In this Fundrise review, you’ll learn how to get Real Estate exposure without having to put down a large amount of capital.

Due to the growth of the Internet, there are now tons of ways to invest in real estate. Some examples are:

Here, we’ll be talking about a new method available to all with the help of a company called Fundrise. Similar to a REIT, Fundrise allows normal people to invest in Commercial Real Estate – an industry that has historically been limited to the wealthy – by letting them buy small portions of buildings instead of being forced to buy an entire property.

Over the past decade, real estate investing gradually became more widely available with the existence of crowdfunding investment platforms like Fundrise. These platforms have made investing in real estate more inclusive and available for a wider range of investors.

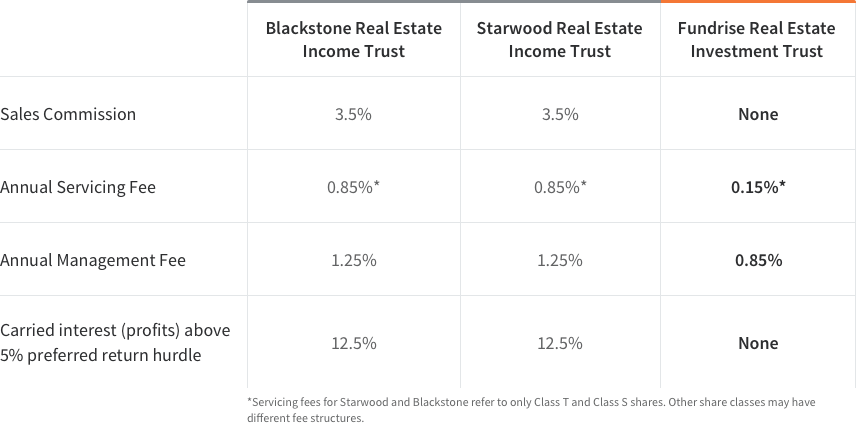

So, what makes Fundrise different? The biggest differentiator between Fundrise and a normal REIT is that you buy shares of the properties directly from Fundrise, instead of going through a broker like you would with most REITs. This allows Fundrise to offer extremely low fees since there’s no longer any middle man, at the cost of some of the easy liquidity you get with classic REITs.

This Fundrise review dives deep into the ins and outs of the service. Below, you will find a brief history of the company, a quick starting guide, some notable pros and cons, and more. Sit back and read on!

What is Fundrise?

Fundrise is a Financial Technology company launched in 2012 by brother Ben and Dan Miller. They were among the first companies to allow crowdfunding for Real Estate.

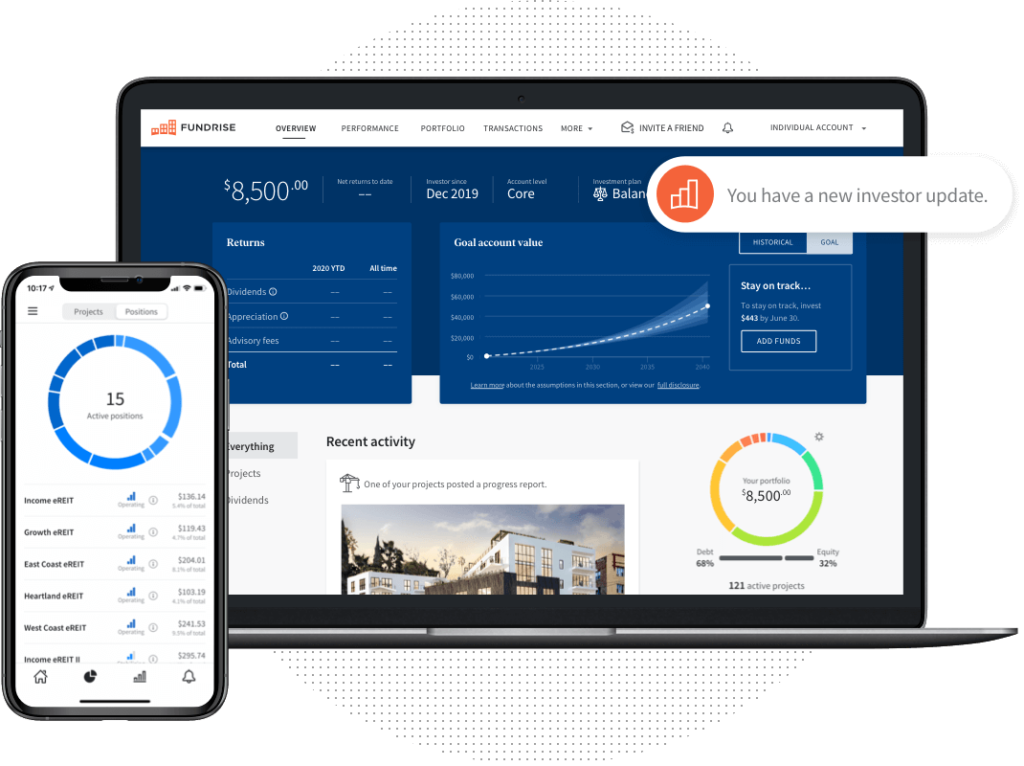

The firm’s services are available through the web as well as on mobile platforms. This means users of Fundrise’s services have the ability to manage their real estate investment accounts with just a few taps on their computers or phones.

Prior to the days of Fundrise, the idea of investing in real estate was already an attractive option for many investors. However, the price made it so that Real Estate investments were only available to highly affluent investors, and thus Real Estate has always been a seemingly exclusive space to invest in.

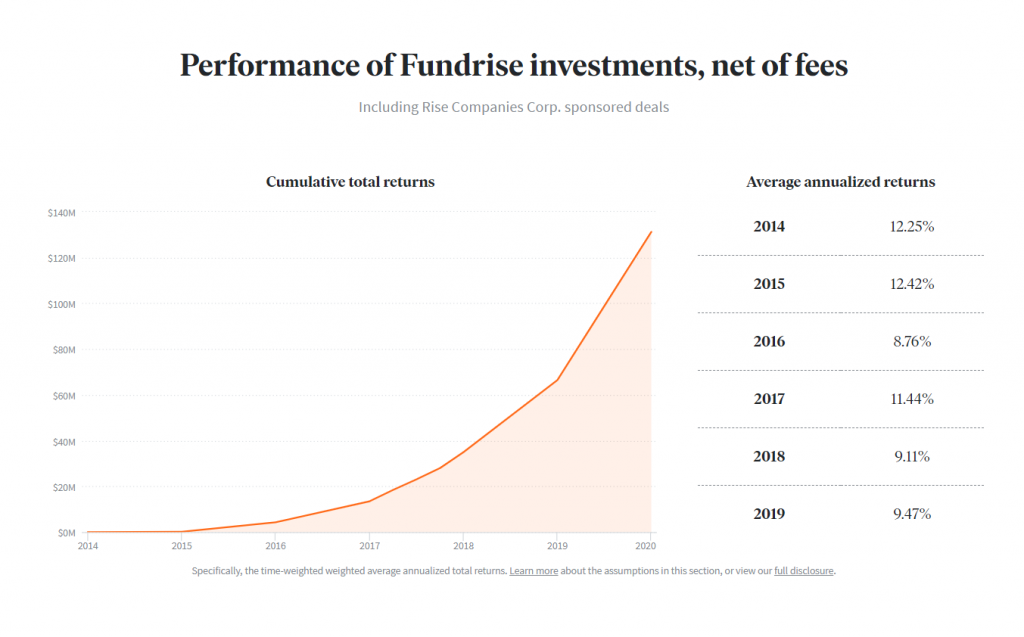

Bringing the crowdfunded investment platform online, Fundrise is among the pioneers who disrupted that notion on real estate investing. They have a great track record as well – by 2020, Fundrise’s cumulative total returns have reached more than $130M:

The company is headquartered in Washington, DC, under CEO, Ben Miller’s management. Today, Fundrise is more than a decade old and its userbase has grown to 130,000 active investors.

Getting Started: Fundrise Review

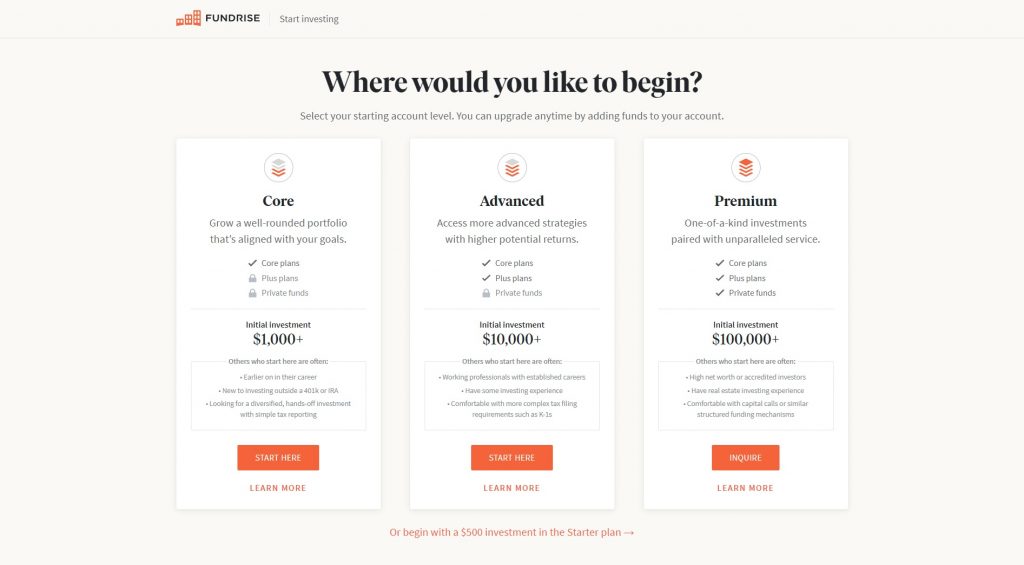

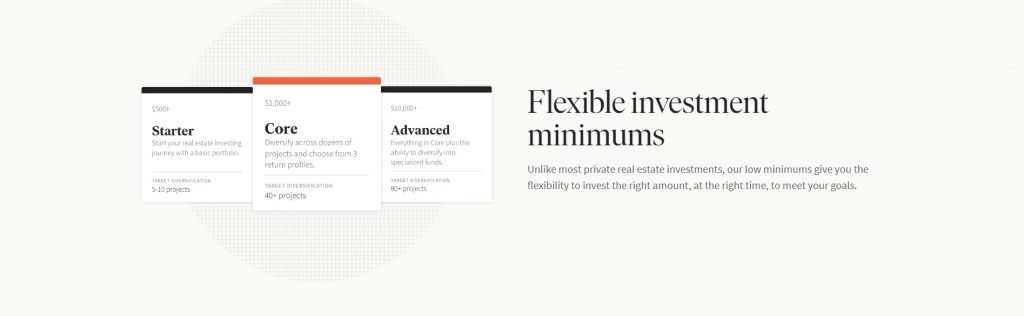

The first step when getting started with Fundrise is to choose one of their offered account levels: Basic, Core, Advanced, or Premium. You will also see in this page a quick comparison of what each of the account level offer as well as their individual price tag.

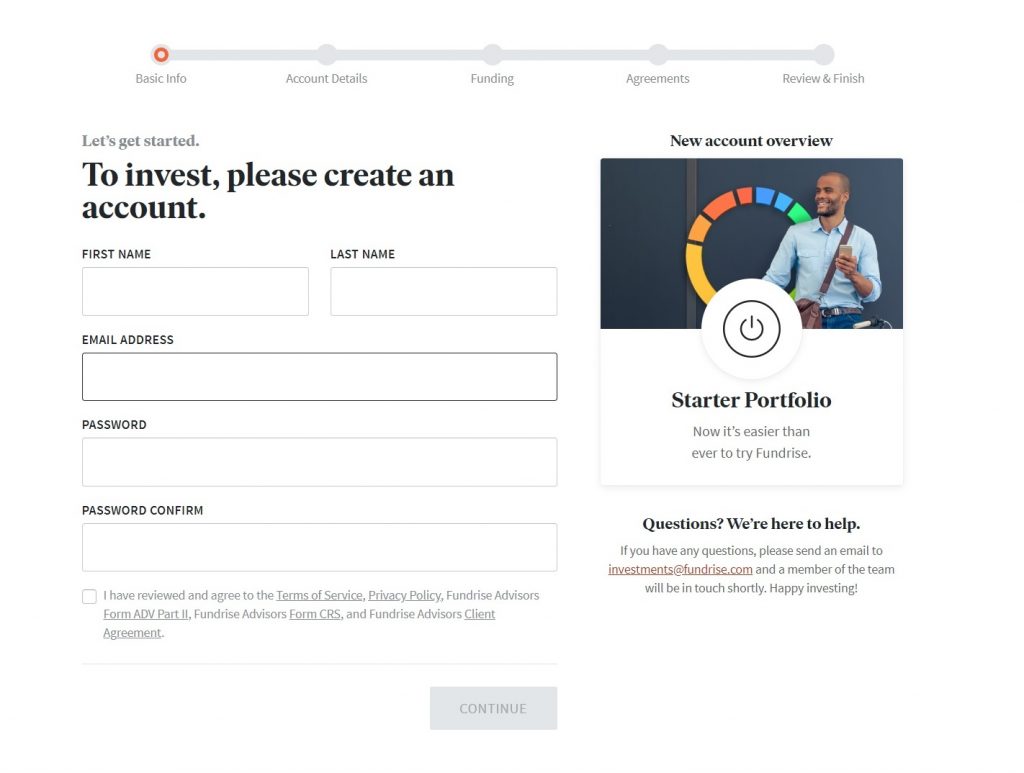

Afterward, you will be taken to the first page of the Basic Info section where you will be asked to enter your name, email, and password. The page following this one will simply confirm your country of citizenship as well as your current country of residence.

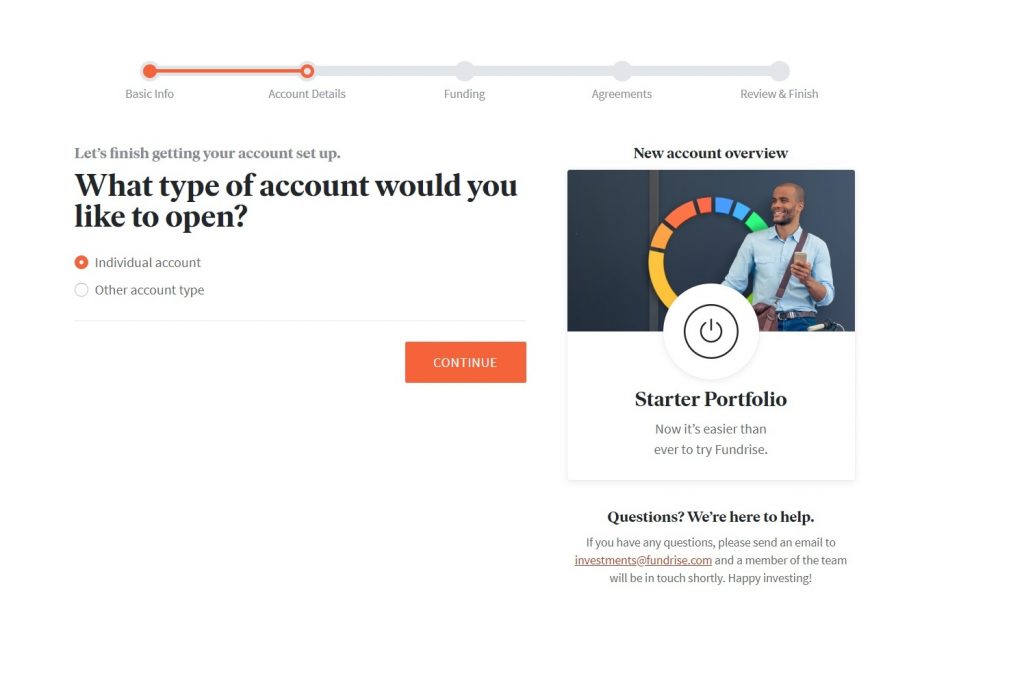

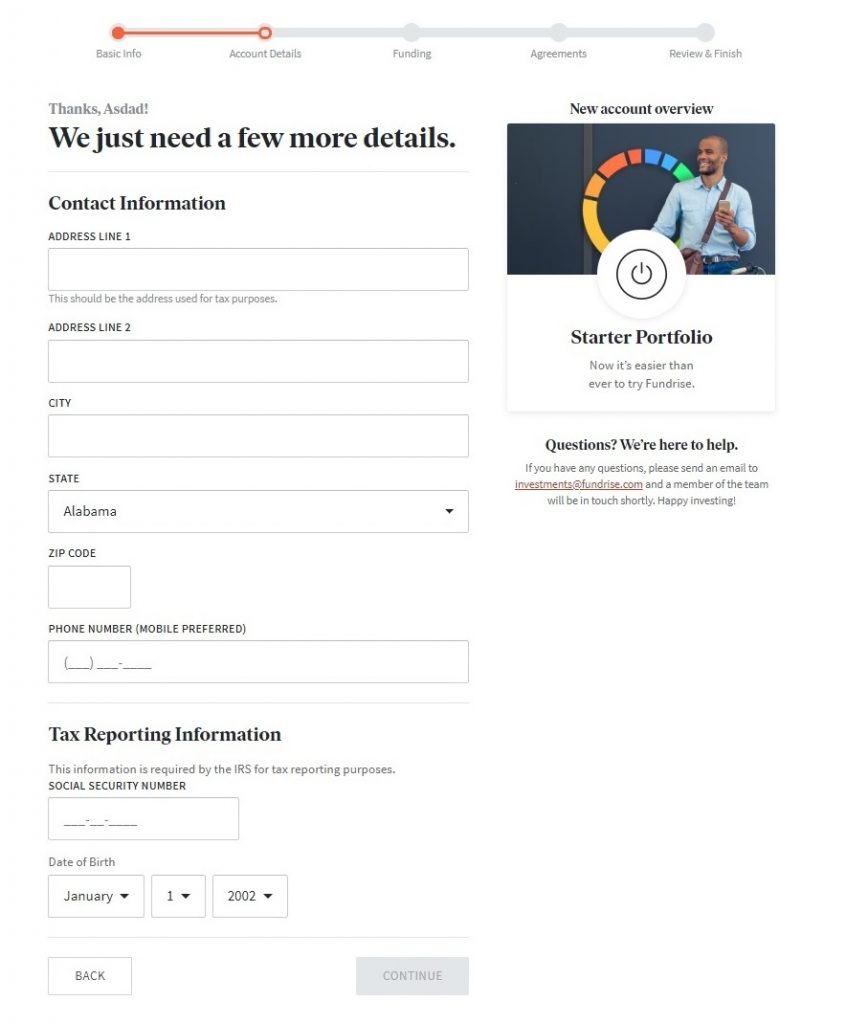

The Account Details section focuses on determining what account type you are interested in managing. Fundrise can manage individual taxable accounts, trusts, joint accounts, and self-directed IRAs.

This page is also where your contact information such as an address, phone number, date of birth, and social security number will be required.

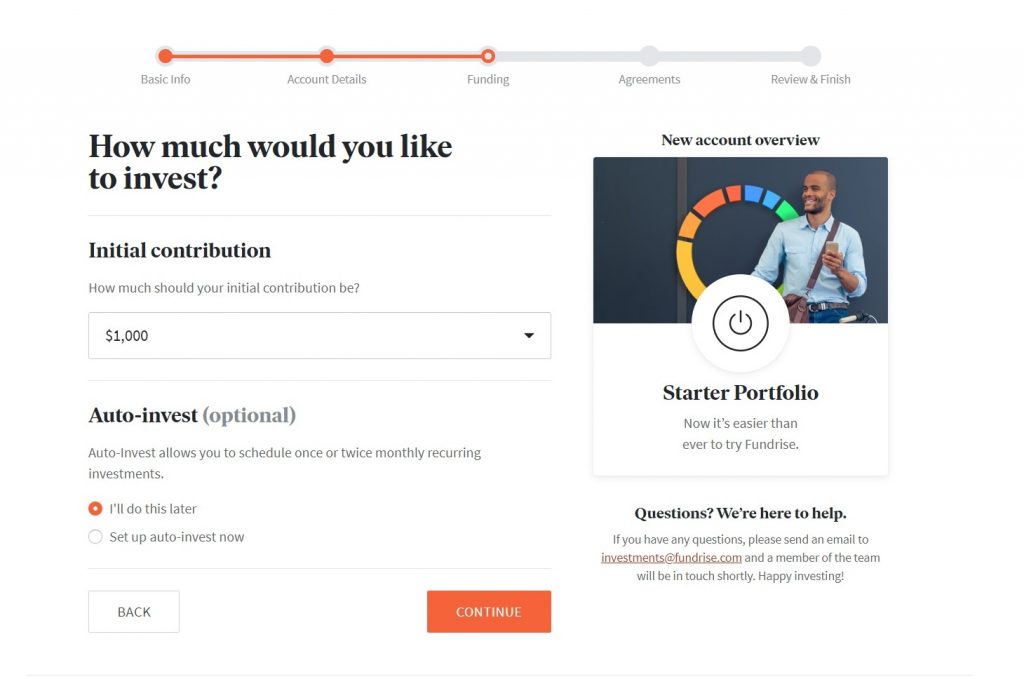

Next, for the Funding section, Fundrise will require you to state how much you want your initial contribution to be. If you are interested in their auto-invest feature, you can also decide to set that up as early as this point in the account creation.

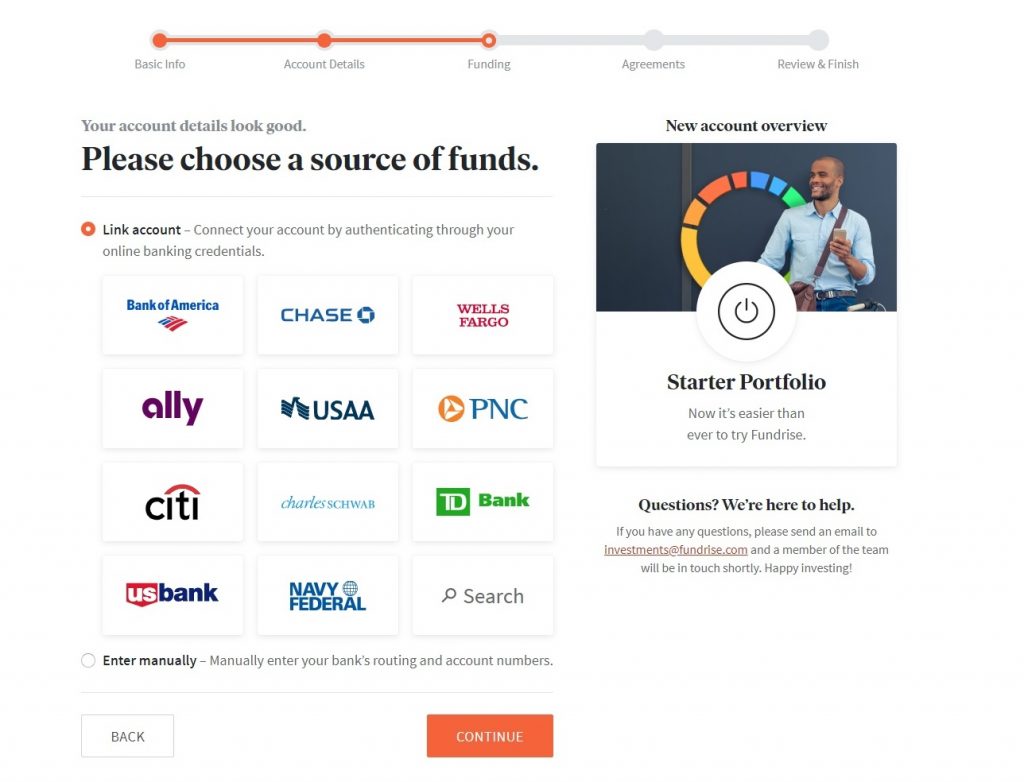

Next, you link Fundrise to your bank. You can either do that by clicking on your bank’s logo or choosing to manually enter your bank credentials.

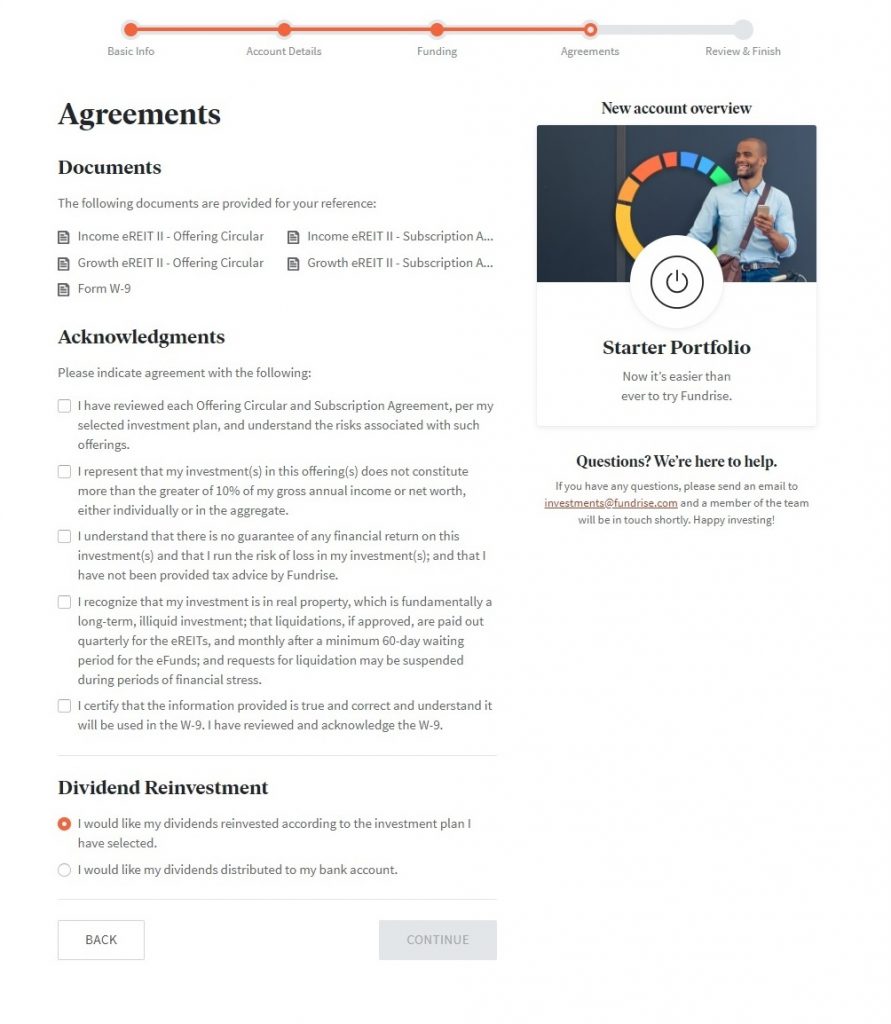

On the Agreements section, you will have to read a couple of documents as well as tick-off some checkboxes. After that, Fundrise will take you to the Review & Finish section where all your previous entries are summarized for double-checking.

The steps here are identical to what you will be seeing if you decide to create a Fundrise account through a mobile device. The setup process takes no longer than 15 minutes if you have your bank account credentials and social security number on-hand.

Fundrise Returns

Since 2014, Fundrise has averaged an annualized return of 10.58%. These returns include both appreciation and income generated from the properties.

In addition, these are average returns across all potential investments on the site. Depending on which plan you choose, you can take on different levels of risk, theoretically increasing or lowering your potential return.

Fundrise Fees

Fundrise charges 1% in fees yearly – much lower than the fees for most REITs. .85% is an annual management fee, while the remaining .15% is an annual advisory fee.

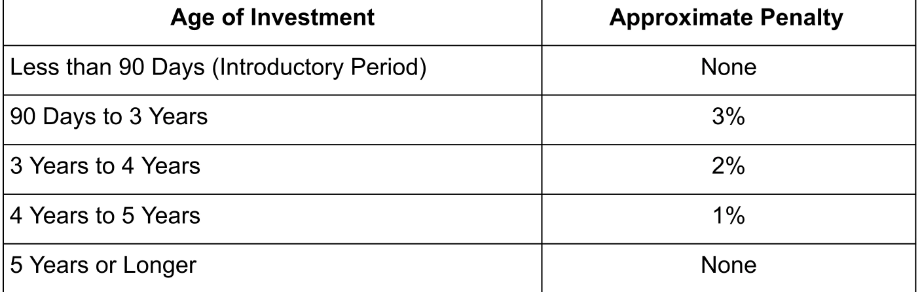

As stated above, since Fundrise is buying the properties directly, they’re able to take out the middle man and reduce fees. However, this means that it isn’t as easy to allow buying and selling, which is why they include withdrawal fees if you’d like to withdraw your money within a 5 year period from when you started investing. The fees are charged according to the schedule below:

Fundrise Review: Pros

Fundrise packs a lot of features that make it a suitable choice for interested real estate investors. In terms of functionality, here are a few areas where Fundrise shines.

- Fundrise caters to all kinds of investors

Many online real-estate investment platforms are exclusive to accredited investors. As defined in the U.S securities law, these are investors who have a net worth of more than $1 million excluding their home’s value.

Investors who acquire $200,000 in annual income are also considered accredited investors. For joint income, the threshold is at $300,000.

This restriction is not present in Fundrise. Literally, anyone (given the right age and citizenship) can opt-in on the service and start investing in real estate. This makes Fundrise one of the only viable options for many investors who are looking to get into real estate.

- Fundrise offers flexible pricing and features

Fundrise offers a variety of account levels, from Starter Plan to Premium. Their least expensive Starter Plan requires as low as $500 for an initial investment. This starting price is unmatched compared with other online real-estate platforms.

Users can also opt for the Core plan which is a recommendable option for young professionals who are new to investing. This plan has an initial investment requirement of $1000.

Users who want extra functionality can opt for the Advanced plan. Starting at $10,000, this plan is advisable for people who have established careers and prior investing experience.

The Premium plan is the most expensive among Fundrise’s list of offerings with an initial investment starting at $100,000. This plan is only available to high net worth or accredited investors.

Overall, Fundrise has a healthy selection of account levels. The offerings for each price point is tailored to a certain type of investor’s needs. The service also offers a selection of portfolio types if you invest at least on the Core plan.

- Fundrise offers three types of investment styles

Aside from the Starter portfolio which comes with Fundrise’s baseline Starter plan, the service also offers a selection comprised of three options: Supplemental Income, Balanced Investing, and Long-term Growth.

Supplemental Income focuses on a steady income stream from dividends. This is accomplished by Fundrise through rental income and property value appreciation.

Balanced Investment, on the other hand, is a better choice when it comes to greater wealth building. This is a highly-diversified investment style comprised of value-appreciating properties.

Meanwhile, Long-term Growth is designed for potentially greater returns over a longer period. Despite not having a regular income from this portfolio style, users can get annual returns as high as 15%.

If you are uncertain about which investment type best fits your need, you can answer Fundrise’s three-step questionnaire for a recommendation. Do take note, that you will only gain access to these goal-based investment styles if you opt for Fundrise’s Core Plan, Advance Plan, or Premium plan.

- Fundrise has relatively low management fees

Fundrise will set you back 0.85% in annual management fees. Furthermore, clients of the management system and investment services pay an extra 0.15% in the annual advisory fee.

In total, you will be paying, at most, 1.0% in annual asset management fees. This is an incredible offer in comparison to traditional alternatives which ranges from 1.37% to 6.45%.

In asset origination fees, on the other hand, Fundrise users will be charged an upfront cost of 2%. This is again significantly lower than the standard 25% to 40% charged by traditional real estate deals.

Fees are also the main reason why Fundrise’s eREITs are better than traditional non-traded REITs. With Fundrise’s eREITs, the cost of a broker is eliminated since you are buying directly from Fundrise.

- Fundrise has a decent redemption program

If things go south and you decide to pull out your investment from Fundrise, it is worth noting that they offer a redemption program. This means Fundrise will allow you to sell back your shares for a fee.

The fee is calculated based on the age of your Fundrise investment. If you decide to redeem your investments within the first 90 days of your account, you will get the original share price; no reduction.

If your investment is at least 90 days old but less than 3 years, your share price will get a 3% reduction. For shares held at least 3 years but less than 4 years: 2% reduction.

Furthermore, there will be a 1% reduction for shares held between 4 and 5 years. While shares held for more than 5 years will incur no reduction.

This is a reasonable share redemption rate especially the 0% charge within the first 90 days. This can be seen as a 90-day money-back guarantee; a feature that is unheard of in this type of service.

- Fundrise offers an easy-to-use service and cross-platform availability

As you have witnessed, getting on-board Fundrise is quick and easy. Even when linking your bank account, there is no need to fill up tons of paperwork; everything is simple and streamlined.

The same thing can be said with the overall experience with the platform. As the tag-line in Fundrise’s website say, “Simple, low-cost, and more powerful than ever.”

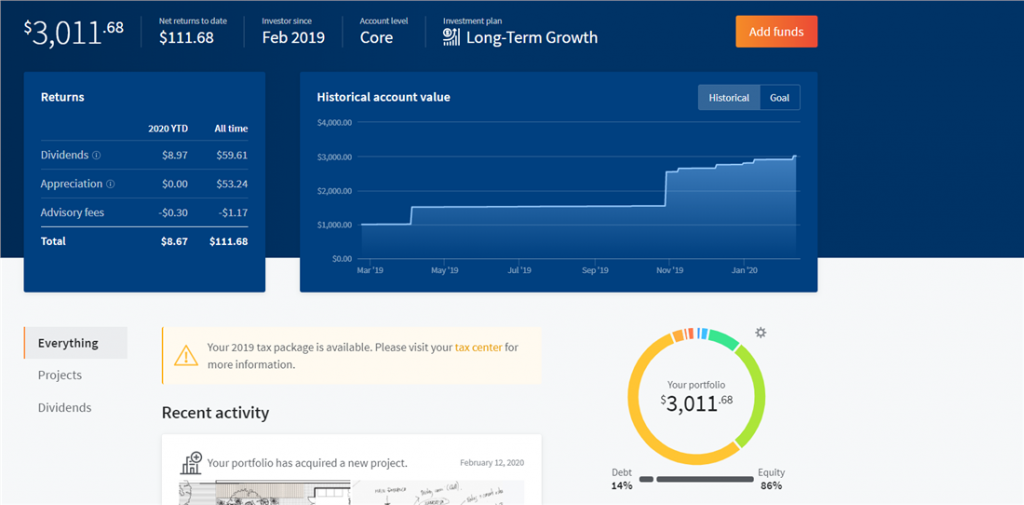

The platform’s features include a summarized earning record through Fundrise’s dashboard. In here, investors can also see their potential earnings (from capital appreciation and dividends), periodic asset updates, and monthly accounts statements.

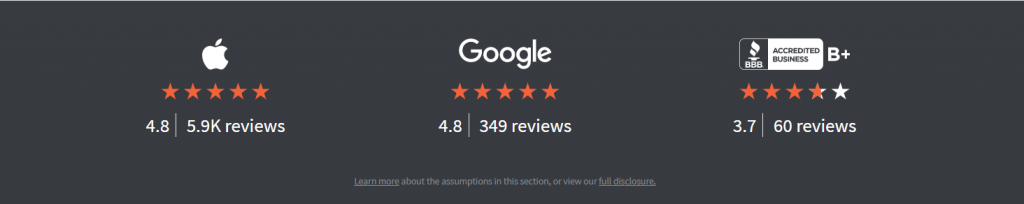

Fundrise’s dashboard is accessible through the web, or through Android and iOS applications. The Fundrise app has a 4.8 rating on both mobile platforms, with over 6000 users vouching for greatly serviced software.

- Fundrise can automatically invest your dividends

Fundrise’s services include a Dividend Reinvestment Program (DRIP). This feature will auto-pilot reinvesting your dividends for you.

Currently, Fundrise pays a decent 9% dividend, and with DRIP these dividends can be allocated according to your prior allocations or it can also be allocated in a different plan of your choosing.

Best of all, there are no extra charges in opting in (or opting out) of Fundrise’s reinvestment program. Just keep in mind that if you will be opting out, you should opt-out prior to the end of the quarter such that it would take effect in the following quarter.

- Fundrise can ensure your security

In terms of account security, Fundrise does not slack behind. The firm is allied with the Securities and Exchange Commission (SEC) and is audited on an annual basis.

Financial statements are updated regularly through a Form 1-K which is readily available for clients’ review. Across all their applications and web service, Fundrise also utilizes a bank-level 256-bit AES symmetric encryption security.

Moreover, fund transfers are protected from hacking attempts with Transport Layer Security (TLS). The company has existed for many fruitful years without any reports of security breaches, or data leaks. In terms of security track record, Fundrise is as reliable as they come.

Fundrise Review: Cons

Despite the promising feature Fundrise offers, there are a few areas where the service lacks. This may or may not be a deal-breaker you depending on your needs. Here are some of them:

- Fundrise’s redemption process takes a long time

If you are pulling your shares out and need it quick, you’re out of luck in Fundrise. The redemption request comes with a 60-day waiting period so all though charges are relatively low, you won’t get your shares back instantly.

Though their 90-day money back guarantee is a great feature, the amount of time it takes to redeem your shares is quite long with Fundrise. Should you decide to redeem your shares, you just need to visit their website and look for the section called “Redeem Shares.”

Within the section, you will find the redemption request form and you will need to fill it out before resubmitting. Upon submission, you will have to wait approximately 2 months to finish the redemption.

- Fundrise has limited liquidity

Since majority of Fundrise’s funds are used to invest in eREITs and eFunds, investments cannot be sold in publicly traded market outright. This means liquidity is one of the issues in Fundrise.

Investments in eREITs and eFunds are always long-term, thus, money cannot be pulled out of a recently signed deal right away. This is the reason why redemption of funds take a significant amount of time before being approved.

However, keep in mind that real estate is intended to be a long-term investment after all, and this makes virtually any real estate investment inherently illiquid. Fundrise’s eREITs and eFunds are designed to provide liquidity after some 5-year period of operations, but there is always no certainty that market conditions will allow for liquidity at a given time.

- Fundrise cannot cut down on your taxes

Another major caveat in Fundrise is the tendency of distributions to be taxed as ordinary income. Fundrise is transparent with this matter, in fact this document issued by the firm, attests to this.

The document reads: “Unless your investment is held in a qualified tax-exempt account or we designate certain distributions as capital gain dividends, distributions that you receive generally will be taxed as ordinary income to the extent they are from current or accumulated

earnings and profits.”

- Fundrise may cost you some extra fees

Even though Fundrise has pretty good-looking straightforward management fees, there are a lot of things that happen with your investments. It is arguable that these are not hidden fees, however, users would have to dig through tons of circulars in order to fully grasp other costs.

There are some shares in eREIT that are sold at a premium price. When this happens, a differential amount serves as a type of sales load that is put on top of the actual eREIT value. For example, a $14.50 share value is sometimes charged $15.

Furthermore, similar to other real estate deals, organizational costs are also existent on both Fundrise’s eREITs and eFunds. According to Fundrise, these costs ranges anywhere from 0% to 2%. This is not charged upfront but rather subtracted from your investment profit.

Also, in Fundrise, development fee can reach of to 5% of the overall development costs. Similarly, 1.5% of the gross proceeds is charged as disposition fee whenever eFund sells a property.

The Verdict: Who is Fundrise for?

Despite being a longer-term investment, real estate has always been a promising market to dive into, and as you saw in this Fundrise review, Fundrise is one of the easiest ways to start. For a reasonable management fee and low minimum investment, Fundrise is an attractive offer, but is it actually suitable for you?

If you are the type of investor who is willing to set aside some of your wealth for a long time, then you are going to see Fundrise as a great opportunity. Though distributions are never guaranteed, their current management fees are definitely sustainable even for many years.

If you are an experienced investor who wants to diversify outside stocks and bonds, Fundrise will also suit you. Since Fundrise offers a diversified mix of commercial properties, it provides an investment opportunity that is otherwise not accessible to many.

Overall, Fundrise is a surefire way to get investing in large commercial real estate. There is a relatively low risk, plus its fees and platform support is excellent. If that sounds like an investment platform you are willing to dive into, then take the plunge because Fundrise is for you.

Recommended Reading

Rental Properties Vs Stocks: Which Has a Higher Return?

Can Rental Properties earn more than the stock market? Find out in this in depth, head to head comparison between the 2 asset classes.

Roofstock Review 2022: Real Estate Investing for Dummies

Want to buy a Rental Property, but are scared it's too difficult? Read this Roofstock review and see how they turn the process into Real Estate for Dummies!