Do you have credit card debt? If you live in the U.S., chances are, you do. In fact, in a 2019 study, the total U.S. credit debt in Q2 was $868 billion!

According to that same study, if you’re like the average person, the answer to how much debt you have is probably around $6,028, if not more.

Regardless of the exact numbers, there is one statistic we can be confident about: 100% of people with credit card debt want to get out of it.

Now, there are plenty of approaches to dealing with credit debt. In case none of those have worked out for you, or you are simply looking for a more convenient way, then it’s time to check out Tally.

In this Tally review, we will go through everything you need to know about Tally. By the end of the review, you should know all about what Tally can offer, and whether it’s the right choice for you.

Let’s get started!

What is Tally?

Tally is a debt management assistant in the form of a mobile app. Its goal is to help you make sound financial decisions when it comes to paying your credit card debt.

After you connect your credit cards to Tally, Tally will review the interest rates on each, and choose which ones you should pay first.

If you’d like, Tally will even automatically pay your debt for you, allowing for a more seamless experience. It does this by extending you a line of credit, which it uses to pay down your credit card debt.

This line of credit will usually be lower than the interest rate for your credit cards.

So, by taking advantage of the line of credit, you only have to worry about a single monthly payment (the payment you’ll be making to Tally for the line of credit) instead of multiple payments (the payments you would have had to make to each credit card company).

Plus, if the interest rate for this line of credit is lower than the interest rate for your credit cards, you save money as well!

Basically, it’s a personal finance assistant that will pay the debt for you and even save you money.

Think of Tally as a finance version of Google Assistant or Siri, but instead of answering basic questions or telling you about the weather outside, Tally looks at your credit debts, crunches the numbers, and presents you with the most strategic way to pay.

And the best part about Tally? Tally is totally free: no annual fees, no late fees, no prepayment fees, and no origination fees. The only thing you’ll have to pay Tally is the interest on the line of credit they offer you, which will usually be lower than what you were paying to the credit card company.

It is a service that is easy to hop right on and try out for yourself.

Getting Started with Tally

As stated above, there are no payments involved if you’d like to give Tally a try – It’s free on the Apple app store and Google Play Store. You just have to download it on your phone, create an account, tinker a little bit on the app, and let it do its magic. However, make sure you have a FICO score of 660 or higher as this is one of Tally’s few requirements.

What is a FICO Score?

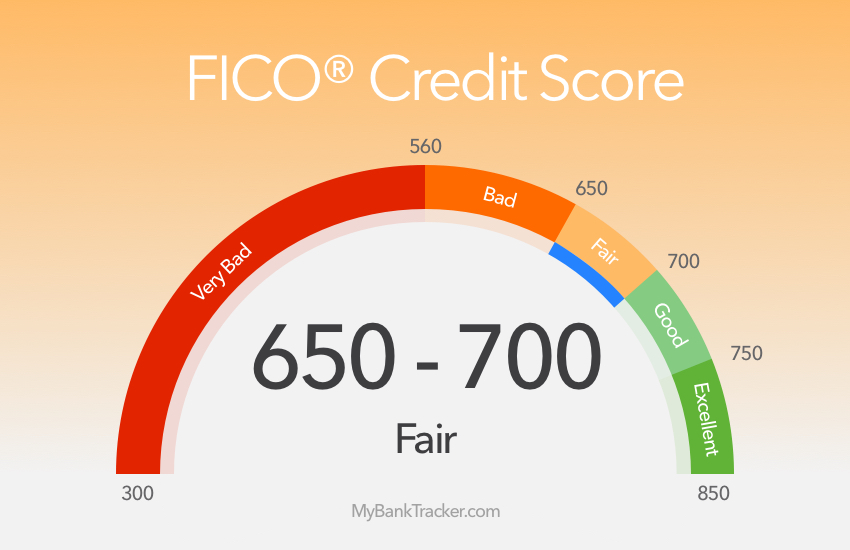

In case you are not familiar with it, a FICO score is a 3-digit number ranging from 300 to 850. It is a score based on your past credit activity, and it helps lenders determine how likely you are to be able to pay your loans.

Ultimately, it helps lenders decide how much credit to offer you. A FICO score of less than 650 is considered poor, while 650 to 700 is fair, and a score greater than 700 is considered a “good” score.

To put things in perspective, only about a third of Americans have a FICO score below 660.

While a 660 credit score will allow you to use Tally, the greater your FICO score is, the better your annual percentage rate from Tally is. Currently, the best annual percentage rate Tally offers is 7.9%, while the highest sits at 25.9%.

Creating a Tally Account

Signing up for Tally is easy. You will need to provide your name, annual income, Social Security number, and your birthday.

Once you’ve inputted this information and your account is activated, the next step is to add your credit cards as well as a bank account from where your payments will be coming from.

Adding Your Credit Cards

In order for Tally to assist you in paying your credit card debt, you must give Tally access to your credit cards. Adding cards to Tally can be done in two ways: scanning them using your phone’s camera or manually entering your credit card information.

In terms of credit card compatibility, Tally works with all the major major credit card companies such as Bank of America, American Express, Barclays, Capital One, Chase, Citibank, Wells Fargo, PNC Bank, and Discover just to name a few. In addition, Tally works with many store credit cards – the complete list can be found on their site.

Getting Approved

Once you have registered your cards into Tally, it performs a soft credit check (more on this later). This step usually takes around 60 seconds.

Once the soft-check process is complete, Tally will award you a certain credit limit and an interest rate for your new line of credit. These values are based on your FICO credit score, as mentioned before.

The potential amount of your line of credit ranges from $2,000 to $20,000. Tally uses this line of credit to pay down your cards, starting from whichever has the highest interest rate or whichever it deems most beneficial.

Pros: What Tally Can Do For You

1. Tally will make debt payment seamless

When you are trying to pay off credit debts, you may not notice it, but you are always preoccupied. Debt leads to stress, and stress leads to bad decisions.

Now, that is not a good way to spend your mental energy, is it? Tools are made to ease instances like these, and that is where Tally comes in.

In case you missed it, Tally makes debt payment a total breeze. The way it works for you is ridiculously simple: Tally does the tally and figures out exactly what you should be doing to pay back your debt as quickly as possible. Tally does this in one of two ways. The first one through an option called Tally Pays while the other one is known as You Pay.

Tally Pays

This option speaks for itself. If you chose this paying method, well, Tally would handle making your payments for you.

Usually, it does this by using your line of credit to pay credit debts with a higher interest rate first. For cards with rates lower than the rate on your line of credit, Tally pays the minimums.

With this option, Tally sends you a single bill consolidating all the payments for that period, the minimum payments as well as the interest on your line of credit. Tally automatically distributes this bill to your credit cards in the most money-saving way.

With this method, paying debt is greatly simplified. Instead of worrying about multiple payments, you just have to remember to make a single payment: The one that will go to Tally.

Tally takes care of all the hard parts: it decides which credit cards to pay first, makes sure you don’t miss any due dates, etc.

Plus, if your credit cards have higher interest rates than what Tally offers you (which is often the case), you’ll be saving money as well.

You Pay

If you choose to pull the payment trigger personally, the You Pay option is the way to go. With this, Tally sends you a reminder before your credit payment deadline. You can then pay for this using Tally’s linked checking account, or you can make payments through the card issuer’s site as you would normally do.

If you opt for You Pay, you are essentially using Tally as a place to manage your credit cards but not necessarily exploiting its full potential. However, if you’re uncomfortable completely trusting a third party to make your payments for you, this is a good middle choice.

Whichever option you deem necessary for your use is up to you. If you later decide that you want Tally Pay for certain cards but you prefer the You Pay option on others, it is worth noting that Tally lets you choose either option for each card.

2. Tally will save you money

When you have debt from multiple credit cards, figuring out which one to pay off first can be challenging.

There are two well-known debt payoff strategies, the stacking method, and the snowball method. The latter works by going through your debt list paying off the ones with the lowest balance first and working its way up to the highest.

This approach is tempting since it allows you to tick off debts quickly; however, if the credit card with the smallest balance doesn’t have the highest interest rate, it costs you significantly more money compared to the stacking method.

The stacking method, also known as the debt avalanche method, focuses on interest rates instead of balances. With it, the debt with the highest interest is paid first, working its way to the debt with the least interest.

This is the method Tally uses and is the most mathematically sound method of paying back debt.

3. Tally has late free protection

On most accounts, late fees reach up to $36. Paying late fees is not a wise financial move, for obvious reasons. If for some reason, you found yourself paying late fees in the past or you simply want to avoid doing so in the future, Tally will help you with that.

If you have an insufficient remaining balance when a payment due kicks in, Tally’s line of credit automatically covers the payment for you. You would still have to pay Tally back later, but more often than not, it would be at a lower interest rate than your credit card. Plus, it saved you from the late fees.

4. Tally does not impact your credit score negatively

For some, their credit scores are a prized possession, and that should also be the case for you.

A high credit score gives you access to perks that are otherwise unavailable. In Tally for instance, as mentioned above, your credit score determines your line of credit as well as Tally’s interest rate. If you are conscious of your credit score (you better be!), rest assured that Tally does not impact your credit score negatively.

When applying for a personal loan or a balance transfer credit card, the lenders usually perform a hard check. Hard checks or hard pulls decrease your credit score by a few points.

On the other hand, soft checks, the way Tally does it, will not affect your credit scores negatively. Plus, utilizing Tally effectively will help you lower your debt, which in turn lowers your credit utilization, which is the biggest factor in determining your credit score (a low credit utilization score means a higher credit score).

So, instead of negatively affecting your score, Tally can actually positively affect it!

5. Tally can guarantee the safety of your accounts (at least on their end)

If you are concerned with the security of your credit cards and bank accounts linked to Tally, you shouldn’t be. Tally utilizes bank-level encryption to ensure user safety.

Even the scanning of your cards in the early steps of the setup process is 256-bit SSL encrypted.

So, as long as you take standard safety precautions, you shouldn’t be worried about any security issues with Tally.

Cons: What Tally Cannot Do For You

1. Tally is not (yet) available in all U.S states

Currently, Tally is not yet available in all U.S. states, but in case you do not live in one of the supported states, Tally is coming your way.

Tally assures users that they are taking some time to cover more ground because they are moving the extra mile to get licensed state by state. They say that this will be beneficial for users in the long run.

Right now, Tally is available in Arizona, Arkansas, California, Colorado, Connecticut, Washington DC, Florida, Georgia, Illinois, Idaho, Iowa, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Mexico, New Jersey, New York, Ohio, Oregon, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington and Wisconsin.

If you are waiting for Tally’s service on your location, the best thing to do is to download the app now and join the waitlist. This way, you will be among the first to know when it comes to you.

2. Tally doesn’t control your spending habits

While Tally can help you pay down debt, the best case scenario is that you stop spending recklessly, and don’t get into debt in the first place.

While Tally can’t help you with that, it CAN help you recover from past mistakes. However, it’s up to you to make sure you don’t repeat those mistakes in the future.

In order to make sure you don’t repeat past mistakes, I recommend using budgeting software.

Tally Advisor

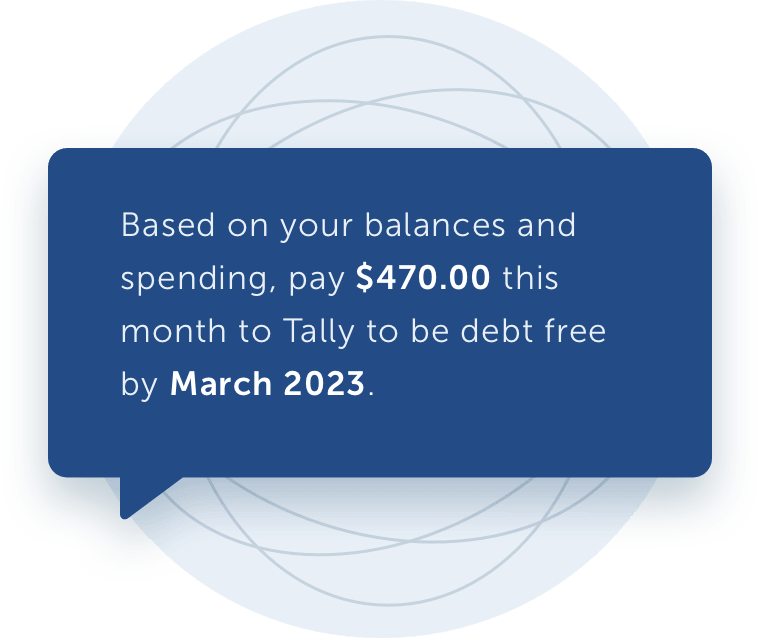

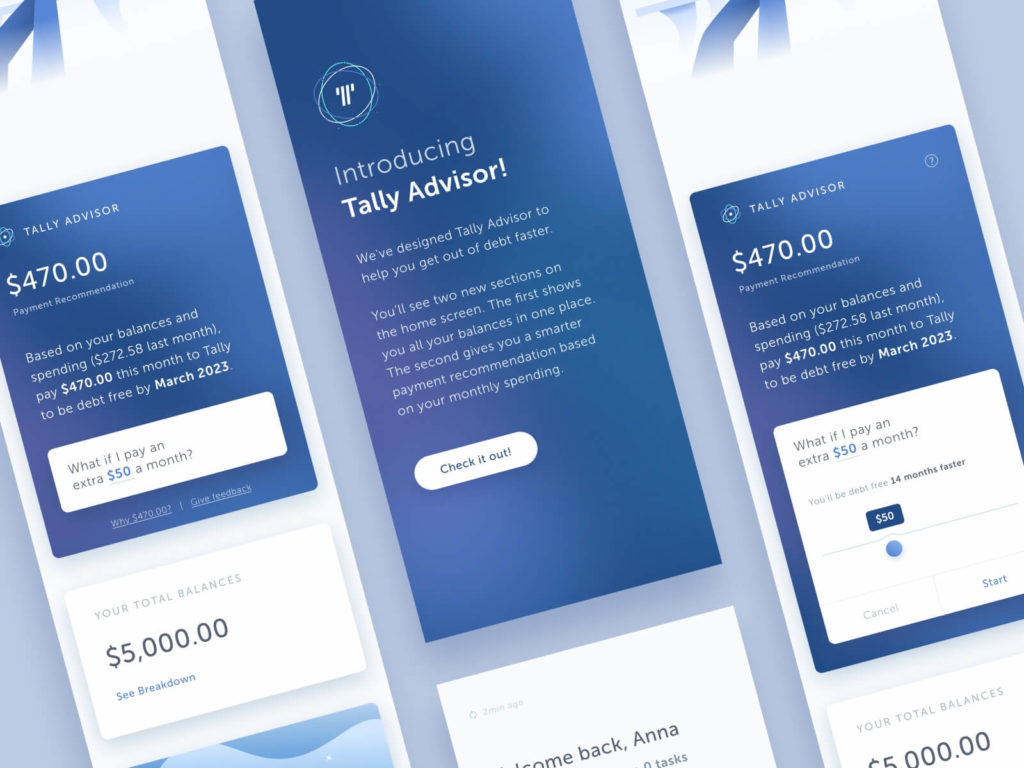

Tally also offers an optional Tally Advisor feature and it also lives within the Tally app. Essentially, it is their “robo-advisor.” Tally Advisor aims to move you out of debt even faster. It utilizes artificial intelligence and machine learning algorithms to lead you down the best path to pay off your balances in accordance with your pre-set timeline.

It does this by learning about your income and spending habits. To give you a bit of detail on how it works, here’s a quick three-step run down:

- Tally advisor requests you to set up a timeline for repaying your credit card debts

- On a monthly basis, the software analyses your finances, including your income that month, spending habits, current debt balance, and your provided timeline.

- From this analysis, it suggests the best possible distribution of your money.

As an example, there are instances when Tally advisor will recommend you to pay an extra $100 or so for a particular card. These estimates are based on mathematical models that take into account all information Tally has available.

With the Tally advisor, you can also see projected times when you will be debt-free based on the plan you set up with Tally.

Basically, the Tally advisor is a finance calculator that has the ability and the artificial intelligence to crunch numbers for you in order to forecast the date when you will be debt-free, based on your current payment patterns.

It also works on the inverse, as you can provide it a day when you want to debt-free and it gives you directions on how to get there.

Bottom line: Should You Use Tally?

Tally is ideal for anyone who is currently struggling with credit card debt.

The app is easy to use, the instructions are clear, and overall Tally is designed to save you as much money as possible, with a minimum amount of effort.

Of course, for best results, you’ll need to work on reigning in your spending – Tally can’t make these decisions for you. However, if you’re committed to getting your finances under control, Tally is one of the best options to help with that.