In general, most people don’t even bother looking into buying Rental Properties – the Stock Market is king when it comes to investing.

It’s simple, liquid, and has high returns – what more could you want?

Well, in this article I’m going to go over an alternative to the stock market: You guessed it, Rental Properties.

Side note – if you want ANOTHER amazing opportunity, there is plenty of money to be made by taking advantage of promotions run by sportsbooks. See this Dinger Tuesday article for an example!

I buy all my Rental Properties through a website called Roofstock. Their website is simple, cheap, and has all the information you need about the houses you’re considering already on the website.

They also connect you with certified property managers, insurance agents, and recommend banks to use – making the house buying process MUCH easier.

The article below won’t teach you how to use Roofstock, or teach you how to pick out a good rental property – all we’ll be doing is going through the numbers and showing how much profit you can expect to make.

If you’re interested in learning more about actually FINDING a property to invest in, I wrote an in-depth review of Roofstock going over how they turn the process of buying a Rental Property into Real Estate for Dummies – if you’d like, you can check that article out once you’ve seen how profitable Rental Properties can be and are ready to buy.

As you’ll soon see, there are many benefits that Rental Properties have over the stock market.

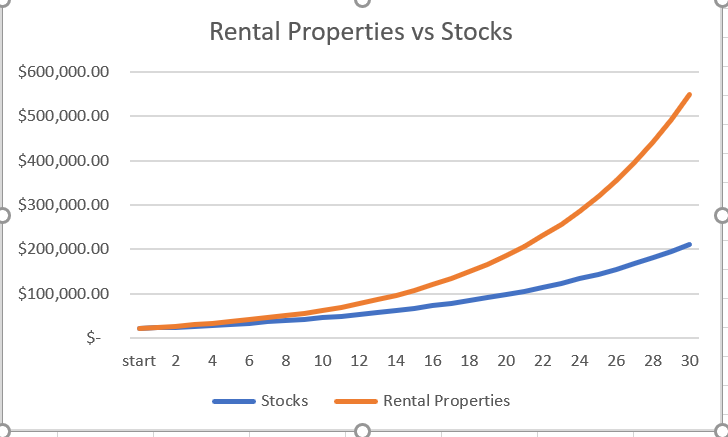

This review will discuss the returns you can expect to receive with Rental Properties vs average stock market returns and show how in many cases buying Rental Properties is vastly superior to buying stocks.

Throughout this post, we will be looking at a property I bought as a case study. We will also assume the stock market provides 8% yearly returns (including dividends), which is right around what it has averaged historically.

Attached to this article is an excel sheet where I go over each step of the calculation. Screenshots from the sheet will be shown throughout this article, but if you’d like to download the actual sheet and follow along, you can do so below.

Do Rental Properties have higher returns than the Stock Market?

Compounding returns are a real thing, and the stock market is one of the best ways to take advantage of them.

However, Rental properties actually offer MUCH higher returns, if you’re willing to do the research and find the right house.

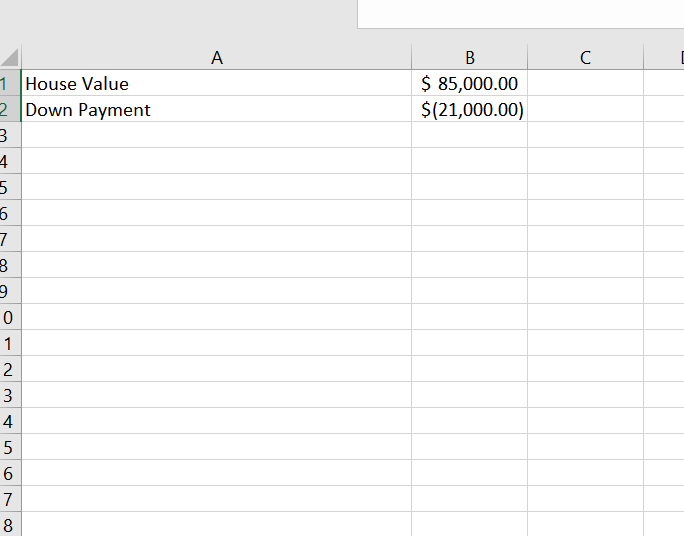

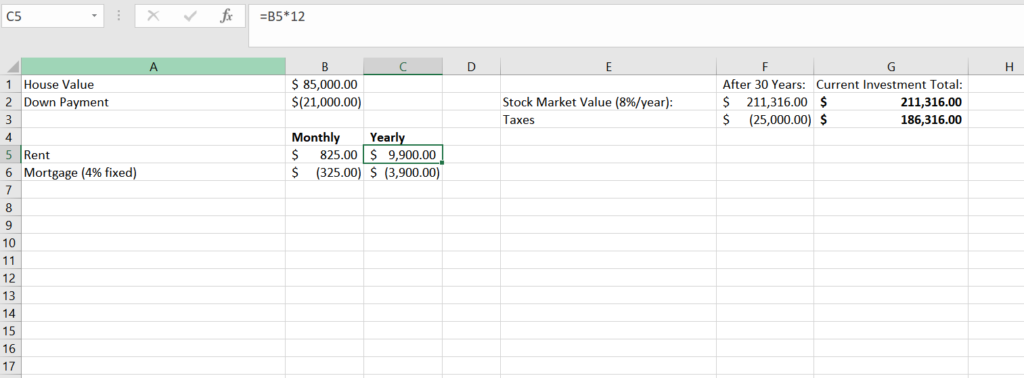

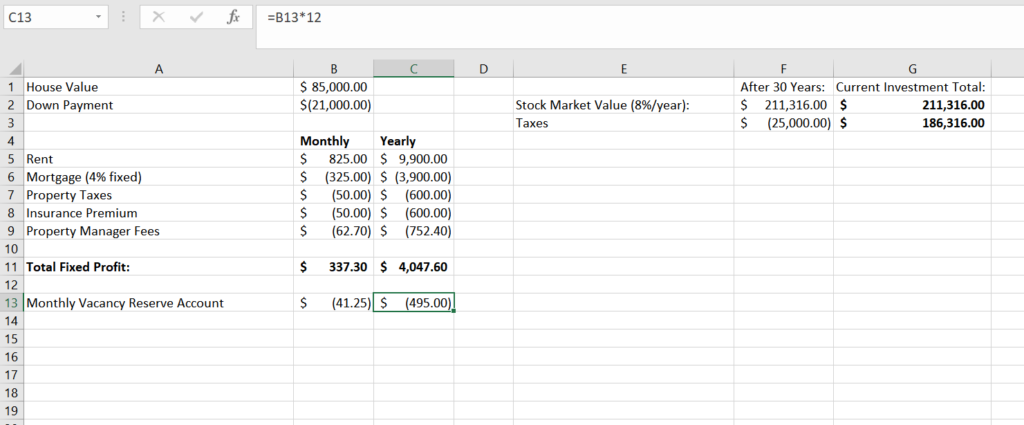

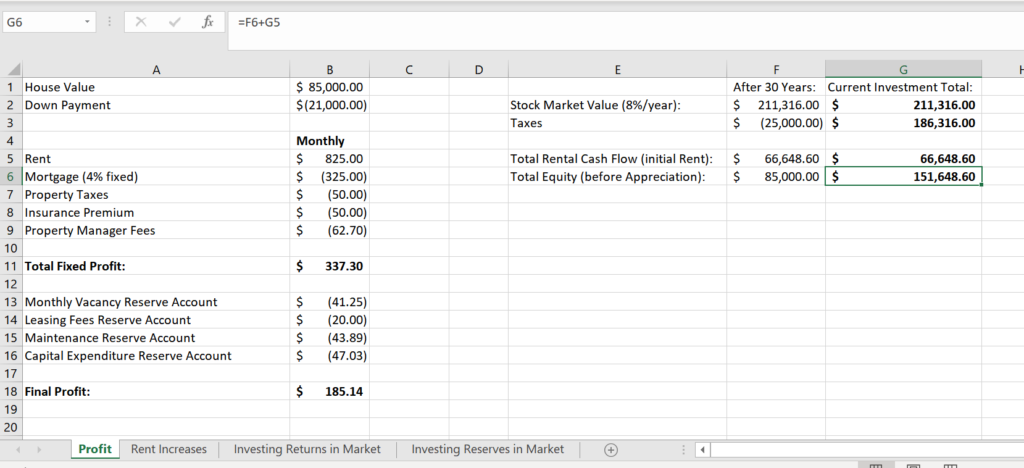

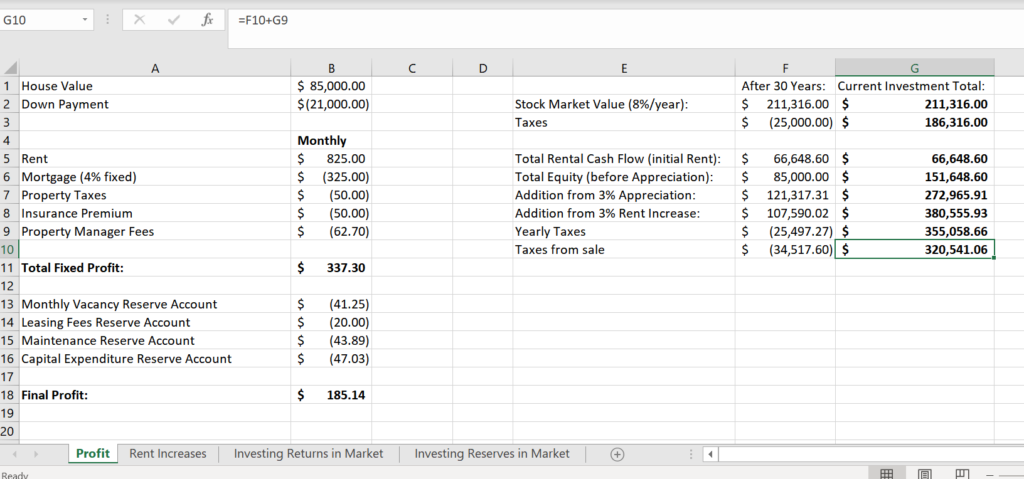

My first house on Roofstock was an $85,000 single-family home in Alabama. For this house, I put 20% down ($17,000) and paid just under $4,000 in closing/loan costs, for a total of just under $21,000 invested upfront.

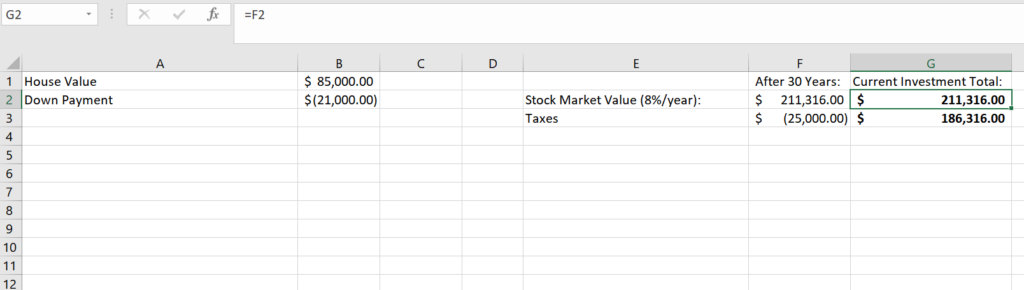

If I had put that $21,000 into the stock market, at 8% growth per year, according to this calculator I would have earned $190,316 after 30 years. Adding in your initial investment, the stocks would be worth $211,316 in total. You’ll then have to pay taxes on this total – we’ll discuss taxes more later, but for most people, taxes will total roughly $25,000, which takes the total investment value down to $186,316.

Now let’s see how much I’m going to make with my Rental property.

The simple math behind Rental Property Cash Flow

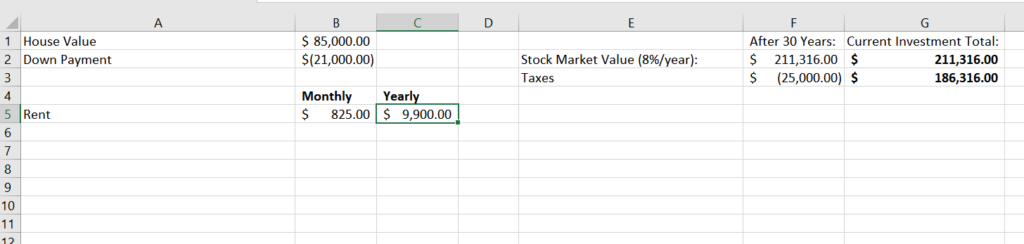

The house I bought had a renter already living there who was paying $825 in rent.

So, to calculate my return, I subtract all my monthly costs from that $825 in rent, and my return would be whatever I’m left with.

The biggest monthly cost is a mortgage: for this house, I was able to lock in a 30 year fixed rate mortgage at 4% interest. This led to a monthly payment of $325.

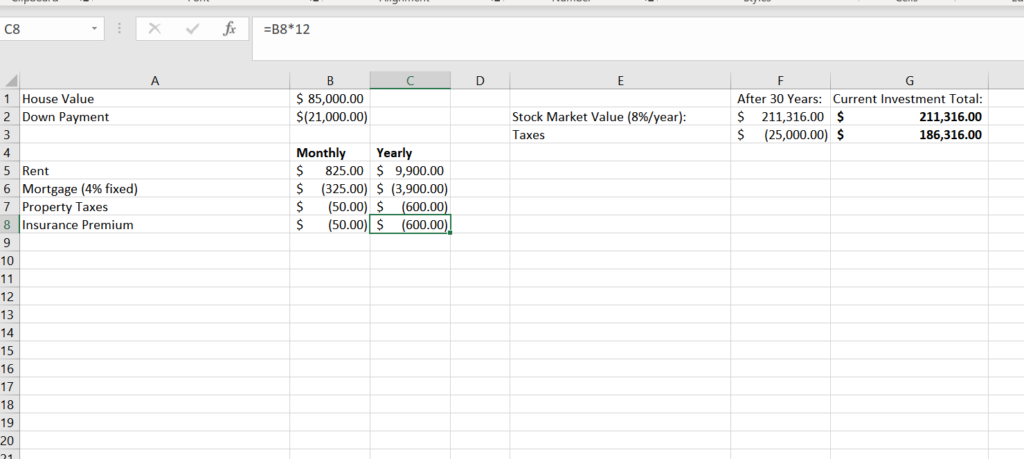

In addition, Roofstock estimated that I would have to pay $50/month for property taxes, and $50/month for insurance – this proved to be within a few dollars of the actual totals (in general you can trust Roofstock’s predictions – they’re often pulled directly from official state sources).

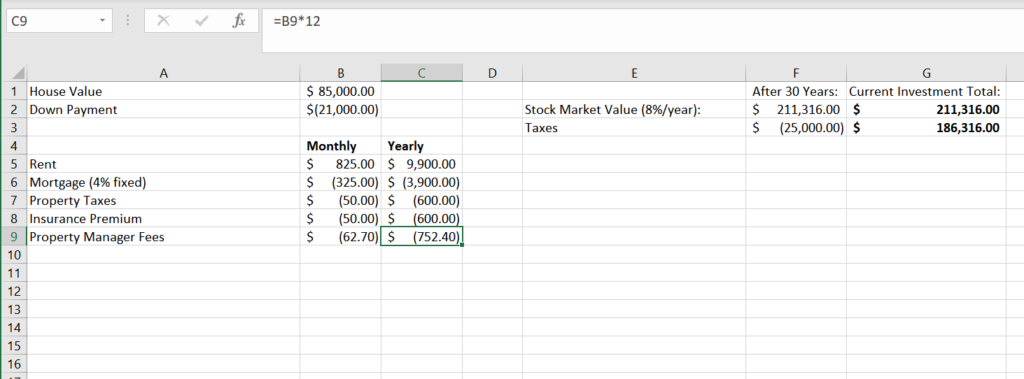

Also, Property Managers that Roofstock recommends usually charge 8% of the collected rent, which meant another $62.7 per month (8% of $825 is $66, but we’re taking 8% of COLLECTED rent to account for vacancies – see later in the post for more details on vacancies).

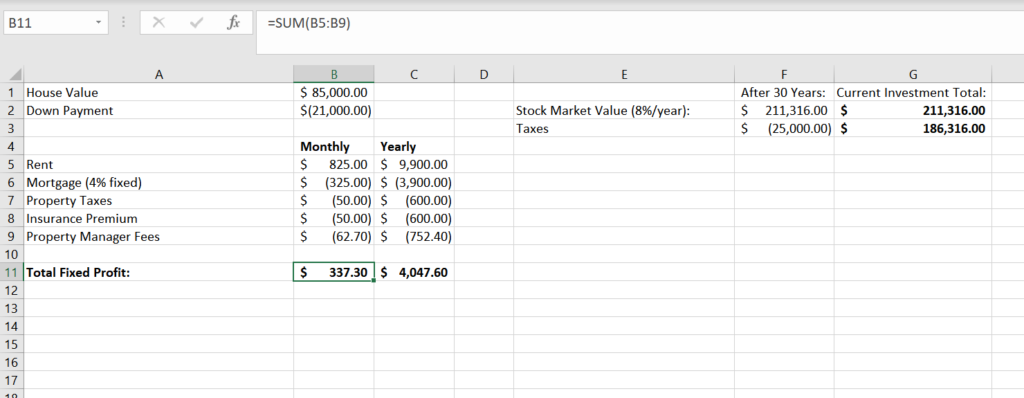

So: $825 – $325 – $50 – $50 -$62.7 = $337.3/month.

Note: Make sure you look into who would be responsible for utilities such as water, gas, garbage, etc. Roofstock doesn’t always factor these costs into their calculations, so if you’re responsible for them, you would have to make the profit adjustments on your end.

Additional Considerations

After calculating your fixed cash flow amount, there are 2 other aspects you have to consider when predicting actual cash flow:

1) How often will the house be vacant?

2) How much will general repairs cost for the house?

These costs will happen, but when they’ll happen and how much they’ll cost are a bit more unpredictable.

So, the standard advice given to new investors is to set aside a certain amount of money per month in either a bank account or in safe, liquid investments, and use that money to cover vacancies, repairs, and other issues as they occur.

Based on the area you bought the property, the age of the house, and other factors, Roofstock calculates how much you should save per month to cover vacancies, general maintenance, and larger expenses (such as a roof collapsing).

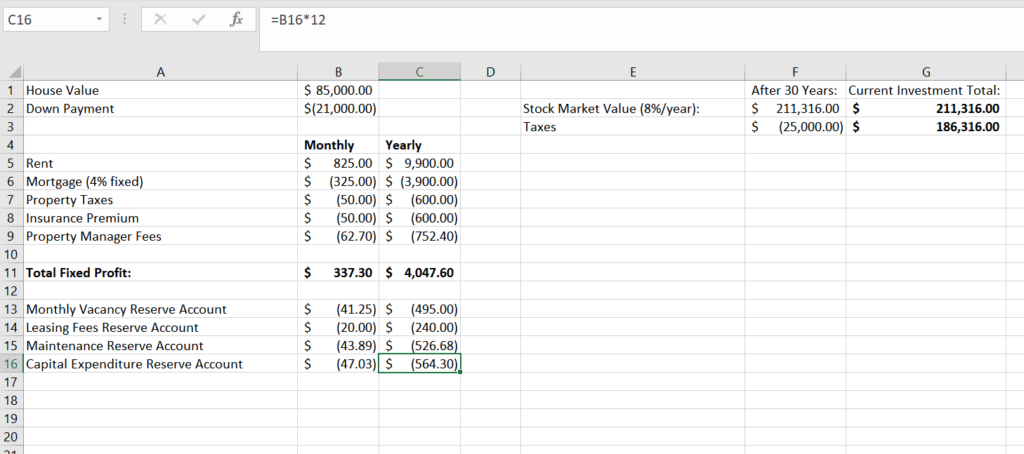

For my house, Roofstock estimated a 5% vacancy rate, meaning they expect my house to be vacant for 1 out of every 20 months.

So, they recommended that I save 5% of rent every month in a safe place, and use these cash reserves to cover the vacant months when they occur. This came out to about $41/month.

In addition, while your property manager largely handles the process of finding and placing tenants for you, that does come with an extra cost. Roofstock calls this cost “leasing fees”, and suggested I save another $20/month to cover them.

Roofstock also recommended I save 5.6% of collected rent ($44) for general maintenance and 6% of collected rent ($47) for larger expenditures that would come up.

If you disagree with their estimates and want to be more/less conservative, you can adjust these numbers on Roofstock’s site.

However, assuming you’re ok with trusting their estimates, that meant I was taking $152 from my return and putting it in a bank account to cover future costs – for all intents and purposes, reducing my monthly return by that amount.

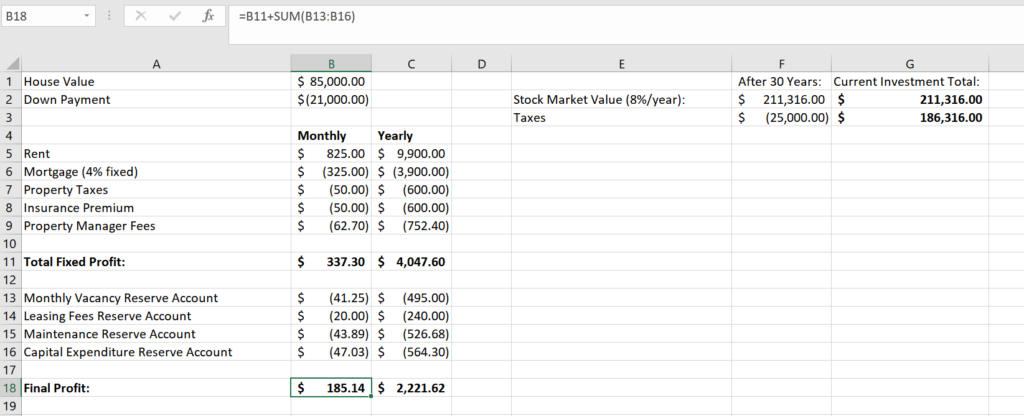

With these adjustments, my monthly return went down to $185.14/month.

Final Rental Properties Cash Flow Calculation

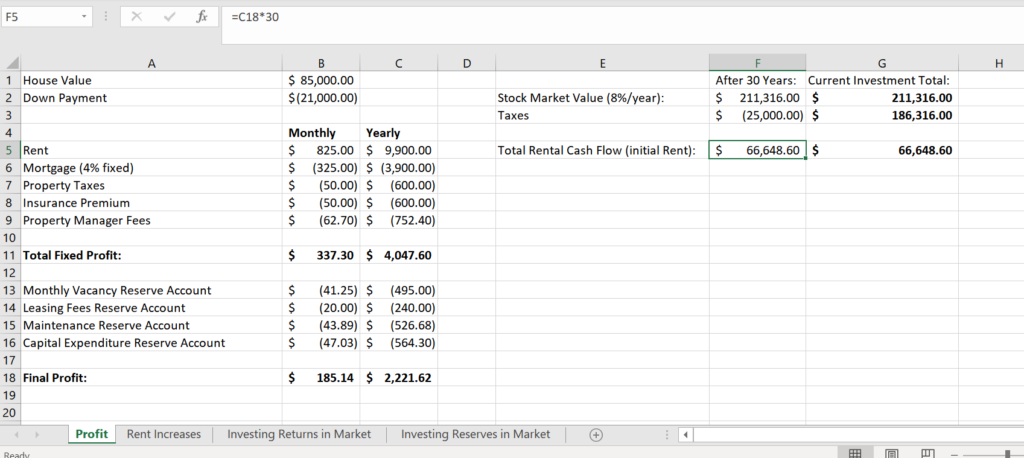

At a return of $185 per month, I am making $2,221.62 per year (a bit over 10% of my initial investment), and $66,648.60 in 30 years.

Now, you might be thinking, “Isn’t that much less than the $211,316 I would have by investing in the market”?

And you’d be right – IF that was the only way to make money through buying rental properties. Luckily, that is not the case!

Building up equity

One point that’s easy to forget is that the $211,316 you’d have if you invested in the stock market includes the $21,000 you initially invested.

This applies to Rental Properties as well – in addition to all the money you made from rental income, you also own the actual house you bought.

After 30 years of paying your mortgage, your house will be completely paid for. The house in this example was worth $85,000 when I bought it, which means that even if the house value stayed the same, I would own an $85,000 asset once the 30 years are up – adding in $85,000 to the $66,648.60 I made from rent payments gets me to $151,648.60.

However, it’s extremely unlikely that the value of the house will be the same in 30 years. This brings us to our next topic:

Appreciation

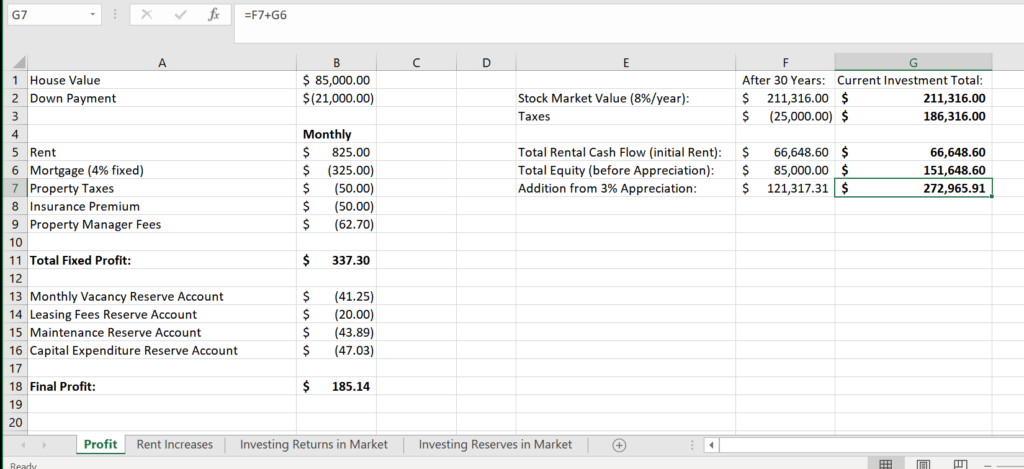

House prices tend to rise along with inflation, which is typically around 3%.

This number can vary based on location and other circumstances, but in general, 3% is a good baseline number to shoot for.

So, assuming your $85,000 house rose an average of 3% per year, it would be worth $206,317.31 at the end of 30 years – an increase of $121,317.31 from its original value.

Adding this to our total return brings us to $272,965.91 – over $60,000 more than if we invested in the market!

But wait – that’s not all. There are even MORE ways you can make money when buying rental properties.

Increasing Rent

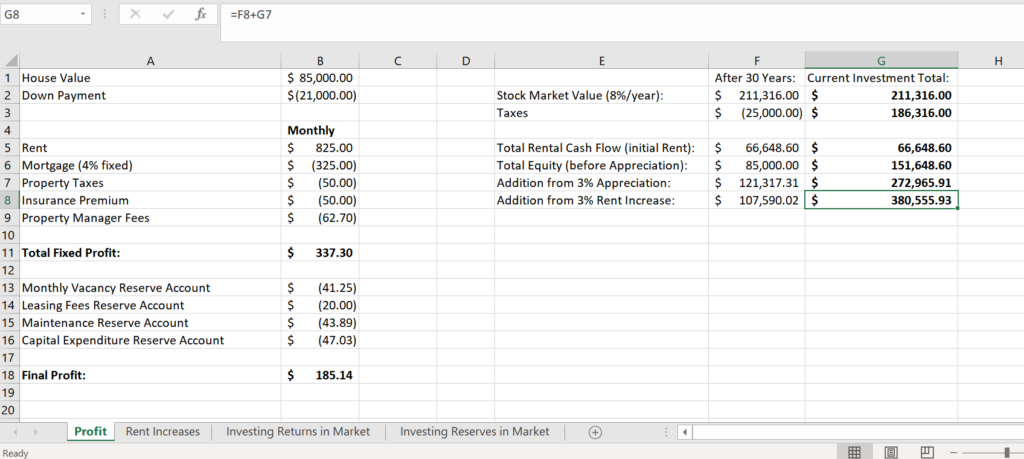

As house prices rise, rent prices rise as well – but your mortgage payment stays the same.

So, in general, a reasonable expectation is that you can increase rent by 3% each year since rent prices typically rise along with the house price.

If your expenses all rose at the same rate as your rent, that would mean that profits would increase by 3% each year. However, your monthly mortgage amount will never change – meaning your revenue is rising faster than your expenses, and profits will increase by MORE than 3% each year.

This can be difficult to understand for those without a background in statistics, so let’s go through a simple example.

Assume every month you collected $100 in rent, and paid out $50 for Mortgage and other expenses, for a $50 profit.

If Revenue and expenses both increased by 3%, you would collect $103 in rent, and payout $51.50 in expenses, for a $51.50 profit.

$51.50 in profit is 3% more profit than $50.

However, if expenses DON’T increase, then you would be making $53 in profit, which is a 6% increase.

If rent prices and all non-mortgage payments rise by an average of 3% per year, my total cash flow will grow exponentially each year, and after 30 years will have totaled $174,238.62 – $107,590.02 more than our initial cash flow estimate of $66,648.60

Adding this to our total, our investment is now worth $380,555.93.

To see the math behind that $107,590.02 number, download the excel sheet at the top of this page and go to the “Rent Increases” page.

Taxes

Let’s take a break from discussing returns and talk about everyone’s favorite topic: Taxes. Rental Properties and Stock Market gains are taxed differently, which can affect returns quite a bit.

Stock Market Taxes

In the stock market, you pay taxes on dividends earned every year, and you pay capital gains tax when you sell.

The yearly tax you’ll pay on dividends is small, and can usually be made up for by utilizing Tax-Loss Harvesting.

However, Capital gains tax is a much bigger deal. How much you’ll pay depends on your income levels (see here for a breakdown).

Most people will fall into the 15% bracket, so let’s use that as an example. If you sell all your stocks after 30 years, you will have to pay 15% on the $190,316 that you earned in the market, minus whatever amount of that was due to dividends earned instead of capital gains.

Between calculating the dividend portion vs capital gains portion of your gains, differentiating between income amounts, and taking advantage of all tax rules, estimating an exact amount for taxes is hard. However, something like $25,000 owed in taxes after 30 years should be a safe estimate.

As stated at the beginning of our calculation, subtracting $25,000 from our stock total means that your stocks will be worth around $186,316 if you cash out after 30 years.

Now let’s look at taxes for Rental Properties, starting with taxes on your cash flow.

Rental Property Taxes

Rental income is taxed at your Income Tax rate, which is usually higher than the Capital Gains rate. However, there are several tax laws you can take advantage of to help mitigate this.

For starters, all expenses you pay per month relating to your rental property are tax-deductible, so you will only be paying taxes on your monthly profit. These profits are taxed every year at the same rate as if it was income that came from your job

Next, there is a big tax incentive for you to take advantage of called depreciation.

When you buy a house, the purchase price covers 2 things: the value of the house, and the value of the land.

According to law, you’re allowed to depreciate the value of the house over 27.5 years and claim this amount as a loss.

This means you can lower your yearly tax bill significantly. However, once you sell the house, you’ll have to pay income taxes on the amount that you depreciated.

So really, this is a tax deferment – similar to a traditional IRA.

In my situation, the land was 20% of the value (a fairly common proportion), which meant the house was worth $68,000. $68,000 divided by 27.5 equals $2,472.73 per year.

For the first few years, $2,472.73 will likely be close to your total return, if not more – so you won’t be paying much taxes on your rental property, and may even get a refund. However, as you start to increase rent, profits will increase, meaning your yearly taxes will as well.

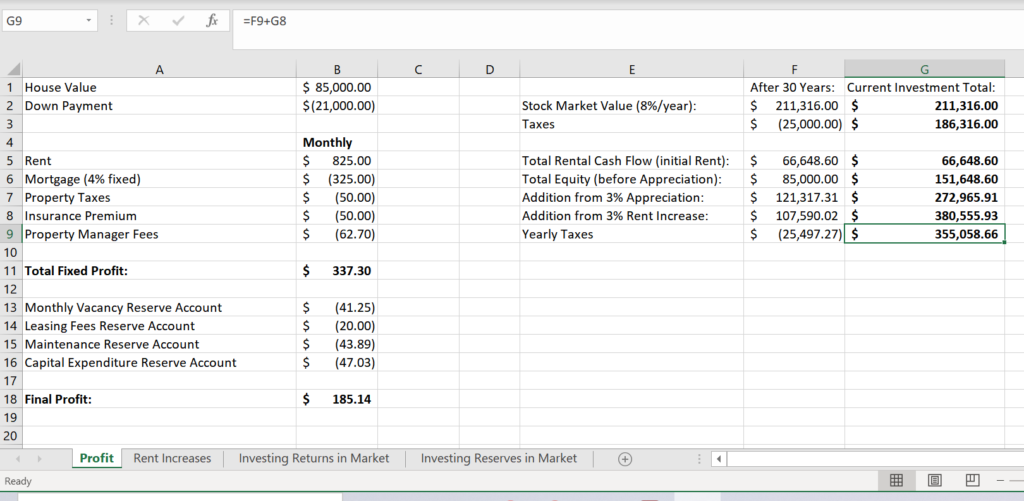

If you remember from above, after Rent increases are factored in our total cash flow was $174,238.62. Subtracting $68,000 from this means that we’ll have made $106,238.62 after 30 years for tax purposes.

Assuming your average tax bracket over those years is 24%, you should expect to pay about $25,497.27 in taxes during that time period, with most of that coming late into the 30-year mortgage.

Subtracting $25,497.27 from our total leaves us with a profit of $355,058.66.

However, cash flow wasn’t the only way we made money with Rental Properties. We made money due to appreciation as well, so we also may have to pay taxes on that.

If you ever sell the house, you will have to pay Capital Gains tax on the amount that the house went up in value, PLUS you’ll have to pay Income tax on the amount that you depreciated.

Above, we estimated that the house would be worth $206,317 after 30 years, which is an increase of $121,317.31.

If we depreciated the full amount, that means we would owe Income Tax on $68,000, and Capital Gains tax on the remaining $121,317.31.

Let’s again assume Income taxes are 24%, and Capital Gains taxes are 15%. That would mean you owe $34,517.60 in taxes, once you sell the house.

In reality, this is probably a high estimate. Many of the costs you pay at closing are added onto the cost basis of your house, as well as most improvements or repairs you do over the years.

This would decrease your appreciation owed – For example, if you bought a house for $100,000 and are now selling it for $200,000, that would normally be appreciation of $100,000 that you owe taxes on. However, if over time you paid fees and did renovations that added $40,000 to the cost basis of your house, it’s as if you bought the house for $140,000, which means you’ll only pay taxes on an appreciation amount of $60,000.

Remember, you also don’t have to sell the house. And, even if you DO sell the house, you can take advantage of the 1031 exchange tax rule and buy another house. However, let’s assume for now that you sell the house after 30 years.

Subtracting all taxes from our total, we’re left with $320,541.06.

Compounding Your Rental Properties’ Returns

Let’s put equity, rising house prices, and tax benefits aside for a second and focus on yearly cash flow.

As stated before, just the income you’ll get from rent-paying tenants is about 10.5% in year 1, which is higher than you’ll get in the market.

So in that case, how come the stock market netted us over $190,000 in cash flow, while our initial cash flow calculation for rental properties would only amount to roughly $66,000 before adding in the additional profit methods we discussed? If the percent return is higher than the stock market, shouldn’t the total return ALSO be higher?

This contradiction is due to the fact that in the stock market, your returns are automatically reinvested, which causes your earnings to compound. This is not true of Rental Properties.

Consider an example: Let’s say the stock market and rental returns were both 8%. If you start with $100,000, your year 1 earnings would be the same in either case: $8,000.

However, in year 2, you would now have $108,000 in the stock market. 8% of $108,000 is $8,640, while your rental property returns are stuck at $8,000.

Raising rent compensates for this somewhat, but rent only rises about 3% per year – not 8%.

So basically, in the stock market, you’ll earn 8% of the combined total of your initial investment AND profits, while with Rental Properties you’ll only earn 10.5% on your INITIAL investment, plus whatever you get from rent increases.

This is why the total stock market return of $190,316 is greater than the total rental income return of $174,238.62 – even after factoring in rent increases.

However, you can easily change that by simply taking your rental returns and investing them into the stock market yourself.

This makes your rental income increase exponentially, similar to how stocks do – although the return on the rental income you put into the stock market will only be 8% instead of 10.5%.

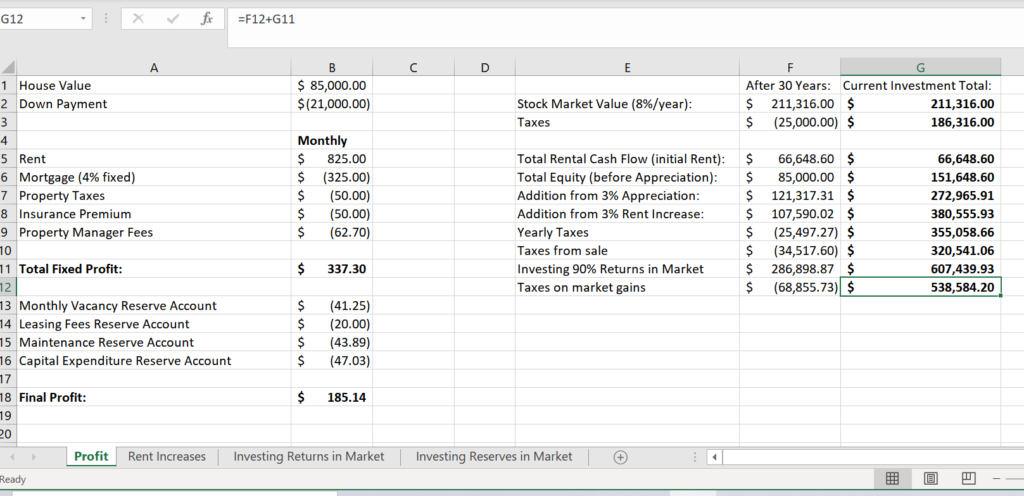

Still, this launches your returns into another stratosphere. If you take your rental profit and consistently invest it all into the stock market, you would make another $318,776.52!!

However, this may be a bit TOO aggressive. Some of your profits will be going to pay taxes, so they can’t be reinvested. While this is mitigated significantly by the fact that you likely won’t owe any taxes for the first few years of this investment (during which your returns have the most time to compound in the market), it still means you can’t literally invest 100% of your returns in many cases.

In addition, you may need some of the money for other things, whether it’s untimely repairs, everyday expenses, or anything else. So, a more realistic goal might be to invest 90% of your rental earnings each year on average, which would still net us an additional $286,898.87. Taxes on this will cost about $68,855.73.

Adding this to our total brings us all the way up to $538,584.20.

To see the math behind the $286,898.87 number, download the excel sheet and go to the “Investing Returns in Market” page.

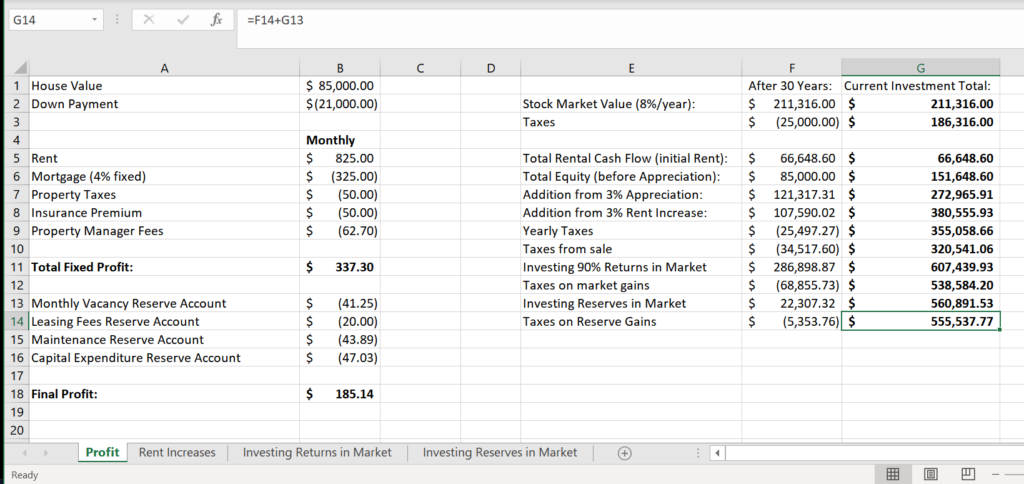

Optional: Invest your reserve accounts in the market as well

Earlier, we discussed the importance of setting aside money in a reserve account to pay for vacancies, repairs, and big expenses that come up through the lifetime of the house.

If you’re comfortable with some risk, you can invest those reserves in the market as well to increase your returns even more.

Obviously, you can’t invest all of it for the full 30 years – after all, over the lifetime of the house, you’d expect to spend all that money on repairs/vacancies.

Let’s assume that on average you’re able to invest these reserves for a year before you need them for repairs. Let’s also assume that any returns you make can be kept in the market until the end of the 30 years.

At 8%, this would net you another $22,307.32, or $16,953.56 after taxes. This increases our total to $555,537.77.

To see the math behind the $22,307.32 number, download the excel sheet and go to the “Investing Reserves in Market” page.

Rental Property Total: $555,537.77

Stock Total: $186,316

Difference: $369,221.77 (or 3x more than stocks)

Wrap up: Rental Properties Returns Vs Stock Market

A lot of the above numbers are just examples, and many assumptions are made. If you’d like, you can recalculate the expected return using different assumptions (for example, maybe you think you will only be able to increase rent by 2% each year on average).

There are also advanced strategies you can take on either side that would complicate the discussions, such as:

- Advanced tax strategies (talk to an accountant before trying any)

- Investing 100% of your rental returns in the market instead of 90%

- Investing your stocks in an IRA to get tax breaks

- Not selling the house after 30 years, or selling it and buying another property with the money

However, no matter what assumptions you use, you’ll likely come to the same conclusion: You’ll make much more money investing in Rental Properties than the stock market.

Diversification: Another reason not to go all-in on stocks

No matter how confident you are in a single asset class, diversification is never a bad thing.

The stock market tends to perform very well over long periods of time, so as long as you’re planning on holding until retirement, you should be fine.

However, past performance isn’t a guarantee of future performance, so it’s always POSSIBLE the stock market is about to have a really bad 20-30 year stretch. Having your money spread between different asset classes helps mitigate the stress of that happening.

This is another reason to invest in Rental Properties. Having a portfolio that includes Stocks, Rental Properties, and other assets is MUCH safer than a portfolio that only includes a single asset class.

Rental Properties Vs Stocks: Wrap Up

If you decide to sell your house, you’ll likely have to wait for months before you see the money. This makes Rental Properties much less liquid than stocks.

So, despite all the advantages of rental properties, you shouldn’t go all-in on them.

A good Rental Property allocation target is about 30-50% of your portfolio. If you stick within that range, you should be in a good position for the long term.

However, it’s clear why Rental Properties should have a prominent place in your portfolio.

When done correctly, the return is MUCH higher than what you’ll get in the stock market – in fact, you can easily earn more than 3x what you would with stocks over 30 years.

And if you use Roofstock as I recommend, you can get started quickly and easily.

Recommended Reading

Roofstock Review 2022: Real Estate Investing for Dummies

Want to buy a Rental Property, but are scared it's too difficult? Read this Roofstock review and see how they turn the process into Real Estate for Dummies!

Fundrise Review 2022: Who is it suitable for?

Want to get Real Estate exposure, but don't think you have the capital? Check out this Fundrise Review for an innovative solution!