Before getting started with this Chime Bank review, let’s talk a bit about online banking.

Like other online banking options, switching to Chime Bank means you will have lower fees, more convenience, and simple-to-use websites and apps to help take care of your banking needs.

Due to their convenience, online banks are constantly gaining popularity amongst both savers and spenders.

In fact, a statistic from Juniper Research claims that by 2024, the number of digital banking users will exceed 3.6 billion! In case you haven’t jumped on the bandwagon yet, I recommend trying Chime Bank.

Chime Bank is an awesome and free way to enter the world of mobile banking. In this Chime Bank review, we’ll go over both the pros and cons of using them as your bank.

By the end of this review, you should know everything you need to know to help guide your decision on whether Chime Bank is right for you.

What is Chime Bank?

Chime Bank is an online-only banking solution with no physical branches. This reduces overhead fees, allowing them to offer you banking services free of charge!

Simply put, Chime Bank lets you do all your banking on your phone or on the web. It comes with a Visa debit card, too.

Through Chime Bank, you can pay bills, pay for your shopping expenses, save money, earn from interest, withdraw, and deposit money, and handle all the rest of your banking needs, free of charge!

Getting started with Chime Bank

The best thing about a branch-less bank is that you do not need to head across town to sit down and fill out forms.

Once on Chime’s website or app, sign up with your email address. Chime then takes you to a minimalist-looking landing page where you will be asked to provide your basic information such as name, address, and phone number.

Currently, Chime is limited to US citizens, and it will only accept US addresses and phone numbers. In order to create an account, you NEED a valid US Address.

That’s it! You now have an account with Chime.

Seems too easy? I thought so too. We’ve been conditioned to think that signing up for a bank requires hours of paperwork and stress, but that’s not true at all with Chime.

The next thing to do is to check out all of Chime Bank’s awesome features and get into the pros and cons of their online-only platform.

Using Chime Bank

Once you’re officially a Chime Bank user, it’s important to get familiar with the features and toggles around the app or website.

The best way to do this is to just start using it – everything is extremely intuitive within the app.

On your phone, opening the app will prompt a security password or fingerprint request. (You might need to set this up in the settings if it’s your first time using the app).

Obviously, make sure to set a secure password so that your information stays safe.

Once you’re in, you are greeted with Chime’s home page, where you will be able to see the balance on both your “Spending Account” and “Savings Account”

These accounts are pretty much what they sound like – the Spending Account is your standard Checkings Account, and the Savings Account, is, well, your standard Savings Account.

Beneath the balance tabs, you can view your recent transactions, whether they’re payments, money transfers, or direct deposits. Under the recent transactions are the linked bank accounts tab where you can see the different external bank accounts you connected your Chime account to.

At the very bottom of the app, are four tabs: Home, Move Money, Pay Friends, and ATM Map.

Home Tab

The home menu is what we’ve been viewing till now. As stated, it has all the basic information of your account and is great as a kind of financial summary.

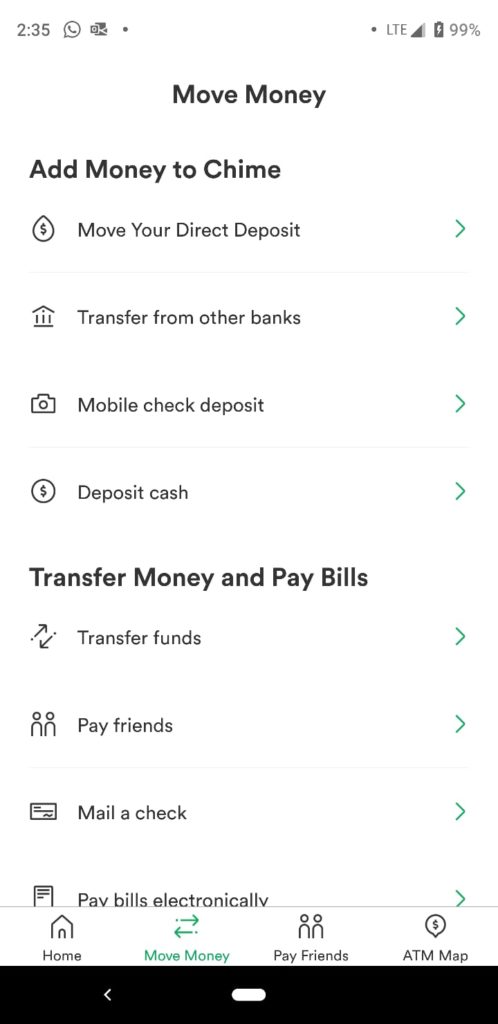

Move Money Tab

The Move Money tab is where you’ll be making all your transactions.

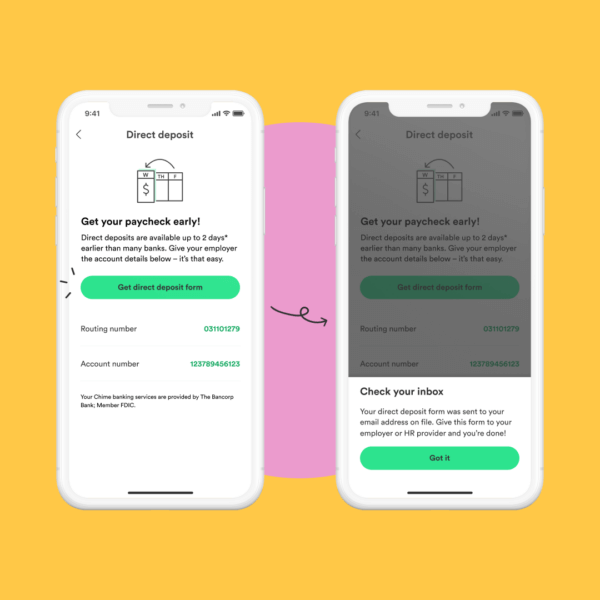

For starters, this is where you can get your Routing and Account numbers. These are used to initiate direct deposits into Chime Bank from an external bank account.

In addition, you can have a direct deposit form emailed to yourself with all the relevant information. This form can be given to the HR department at work so they can deposit your paycheck directly into Chime. Even better, Chime boasts that they’re able to get you you’re paycheck up to 2 days earlier than most other banks!

You can also connect other bank accounts to this one, and initiate transfers quickly and easily.

Finally, you can deposit checks (once you’ve set up direct deposit) and even deposit cash at one of their 90,000+ retail locations.

You can also effortlessly transfer money out of your Chime Bank account as well. This leads us to the next section:

Paying Friends

Most of what applied in the previous section applies here as well. If they have a Chime Bank account, you can simply select their name from your contacts and select how much money to send them.

If not, you’ll have to enter their Routing and Account numbers like usual. Or, if they download the Chime Bank app from the link you send them, you both get $50!

ATM Map

The ATM Map is the third menu found in the bottom panel. Within this menu, users get a map of all nearby ATM machines. This is handy especially when you are traveling and do not have a fair grasp of your surroundings just yet.

Aside from the customer support tab on the upper right-hand corner of the app (which offers fantastic support, both through a chatbot and with a live person), and the app settings on the upper left, that’s pretty much all you need to know about navigating Chime Bank through the App.

The website is very similar to the App and features most of the same User Interface. The easy and elegant design is perfect for people who just want to take care of their banking needs as quickly as possible

I told you it was simple to use Chime Bank!

Advantages of Chime Bank

Ok, you know how to use Chime Bank. Now, let’s get into the reasons why you should WANT to use Chime Bank. Here is a list of features and points to note about Chime Bank, both positive and negative.

Pros

- Simplicity

If you are in search of the easiest way to get your hands on a VISA debit card or if you just want to shop online but you do not have a bank account, then Chime can very easily solve your problems.

Chime is also a quick solution if you just want to stop using actual cash and practice digital banking. Once you have a Chime account, you are automatically eligible to use it for spending (if you fill your balance up by depositing real money first).

After having opened your account, Chime automatically starts creating your personalized Visa Card. They finish this process in just one business day, but it will take 5 to 10 business days for you to receive the actual card, as they will have to ship it to your home address.

While you’re waiting for your card, you can still use Chime online even without your physical debit card.

Basically, Chime Bank is one of the fastest and easiest ways you can get started with banking, online or otherwise.

- Chime helps you save money.

Aside from the spending account, you get from Chime, there is also an optional savings account. The spending account is mandatory, but if you like you can focus solely on the savings account instead.

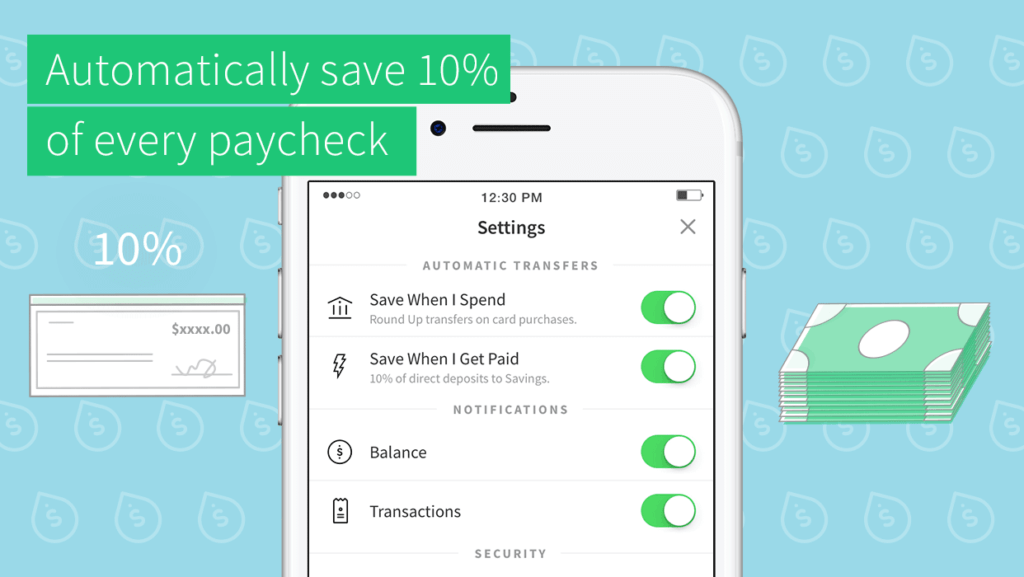

Chime has two optional saving features that allow you to automatically save money when you spend or when you get paid. Save When I Spend rounds up every purchase to the nearest dollar and deposit the difference to your savings account.

For example, if you paid $23.70 in a transaction, Chime will round this up to $24.00 and deposit the $0.30 into your account. This adds up over time, and is a great way to help you save without even noticing it!

Meanwhile, the other feature, Save When I Get Paid, will automatically deposit a pre-set percentage of every direct deposit to your savings account. If you want to enable this feature, you must manually do so – it is not a default setting. In the setup process, the app will ask you what percentage of your direct deposit you want to save.

- Chime can free you from monthly fees and overdraft fees.

In case you missed it, Chime has no monthly fees and no overdraft fees. No overdraft fees mean that Chime will lend you money by allowing your transactions to push through despite the fact that your balance is insufficient. The best part is that Chime will not charge you for it!

The savings on these fees can be significant. In some banks, overdraft fees can reach up to $35 for a single transaction!

Chime’s overdraft policy is not a bottomless pit, however. Free overdraft fees are guaranteed for up to $100, but this limit starts at $20 and progresses according to your individual account history and usage. This feature is what Chime calls SpotMe.

To be eligible for SpotMe, your Chime account must have received at least $500 of direct deposits within the past 31 days. Take note that SpotMe is an optional feature and that SpotMe is limited to debit transactions only.

- Chime allows you to write checks.

In case you want your online bank to be able to write checks for you, Chime does that. But first, your account must be at least 30 days old and your recipient must have an address that is within the 50 states of the United States.

With Chime’s Checkbook feature, writing checks are simple – you just need to spell out for Chime the bill you need to pay and the amount you are paying. Afterward, Chime will write the check and mail it on your behalf.

Just take note that there is a $5,000 limit per payment and a $10,000 monthly limit. Your recipient should expect the check’s arrival between three to nine business days.

- Chime gives you plenty of deposit options.

As a Chime newbie, one of your first tasks is to deposit real cash into your account. Lucky for you, there are plenty of ways to do this.

Firstly, with Chime bank, you get access to a direct deposit feature which is fairly easy to set up. This feature allows employers to hand out salaries through Chime. The setup process involves simply printing out a form to be filled out by your employer, and that’s it.

This direct deposit feature is one of Chime’s selling points. With this, you get quick access to your funds, up to two days early.

Secondly, you can transfer money to your Chime account through cash deposits at any GreenDot retail location.

There is a limit of $1000 for each cash deposit, but this limit resets every 24 hours. Moreover, there is also a $10,000 limit per month.

You can use cash deposits up for up to 3 transactions in a single day. Despite those limits, this is the fastest way of refilling your balance. According to Chime’s Zendesk, it will take a maximum time of 2 hours for a successful deposit to push through.

Furthermore, there is also an option to fill up your balance by initiating a bank transfer from Chime. This option can be found in the Move Money section of the app.

If you are doing this for the first time, you will need to link an existing bank account first. Once you’re all set, you can initiate a transfer through to your Chime Bank app. The transferred funds will be available to use in your Chime spending account within 5 days. But, take note of the $200-per-day limit and $1000 limit per month.

For this feature, the supported banks are Chase, Wells Fargo, Bank of America, US Bank, Citi, USAA, Fidelity, PNC Bank, Capital One 360, Navy Federal, Charles Schwab, and many more.

The list is continuously expanding – the best way to know if your bank is on the list is to try it out in your Chime Bank app.

Another way of transferring money to Chime from another bank is by initiating a bank transfer from an external bank. These deposits are a bit quicker than the previously mentioned bank transfer method. This only takes up to 3 business days, plus daily and monthly transfer limits are likely to be bigger.

- Chime gives you a lot of accessibility options to get your cash.

Aside from being very easy to hop on to, Chime also gives members access to over 38,000 fee-free Visa Plus Alliance and MoneyPass ATMs. These ATMs are commonly in convenience stores like 7-eleven, Costco, Target, CVS Pharmacy, and most malls. Remember, you can always use Chime’s ATM finder to easily navigate to a nearby fee-free ATM.

In addition to Chime’s local accessibility, you can even take your card abroad and still not get charged for every transaction you make. This is a great edge for Chime since a lot of other banks typically charge up to 3% of transactions made abroad.

- Chime can forgive your past mistakes.

If you’ve only made sound financial decisions in the past, then it might be new to you to hear about ChexSystems. ChexSystems serves as a replacement for a credit bureau for the banking industry. It maintains a database of all checking and savings accounts, and for those who have had bad banking reputations in the past, this is terrible news.

Before taking on new clients most banks consult ChexSystems’s database. However, Chime bank is not among those banks.

Chime Bank is one of those banks that believes in second chance banking. Chime is willing to forgive your past banking mistakes, and won’t hold your past mistakes against you.

Cons

While Chime Bank is great, it isn’t perfect. Here is a list of the cons Chime Bank has – none are likely to be a dealbreaker whatsoever, but it’s worth keeping them in mind

- Chime does have SOME fees

While Chime Bank is extremely cheap and mostly free, some banking aspects still cost money. Here is a list of fees you will have to pay with Chime Bank:

- Possible fees to third party Greendot ATM’s

- $2.50 per transaction with an out of network ATM

And that’s it.

Fees are bad, but Chime Bank has far fewer fees than just about any other banking option.

2. Withdrawal and Spending limits

Here are some of the limits Chime Bank imposes on you:

- $500 withdrawal limit per day

- $2,500 spending limit per day

So, for heavy spenders, Chime Bank may not be ideal.

3. Low APY for Savings Account

As mentioned, you can save money on Chime, and the bank often helps you do so. However, that doesn’t always mean using Chime Bank to store your money is a good idea.

For Chime, the current Annual Percentage Yield (APY) is 0.06%. If growing your money through interest is your main goal then there is likely a better option out there at the moment.

However, if your priority is ease of use, with the saving being an added bonus, then Chime Bank is a fantastic choice.

How does Chime make money?

Here is a list of services that have 0 fees with Chime Bank:

- No monthly fees

- No overdraft fees (up to a limit)

- No minimum balance requirement

- No bank transfer fees

- No card replacement fees

- No foreign transaction fees

- No ATM fees (in the network)

So, how exactly does Chime make money? What do they get in return from offering a free online banking experience?

The answer is quite simple, Chime makes money from Visa through what is called interchange fees. Interchange fees are the small percentage Chime gets from Visa for every transaction made using their card. This fee does not charge users any amount.

So, unlike most banks, Chime Bank doesn’t try to make a profit by charging its users – instead, they make a profit by charging big corporations and provide services free of charge. Truly, they are one of the few banks that’s looking out for the little guy.

How safe is Chime Bank?

Chime is backed up by Bancorp Bank, a member of the Federal Deposit Insurance Company (FDIC). This means that your account and your deposits are federally insured up to $250,000. So, to answer the question, yes, Chime bank is safe.

Chime Bank has existed since 2013 when founders Chris Britt and Ryan King established it. By now, its brand is well-known, tried, and tested by millions of users. Chime’s complimentary Visa debit card is also EMV-equipped. EMV chips serve as an extra line of security in addition to the magnetic strips found behind both many credit and debit cards.

The only thing left is to make sure you practice safe practices on your end. Chime allows you to either set a password or use a fingerprint ID, so make sure you take advantage!

BOTTOM LINE: Should you use Chime Bank?

If you’re someone who’s looking for the simplest and cheapest banking options, you’ll be hard-pressed to find something better than Chime Bank.

With almost all of their services being 100% free, and the app being designed in such an intuitive way that anyone can understand it, Chime Bank will transform your view of banking in a very positive way.

Heavy spenders may be bothered by the limits Chime Bank imposes, and if you’re looking for a high APY there may be better options.

However, for most users, Chime Bank accomplishes everything you’ll need your bank to accomplish.

The best way to know if Chime bank is right for you is to try it out. After all, getting on board is so easy anyway – may as well try it!