My goal in writing this Roofstock review is simple: to explain how Roofstock turns the process of buying Rental Properties into Real Estate Investing for Dummies, and to show how this method of investing can be much more profitable than the stock market.

After using Roofstock to invest in my first Rental Property, my entire perception of real estate was changed forever. I had assumed Real Estate investing wasn’t for me, and with good reason.

After all, investing in Real Estate used to be inaccessible for most people.

You had to be rich, hire a broker to help find properties, and pray that you didn’t get a tenant who would ask you to constantly do annoying tasks like changing their light bulbs in the middle of the night.

Today, Roofstock and other turnkey Real Estate marketplaces make it easy for the general public to buy this amazing asset class.

In fact, they simplify the process so much that I like to call the Rental Property Investing process on Roofstock “Real Estate Investing for Dummies”.

What is Roofstock?

When done right, a rental property can be an amazing source of passive income – and Roofstock helps you do it right.

Roofstock is a website that allows you to browse properties for sale, compare the financials and other relevant information, and purchase. Plus, they’ll be helping you out through the entire process and ensuring that you don’t feel overwhelmed.

Does Roofstock Work?

With Roofstock, finding a profitable property to buy is quick and easy.

Plus, by using one of Roofstock’s Certified Property Manager partners, you can buy a house thousands of miles from where you live, and have the property manager be the one to deal with your tenant.

In fact, when I bought my first property from Roofstock, I never even saw the house in person!

In this Roofstock review, I’m going to go over what Real Estate Investing for Dummies means, and why you should want to own rental properties in the first place.

And I should know – a few months before buying my first property, I had never DREAMED of being a landlord.

By the end of this Roofstock review, you’ll see how I used Roofstock to purchase my first property, and you’ll have all the knowledge necessary to buy YOUR first property and start raking in that passive income.

Let’s get started!

How does Roofstock turn Rental Property Investing into Real Estate Investing for Dummies?

Think of Roofstock as the Ebay of Rental Properties.

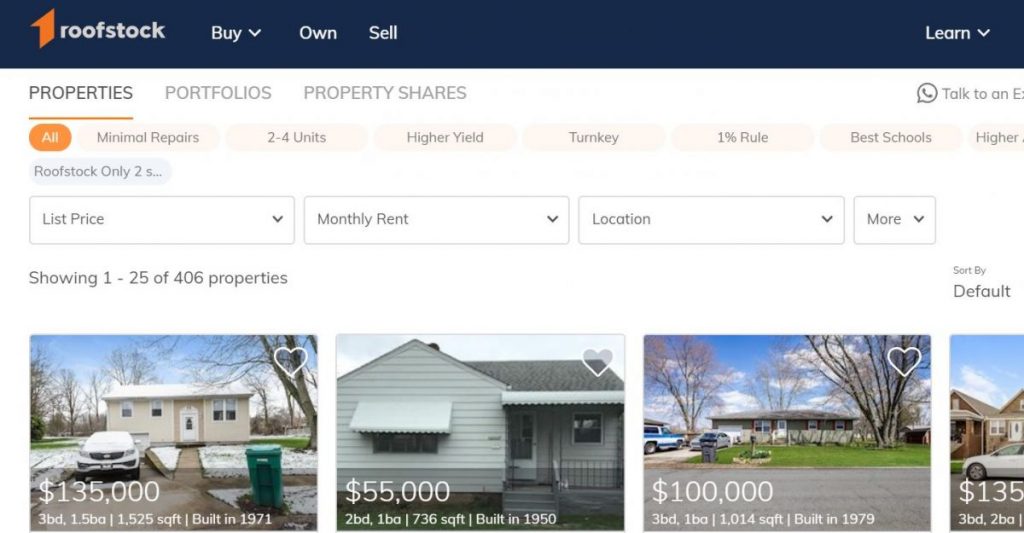

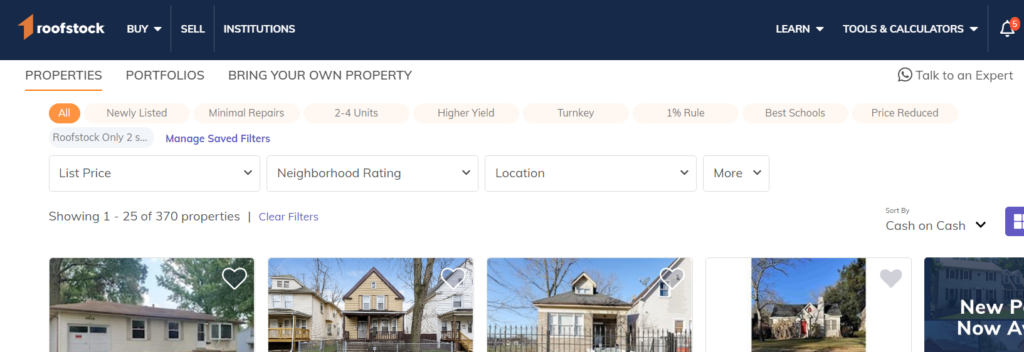

Instead of paying a real estate agent to find you a house, you can just go onto Roofstock’s website, select the criteria that you’re looking for, and scroll through all the houses that match that criteria.

You can filter based on location, total return, amount of immediate repairs necessary based on the last inspection, and so much more.

Once you’ve found a house you’re interested in, you can view all necessary numbers and information on that house’s listing page.

And if you’re still struggling to find a house, you can call up Roofstock and ask for help – their customer service is amazing.

Roofstock Review: User Interface / Ease of Use

Roofstock makes sure their site is incredibly easy to use.

To view available properties, click the Buy button on top of the screen, then click Properties.

You will then see a list of all available properties. Filters can be created and saved with the click of a button, and email alerts can be set up so that you’re notified if more houses become available that match your specifications.

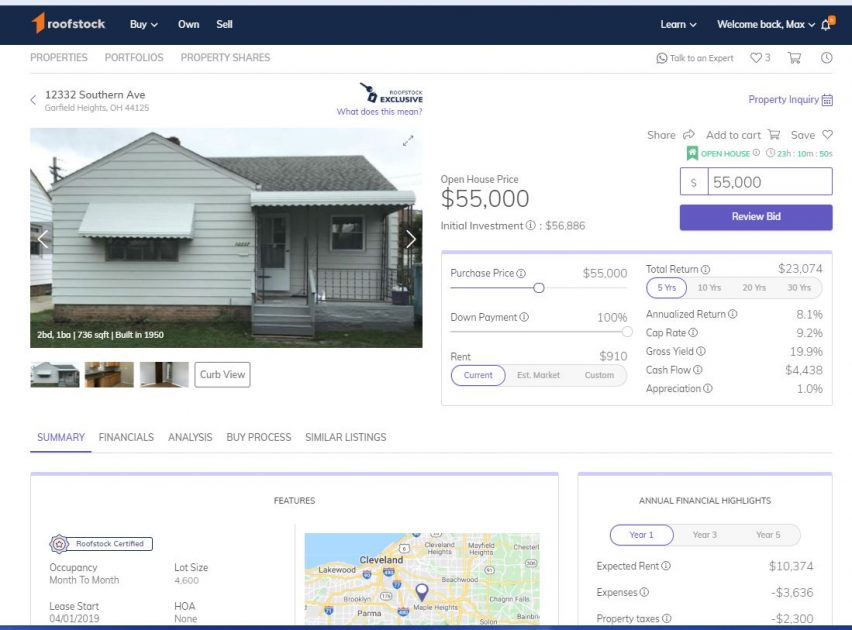

Once you’ve selected a house, you will be taken to that house’s listing page.

Here, you can view all relevant information about the house.

At the top left of the screen you’ll see pictures of the house, and can view the surrounding houses as well by clicking “curb view”, helping you get a sense of the neighborhood your house is located in.

On the top right you’ll see the purchase price, estimated closing costs, estimated return, estimated rent, and other useful metrics. This works as a quick overview of the asset you’ll be buying, but the REALLY useful information is lower down on the page.

If you scroll down a bit, you will be able to choose from 5 different tabs:

- Summary

- Financials

- Analysis

- Buy Process

- Similar Listings

Let’s quickly go through the important tabs and see what information they each hold.

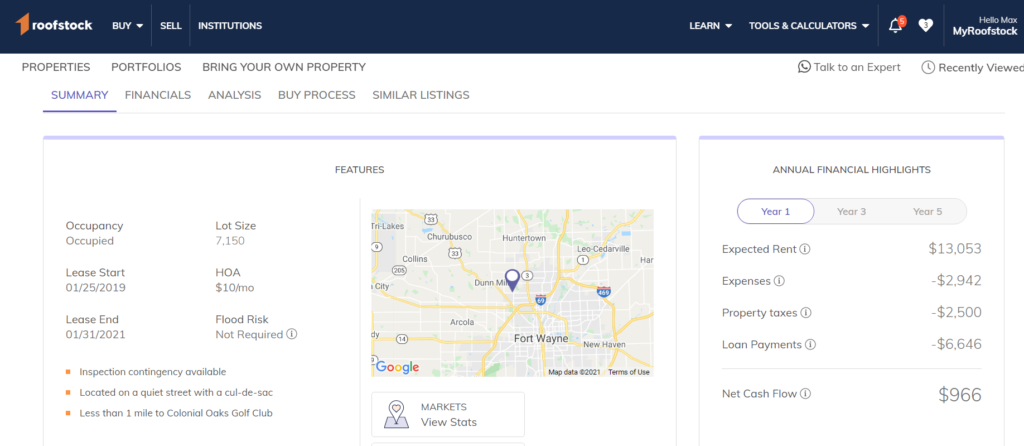

Roofstock Summary Tab

This tab is a continuation of what was shown at the top of the page and acts as a quick overview of what you’ll find in the other tabs, but less detailed and more simplified.

You’ll find some information about your renter, the neighborhood, profitability, and other useful information about the house.

Roofstock Financials Tab

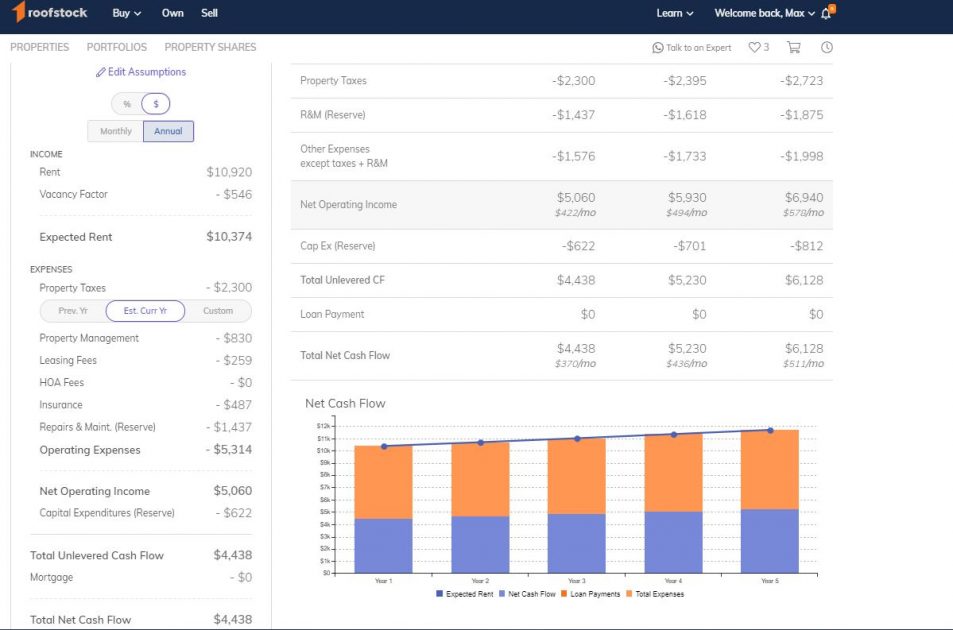

Here is where things start getting interesting. The financials tab contains everything you need to know to determine how much money you’ll be making from this house each month.

Some of the numbers you’ll see are estimates by Roofstock. If you don’t agree with them, you can edit them with your own numbers and see how that changes your overall profit.

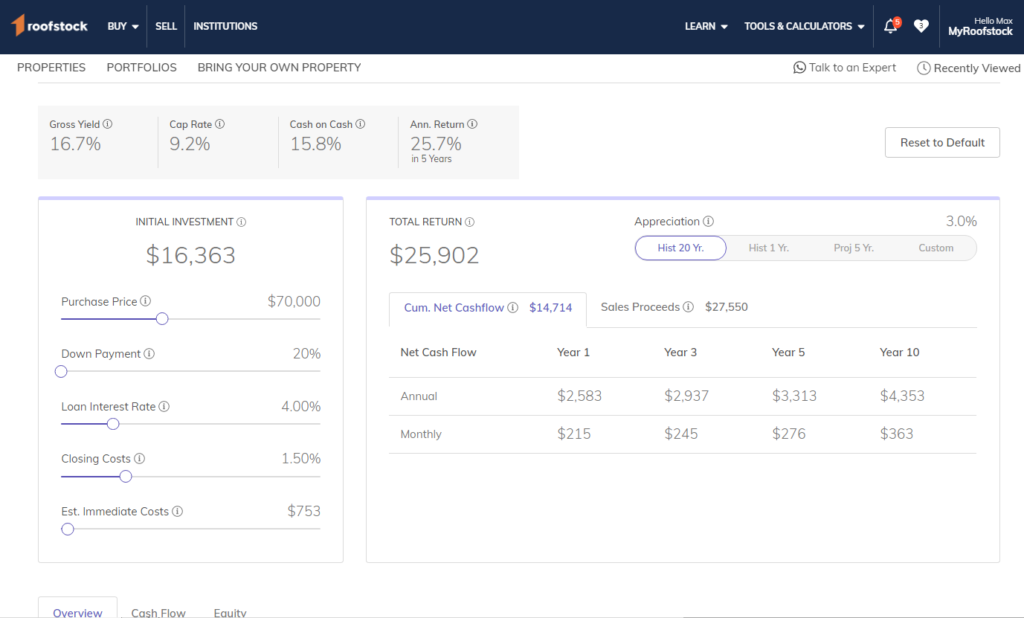

At the top of this tab, you’ll see some basic estimates for how much money you’ll make each year.

To see the underlying numbers that make up these calculations, scroll down until you see 3 MORE tabs to choose from:

- Overview

- Cash Flow

- Equity

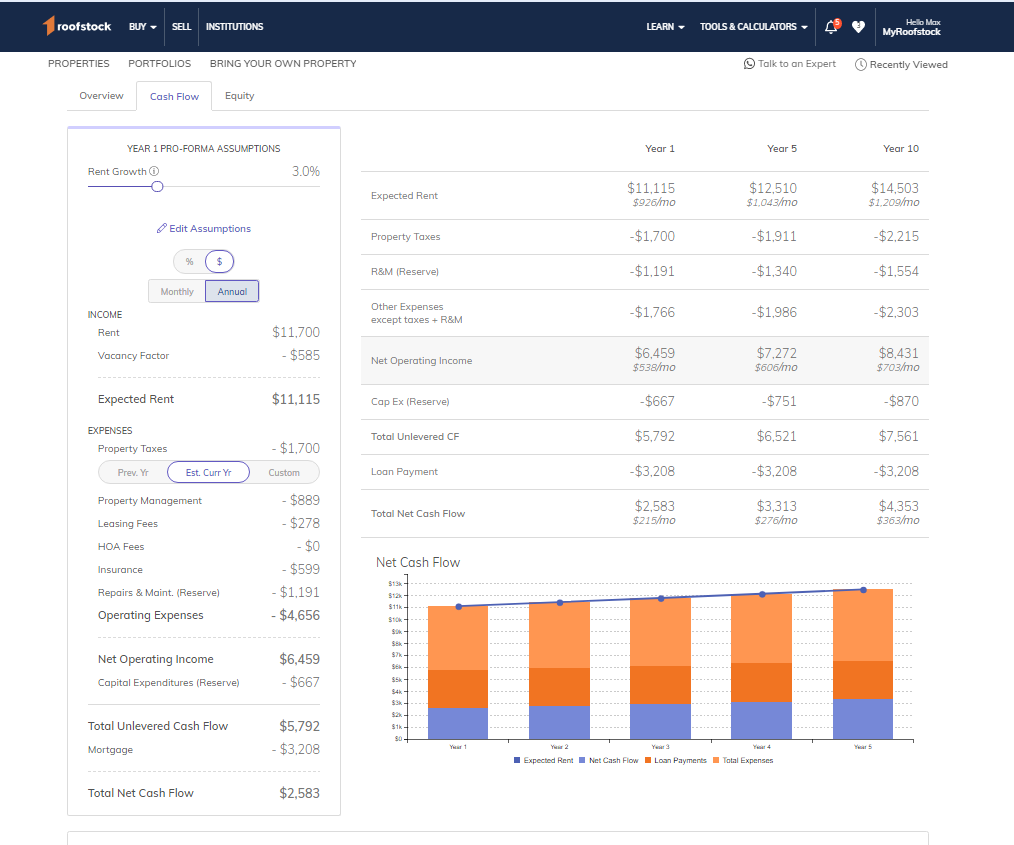

The tab that you should be interested in is the Cash Flow tab.

You will build up equity on all houses at the same rate by simply paying your mortgage each month, so there isn’t much to show there.

Cash Flow, on the other hand, is calculated by taking your rent and subtracting a bunch of different costs. These costs will be discussed later on in the review when we go over how to evaluate a property.

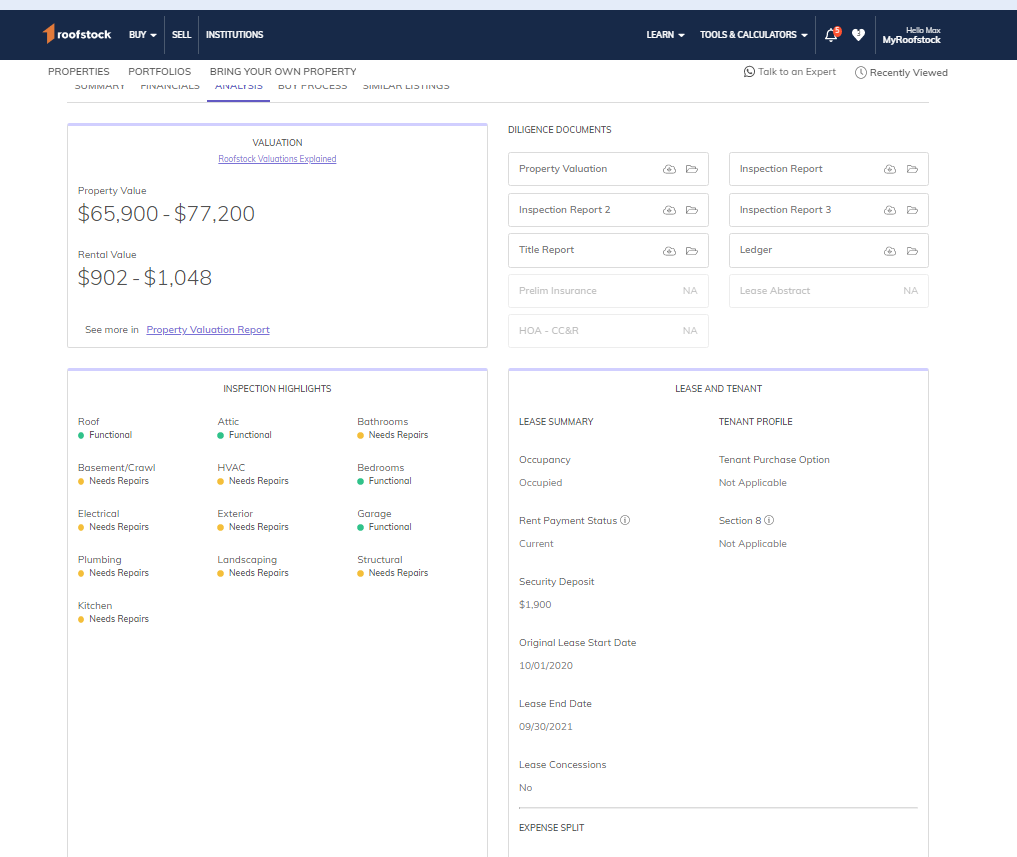

Roofstock Analysis Tab

In this tab, you’ll view important information that is more qualitative than quantitative.

The most important section of this tab is the Diligence Documents section. Here, you can view inspection reports, title reports, tenant ledgers, and more.

Going over these reports is crucial, and helps make sure you’ll be ready for any unique characteristics your house may have.

You can also view neighborhood information in the Neighborhood section. This will be discussed more later on.

Real Estate Investing for Dummies: The Step by Step process for buying and owning Rental Properties

Here are the exact steps I recommend you follow when buying your first Rental Property:

0: Sign up with Roofstock.com

Before doing anything else, you have to sign up. Signing up is free, so make sure to do that right away using the link below before diving deeper into Roofstock.

1: Set up a meeting with Roofstock’s customer service

First, call up Roofstock and go over everything with a customer service rep. They’ll help you set up your initial filters, and will then schedule a follow-up video call with one of their specialists to go over some properties you found interesting if you’d like.

Buying a Rental Property – especially your first one – can be quite nerve-wracking. So, going over everything with someone experienced can help you calm down and make sure that you accounted for all important factors.

2: Set up your filter

Customer Service will often help you out with this step if you ask. As you can see below, there are many filtering options available on Roofstock, making it easy for you to find a house that perfectly fits your needs.

Everyone’s criteria will be different, but in general make sure to only show houses within your price range, houses that have at least a 2-star Neighborhood Rating, and set the listing source to Roofstock Exclusive.

3: Find 3-5 properties that appeal to you

Later on in this Roofstock Review, we go over everything you should look for in a Rental Property. Use this as a guide to evaluating properties, and pick 3-5 that are a good mix of profitable, safe, and simple.

4: Go over all selected properties with a Roofstock specialist.

If this is your first time buying a house, you’ll want to make sure you’re doing everything correctly. So, on the follow-up video call, show the Roofstock specialist all the houses you picked out, and see what they think.

Then, the specialist from Roofstock reviews the properties with you and goes over any important details you may have missed.

If there’s anything you forgot to take into account, they’ll tell you. They’ll also go over every step you’ll have to take after choosing a house.

5: Choose a house and buy it

Next, it’s time to start making offers. If you’re unsure about a specific house at the full price you can try to offer a lower amount and see if the owner bites. However, you normally won’t be able to get a house any lower than 95% of list price – and for some high demand houses, people may actually offer slightly MORE than the list price.

Owners have 2 days to either accept or counter your offer. After 2 days, the offer expires.

After you select a house, you will have a personal Transaction Coordinator from Roofstock review with you the next steps. They will be available to answer any questions you have and can walk you through all steps of the process if you ever get confused.

This Roofstock review goes through all the steps as well, but if you’re still confused about something you can ask your transaction coordinator for more clarity.

Like I’ve been saying: Roofstock does everything in their power to make this as simple as possible. As you’ll see, buying through Roofstock truly is Real Estate Investing for Dummies.

6: Sign the initial Purchasing Contract

Within a couple of days, Roofstock will send you a Purchasing Contract to sign electronically. You can have a lawyer go over it with you if you’d like.

Once you’re satisfied, sign the document and pay an Earnest Money Deposit of $1500 (this is NOT a fee. Instead, it goes towards your down payment, and is refunded if you back out of the deal if the inspection or appraisal don’t go well – basically, you’re paying it now instead of when you actually close).

7: Connect with providers for all necessary services

Once you choose a house, you’ll need to choose a Mortgage lender, an Insurance company, and Property Manager.

Even if you can afford to pay for the house without taking out a mortgage, I don’t recommend it. Leverage is an important part of making money with real estate investing, and will allow you to get maximum returns on your investments.

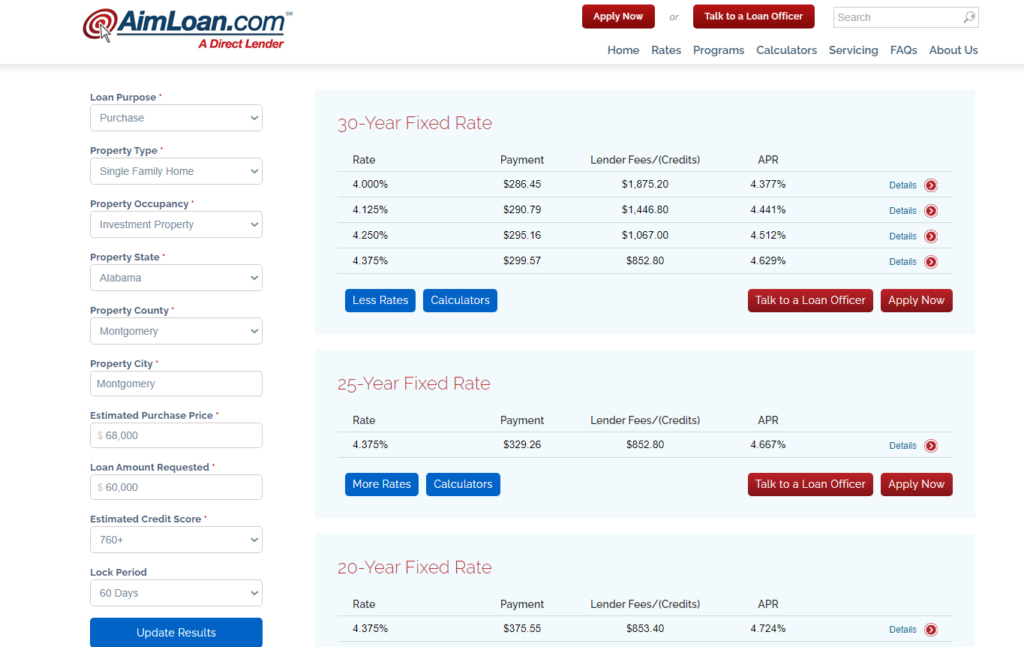

Personally, I use AIM Loan for my mortgages. They’re cheap, transparent, and simple – everything you can ask for in a bank.

The best part of choosing AIM Loan is that they have a tool where you can enter in all the details of the house you’re planning on buying, and see all your loan options (WITHOUT a hard credit pull).

You can see your estimated interest rate and closing costs for TONS of different loan options.

And they have great customer service, too – if you ever have any questions you can ask them.

Get an official rate lock from them (or any other bank) as soon as possible – until that’s done, Roofstock can’t schedule an Appraisal or Inspection Report.

After committing to buy a house, Roofstock will put you in touch with the Property Manager and an Insurance company for your house’s city. I recommend touching base with the Property Manager when you get a chance as soon as possible and going over their systems and policies.

The insurance company will email you their quotes, and ask you to select a level of coverage. Select whatever level of insurance you’re comfortable with, and send over whatever documents they need.

8: Keep an eye on your emails

Over the next few weeks, your Mortgage Lender will be emailing you and asking for information to help process the loan. The information they need includes bank statements, personal information, and more.

At the same time, be ready for an email from Roofstock about the appraisal and Inspection that will be done on your house. These will be done at the same time, but you may receive the results of one before the other.

If you aren’t happy with the results of either report, you can try and negotiate a discount with the seller, or even back out completely. If you back out, Roofstock will refund you 100% of what you paid them, but you won’t get refunded for the appraisal fee that you paid to your lender.

9: Schedule a time to sign the closing documents

Roofstock will have a mobile notary meet you at any time and place of your convenience. When they come, go over and sign all the final documents – expect this process to take around an hour.

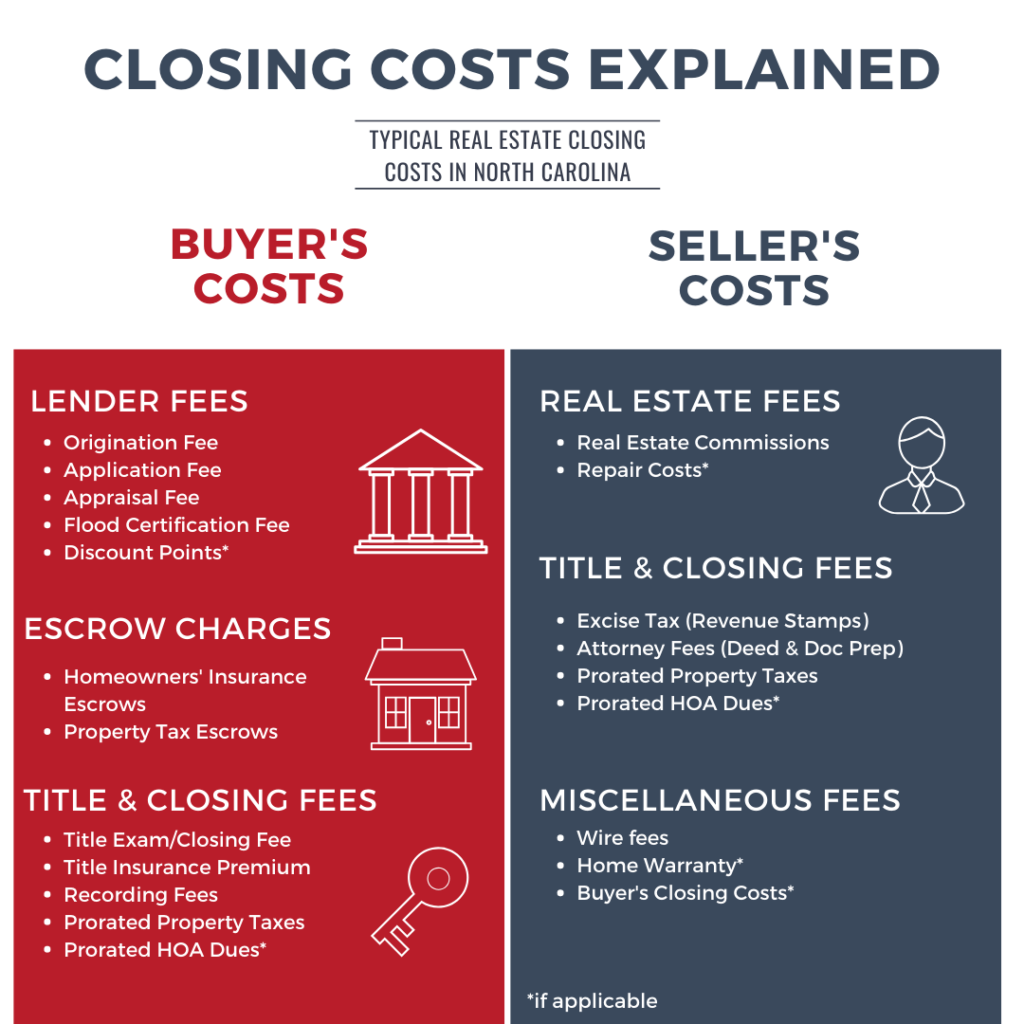

You will also pay your complete down payment + closing costs at this time.

Congratulations, you just bought a house! The entire process should be over within 1-2 months.

What should I be looking for in a Rental Property?

Now that you know HOW to buy a Rental Property, the next section of this Roofstock Review will focus on which Rental Properties you should buy.

There are 6 criteria that I consider when choosing a house:

- Cash Flow

- Price + closing costs

- Appreciation

- Location

- Expected Repairs

- Current Renter status

Cash Flow

This is the most basic category, and the reason everyone wants to buy a rental property in the first place: that sweet, sweet cash flow.

Instead of hoping that an asset you own goes up in price, with a Rental Property, you will be getting consistent cash each month!

Obviously, your income comes from your rent, and your biggest expense is your mortgage. However, there’s a bit more you have to consider than just those 2 numbers.

Here is a list of expenses you’ll have to pay each month:

- Mortgage

- Property Tax

- Insurance

- Property Management Fee

- HOA fees (if applicable, most houses don’t have these)

And here is a list of expenses you’ll definitely have to pay at SOME point, but aren’t a uniform payment each month:

- Repairs & Maintenance

- Capital Expenditures

- Vacancy (this is more a “loss of revenue” rather than a fee, but as you’ll see soon, it’s treated as if it’s a fee)

- Leasing Fees

Seems like alot, but don’t worry.

As promised, Roofstock turns the process into Real Estate Investing for Dummies, and I’m about to show you how.

Consistent Fees

Let’s go over each of these expenses one by one.

We’ll start with the fees that happen every month, and then move on to the inconsistent costs that WILL happen, but not at any set time.

Mortgage

Your mortgage expense is based on the terms you select, and the interest rate you receive.

My preferred bank, AIM Loan, is one of the most transparent banks I’ve seen, and their rates are really low as well.

Even if you don’t use them for the final loan, you can still use their rate estimator tool to predict your monthly mortgage payment and closing costs.

Property Tax & Insurance

To estimate these costs, Roofstock reviews property tax and insurance data that comes straight from city and company sources and uses the data to estimate your monthly costs.

That means that these estimates are pretty accurate.

They’re also easy to forget about. Many people make the mistake of seeing a house with a great rent to mortgage ratio and forget about these other costs.

Property Tax and Insurance costs can vary wildly based on house location, so it’s VERY important that you don’t forget to take them into account.

Property Management

Hiring a good Property Manager is an integral part of turning the rental property process into Real Estate Investing for Dummies.

If you don’t want Rental Property investing to become your full-time job, hiring a Property Manager is a must.

They do EVERYTHING for you – answer tenant questions, collect rent, find new tenants, make the house “rent ready” when a tenant leaves, and more.

If you have a good Property Manager, you’ll pretty much never have to put any work into the house after you close – you’ll have oversight and can overrule any decision your Property Manager makes, but in general, you can trust them to do a good job.

Luckily, Roofstock reviews customer feedback, policies, and prices from tons of Property Managers, and partners with the ones who pass their background check.

This means that the Property Managers Roofstock recommends are almost always top-notch.

The standard market value for a Property Manager is 10% of the collected rent, but Roofstock negotiates a discount with most of their recommended Property Managers – in general, you’ll only be paying 8% of collected rent.

There will also occasionally be other fees you will pay them – these are discussed in the “leasing fees” section.

HOA Fees

Most buildings don’t have this, but it’s important to check for them anyway. If a building DOES have HOA fees, it’s possible the building won’t be profitable once those fees are factored in.

So, just remember to always check before you commit to buying. Luckily Roofstock prominently displays all fees, so it shouldn’t be much of an issue.

Inconsistent Fees

The rest of the fees you’ll be charged don’t happen consistently each month – for example, some months you may have 0 repair costs, while there may be one month where there’s an issue with your roof and you have to pay a few thousand dollars to fix it.

This makes calculating cash flow difficult – if expenses change every month, how can you know how much money you’ll be making per month, or even if you have enough cash on hand to handle issues that may happen?

In fact, fear of maintenance type issues is probably one of the biggest reasons most people fear investing in Real Estate.

Luckily, there’s a way to resolve this, and keep the process worthy of the “Real Estate Investing for Dummies” title.

The way to deal with this issue is to create a Reserve Account, which can either be a savings account or other safe, liquid investment account.

Each month, place a portion of your rental income into this account. Don’t spend this money – in fact, treat it as if it isn’t there, and ignore it when calculating your monthly profits.

Then, when unexpected costs come up, pay for them using the money in the reserve account.

Here’s an example: If you charge $1,000 in rent, and monthly expenses are $600, at this point your profit is $400 per month.

However, if you decide to deposit $150 each month into a reserve account, pretend that $150 doesn’t exist – this means your monthly profit is only $250.

This way, your profits will be the same each month, and when issues come up you’ll be ready to fund them – and have your Property Manager deal with them.

The combination of Property Managers and Reserve Accounts pretty much solve the maintenance issue – you’ll have money to deal with issues, and won’t have to deal with them yourself.

Obviously, if you’re taking some of your profit each month and setting it aside to deal with future issues, you’ll have to make sure you only buy houses profitable enough where you can afford to do that.

You also have to determine how much money to put into the Reserve Account each month.

As you’ll see shortly, Roofstock estimates how much money you’ll need to spend on these variable costs over the lifetime of the house, and gives a recommendation for how much you should put in your reserve account each month.

Repairs and Maintenance / Capital Expenditures

Repairs and Maintenance are smaller, general issues that come up during the life of a property – For example, the lock isn’t working and needs to be fixed.

Capital Expenditures are larger projects that need to be done – for example, the roof is leaking and needs to be replaced.

Repairs and Maintenance type issues happen far more frequently, but Capital Expenditures are MUCH more expensive.

So, a general guideline is to save around 5% of collected rent for each of these categories – 10% in total.

Roofstock won’t always suggest exactly 5% – they’ll look at other factors such as the age of the house, and what past repairs have been done, and come up with their own estimate. However, for most houses, it will be right around 5% each.

Vacancy

If you could guarantee that you would always have a renter paying rent, that would be fantastic.

However, that isn’t always the case – renters leave, and then you have to spend time finding another one.

This means that there will be some months where you won’t be collecting any rent, but will still have to pay for your mortgage and other monthly expenses.

(Note: you will NOT have to pay your 8% Property Management fee during months when you don’t have a tenant. That fee is 8% of the COLLECTED rent, so if you don’t collect rent, there is no fee. Most other fees will still be charged like normal).

So, to account for this, Roofstock looks at historical vacancy rates in your property’s area and calculates a vacancy rate.

Whatever the estimated vacancy rate is, save up that amount in a reserve account each month. When you find yourself without a renter, “pay” yourself using the money from that vacancy reserve account. This will make it as if you are still receiving your regular monthly income.

Vacancy rates are usually around 5%.

Leasing Fees

Whenever your tenant’s lease is up, you’ll have to either renew the lease or find another tenant.

While your Property Manager will handle all the work, they’ll charge you a bit – for example, my property manager charges 30% of the first month’s rent for renewing a lease, and 65% of the first month’s rent when they place a new tenant into your building.

These fees cover everything related to the tenant process, including:

- Doing a market analysis to recommend a new rent amount you should charge

- Setting up the new lease

- Move-in/Move-out inspections

- Marketing the home for rent

- Screening all potential tenants so you can easily choose the one you think is best

- Anything else related to this process

Roofstock recommends that you put 2.5% of collected rent into a Reserve Account each month to cover these leasing fees.

So, in total, expect to put around 15-20% of your collected rent into reserve accounts each month. When looking for houses to buy, make sure to look at houses that are still profitable even after these reserves are taken out.

Cash Flow Wrap Up

Those are all the components for calculating cash flow.

At first, it seems like a lot to handle. So, how exactly does Roofstock turn this process into Real Estate Investing for Dummies if there’s so much to keep track of?

Answer: By doing all the math for you.

On the property page in Roofstock, Click the “Financials” tab and scroll down a bit. Set your down payment to 20% (or whatever % you plan on paying) and set your mortgage rate to your estimated rate (based on AIM Loan’s estimate, or the estimate of whatever bank you choose).

Then, scroll down a bit more and click the “cash flow” tab.

Below, on the left side of the screen, you will see a calculation of ALL your expenses, broken down either by year or by month.

This includes “expenses” that aren’t consistent and will instead be going into a reserve account monthly.

If you disagree with any of Roostock’s estimates, you can change them by clicking “edit assumptions”.

Once all your assumptions are in order, you can see exactly how much cash flow you’ll make: Roofstock labels the final number “Total Net Cash Flow”, which shows your total cash flow either by month or by year, depending on how you prefer to view the numbers.

This is a general guide on how to calculate profitability for Rental Properties.

For a much more in-depth guide that goes WAY deep into the math behind your expected returns, check out this post where I compare the potential Rental Property returns to those of the stock market.

Closing Costs

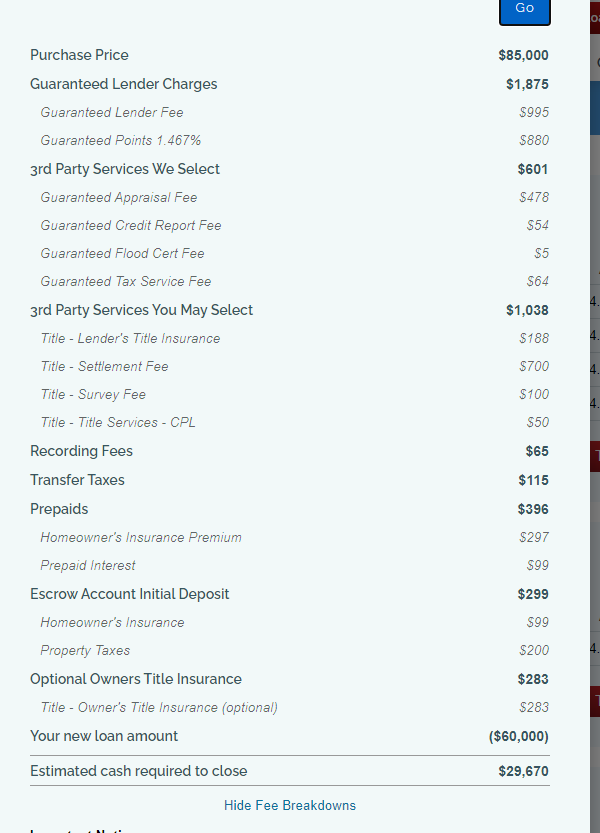

Once you have your total return, you can use it to calculate a yearly return percentage by dividing your yearly return by your total closing costs.

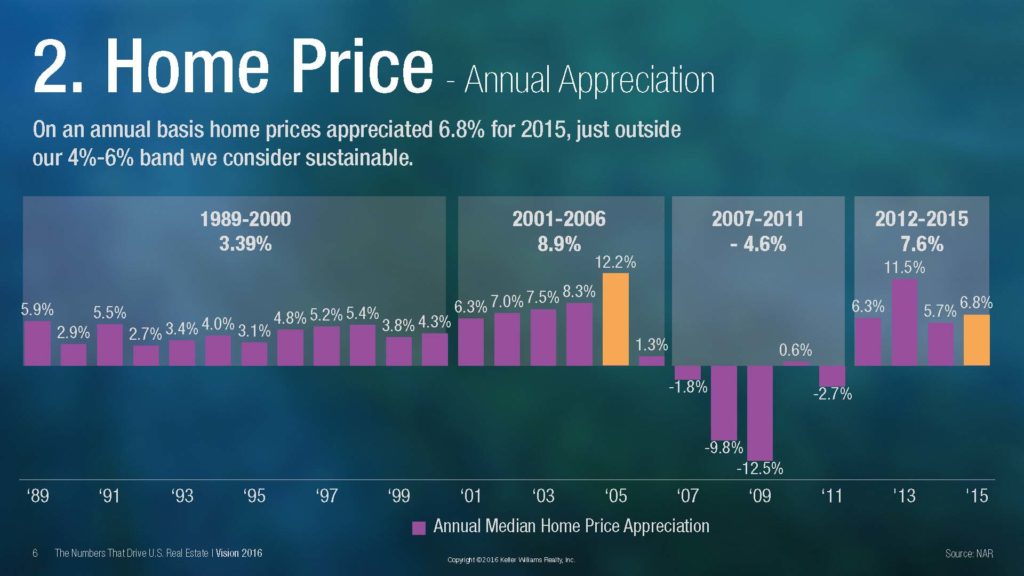

The stock market averages about 8% returns per year, but with rental properties, you can usually get over 10% per year.

Roofstock estimates closing costs (you can see them by hovering over the little “i” under the list price), but these tend to be the least accurate estimates that Roofstock provides.

If you want a more accurate number you can turn to AIM Loan.

After using their tool to get estimated mortgage rates, click the “details” button next to your desired loan rate.

Then, navigate to the “cash to close” tab, enter the yearly property taxes Roofstock estimates that you’ll pay, and click “Go”.

If you scroll to the button, you’ll see your “estimated cash required to close”. This number takes into account your down payment, loan costs, and most other closing costs you’ll have.

The one thing it does NOT take into account is any initial maintenance costs that will need to be done on the house.

Roofstock provides this number along with the rest of their estimated closing costs, so you can add this number to the number AIM gave you to get a total closing cost amount.

Often, you can negotiate that the seller will pay for these costs, but it’s best to assume that won’t be the case just to be safe.

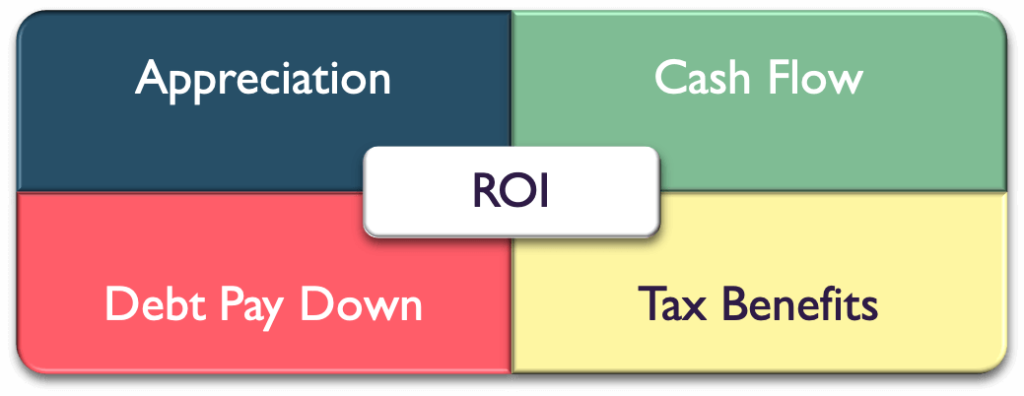

Appreciation

The beauty of Rental Properties is that cash flow isn’t the only way you’ll be making money.

You also make money by building up equity in the house and taking advantage of appreciating housing prices.

Building equity will happen automatically – every month as you pay your mortgage, you’re slowly buying more and more of the house until you own 100% of the property.

Appreciation, on the other hand, is different for each house. While some houses may quickly increase in price, others can stagnate for years in the same price range.

There are ways to estimate appreciation – Roofstock even does this on their website, taking into account things like location and population statistics.

You’re welcome to keep this in mind, but in general, I mostly ignore appreciation and treat it as a bonus.

When investing in the stock market, I highly recommend using Robo Investors that attempt to imitate the overall market growth. This is because I believe that predicting the stock market is close to impossible and that you’ll be better off just taking the market average.

I apply similar thoughts to the housing market. Estimating future inflation of housing prices is very difficult, and hard to get accurate. So, I just assume that most houses will grow similarly over the long run, and focus much more on finding houses with a high cash flow.

Yearly inflation is about 3%, and housing prices tend to keep up with inflation – if you’d like, you can use 3%/year as an estimate for how quickly your house will grow in price.

Location

Location can theoretically affect appreciation rates, but that’s not what I look for when analyzing which locations I prefer to buy in.

Instead, I like to make sure that the neighborhood where I’m buying is safe, and has high-quality tenants.

Often, the most profitable houses are ones in extremely low-income neighborhoods. People in these neighborhoods can’t afford to buy houses, which greatly increases the rent demand.

However, buying in these neighborhoods opens you up to a lot of risk.

Here are some of the issues you may encounter:

- Tenants will often have low credit scores or even bankruptcies on file

- Tenants can lose their job with little savings, and not be able to afford rent

- Tenants won’t treat the house well, will throw parties, and leave the house in much worse condition than when they moved in

- Tenants will leave with no warning

Basically, lower-quality neighborhoods tend to attract tenants who are problematic, which can cost you a lot of money over the life of the house.

Roofstock rates neighborhoods on a scale of 1-5 stars. These Ratings, along with other information about the neighborhood, can be found in the “Analysis” tab by scrolling down until you hit the Location section.

In general, I’d avoid any 1-star neighborhoods, and only go with a 2-star neighborhood if it’s a really good deal.

The sweet spot is 2.5-3.5 stars – any lower you’re taking on a lot of risks, and any higher you’ll struggle to find profitable deals.

Expected Repairs

If the house you’re interested in has had an inspection done recently, you can view these inspection reports on Roofstock in the “Analysis” tab.

Houses with a recent inspection report may show some immediate repairs that are suggested to be done before finding a new renter.

If there is no recent report, you’ll get a free inspection after buying the house.

Often, sellers will be willing to chip in to help cover these initial repairs.

This is especially true if there wasn’t already an inspection report at the time when you agreed to buy the house, and the inspection report done at the time shows some necessary repairs that need to be done.

However, lots of initial repairs could mean structural issues with the house that will lead to more repairs down the road.

We (and Roofstock) attempted to account for this by creating reserve accounts to cover maintenance and larger fixes, but a bad inspection report could imply that you should be putting a larger percentage of your rent in reserve than you initially expected.

So, keep this in mind when looking at houses.

Current Renter Status

In the Features section of the “Summary” tab, you can see if the property is currently occupied, and if so, when the current tenant’s lease is up.

You can also check the tenant’s payment history by viewing the Ledger in the “Analysis” tab. This will show you every payment the tenant has made, and if they missed or were late on any payments.

If you can find a property that already has a high-quality renter, the already easy buying process is even easier. Real Estate Investing for Dummies 2.0?

What happens after I purchase?

After you purchase the house, your Property Manager will handle everything. Work with them to understand their systems, and how they deal with issues such as collecting rent or doing maintenance.

If you don’t have a renter, they will also handle that for you as well.

Each Property Manager has slightly different methods of dealing with things, so make sure you understand their processes so you can intervene if necessary.

I recommend setting up automated rent deposits into your account, and automated payments for your mortgage and other costs.

In addition, set up your reserve account somewhere separate from the rest of your money, and automatically enter a portion of your rent into that account each month.

If you’d like, you can invest your profits in the stock market. Stock market returns get automatically reinvested into the market, but Rental Property returns don’t get reinvested into Rental Properties. So, reinvesting them yourself into the Stock Market is a solid strategy in order to boost returns even further.

Is Rental Property Investing safe?

While nothing is guaranteed, Rental Property’s are a pretty safe place to store your money.

Before officially closing, Roofstock allows you to either renegotiate or back out of the deal if the inspection or appraisal show any information that worries you. So, if you get to closing time, you should already be fairly comfortable with your choice of rental properties.

There is always the risk that you can’t find a renter for long periods of time, but your Property Manager will work with you to help make sure that doesn’t happen.

In addition, Roofstock offers a Rental Guarantee if you buy a house without a current renter.

If the house is rent ready, but you still can’t find someone to rent the house to, Roofstock will pay you 75% of the rent for up to 12 months! This eliminates the risk even further.

Regarding maintenance and damages, your reserve accounts should help lessen most of that risk. Plus, if something truly catastrophic happens, your insurance should cover it.

In general, try and avoid using your insurance, since using it will cause premiums to rise. However, it’s nice to have the option in case something terrible happens.

The last risk to be aware of is the risk of being sued by your tenant. While rare, the tenant can technically try and sue you for anything that goes wrong in the house – even if they trip and fall.

Again, this is extremely rare, and you’ll likely never have to deal with this. If it DOES happen, most insurance plans contain liability protection as well, which protects you from most of these cases.

For additional protection, you can transfer the mortgage to an LLC. That way, even if you’re sued, the tenant can only come after the money in the LLC, and not your personal assets.

If you plan on doing this, make sure to discuss it with your Mortgage lender first. Some don’t allow it, and the ones that DO allow it often only allow it under certain circumstances.

AIM Loan allows mortgage transfers only if the mortgage is done through Fannie May, so make sure to request that if you plan on transferring to an LLC.

For more information on transferring mortgages, read this article – it explains the potential issues and how to deal with them.

Roofstock Competitors

Roofstock is fairly unique, but there ARE other options that do something similar. Let’s discuss how Roofstock stacks up vs 2 of their main competitors, Fundrise and Homeunion.

Roofstock vs Fundrise

With Fundrise, you aren’t actually buying a property yourself. Instead, Fundrise buys a property, and then lets many individual investors buy “shares” of this property – making it very similar to buying stocks.

Since you don’t own the property with Fundrise, you aren’t making decisions – instead, you’re basically paying Fundrise to handle everything for you. Fundrise buys and manages the porperty, and then pays investors out based on the proceeds they make.

The cost to invest with Fundrise is 1% of your investment each year. This fee can be thought of as similar to the fee you pay a property manager when buying through Roofstock – however, a property manager usually costs much less than this, and you also won’t pay it if your house is vacant.

You also can’t control things like raising rent. This, coupled with Fundrise keeping some of the profits for themselves, eman that the profit you get from Fundrise will probably be lower than what you can make by buying your own property – PLUS the fees are higher.

On the plus side, Fundrise investments are much more passive than Roofstock investments (although when done right, Rental Properties can be pretty passive as well). So, if you’re willing to give up some of your returns then Fundrise may be for you.

Roofstock vs Homeunion

Homeunion is like the younger sibling to Roofstock – they’re trying to emulate them, but they just can’t quite stack up.

For starters, alot of what makes Roofstock great are the guarantees they offer: If the appraisal or inspection are poor you can back out, if you can’t find a renter they’ll cover rent, etc.

Homeunion doesn’t offer these guarantees, which makes investing with them more risky.

They also have much fewer houses and work in fewer neighborhoods when compared to Roofstock. Plus, their website looks old-fashioned, especially compared to Roofstock’s sleek design.

In terms of fees, Roofstock is transparent with what they charge, while Homeunion doesn’t list a standard fee on their site – you have to call them and work out an individualized fee for each deal.

With all these red flags, I recommend staying away and sticking with Roofstock (or Fundrise if you prefer something more passive).

FAQ

- Should you see turnkey properties and review them in person before buying?

In general, Rental properties found on Roofstock are rent-ready (turnkey). Therefore, when you consider that you’re getting an appraisal and an inspection report during the buying process, you often don’t actually have to go see the house yourself in person – others have already checked out the property FOR you.

2. How does Roofstock work? How does Roofstock make money?

Roofstock charges the buyer a fee of $500 or .5% of the property value, whichever is higher. This fee is only paid once you’ve chosen a property, and if you don’t end up purchasing due to a bad appraisal or inspection, you are given a complete refund.

On the seller side, Roofstock charges 3% selling fees to sell a property on Roofstock.

3. Is Roofstock a good investment?

In this case, you aren’t investing in Roofstock – you’re using them to invest in a rental property. As discussed above, the returns on properties found on Roofstock is often over 10% annually, and you also build up equity in the property over time, benefit from appreciation, and can take advantage of tax breaks.

4. What is the difference between Roofstock Exclusive and Roofstock Select?

If a house is marked as Roofstock exclusive, that means this house isn’t being marketed anywhere else. In these cases, you’ll often be able to negotiate the asking price down a bit.

If the house is marked as Roofstock Select, that means the house IS being marketed elsewhere, and negotiating may be a bit tougher.

Roofstock Review: Final Thoughts

Roofstock transforms an extremely difficult buying and owning process into something simple and easy to understand: Real Estate Investing for Dummies.

They are transparent, and are willing to help you out every step of the way.

In addition, they’re cheap – while most Real Estate brokers charge 3-6% of the house price in fees, Roofstock charges the higher of a flat fee of only $500 or .5% of the house value.

In short: If you’re going to buy a Rental Property, buy it from Roofstock. Do it the Real Estate Investing for Dummies way.

You won’t regret it.

Recommended Reading

Rental Properties Vs Stocks: Which Has a Higher Return?

Can Rental Properties earn more than the stock market? Find out in this in depth, head to head comparison between the 2 asset classes.

Fundrise Review 2022: Who is it suitable for?

Want to get Real Estate exposure, but don't think you have the capital? Check out this Fundrise Review for an innovative solution!