In my opinion, any discussion about the merits of Acorns Vs Betterment has to start with a conversation about Robo Advisors in general.

Nowadays, when people talk about investing, Robo Advisors are guaranteed to be a major point of discussion. After all, they have low fees, generally outperform actively invested funds, and usually have a super sleek website. What’s not to love?

The popularity of Robo Advisors has caused tons of different options to pop up over the last few years. This means there are plenty of great options to choose from, which is both good and bad.

On the plus side, all the competition incentivizes Acorns, Betterment, and other Robo Advisors to make sure their products perform well, offer unique features, and are priced cheaply.

On the other hand, the more options there are, the harder it is to choose one to use that best fits your personal situation.

In this article, I’m going to break down two of the most popular options out there: Acorns Vs Betterment. Both of these options are powerhouses in the industry, and either could be a great choice depending on your situation.

What is Betterment?

Founded in 2008 by Jon Stein and Eli Broverman, Betterment is one of the first Robo Advisors to hit the market and helped lead to the Robo Advisor boom. The service was designed specifically to be a platform that caters to users who want automation on their investments.

The increased automation leads to decreased overhead costs, which allows Betterment to offer their services at a much lower rate (.25% yearly fee) than they would be able to otherwise, and also means your investments will generally perform better than if a human was managing your money.

According to a report from Investment News, as of March 2020, Betterment’s assets under management (AUM) have surpassed $22 billion, making it the fifth-largest Robo Advisor in terms of AUM. Currently, Betterment serves over 500,000 registered accounts.

Check out this article for a full, in depth review of Betterment!

What is Acorns?

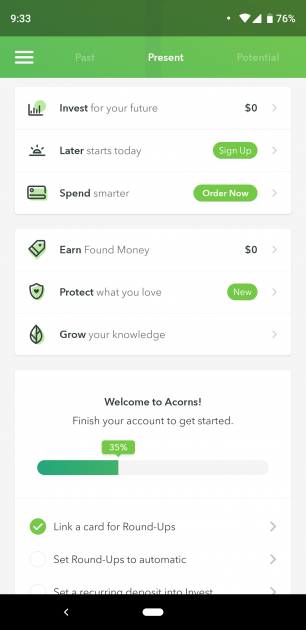

Acorns is a newer entrant to the Robo Advisor game. The company was founded in 2012 by father and son duo Walter Wemple Cruttenden III and Jeffrey James Cruttenden to promote incremental and passive investing but really started to take off when they launched their App in 2014.

Acorns is still fairly new, as evidenced by their Assets Under Management being around $3 billion, compared to Betterment’s $22 Billion. However, they’ve already managed to carve out a significant niche for themselves.

With an amazingly intuitive design and features such as Round-Up that allows you to invest loose change, Acorns is a fantastic option for newer investors.

In addition, Acorns offers the same functionality that other Robo Advisors do, such as automated investing, utilizing modern portfolio theory, and diversification.

Since the Acorns Robo Advisor service is so newbie-friendly, some advanced features like Tax-Loss Harvesting are not included. Still, for newer investors, it’s tough to beat what Acorns can offer.

Acorns Vs Betterment

In order to make this comparison easier to follow, I’ve divided it into the 5 categories I’ve deemed are most important when choosing a Robo Advisor:

- Investing Performance/Methods

- User Interface and Ease of Use

- Advanced / Bonus features

- Customer Service, Security, and Privacy.

- Fees

I’m going to go through each of the above 5 categories, and choose a winner between Acorns and Betterment. Once all 5 have been completed, we’ll go through the pros and cons of each and try to come up with a final decision on which service is superior.

So, are you ready for the Acorns Vs Betterment showdown? Let’s get to it!

Investing Performance/Methods

At the end of the day, we all invest because we want to make money. So, understanding the investment strategies used by both Betterment and Acorns is priority number 1 when deciding which service to use.

Investing Performance/Methods (Betterment )

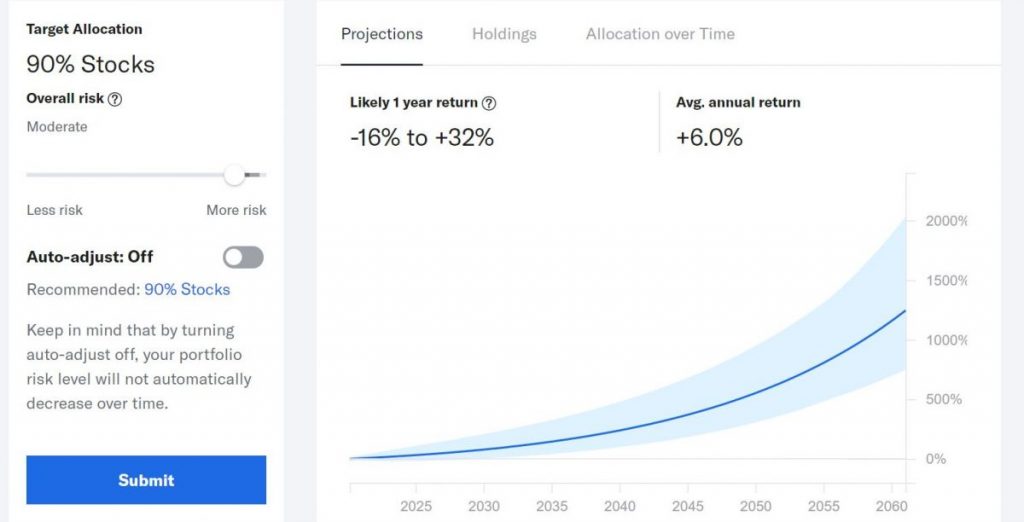

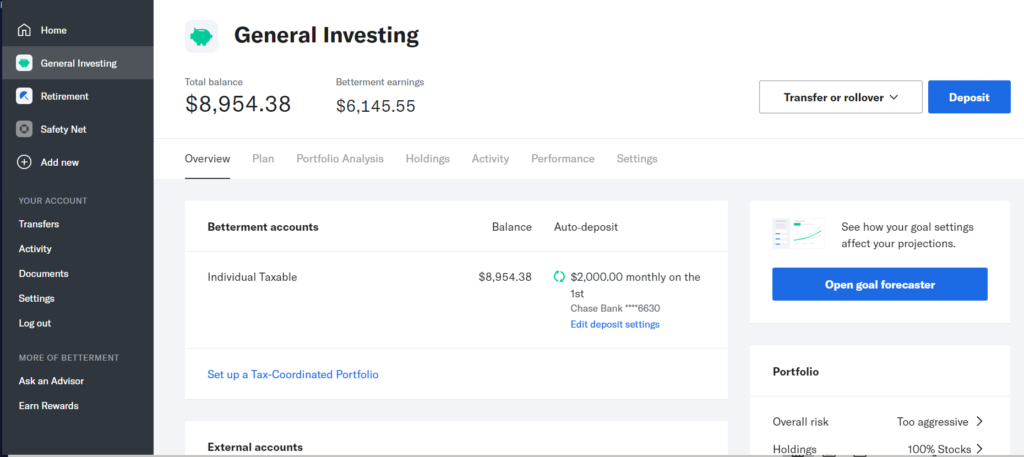

One of the best things about Betterment is how transparent and easy to use it is. At the click of a button – or drag of a slider – you can instantly change how your investment portfolio is allocated, and see exactly what you’re invested in at any given time.

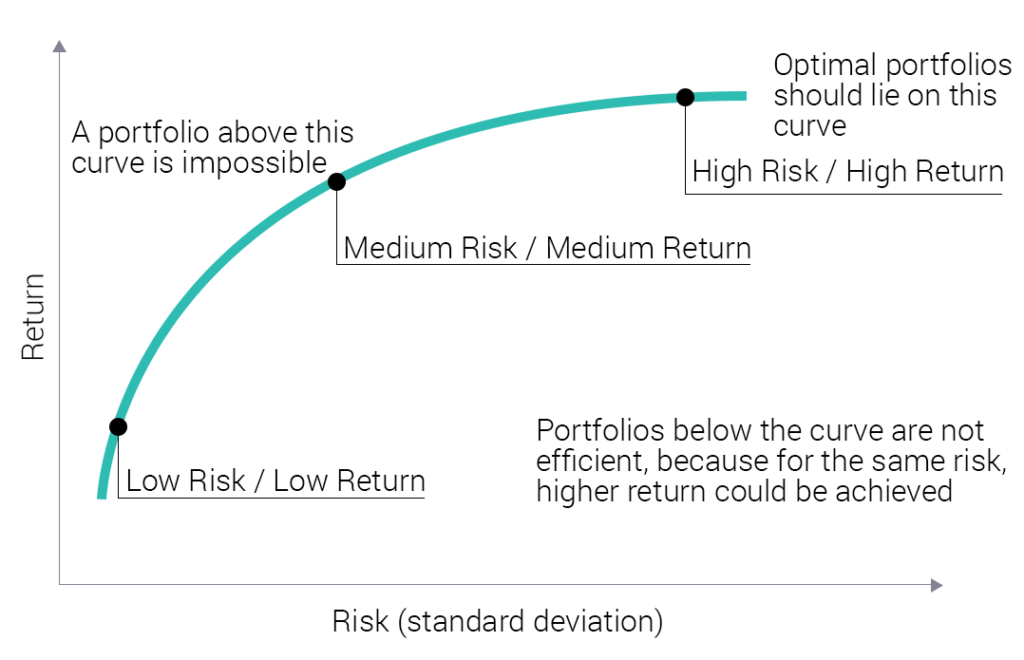

Betterment uses Modern Portfolio Theory as the basis for its investment strategy. For more detail on what that entails, you can read this Investopedia article, but what it basically means is that they attempt to diversify your holdings in a way that leads to big gains with little risk, as much as that is possible.

Normally, risk and reward are inversely correlated, meaning the more risk you take on, the more reward you can get, and the LESS risk you take on, the lower the reward will be.

Modern Portfolio Theory attempts to find the best possible balance between risk and reward to ensure that your gains will be much larger over time than with an un-optimized portfolio.

Betterment has 2 main assets they invest in: Stocks and Bonds. Within these 2 asset classes, there are 32 different funds that will be considered based on your risk preferences.

Within the stocks category, Betterment invests in a huge variety of index funds designed to capture the average performance of a specific type of stock.

For starters, there are funds that approximate the entire U.S market, and there are funds that approximate the entire international market.

There are also funds that contain only big companies, funds that contain only mid-size companies, and funds that contain only small companies.

Finally, there are funds that only contain developed, “safe” companies, and funds that contain “emerging market” companies, which have a higher risk/reward ratio than developed companies.

The bond funds are similar. The same way they have all different types of stocks that they invest you in, they also have all different types of bonds.

This level of diversification helps ensure that you are never too reliant on a specific company, or section of the market. It also greatly reduces risk while still keeping a generally high return.

And, as stated above, at any point in time you can log into your Betterment account and see EXACTLY which funds you’re currently invested in at any given time.

The best part? If you’re scared your portfolio is either too risky or too safe, you can change that! Betterment allows you to select at any time how much of your portfolio will be stocks.

How do you do this? It’s actually really simple.

You simply drag a slider across the screen and stop when it hits the percentage of your portfolio that you’re comfortable keeping in stocks. The rest of your money will be put into bonds, which in general are much safer than stocks (although their returns are usually lower).

This is all great, but if you’re like most people, you only care about one thing: How much money will I make?

Betterment Returns

Luckily, Betterment is extremely transparent about that as well. On this page, they have an interactive chart that will show you EXACTLY how much Betterment has returned at each different stock/bond allocation, over ANY time frame.

There’s a ton of information included, too. For example, you can see the best and worst returns in a single month, which is a great way to measure how volatile your desired allocation level is.

They even compare this performance to a bunch of other benchmarks, such as the S&P 500 and the average private equity investor return, so you can get a sense of how Betterment performs compared to other options.

The Betterment returns are after fees, which explains why Betterment’s overall numbers are usually slightly lower than the S&P 500 average returns. However, you’re going to have to pay fees no matter how you invest, and as we’ll see in the later sections, the Betterment fees actually aren’t too bad when you consider everything you get by using their platform.

Betterment’s transparency is legendary, which makes it so easy to evaluate their investing performance. As we’ll see soon, that transparency isn’t a given and is one of the biggest things that Betterment has over Acorns.

Investing Performance/Methods (Acorns)

While both Betterment and Acorns attempt to appeal to new investors with sleek user interfaces and designs, Acorns also simplifies the investment options available to their users.

Betterment has 32 different ETF’s to choose from, and a slider allowing you to have stocks be any percent of your portfolio you desire. Acorns, on the other hand, has only 18 funds that your money will be invested in, and allows you to choose from 5 different options on how your money is invested within those funds:

- Conservative

- Moderately conservative

- Moderate

- Moderately aggressive

- Aggressive

Depending on which of the 5 options you pick, your money will be distributed throughout their 18 available funds in a way that matches your preference.

While there are fewer options than Betterment, that doesn’t NECESSARILY mean that Acorns isn’t as good. Betterment may use Modern Portfolio Theory to help guide their investment decisions, but Acorns actually has the FATHER of Modern Portfolio Theory, Dr. Harry Markowitz, on their advisory board.

What does this mean? It means that, though you may have less of an ability to customize your investments, in general, you can probably trust that your investments will be in trustworthy hands.

Acorns Returns

Unfortunately, Acorns hasn’t been around too long and isn’t as transparent with showing their average returns as Betterment is. This makes figuring out which option has a better average performance a bit of a challenge.

However, we DO know the returns for the individual funds Acorns invests your money into. These funds are more or less the same as Betterment’s, so we can assume that Acorns returns are similar to Betterment as well, which means the most important distinction between the 2 is how they diversify your money across the different fund options.

Acorns Vs Betterment Decision: Investment Returns/Methods

Since it’s impossible to get an exact answer on who has better performance, I’m going to give Betterment a small edge here due to them having better transparency and more fund options.

While that doesn’t necessarily mean Betterment has higher returns than Acorns, it DOES mean you can be more comfortable trusting your money with them than with other options. That extra level of trust is tough to put a specific value on but it is enough to give Betterment the edge.

User Interface and Ease of Use

This is an area where both companies excel. Betterment and Acorns both make a huge effort to be user friendly no matter what your investment experience is, and frankly, both do a great job. Let’s get into some specifics:

User Interface and Ease of Use (Betterment)

Betterment’s main focus is simplicity. They have both an App and a website, and both are extremely easy to use. As stated above, it’s extremely easy to change your investment allocation within Betterment – all you have to do is drag a slider.

While that’s extremely important, Betterment also has a ton of other features that are easily accessible. For example, you can easily:

- Personalize goals based on when and how you want to retire

- See your personal performance over any time period

- View the tax implications of withdrawing money, helping you to decide whether withdrawing right now is worth it, or if it would be better to wait

- See your activity, including all withdrawals and deposits, and all dividends earned

Each of the above features is displayed in a clear and easy to understand format. Using Betterment is a very stress-free experience, and having all this information accessible really helps you feel comfortable in your investment choices.

User Interface and Ease of Use (Acorns)

While Betterment does a great job regarding ease of use and functionality, they can’t come close to Acorns from a design perspective. The Acorns App has won numerous rewards for its sleek design, and the website looks amazing as well.

Logging into the App is simply an enjoyable experience, in a way that’s tough to understand until you try it.

Functionality wise, Acorns does most of what Betterment can do, and adds in some neat features that are great for smaller investors (This will be discussed later in more detail).

Acorns Vs Betterment Decision: User Interface and Ease of Use

Because of this, Acorns is the pretty clear winner here due to their amazing design choices and how enjoyable it is to use. If you only care about simplicity and useful features then Betterment is a great choice as well, but Acorns goes above and beyond what most Apps and websites can manage, giving them the win in this category.

Advanced / Bonus features

Betterment and Acorns each have some unique wrinkles to set them apart from the average Robo Advisor.

Since Robo Advisors have fees that you can avoid by simply investing directly into specific funds by yourself, the only reason they’re worth paying for is that you get features that aren’t available when investing solo.

The main feature that all Robo Advisors have is the ability to ensure your portfolio is always balanced. If you buy funds by yourself, certain funds will inevitably grow quicker than others, causing your portfolio to be overweight in some areas and underweight in others.

In order to stop that from happening, you would need to constantly monitor your portfolio and make additional trades to fix your allocations and remain balanced. This costs you extra time and money and can be avoided by using a Robo Advisor.

In addition to this obvious benefit, individual Robo Advisors usually like to add other features as well in order to differentiate themselves. Here are the “bonus features” you get from both Betterment and Acorns:

Advanced / Bonus features (Betterment)

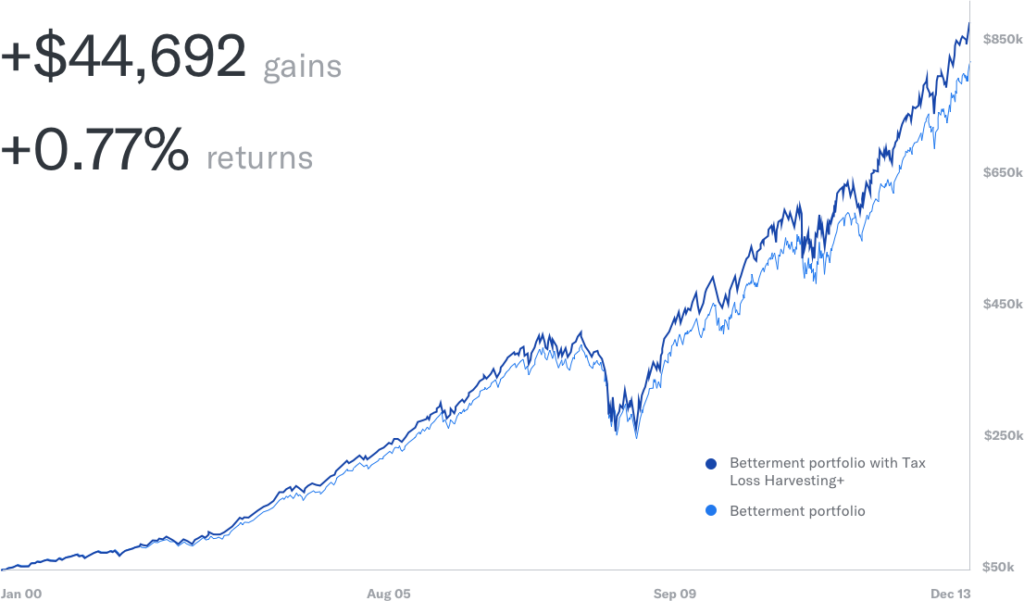

The biggest feature Betterment offers is called Tax Loss Harvesting. If you’re unfamiliar with the term, Betterment does a great job of explaining the feature in-depth here. If you don’t want to read through all that, here’s a quick rundown:

Funds go up and down in value all the time. This change in value affects how you pay taxes. If your stocks go up you pay taxes, and if your stocks go down you actually get a tax CREDIT from the government.

Normally, you don’t pay taxes until you sell your stocks. However, with Tax Loss Harvesting, if one of your funds goes down significantly at any point, Betterment will automatically sell that fund and buy a very similar fund with the money you just got by selling the underperforming fund (remember how Betterment had so many funds to choose from? Well, this is why).

Since a fund was sold, taxes are owed on that sold stock NOW, instead of later when you finally withdraw (hopefully during retirement age). And, since the stock you sold actually LOST money, that means you actually get to deduct those losses against your personal income and reduce your tax bill!

According to Betterment, Tax Loss Harvesting averages .77% of your portfolio per year. So, for each $10,000 you have invested, you get to “Harvest” $77 of losses, on average, to deduct against your personal taxes.

This may not sound like much, but the tax benefits start getting pretty big as your portfolio grows and provide a great reason to pay Betterment’s fee instead of using an option that doesn’t include Tax Loss Harvesting.

Tax Loss Harvesting isn’t for everyone. In certain cases, such as if you plan on withdrawing at a time when your income will be higher than it is now, this feature may not be useful.

In Betterment’s explanation of Tax Loss Harvesting, they go through a few more examples of cases where the feature shouldn’t be used. So, before using this feature, make sure your situation is one that can actually benefit from it.

Aside from this, Betterment also has a ton of features to help you organize your finances.

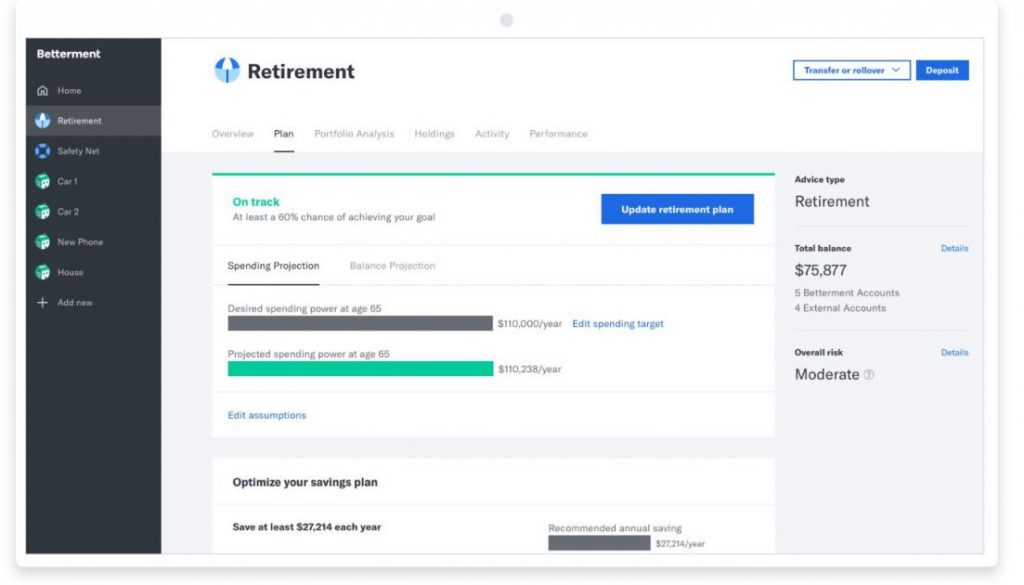

One of the coolest features Betterment has is an amazing retirement calculator to help you understand how much money you’ll need to save in order to retire.

You input information such as what investment strategies you’re using, how much you’ll contribute, and how much you plan on spending in retirement into the Betterment retirement calculator, and Betterment calculates exactly what actions you should be taking to achieve these goals.

Retirement calculators exist elsewhere on the internet, but few are as all-inclusive as Betterment. Plus, since your money is being invested with them, Betterment has MUCH more information about your personal finances to work with when compared to other retirement calculators.

These features, combined with other features such as goal setting and great portfolio analysis options, really paint a clear picture of why Betterment is worth using.

Advanced / Bonus features (Acorns)

Acorns’ bonus features are mostly geared towards helping small investors save money.

Their most famous feature, Round-Ups, looks at all your credit card transactions and invests the “spare change” for you automatically.

For example, let’s say I use a credit card that is connected to Acorns to pay for a $13.77 Uber. Acorns will round that $13.77 up to $14.00, and invest the $.23 difference.

This is done so that people who feel like they never have money to invest will constantly be investing little bits of money, and not even realize they’re doing it. So, if you’ve been struggling to find the money to invest, this feature might be perfect for you.

Another feature they have is called “Found Money”. Acorns has tons of partners, such as Walmart, Disney, Grubhub, and more, who will automatically deposit money in your account when you spend money on their websites.

To take advantage, just log into Acorns, find the retailer you’re planning on making a purchase from, and click the link within Acorns to go to their website. Anything purchased during this session with a credit card that’s attached to Acorns gets you free money in your Acorns account!

The amount of money you get is different for each retailer, but it’s hard to argue with free money. The money may take a few months to actually reach your account, which isn’t ideal… but again. It’s hard to argue with free money.

Like Betterment, Acorns offers retirement tools to help you plan for retirement, though they aren’t as robust as Betterment.

Unlike Betterment, Acorns does NOT offer Tax Loss Harvesting. So, if you’re someone who can benefit from this feature, it may make more sense to use Betterment or another option that offers that feature.

Acorns Vs Betterment Decision: Advanced / Bonus features

Picking a winner in a strict Acorns Vs Betterment match up is tough for this category. Each has some unique features, and it really depends on the person. If you’re in college and are starting to invest for the first time, Acorns may be a better fit.

However, Betterment’s Tax Loss Harvesting is a feature that can actually increase your profits by a real amount. While Acorns is mostly all about helping you find money to invest in, Betterment is about maximizing your returns as much as possible, and because of this, I’m giving the nod to Betterment here.

Customer Service, Security, and Misc.

Customer Service, Security, Privacy…

These are all supplemental features that are extremely important, but act more as “background” features rather than features that you’ll notice through use or performance.

Even though I’ve put them in the same overall category, I think it still makes sense to look at each issue separately, starting with customer service:

Customer Service ( Betterment)

As stated countless times in this review, Betterment is truly extraordinary when it comes to transparency.

This applies to customer service as well, as they have very helpful customer service reps available through phone support (5 days a week, 9 hours a day), as well as email support, and countless help articles scattered throughout their website.

You can ask these reps any question you need, and in general, they’re really helpful. So don’t be shy!

Customer Service (Acorns)

There is a phone number you can call to reach customer support at Acorns, but officially that number is only for gift card sales (although some have reported having success calling that number about other topics).

If the phone option doesn’t work, you also have an option to email them a question, and like Betterment, they have many helpful articles available on their website.

Acorns Vs Betterment Decision: Customer Service

Customer Service is hard to judge, as it’s very dependent on the specific rep assigned to handle your issue, but if I had to choose a winner I’d pick Betterment. It all goes back to their transparency – with Betterment you don’t feel like you have to jump through hoops to get your questions answered. Instead, everything is provided to you with relative ease.

Security (Acorns and Betterment)

Something many people are worried about when starting to invest is whether your money is secure and whether Betterment and Acorns are trustworthy. Luckily, they both have the security aspect covered.

Even if Betterment/Acorns ever declared bankruptcy (an extremely unlikely event), you’re still almost certainly (as in 99.999% certainly) going to get all your money back due to the security measures they have in place.

They are both SIPC insured, which means a few things. For starters, there are TONS of regulatory checks that must be done often, sometimes on a daily basis.

These checks will ensure that Betterment/Acorns keeps your money secure, separate your invested assets from the company’s assets, and don’t use your money for anything other than investing in the funds they say they invest in. This helps prevent a Madoff – like scheme from ever happening.

As long as your assets are separated, you will get your money back in a bankruptcy situation no matter how much money you have stored – since this money was never touched and is just sitting in the funds, the company going bankrupt has no effect on it.

Even if something goes horribly wrong, the company somehow gets around the safeguards and spends your money without your permission, then goes bankrupt and can’t pay you back, SIPC insures your money up to $500,000, meaning you’re never in any danger at all until you hit that amount.

Acorns Vs Betterment Decision: Security

Since both options are SIPC insured, this subcategory ends in a tie.

Privacy (Betterment)

If bankruptcy isn’t a concern, then the only danger of investing with them (other than, of course, your investments not performing well) is that you could be the victim of a cybercrime and have someone steal your money. To avoid this, Betterment takes many preventative actions.

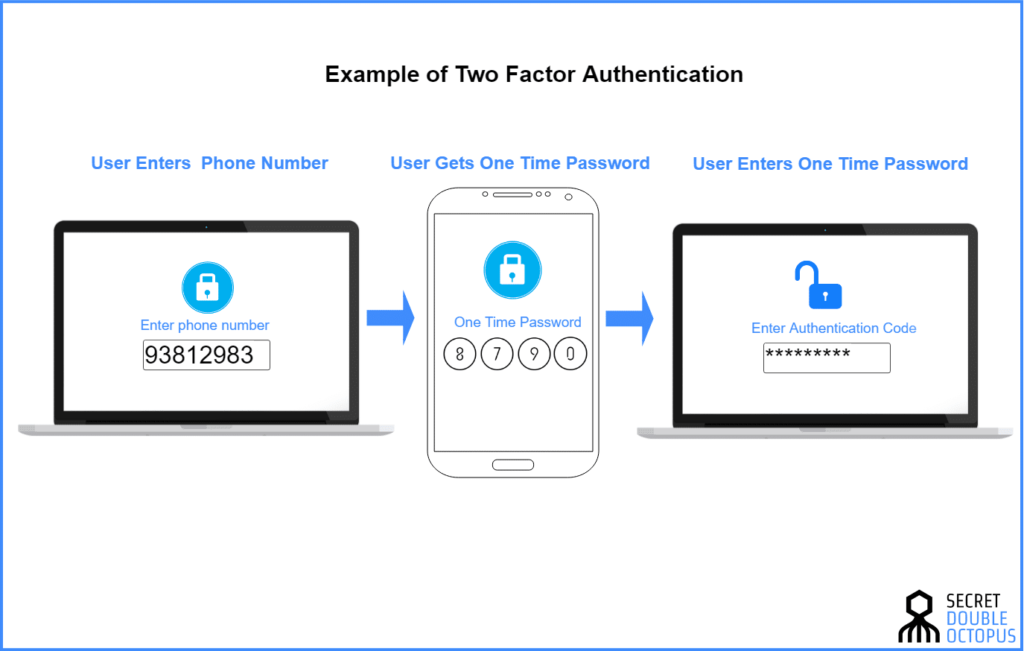

For example, among other things, Betterment encrypts all passwords, uses special app-specific passwords for any software that needs to correct to Betterment (such as a tax preparing service like Turbo Tax), offers Two Factor Authentication, and limits the amount of data that can be accessed by anyone at the company.

Privacy (Acorns)

Acorns offer encryption and limit your available data as well, but does not offer app-specific passwords or, more importantly, 2 Factor Authentication. The lack of these features hurts Acorn in the security department, though I would still feel comfortable investing with them in most cases.

Acorns Vs Betterment Decision: Privacy

In general, both take security extremely seriously and do everything to ensure that we can feel as safe trusting them with our money as we can with any other bank. However, Betterment goes above and beyond and offers pretty much every safety feature available, which makes them the leader of this category.

Fees

Since it’s unclear which of Betterment or Acorns has better average returns, one way we CAN rank performance is by comparing fees.

Betterment Fees

Betterment charges a fee of .25% of your overall balance each year. This is automatically taken out of your account slowly throughout the year, so you probably won’t even realize it’s gone. .25% means for every $10,000 you have in your account, you pay $25 per year.

While this fee starts to add up as your balance increases, the features you get from Betterment, especially Tax Loss Harvesting, often make this fee worth paying.

As an added bonus, if you sign up for Betterment through any of the links in this article, you get 1 year managed absolutely free.

Fees (Acorns)

Rather than charging you a percentage of your balance, Acorns instead charges a fixed monthly fee. Acorns’ basic service costs a fee of $1/month, but if you want a retirement account option the fee goes up to $2/month, and adding a checking account option increases the fee to $3/month.

When compared to Betterment’s fees, the $1/month fee Acorns charges will be more than Betterment charges if your balance is $4,800 or less, but once your balance exceeds that amount, Acorn’s fees become cheaper.

Plus, if you sign up for Acorns through any of the links in this article, you get a free $5 added into your account, which is 5 months’ worth of fees at the $1 fee level.

Acorns Vs Betterment Decision: Fees

Acorns’ fee structure confuses things. Since the fee doesn’t go up as your balance increases, you might think it makes sense to switch to Acorns once your balance gets higher.

However, most of Acorns’ features are geared towards new investors. As your balance increases, investing in spare change stops mattering as much, and you might want to switch to Betterment to take advantage of their more robust features.

Since this depends on your situation, I’m going to call this a draw.

Bottom line: Acorns Vs Betterment

Ok, now that we’ve gone over each important category, which service should we choose? Who wins this epic Acorns Vs Betterment faceoff? Let’s do a quick recap of the case for each option:

The Case for Betterment

- More transparency around investment options and choices

- Better customer service

- Better security options

- Tax Loss Harvesting is offered

- Cheaper fees for balances under $4,800

The case for Acorns

- Sleeker design layout

- Features designed to help new investors save money

- Cheaper fees for balances above $4,800

Acorns Vs Betterment: Final Decision

So, which service should you pick? Unfortunately, there isn’t a single right answer.

If you’re someone who can benefit from Tax Loss Harvesting, I would go with Betterment. The savings you get from this feature will probably outweigh anything you can get from Acorns (unless you REALLY love Acorns design and are not a fan of Betterment’s).

If you AREN’T someone who can benefit from Tax Loss Harvesting, then the decision is a bit harder.

If your balance is above $4,800, Betterment will have a higher fee than Acorns, making Acorns more worth it if you just want the lowest fee option.

However, you also have to decide if paying that extra fee, and giving up the sleek design and beginner-friendly features that Acorns has, is worth getting access to the extra transparency, customer service, security, and other general features that Betterment offers.

If your balance is BELOW $4,800, it’s the exact opposite: Acorns will have a higher fee than Betterment, making Betterment more worth it if you only care about fees.

So, calculate how much extra in fees you would be paying with Acorns, then decide if paying that extra fee and giving up on everything Betterment offers is worth it to keep using Acorns’ sleeker App/Website, and to keep taking advantage of Acorns’ beginner-friendly tools – tools that are probably more valuable to you if your balance is small.

At the end of the day, it probably makes sense to try them both and stick with the one you like.

However, if I had to pick a single winner, I would say that Betterment is the better choice for most people.

Recommended Reading

Webull Vs Robinhood: Choose an Online Brokerage

Ever wondered which Online Brokerage is the best fit for you? Here we compare Webull Vs Robinhood and determine which is the better option.

Webull Review: Choose This Online Brokerage?

Looking for a new, awesome brokerage to use for trading stocks? Check out this Webull Review and see all the amazing features they have to offer!

Blooom review 2022: Optimize for Retirement

Need help managhing your 401K or other retirement account? Check out this Blooom review and see how much money and time you can save!

Wealthfront vs Betterment: Which Robo-Advisor is Best?

Deciding between Wealthfront vs Betterment? This review will help you decide which Robo-Advisor is the right choice for you!

Betterment Review 2022: The Best Robo-Advisor?

In this Betterment review, you'll see everything Betterment can do for you. Hop on board the Betterment Robo-advisor train now!

Vanguard vs Robinhood 2022: Best Online Brokerage?

Want to start investing, but not sure which service to use? Check out this guide comparing Vanguard vs Robinhood and decide now!