College is great, but there’s one clear disadvantage to going: The high price. Luckily, Ascent Student Loans can help most people out with that, regardless of their individual situation.

Ascent prides itself on giving everyone equal access to financial help without limiting their potential. Here are some of their mission statements that can be found on their website:

“Ascent empowers you to reach even higher goals, greater success, and an even brighter future.”

“Student loans should expand your possibilities, not limit them.”

“We advocate awareness of the potential financial outcomes of your college choices (school, major, years in school, financing your education).”

These quotes all have a central theme: Ascent Student Loans wants to help you use your college years wisely, and they’re willing to help you achieve that goal. If you buy in, they’ll do their best to make sure a lack of funding isn’t what holds you back.

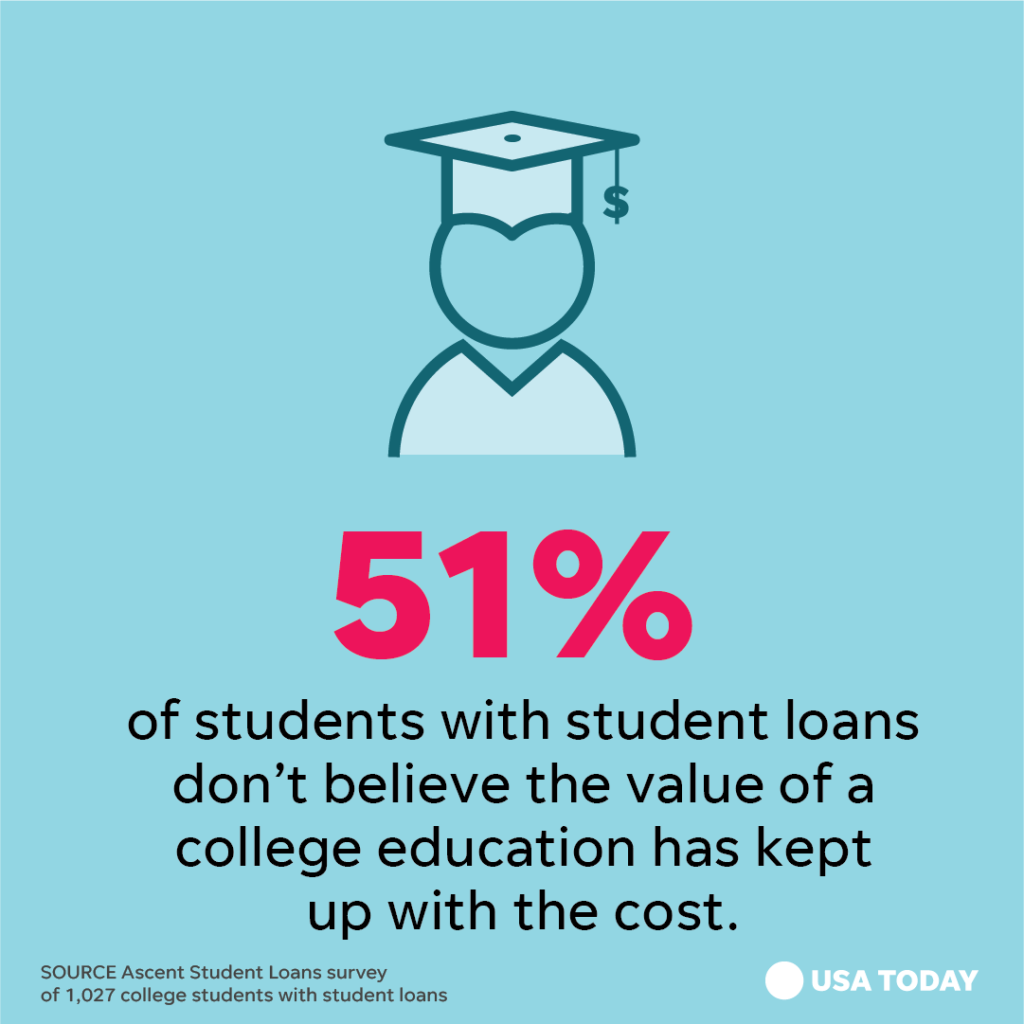

Until now, student loans have been a real burden on potential students. Ascent is looking to change that.

So, what exactly does Ascent Student Loans offer? Let’s find out!

Who is Ascent Student Loans?

Ascent Student Loans is located in San Diego. Their parent company, Goal Solutions, Inc., has been giving out student loans for decades.

There are a few companies involved with getting you your loan: Loans are processed by Ascent Funding, serviced by a company called Launch Servicing, and Financed by Richland State Bank (RSB), Member FDIC.

In practice, knowing the details of which company does what isn’t important if all you care about is getting your loan, but it helps avoid confusion if you see any of those names come up at any point in the process.

In order to be eligible for a loan, you must be a member or permanent residence of the United States (any of the 50 states is fine). If you aren’t, your only option is to find a Cosigner who fits those criteria.

Depending on the specific loan you’re applying for, there may be income/credit requirements as well – below we will go over each type of loan Ascent offers.

How to apply for a loan

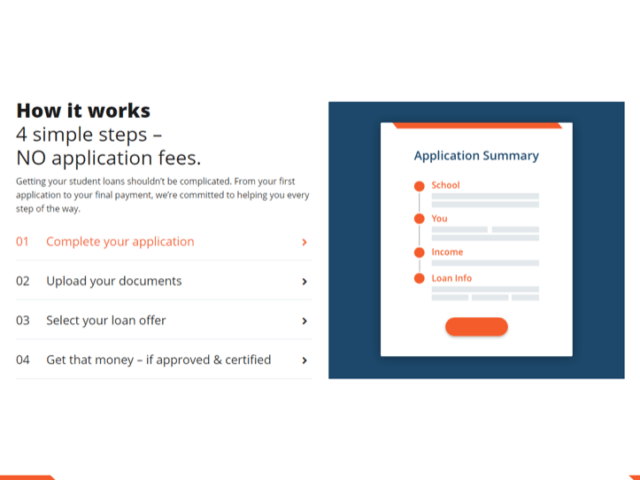

The application process for Ascent is fairly simple and straight forward.

In fact, their entire SITE is pretty simple and straightforward – in terms of user-friendliness, it’s hard to find a better student loan provider than Ascent.

After creating an account and starting an application, you will be asked for some personal details so that Ascent can determine whether to accept your application and what interest rate to offer.

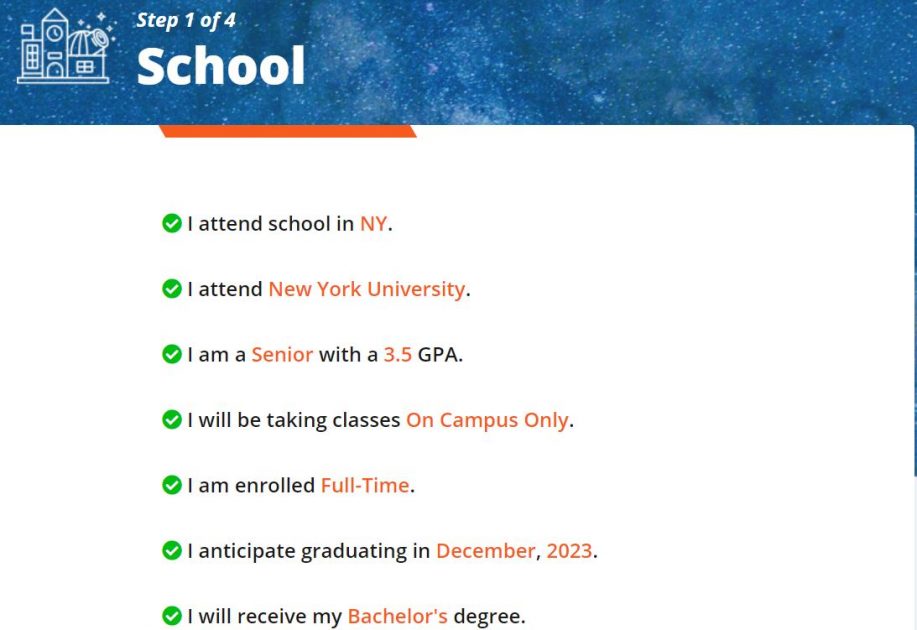

The first page of questions is titled “School”. In this section, they will ask for information about your college situation, such as which college you’re attending, if you’re a full-time student when you plan on graduating, and what major you’re pursuing.

The next section of questions is “You”. This section will ask for personal details like your name, address, phone number, and Social Security Number.

Third, you’re asked about “Employment”. Note that you don’t have to be employed to be eligible for a loan, but if you are then you will have to report your income.

Finally, the last section is titled “loan info”. Here, you will be asked questions about the loan you’re hoping to receive, like:

- Which term is the loan for?

- Are you paying in-state or out-of-state tuition?

- How big of a loan do you want?

After answering these questions, you will be shown some vague details about your loan options.

You can then select if you will be using a cosigner and if you want to use a fixed or variable rate.

Based on those choices, a range of interest rates you might pay will be shown.

You will also be shown all the available payment plan options, and Ascent’s late fee policy: 5% of the past due amount, with a minimum of $5 and a maximum of $25.

After applying, a soft credit check is done – no hard checks are required.

Loan applications typically take 1-2 business days to review. The loan information is then sent to your college, which will then have to verify all the information you provided about your schooling.

Once they finish reviewing, your loan application is complete!

Ascent Student Loan Types

Next, let’s discuss all the different loan options that Ascent offers, and go over the benefits and eligibility requirements of each.

Ascent offers loans both with a cosigner, and without a cosigner.

If you choose to not use a cosigner, you can either base the loan on your income and credit history (if you have any previous work/credit experience) or on your future income potential (if you DON’T have any previous work/credit experience).

Whichever loan type you choose, you can elect for either a fixed or variable interest rate and can select 1 of 4 different payment plan options.

Let’s start off by discussing each of the 3 loan types: Cosigner, non-cosigner credit-based, and non-cosigner future income-based.

Then, once you’ve determined which loan type is best for you, we can go over how to customize your interest rate and payment plan to best fit your needs.

Cosigner loans

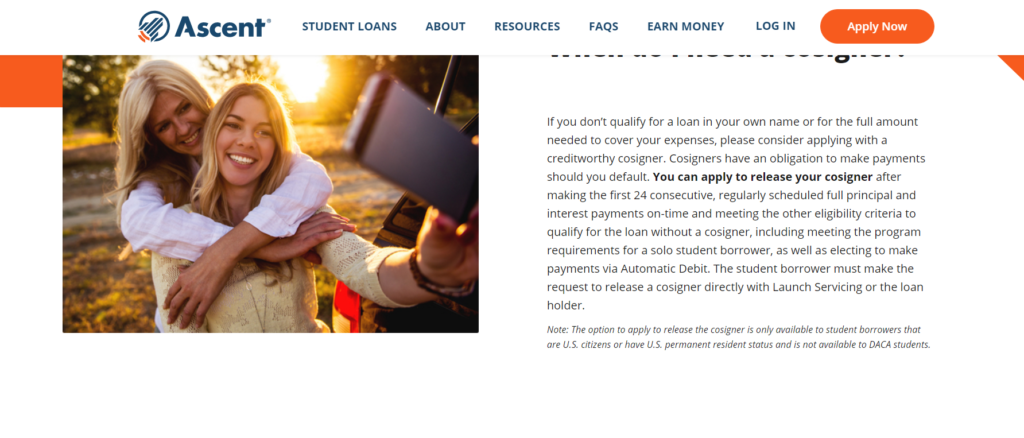

Cosigner loans, as the name suggests, require you to find someone to cosign your loan and share responsibility if you fail to pay it back.

This limits the risk that your loan issuer won’t end up getting paid back for the money they lent you.

From their perspective, it’s hard for Ascent to predict what kind of career you’ll end up having until you actually enter the workforce. So, in order to mitigate the risk that you’ll end up at a dead-end job and defaulting on your loans, they allow you to use a reliable cosigner that will pay back the loan if you’re unable.

Here are some things to be aware of when selecting a cosigned loan:

- Loans can be requested for anywhere between $1,000-$200,000.

- Loan terms (i.e. how long you’ll have to pay back the loans) can be either 5, 10, or 15 years (the 15-year option is only available if you select a variable rate).

- Your cosigner must have at least a 620 Credit Score. However, if your credit score is under 700, then your cosigner’s minimum required score is raised to 660.

- If you don’t have a credit score, that’s ok – you are still eligible for this loan. However, if you DO have a credit score, it must be at least 630 – otherwise, you are no longer eligible.

- Your cosigner must prove they have made at least $24,000 each of the last 2 years. There is no income requirement for you, just for your cosigner.

- After 24 straight months of making your payments on time, you can apply to remove your cosigner from the obligation to cover your debt should you be unable to pay.

- Interest rates are shown on the site range, and from 2.72% to 13.00% for variable loans, and 3.53%-14.5% for fixed loans. The rates shown on the site can be used as a guide but aren’t always 100% accurate – when I applied for a loan, the range it gave me was 3.83%-14.43%.

A quick note about interest rates: both the numbers listed on the site and the actual interest rate numbers are subject to change. These numbers are based on the 1-Month London Interbank Offered Rate (LIBOR).

LIBOR constantly changes, although the changes usually aren’t too big in either direction. When the LIBOR rate increases, Ascent’s rate increases as well, and vise versa if the LIBOR rate decreases.

That’s why the rates listed on the site may not always match up with the actual rates you’ll receive – Ascent updates their site if there’s a big change in LIBOR, but may not always catch some of the smaller changes.

In addition, you can lower your quoted interest rate by .25% simply by signing up for automated, biweekly payments. This is highly recommended and can greatly decrease the interest you will pay over the lifetime of your loan.

Ascent Non Cosigner Credit Based Loans

If you’ve worked in the past and then went back to school, or are working part-time while still in school, then you may not need to get a cosigner.

Getting a cosigner can be difficult and can lead to bitterness if they have to unexpectedly pay for your loan. So, if you can avoid one and still get a good interest rate, you should.

Most of what applied to a cosigner loan are true here as well, with the notable difference being that the credit and income requirements that were previously for the cosigner are now your responsibility.

The minimum income amount is still $24,000 for the last 2 years. However, the minimum credit score is now 680 instead of 660.

In addition, having a lot of debt may hurt your chances at acceptance – Ascent takes your debt to income ratio into account for this loan type, and if you have too much debt, you’ll get denied.

Ascent Non Cosigner Future Income Loans

This loan type is one of the more unique features that Ascent Student Loans offers.

Instead of looking at credit and income, Ascent will now look at a multitude of other factors. They will use these factors to try to predict how much income you’ll make in the FUTURE. Here are some of the factors they’ll take into account:

- School of attendance

- Program

- Major

- Graduation Date

- Cost of attendance

- Other proprietary factors

To qualify for this loan, you must either have no credit or pass minimum requirements but no income history. In addition, you must meet the following requirements:

- Be a college junior, senior or graduate student enrolled full-time (or with an expected graduation date within 9-months of the date the loan application is submitted) in a degree program at an eligible institution.

- Have a GPA of 2.5 or greater.

This loan is applied for the same way you would apply for Non-Cosigned Credit based loan.

By selecting “No Cosigner” in the loan application, you will automatically be signed up for either the Credit based loan or the future income-based loan – since you can only be eligible for either one and not both, Ascent will make sure your application is for the correct loan type.

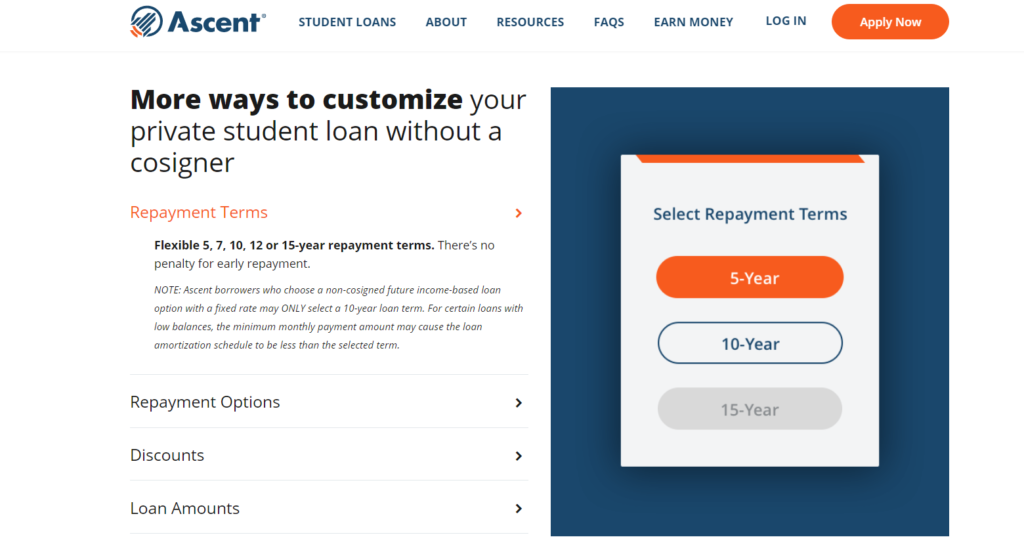

If you go with this loan, you will not be able to select a 5-year payment plan, and if you go with a fixed interest rate you can’t select a 15-year payment plan either – so you’re left with the 10-year option.

Notably, instead of the .25% discount for setting up automated payments, now the discount is all the way up to 2%. So, set up online payments. You’ll save a TON of money.

Are Interest Rates competitive?

Interest rates for Ascent are pretty much in line with the average rates for private student loans. According to this Balance article, rates range from 3.95% to 14.28%, which is almost EXACTLY the range you can find on this site.

The benefit of using Ascent Student Loans is the extra options they provide. This is especially true if you qualify for their future income based loans.

Just take a look at all the flexibility Ascent Student Loans provide:

- Cosigner or non cosigner

- Credit-based or Future Income-based

- 5, 10, or 15-year loan terms

- Fixed or variable rates

- 4 Repayment types (Deferred Repayment, Interest Only Repayment, $25 minimum repayment, and graduated repayment)

This kind of flexibility is hard to find elsewhere. This makes Ascent Student Loans a great option for a one-stop shop for all your student loan needs.

Customizing your loan to get the maximum benefits

While flexibility is great, it can also lead to confusion on which choices to pick. Let’s go through each decision you’ll have to make about your loan and try to decide which options are best for your specific situation.

Cosigner or no cosigner?

The first decision you’ll have to make is whether to use a cosigner.

Now, this decision depends on a few things:

- 1) Do you have access to a reliable cosigner?

- 2) What is your income and credit history?

Obviously, if you can’t find a cosigner, you’re stuck applying without one. So let’s assume you have a Cosigner with strong credit and work history available and willing.

Ascent themselves give pretty good advice regarding when you need a cosigner:

If your credit and income history is strong, then don’t use a cosigner. There’s no upside.

If your credit and income history is NOT strong, then you should go with the cosigner option. You’ll end up with a much lower interest rate that way.

If your credit and income history is ok, but you know a cosigner with slightly better credit/income, I personally still would apply without a cosigner.

If the cosigner ends up responsible for your loan, it will likely ruin the relationship between both of you. In most cases that wouldn’t be worth the extra couple of interest points.

Instead, I’d prefer to take on the responsibility myself, and if times get tough I’d figure it out then without forcing someone else to bail me out.

However, this situation is really up to you, and how comfortable you are asking someone to agree to bail you out if you struggle to pay the loan back.

Credit based or future income based?

This won’t actually be a choice most people have to make.

If you aren’t using a cosigner, you’ll only be eligible for either the credit-based or future income-based loans depending on your credit/work history – you’ll never be eligible for both simultaneously.

This decision only comes into play if you’re eligible for the future income-based loan, and also have a strong cosigner option available. In that case, I would use the cosigner and get the loan based on their credit, as the interest rate will likely be lower.

Payment terms/length

Depending on the type of loan you select, the main ways you can opt to pay back these loans in either 5, 10, or 15 years.

Short term loans have lower interest rates than long term loans. This, along with less time for interest to accumulate, leads to much less interest being paid out over the entire length of the loan.

However, short term loans also have higher monthly payments than long term loans. This makes sense since you’re paying back the loan over a shorter time period, so each month you’ll be paying back a larger percentage of the total loan.

If you can afford to pay back the loan in 5 years, you should. However, if you’re scared the monthly payments will be too high, longer loan terms are acceptable as well.

Fixed or Variable?

Variable rates start off with lower interest but are riskier than fixed rates because if interest rates rise, your rate will rise as well.

With a fixed rate, you know exactly how much you’ll have to pay each month. No outside factors would change that.

With a variable rate, constantly changing interest rates mean you’ll never know exactly how much you’ll need to pay.

For most people, I’d recommend just taking the fixed rate. Interest rates are low right now, and they can easily rise in the future, making variable a weaker choice.

Plus, the peace of mind you get by knowing exactly how much you’ll have to pay each month is valuable. You won’t have to worry about accidentally overdrawing from your bank account and incurring fees because your payment this month was more than you thought it would be.

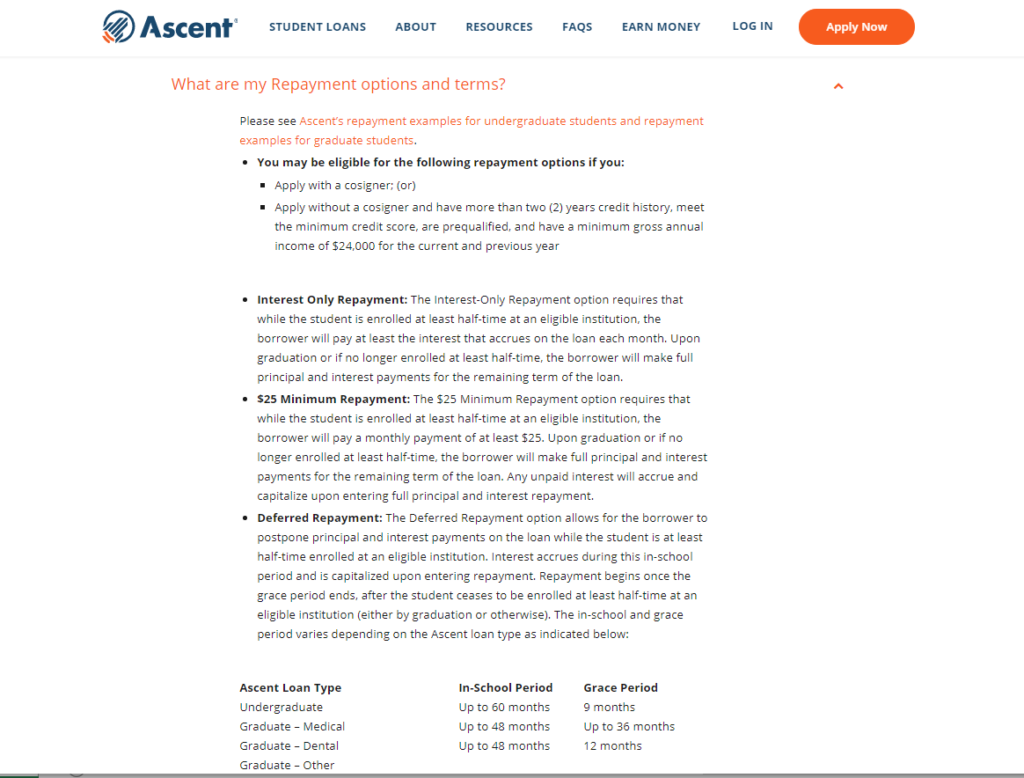

Repayment options

As discussed above, there are 4 different repayment options you can choose from. Let’s go over each of them and discuss the pros and cons.

Deferred Repayment

This is the standard payment plan. With this option, you won’t have to pay anything until 6 months after your graduation. At that point, you’ll hopefully have an income, and will start being responsible for monthly payments.

If you don’t have a job 6 months after graduation, you can request this period to be extended. Your loan processor will decide whether to accept your request; it’s impossible to know beforehand whether they’ll agree to extend or not.

So, be ready to start paying as soon as the 6 month mark hits.

Important note: You can elect at any point to make overpayments towards this loan, for no fee. So, if you’d like to get this paid off sooner, you can simply pay a bit more each month, or even put a large lump sum of money into the loan at any point.

Interest Only Repayment

With this payment plan, you will pay for the interest of the loan while still in school. Then, 6 months after graduation, you will become responsible for covering the principle as well.

Paying the interest off while in school stops the interest from compounding. This will greatly decrease the total amount you will owe over the course of the loan.

It’s also possible that choosing this option will lower your interest rate a bit. However, you shouldn’t expect it to make much of a difference in that regard.

$25 Minimum Repayment

This is similar to the Interest Only Repayment plan, but instead of paying the interest portion of the loan while in school, you will instead pay a flat fee of $25 each month.

You will then start making full payments once you have left school for 6 months.

Again, this will greatly increase your total payment owed over the course of the loan, and may SLIGHTLY affect your rates.

Graduated Repayment

This option isn’t really a standalone option – instead, you combine it with one of the previous repayment options.

If approved, then 6 months after graduating you can start off making smaller payments instead of the full amount.

You can then gradually work your way up to the full amount.

This is a good option if you haven’t been able to find a job right away, but if you can avoid using this option then you should.

If you DO use this option, it will end up costing you a lot in total money paid through the history of the loan.

The lower your initial payments are, the more interest there is to compound.

Bottom Line: Repayment Options

In general, the deferred repayment option is fine for most people. If you ever want to pay it off faster you can, and the benefits of locking yourself into either the interest-only or $25 minimum payment plans are minimal.

Try to avoid the Graduated Repayment plan, but it’s nice to have it as a backup.

Addition benefits offered by Ascent Student Loans

Ascent offers numerous side benefits if you use their program. Let’s go through some of them now:

Scholarships

Ascent offers scholarships in addition to their loans.

In fact, in 2020 alone they plan on giving out over $60,000 in scholarships!

Apply to these scholarships by following the instructions laid out on the Ascent website.

An example may be that you’ll have to follow Ascent on Instagram, but the specific requirements can change over time.

So, make sure to give the scholarship section a look. To access the scholarships section, hover your mouse over the “Earn Money” tab and click “Scholarships”

Ascent Rewards

If you’ve ever used a cashback site like Rakuten or Topcashback, then you know how this works.

Before shopping at any retailer that partners with Ascent, find it on the Ascent Rewards page first.

If you do, you will receive a percentage of your purchase back in the form of Cash Back.

Each retailer offers a different percentage. For a list of partner retailers, and the links that you’ll need to click through to start earning, hover over the “Earn Money” tab, click “Ascent Rewards”, then scroll down and click “Ascent Rewards” again.

1% Cash Back

At graduation, you may become eligible for 1% cashback on the loan principal.

As long as you graduate from the same college on your application, get the same level of degree (i.e. bachelor’s, master’s, etc.) and you signed up for automated payments, you will be eligible for this program.

Refer a Friend

If you have a friend who’s also interested in finding a student loan provider, refer them to Ascent Student Loans and you’ll be eligible for up to $525 in cash!

In addition, your friend that you referred will also earn $100 just for signing up through your link.

That’s why, if you sign up through any link in this article, you’ll automatically get $100 – since I’m referring you to Ascent Student Loans, you get a reward!

Ascent Student Loans: Bottom Line

Ascent Student Loans is one of the most flexible and user-friendly student loan services there is.

No matter what your situation is, they likely have a loan option for you.

Their site is very user friendly, there are no hidden fees, and there are plenty of ways to earn cash or get discounts on your loans.

In other words: Ascent Student Loans is a fantastic service, and probably one of the best student loan providers in the world. You can feel good about using them, knowing that you’re in good hands.

Good luck with your application!