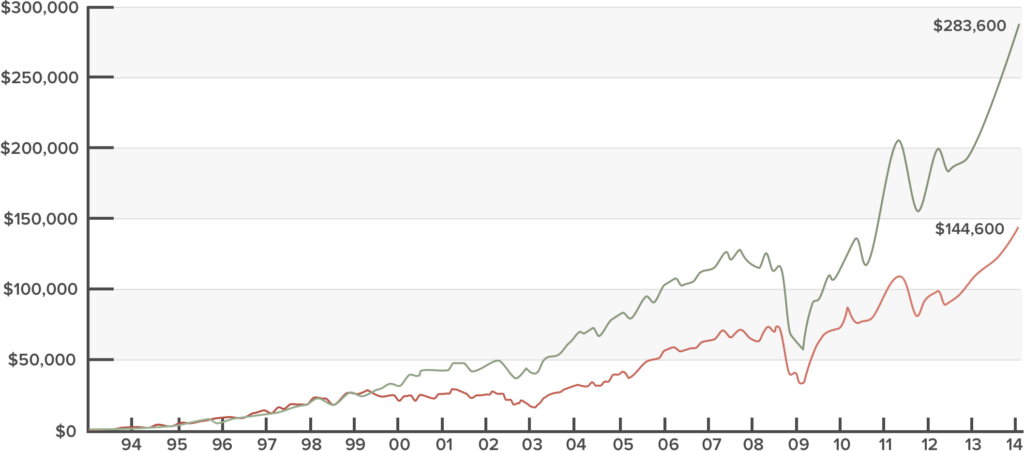

When investing with Aspiration, you are limited to buying their Redwood fund (REDWX), which is managed by UBS Asset Management.

Here is what Aspiration’s website says about the fund:

“The Aspiration Redwood Fund is a mutual fund whose goal is to help you build value in your portfolio and honor your values – all at the same time. It is built on the belief that investing in companies that combine strong fundamentals, with a long-term business model emphasizing sustainable environmental, social, and governance (ESG) practices, will bring investment results that may beat the S&P 500 index. While there’s never any guarantee when you invest in a mutual fund or invest in the stock market generally, we are aiming for investment decisions in core values that will pay off down the line.”

So, when buying this fund, you can both hope for good performance, and feel good about making a difference – which is a theme for Aspiration in general.

Regarding fees, there are no:

- Front load fees

- Back load fees

- Per transaction fees

- Performance fees

- Redemption fees

There IS a .5% operating fee. This is slightly higher than you can find at Robo-advisor style brokerages but less than you would pay for someone to actively manage your stocks.

Keep in mind that there is a $10 minimum for this account. If the balance temporarily falls under $10 because of your fund performance that’s ok, but if you withdraw from the account make sure to leave at least $10 in.

Aspiration Bank Review: Retirement accounts

Aspiration also allows you to buy the Redwood fund within an IRA account.

This account will be a traditional IRA, so it has all the added benefits and restrictions of a normal IRA.

All the same rules regarding fees and minimum balances apply here as well.

Using Aspiration Bank internationally

To use your Aspiration debit card while outside of the US, enable international debit card usage in the settings page. Log in, click “Settings” on the left side of the page, then click “International Travel.

If you have a digital card, it works like a physical card internationally, but details won’t load in the mobile app while you’re overseas. Adding a digital debit card to Apple, Samsung, or Google Pay before your trip will make it so you can easily use it abroad.

When international travel is enabled, you will be able to make transactions in most countries, other than a few that are restricted.

Here’s a list of the restricted countries that you can’t use your Aspiration debit card in:

- Albania

- Belarus

- Bosnia Herzegovina

- Cuba

- Democratic People’s Republic of Korea

- The Democratic Republic of the Congo

- Iran

- Iraq

- Kosovo

- Lebanon

- Libya

- Macedonia

- Montenegro

- Serbia

- Somalia

- South Sudan

- Sudan

- Syria

- Turkey

- Ukraine

- Venezuela

- Yemen

- Zimbabwe

In every other country, your Aspiration card will work perfectly.

Other Aspiration benefits

Aspiration has a bunch of side features that they offer in addition to their main products. Here’s a quick list of other cool features they offer that you can take advantage of:

- Free paper checks

- Identity theft protection

- Up to $600 in free cell phone protection if you pay your cell phone bill through Aspiration

- Up to 2 million in FDIC insurance, meaning your money is safe and protected at all times

Customer Service

Aspiration has 7-day phone support, which is really nice. Weekdays they’re available from 6 AM – 6 PM PT, and weekends from 8 AM – 4 PM PT.

In addition, they have an extremely helpful FAQ section on their site. When researching for this article, I typed in tons of questions into their search bar and was always able to find the answers I was looking for.

Aspiration Bank Review: Bottom Line

Aspiration Bank has a lot to offer. As a bank that actually cares about the world, they are unique and in a prime position to appeal to a younger, more socially conscious generation.

They haven’t forgotten about YOU, either. 1% interest rates are very competitive, and their cashback rates are top-notch – especially when you consider that you get those rates from a DEBIT card, not a credit card.

The low (usually 0) fees are nice, the site is a pleasure to use, and the customer service is solid as well.

So, if you want to try to improve the world a bit while also getting great services from an online bank, give Aspiration Bank a try. As you’ve seen throughout this Aspiration Bank review, you won’t regret it.