Before we compare Webull Vs Robinhood, we should talk a bit about investing in general.

When looking to invest money into the stock market, there are 2 main ways to do that:

- 1) Investing in index funds that attempt to approximate the returns from the overall stock market

- 2) Picking individual stocks that you think will grow faster than the overall market, and buying those stocks.

In general, I strongly recommend the first option, especially for newer investors. It’s safe, you’ll outperform most active traders, and it’s much less time-consuming.

If you agree, stop reading this article and check out one of the following posts instead:

However, many people simply aren’t satisfied putting all their money into a Robo Advisor. Maybe you’re convinced that you’ve perfected a strategy to always pick winning stocks, or maybe you’re just bored with passive investing and want to have some fun actively trading.

Historically, active traders would turn to big firms like Schwab or Fidelity as their brokers of choice, but recently some new, smaller players have taken the brokerage scene by storm. In this article, I’m going to do a head to head comparison of Webull Vs Robinhood, the 2 new brokerages that have changed the game forever.

Below are the 5 categories I’ve deemed are most important when judging brokerage accounts:

- Investing Options

- User Interface and Ease of Use

- Available Research, Tools, and Features

- Customer Service, Security, and Privacy

- Fees

I’ll now go through each of these 5 categories, pick a winner in each, and then have a final rundown of the pros and cons of both options. After that, you should have all the information you need to help choose which Brokerage Account will work best for you.

So, are you ready for the Webull Vs Robinhood showdown? Let’s get to it!

What is Robinhood?

Founded in 2013 by Vladimir Tenev and Baiju Bhatt, Robinhood took the world by storm and quickly became the favored brokerage choice for college students and other new investors.

Boasting a slick, simple to use App and no trading fees (which was unheard of at the time), it was easy to see the appeal of Robinhood.

Since then, Robinhood has continued to add to its offerings and deserves its place as one of the leaders of the online brokerage era.

What Is Webull?

Webull was founded in 2017 and only first announced their app in 2018, making them one of the newer players in the online brokerage world. They are regulated by both the SEC and FINRA.

Following the trend Robinhood and other online brokers had set, Webull wanted their app to be accessible to everyone, and so did away with all trading fees.

Unlike most other online brokerages, Webull didn’t solely target new investors. Rather, they made sure their offerings would be suitable for all types of investors, regardless of experience level.

While online brokerages like Robinhood focused their budgets on designing their offerings to be user friendly to new investors, Webull sacrificed some design simplicity in order to load their App with an impressive amount of useful tools, making them a top choice for any advanced investor that was sick of paying trading fees.

Investing Options

The first thing you need to know about investing with either Webull or Robinhood is what you’re actually allowed to invest in with each service.

Even if you’re 100% confidant that a stock will go up in value, it won’t do you any good if your brokerage doesn’t have that stock available.

Investment Options (Robinhood)

Robinhood changed the investing world forever when they launched their app in 2015 and offered 0 fee trading.

As per their website, they now offer a robust set of asset classes to choose from, including:

- Over 5,000 U.S. Exchange-Listed Stocks and ETFs

- Options Contracts for U.S. Exchange-Listed Stocks and ETFs

- Cryptocurrencies, including Bitcoin and Ethereum

- ADRs for over 250 Globally-Listed Companies

This is more than enough options for most investors, and seeing as Robinhood is always adding to their platform, there may be even more asset classes available to trade on their platform in the future.

Investing Options (Webull)

Webull arrived at the party in 2017, and since then has become a powerhouse in the fintech brokerage world.

Like Robinhood, Webull offers free trades on stocks, ADR’s, ETF’s and Options.

As of November 2020, they now offer Crypto Currency trading as well. This eliminates one of the biggest advantages Robinhood had vs. Webull.

Webull also offers short-selling on certain stocks, which is something Robinhood doesn’t do at the moment.

Webull Vs Robinhood Decision: Investment Options

Overall, these brokers offer pretty similar investment choices. Webull offers short-selling, which is something Robinhood lacks. Now that Webull offers Crypto trading, they offer everything Robinhood offers and more, so I’m giving the win to Webull here.

User Interface and Ease of Use

Having tons of investing options is great, but if your chosen platform is stuck using technology from the 1900s, you’re not going to have an enjoyable experience.

If you’re considering either Robinhood or Webull, that likely means you’re interested in being an active trader and will be on the platform a decent amount. So, having a simple and intuitive User Interface is extremely important.

User Interface and Ease of Use (Robinhood)

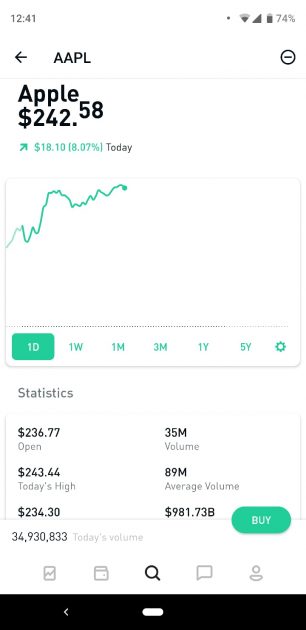

Other than free trading, the biggest thing Robinhood did differently than other legacy brokerages is that they focused on building an App instead of building a website.

The app is light on some of the heavy research and features that other competitors had but is EXTREMELY easy to use.

This, along with the 0 fee structure, made it an instant favorite among the younger crowd of investors.

In fact, in 2015, an amazing 80% of Robinhood’s users were millennials, and the average user’s age was 26. While those numbers are a few years old, there’s no reason to think that anything’s changed.

Robinhood still has 0 fees, an easy to use app, and has now added a website option as well.

The website works mostly the same way the App does, which is great news since the App is so simple.

When using Robinhood, all the steps in the trading cycle can be performed effortlessly. Once your bank account is connected to Robinhood, you can send money into your Robinhood account INSTANTLY (up to $1,000).

This means you can say goodbye to having to wait days before buying stocks.

The act of buying stocks is incredibly simple as well. You simply search for the stock you want, click the “buy” button, select the number of shares you want, and hit the checkmark. You then own the stocks.

(Note: the above explanation is for buying stocks through a Market Order. However, you can also select to buy through a Limit Order, Stop Order, Stop Limit Order, or Trailing Stop Order.)

Selling your stock is just as easy, and you get access to the money right away.

In short: Robinhood is quick, sleek, easy, and has everything you would ever need as a beginner investor. For more seasoned investors, if you don’t highly value some of the research tools offered by other competitors, it may make sense for you to take advantage of Robinhood’s simpleness as well.

User Interface and Ease of Use (Webull)

Webull came along later than Robinhood but seems to have adopted a similar strategy in deciding which features to target.

Robinhood features such as free trades, a Mobile App, quick transfers, and easy trades are found in Webull as well.

In fact, as a whole, everything is the same as Robinhood… but a little clunkier and less intuitive.

Robinhood made great efforts to ensure their app was simple and made sense to beginners.

Webull’s App is good as well, but they seem to have put a bit more emphasis on the research and investing side of things.

Webull Vs Robinhood Decision: User Interface and Ease of Use

Since both of these brokerages have more or less the same features, this category really comes down to which layout you prefer.

And, when it comes to layout, the consensus is that Robinhood is a clear winner.

The Robinhood App is famous for being so easy, a college kid can do it.

Webull, on the other hand, seems more geared for advanced investors.

After using both Webull and Robinhood, I absolutely agree with that sentiment, and will, therefore, give Robinhood an edge here.

Available Research, Tools, and Features

Now that we’ve got the essentials out of the way, we can start diving into some of the unique features each platform has that helped differentiate them from their competitors.

While these features may not be necessary to actually make investments, they are certainly welcome additions to the platform and can help make an investor’s life much, much easier.

Available Research, Tools, and Features (Robinhood)

Since Robinhood caters mostly to new investors, historically it hasn’t focused much on providing advanced research options for the more experienced investor. This has changed a bit recently as Robinhood adds to their platform, but the options are still a bit lacking.

Here are some of the research tools Robinhood offers:

- Basic Statistics (P/E Ratio, Dividend Yield, etc.) of any stock you’re interested in

- Recent news articles pertaining to your stock

- Charting of Stock Price in either line or candlestick format over timeframes of 1 day, 1 week, 1 Month, 3 Months, 1 Year, and 5 Years

- Analyst Ratings

- Quotes from both bullish and bearish investors

- Lists of stocks that people who bought your stock also bought

- Basic fundamental information about the company

- The ability to add and remove stocks from a watchlist

- Information about recent and future earnings calls

- Top mover lists (stocks that have moved up or down the most in the last day

While all these tools are nice to have, nothing is here that can’t be found in numerous other places. If you’re looking for a platform that provides the ability to do heavy research, there may be better options.

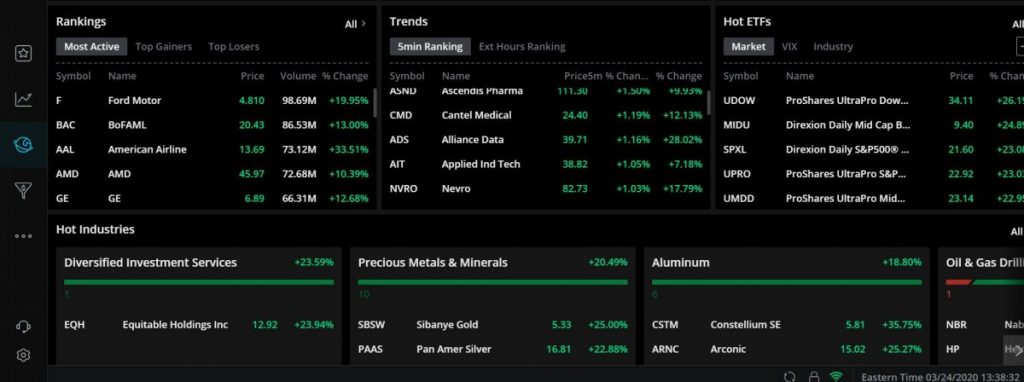

Available Research, Tools, and Features (Webull)

Webull’s research offerings are much more robust than Robinhood. While they sacrificed a bit in terms of ease of use, they compensate for that by offering many more tools and features than Robinhood, making them more suited for more technical investors.

Webull offers pretty much everything Robinhood offers, and more. Here are some features Webull has that Robinhood doesn’t:

- More charting options

- Real-time information on volume, price, and trades

- More information on statistics, key executives, and company fundamentals

- Detailed information from Income Reports, Balance Sheets, and Cash Flow Statements.

- A community you can use to discuss stock picks with others

- A trading simulator you can use to practice trading and test out strategies without risking real money

There are other features as well, but these were the ones that stuck out to me most when using the platform.

Webull Vs Robinhood Decision: Available Research, Tools, and Features

This one is a clear winner for Webull. Robinhood has some nice tools for beginners, but Webull has all those tools, and much more, giving them the win.

Customer Service, Security, and Privacy

These are the “invisible” parts of a brokerage – they’re all extremely important, but easy to miss since they don’t directly affect trading. I’ve put them all in the same section since they’re all similar in that way, but I’m going to break each of them down into “mini” sections as well.

In general, the pattern of Webull having slightly more features than Robinhood, while cutting back on some of the ease of use Robinhood is famous for continues. As you’ll see, Webull has a few customer service and security options that are currently lacking from Robinhood, but because of Robinhood’s overall strategy, are not as critical for them to offer.

Customer Service (Robinhood)

Robinhood has email support and a help center filled with helpful articles. However, it does not offer a phone number you can call to get a quick answer to a specific problem.

Luckily, since the Robinhood platform is so simple, you shouldn’t be needing support very often. The platform is intuitive and there aren’t a ton of complicated features to work through.

While it would have been nice to have a phone number you can call, I haven’t found the lack of one to be such a huge deal.

Customer Service (Webull)

Unlike Robinhood, Webull DOES have a phone number you can call, which can be found at the bottom of their website. To get to an actual person, press 4 when they’re going over their menu options.

This is good, since Webull has more features than Robinhood, and some of those features can be a bit confusing.

Now, if you get stuck using some of their features, you can simply call the number and get some immediate help.

One thing I DID notice is that while both have numerous help articles available on their site, I was able to find helpful articles on Robinhood much easier than I could on Webull.

As evidence of that, I’ve linked to specific Robinhood pages throughout this article that directly references a topic I’m discussing, but finding similarly helpful articles on Webull was a challenge and usually involved combining information from different sources.

Webull Vs Robinhood Decision: Customer Service

Phone support gives Webull the win here. While it’s true that Robinhood doesn’t need phone support as badly as Webull does, having the option would still be nice.

Security (Both)

Something many people are worried about when starting to invest is whether your money is secure and whether Webull and Robinhood are trustworthy. The answer to those questions is YES, these services are both safe and worthy of your trust.

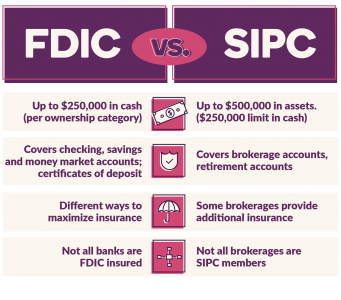

These brokerages are both SIPC insured, which means a few things.

For starters, even if either of them ever declared bankruptcy (an extremely unlikely event), you’re still almost certainly (as in 99.999% certainly) going to get all your money back.

SIPC insures your money up to $500,000, meaning you’re never in any danger at all of losing money due to bankruptcy until you hit that amount.

Second, there are TONS of regulatory checks that must be done often, sometimes on a daily basis.

These checks will ensure that Webull/Robinhood keep their word and separate your invested assets from the company’s assets, and don’t use your money for anything other than investing in the funds they say they invest in. This helps prevent a Madoff – like scheme from ever happening.

As long as your assets are separated, you will get your money back in a bankruptcy situation no matter how much money you have stored – since this money was never touched and is just sitting in the funds, the company going bankrupt has no effect on it.

So basically, going bankrupt has 0 effect on your money up to $500,000. And, assuming the constant regulatory checks work to ensure that your money is separate from company money, the rest of your money is safe as well.

In addition, Webull’s clearing firm, Apex Clearing, purchased an additional policy that protects your securities up to 37.5 MILION.

While it’s extremely unlikely this will ever be necessary, having extra security is never a bad thing, especially since Webull likely will appeal to bigger, more experienced investors who have more than $500,000 invested.

Webull Vs Robinhood Decision: Security

SIPC insurance is the biggest factor here, and both options have it. Webull has an additional layer of security as well, which gives them a small edge, but in practice, your money should be perfectly safe with either option.

Webull gets the win here but by an EXTREMELY small amount. Both options are great security-wise.

Privacy (Both)

If we’re not worried about Bankruptcy, then the only danger of investing with either of these services (other than, of course, your investments not performing well) is that you could be the victim of a cybercrime and have your money stolen by a cyber-criminal.

Luckily, Robinhood and Webull take many actions to help prevent that from happening. Here are some of the preventative measures they offer:

- Password encryption

- Encryption of other sensitive information (such as Social Security Numbers)

- Secure Communication between Servers using TLS protocols

- Never access banking information without first going through trusted third-party applications

- Two-factor authentication

Obviously, no security measures are perfect.

However, these measures, combined with using some common sense, should be enough to keep you safe.

Webull Vs Robinhood Decision: Privacy

The privacy measures taken by both brokerages appear to be similar to each other and conform to the industry standard.

In general, you should feel safe investing with either of them.

This subcategory ends in a draw.

Fees

Since both of these services are famous for 0 fee commissions, you might think that there isn’t much to talk about in this section.

And, if you’re just going to be using their basic services, you’d be right. However, each of these platforms has some additional features not included in the free version that is behind a paywall, which is what we will be discussing.

Fees (Robinhood)

Robinhood’s paid option is called Robinhood Gold, which you can get for $5/month. Robinhood Gold offers the following features:

- Better research tools & Market Data

- Bigger instant deposits (scales up as your portfolio grows in size)

- Access to Margin Investing

Extra research options are nice, and some people might find the ability to make a bigger instant deposit nice as well.

The $5/month cost of Robinhood Gold covers the first $1,000 of margin you borrow. Anything above that, and you’ll be paying an additional 5% of interest.

Margin trading is for more advanced traders. If you’ve been trading for a while and would like to play around with Margin Trading then you’ll have to get Robinhood Gold to do so. Otherwise, I would stay away, at least until you gain more experience.

Fees (Webull)

Webull does not have a paid program like Robinhood does, but they do charge interest if you want to Margin Trade. The interest is different depending on how much you borrow:

- $0-$25,000: 6.99%

- $25,000.01-$100,000: 6.49%

- $100,000.01-$250,000: 5.99%

- $250,000.01-$500,000: 5.49%

- $500,000.01-$1,000,000: 4.99%

- $1,000,000.01-$3,000,000: 4.49%

- > $3,000,000: 3.99%

Webull Vs Robinhood Decision: Fees

Realistically, most people won’t be paying a dime in fees when using either of these services. The only fees being charged are for extra services that probably won’t appeal to most investors – and if they DO appeal, you may be better off going with a more traditional brokerage.

Therefore, this category ends in a draw.

Bottom Line: Webull Vs Robinhood

If you’ve been paying attention, you probably noticed that a lot of these categories ended in either a draw or a slight advantage one way or the other.

You may have even come to the same conclusion I did: That where you invest your money isn’t as important a choice as most people think.

At the end of the day, these brokerages are extremely similar to each other, with any differences being pretty minor.

However, I DID promise to pick a winner.

So, who wins this epic Webull Vs Robinhood faceoff? Let’s do a quick recap of the case for each option, and see how they differentiate themselves from each other:

The case for Robinhood

- Extremely simple and intuitive user interface

- Has been around longer than Webull, so could be considered more trustworthy

- Margin Trading Fee structure may be more beneficial

The case for Webull

- Has significantly better research tools than Robinhood

- Offers phone support

- Offers Short Selling

- Margin Trading Fee structure may be more beneficial

Webull Vs Robinhood: Final Decision

If you’re deciding between these 2 brokerages, the biggest reason is probably that you want 0 fee trading.

And, if that’s all you care about, either one of these brokerages can work.

Unless you’re interested in niche services Short Selling or Margin Trading, the final decision comes down to 1 thing: Ease of Use, or extra research features. Whichever one of these factors is more important to you should decide which service you use.

Overall, I’ve found that you can get the equivalent of most of Webull’s extra features elsewhere on the internet.

If you’re able to get your research from other sites, then Robinhood starts to look a whole lot better, since it’s sooooo easy to use.

Therefore, after much thought, I’ve decided to crown Robinhood the champion of the Webull Vs Robinhood face-off.

Recommended Reading

Acorns Vs Betterment: Robo Advisor Face-off

Ever wondered which Robo Advisor is the best fit for you? Here we compare Acorns Vs Betterment and try to decide which is the better option.

Webull Review: Choose This Online Brokerage?

Looking for a new, awesome brokerage to use for trading stocks? Check out this Webull Review and see all the amazing features they have to offer!

Blooom review 2022: Optimize for Retirement

Need help managhing your 401K or other retirement account? Check out this Blooom review and see how much money and time you can save!

Wealthfront vs Betterment: Which Robo-Advisor is Best?

Deciding between Wealthfront vs Betterment? This review will help you decide which Robo-Advisor is the right choice for you!

Betterment Review 2022: The Best Robo-Advisor?

In this Betterment review, you'll see everything Betterment can do for you. Hop on board the Betterment Robo-advisor train now!

Vanguard vs Robinhood 2022: Best Online Brokerage?

Want to start investing, but not sure which service to use? Check out this guide comparing Vanguard vs Robinhood and decide now!