In this Betterment review, you’ll learn what Betterment is, and why you should use it for your investment needs.

Betterment is an automated investment platform that invests your money in a portfolio suited specifically for you, based on your age, risk preferences, and goals. As one of the first Robo-advisors, they were also integral to the start of the Robo-advisor boom that took place over the past decade.

Despite the increased competition, Betterment still manages to shine. This Betterment review will aim to show all the ways Betterment separates itself from the rest of the pack.

This review will scrutinize the cost, pros and cons, setup process, and other notable features of Betterment to help you figure out if it fits your needs. So, sit tight and read on!

What is Betterment?

Founded in 2008 by Jon Stein and Eli Broverman, Betterment is among the first Robo-Advisors that was created, helping to usher in a new era of investing. The service was designed specifically to be a platform that caters to users who want automation on their investments.

Over time, their service evolved from just being a simple method of investing, to being a simple method of investing that also has tons of awesome features. These features will be discussed throughout this Betterment review.

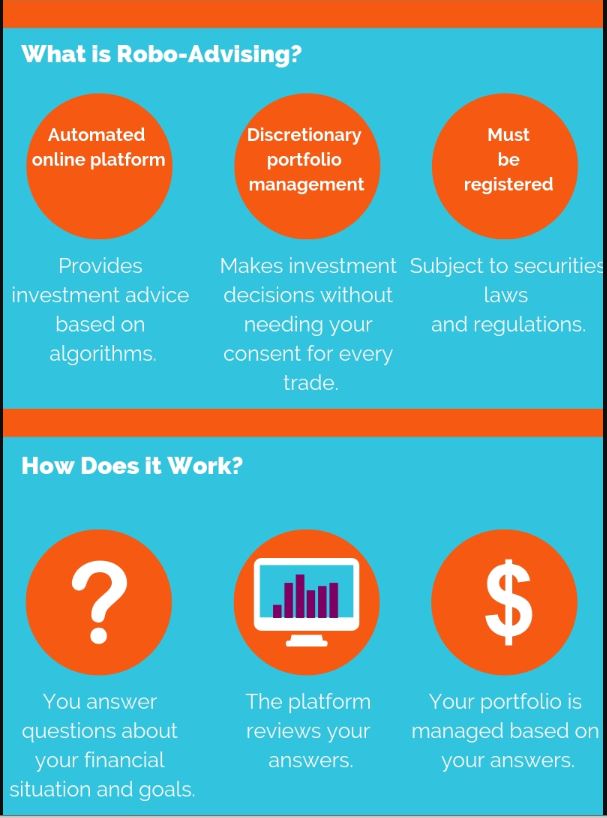

Basically, the difference between a Robo-advisor and a traditional Financial Advisor is that instead of having real humans invest your money for you, your money is invested by a computer algorithm instead.

If you want to actively trade stocks, Betterment isn’t for you. Instead, you should find an online brokerage that allows you to make trades for no fee.

The increased automation you get with Robo-advisors leads to decreased overhead costs, which allows Betterment to offer their services at a much lower rate (.25%) than they would be able to otherwise, and also means your investments will generally perform better than if a human was managing your money.

According to a report from Investment News, as of March 2020, Betterment’s assets under management (AUM) have surpassed $22 billion, making it the fifth-largest Robo-advisor in terms of AUM. Currently, Betterment serves over 500,000 registered accounts.

What is Betterment’s Goal?

To answer this question, let’s start with a more basic question: What is the goal of investing in general?

The specific goals are different for each person, but in general, you’re investing because you want to own assets that will grow in price. If possible, you would like to do this in such a way that:

- Your assets grow in price very quickly.

- You aren’t taking on a ton of risk.

- You don’t have to spend too much time researching and tracking your investments.

Betterment’s goal is to help YOU reach your investing goals as quickly and easily as possible. Betterment utilizes Modern Portfolio Theory to invest your money in a portfolio that performs well over time, has a limited amount of risk/volatility, and requires at most a few minutes of your time per month (and often won’t require you to log in at all).

Even better, Betterment customizes your portfolio according to your specific situation and goals. For example, are you saving for retirement? Or are you hoping to buy a house in a few years?

Betterment takes these goals into consideration, along with your age, salary, current net worth, and other details specific to you, and uses Modern Portfolio Theory to craft a portfolio specifically designed for your unique situation.

Want to know more about how they do this? Let’s dive deeper into the inner workings of Betterment, Modern Portfolio Theory, and Goal-Based Investing.

What is Modern Portfolio Theory?

As everyone knows, investing in stocks can be profitable, but can also be risky. Every year, some companies see their stock prices greatly increase, some companies go bankrupt, and some companies remain relatively stable.

If there was a way to confidently pick only stocks that will increase in price that would be great – except that’s pretty much impossible.

Even the best investors in the world aren’t perfect. This means that no matter how confident you are in a single stock, it would be silly to go all-in on that one stock since there’s a chance that you might be wrong.

So, what should we do about this?

Answer: Diversify.

If you buy multiple stocks instead of a single stock, the chances of you losing all your money go down significantly. While diversification may decrease your upside (since it’s unlikely all the stocks you buy will perform exceptionally well), it will also significantly decrease your downside, which is generally considered a good trade-off.

Going even further, many people like to buy ETF’s instead of individual stocks, since buying an ETF is kind of like buying hundreds of different stocks. And going even FURTHER, some people like to diversify out of the stock market altogether and put some of their money in bonds, Real Estate, Cryptocurrency, or other assets.

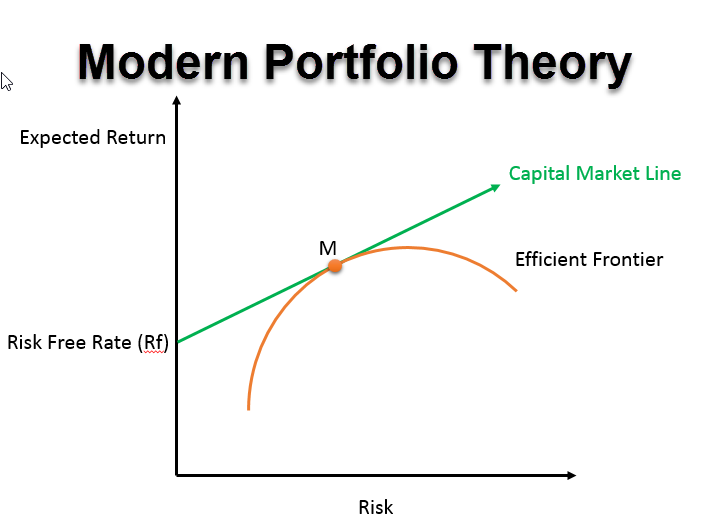

Once you’ve decided to diversify, the question becomes “How do I diversify in a way that maximizes returns and minimizes risk as much as possible?”

That question is exactly what Modern Portfolio Theory attempts to answer.

In general, the more risk you take on, the bigger the potential reward will be. However, that isn’t always true – occasionally, some portfolios may be very risky, but not have a significantly higher reward than a safer portfolio.

Without getting too deep into the weeds, Modern Portfolio Theory attempts to invest your money in a combination of Stock and Bond funds that has the best risk/reward ratio possible. And that’s what Betterment does – they invest your money in an optimal combination of 14 different types of stock and bond funds according to the principles of Modern Portfolio Theory.

However, Modern Portfolio Theory has one issue – the optimal risk/reward ratio will be different for each person. Some people are comfortable with risk and have goals that fit with a risky portfolio, while some people may prefer a portfolio that’s a lot safer.

For example, if you plan on retiring in a couple of years, it’s usually not smart to take on too much risk – after all, your portfolio won’t have much time to recover before you start to rely on it to survive.

So, in order to solve this issue, Betterment also utilizes goal-based investing. This allows them to tailor your portfolio to fit your specific needs and personality.

What is Goal-Based Investing?

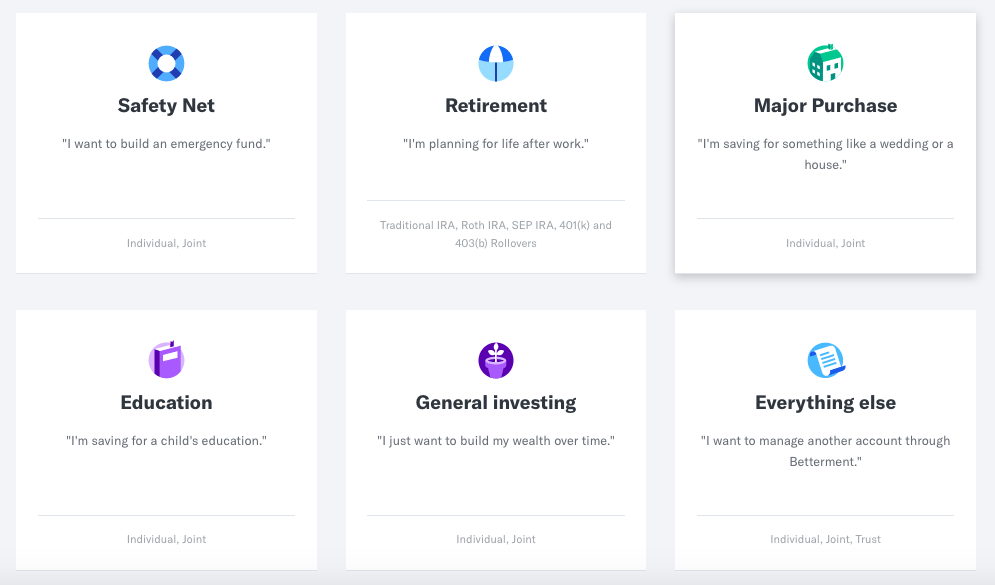

Goal-Based Investing allows Betterment to adjust the amount of risk in your portfolio based on your specific situation and goals.

If you’re a young person saving for retirement, it makes sense to take on as much risk as possible – after all, you won’t need the money for another 30+ years, which gives you plenty of time to make up any losses that happen along the way.

However, if your goal is to buy a house within 3 years, you should be investing in a much less risky portfolio – 3 years isn’t such a long time, and there have been 3 year stretches in the past where the market lost value.

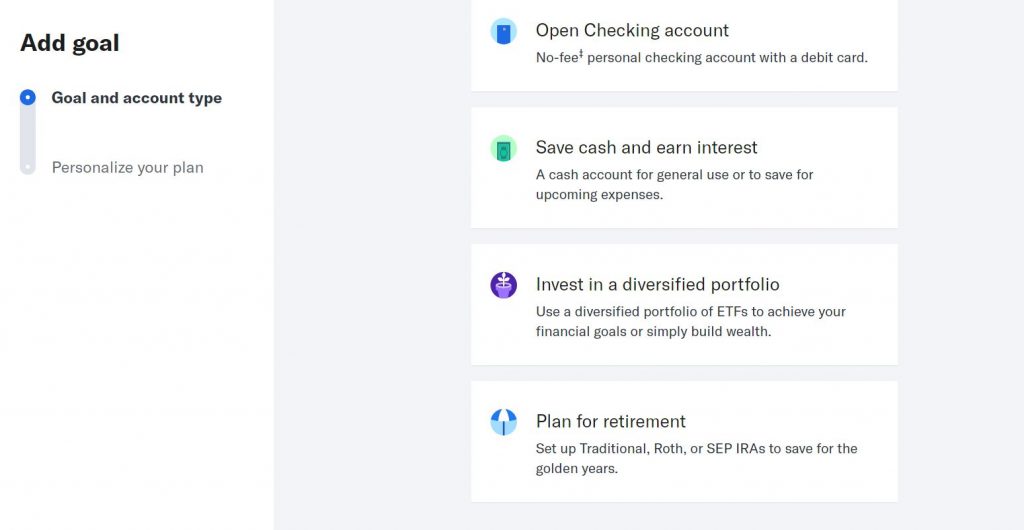

Betterment begins their Goal-Based investing process by asking what type of account you’d like to start – a checking account, savings account, taxable account, or Retirement account (such as an IRA.). Then, they get into more specifics and ask what exactly you’re saving for.

Once you pick a goal, you then choose a target for how much money you want in that account by a specific time, and Betterment recommends a portfolio tailored to you.

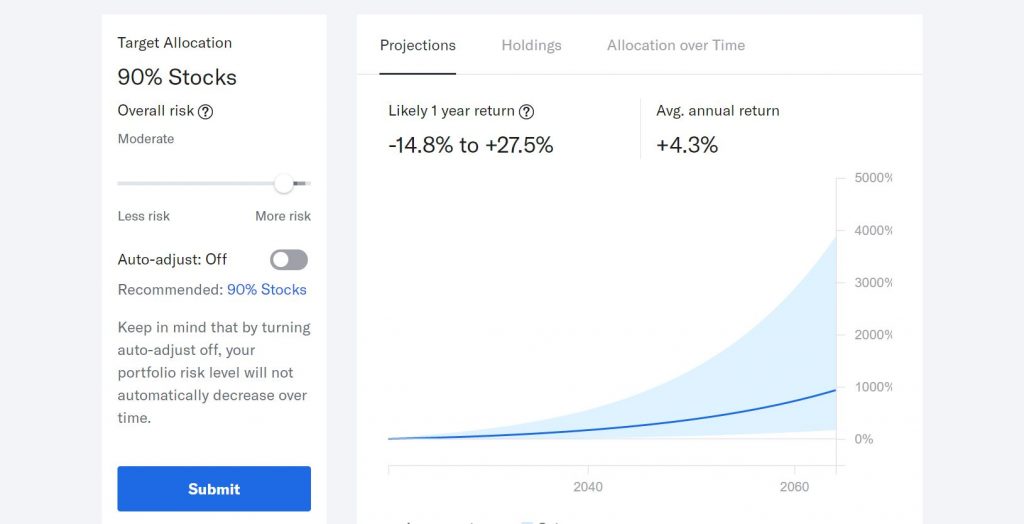

These goal choices, along with your personal details such as age and salary, affect Betterment’s recommended portfolios, but you can always choose to change your allocations by simply moving the slider to select how much of your portfolio should be stocks and how much should be bonds.

Even better, Betterment will ensure that you always remain at this allocation. For example, if you select 90% stocks and 10% bonds, but then the stocks you own increase in price significantly faster than your bonds, Betterment will sell some of the stock gains for bonds so that you remain at the 90%-10% mark that you set.

Betterment Review: Account Types

Betterment offers a wide variety of taxable accounts, retirement accounts, and more. Here is a complete list of the account types they offer:

- Individual Taxable Accounts

- Joint Taxable Accounts

- Roth IRA

- Traditional IRA

- SEP IRA

- Inherited IRA

- Trust Accounts

The following accounts are not currently supported by Betterment:

- 529 Accounts

- Custodial or Minor Accounts

- HSA Accounts

- Solo 401Ks

- Self Directed Accounts

Betterment Vs the Competition

At a high level, here is how Betterment stacks up to the competition:

Of course, there’s much more to get into when discussing a powerful Robo-advisor like Betterment than can be shown in a single table. Let’s discuss in more depth some more perks and features that Betterment offers.

Betterment Historical Returns

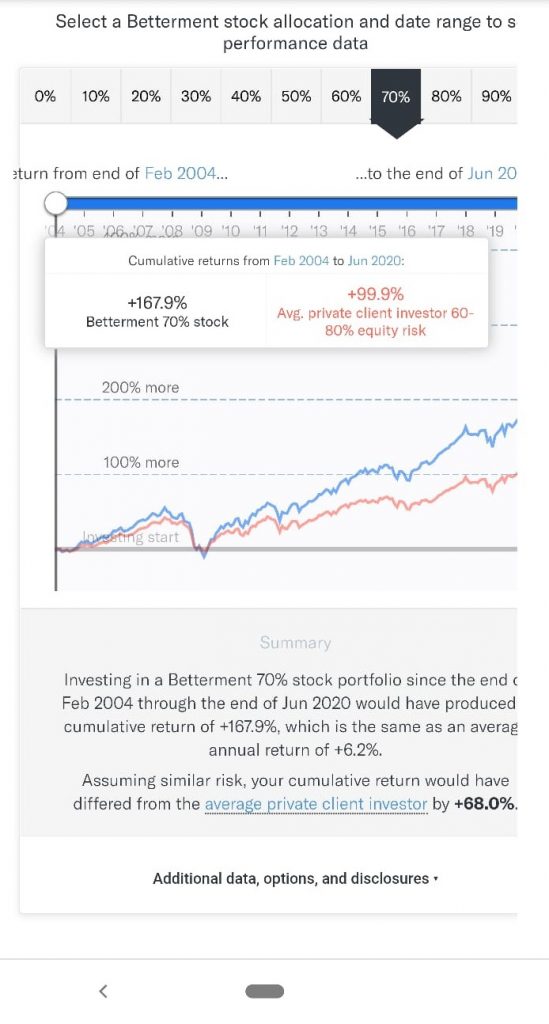

Unlike many Financial Advisors – both Robo and human – Betterment is EXTREMELY transparent about their historical performance.

On this page, you can check the historical performance of all the different Betterment portfolio options since 2004, and you can even compare them to the performance of common indexes like the S&P 500, or the returns of the average private client investor.

Increase Returns with Tax Loss Harvesting

Before we can understand what Tax-Loss Harvesting is and how it can help you, let’s go over some basic tax information first.

When investing, many people focus solely on the returns and rarely focus on tax implications. Forgetting to account for taxes can be a huge mistake, so let’s go over the basics of how stocks and bonds are taxed.

Any income you make by investing in stocks or bonds is considered “Capital Gains“. There are 2 main ways that Capital Gains are taxed:

- Long Term Capital Gains

- Short Term Capital Gains

In addition, any income you receive from Dividends is considered normal income and taxed the same way your income from your job is taxed. Dividend income is taxed the year the income is earned.

Unlike dividends, Capital Gains are only taxed once you sell the stocks that went up in value. So, even if your portfolio went up by $1,000 this year, if you didn’t sell anything then you don’t owe any taxes on it.

If you buy a stock or bond that goes up in value and sell it within 1 year, that is considered Short Term Capital Gains. If you sell it after a year then it’s Long Term Capital Gains. Short Term Capital Gains have a higher tax rate than Long Term, so in general, try and hold your stocks for at least a year.

Now, here’s where things get interesting: The same way that Capital Gains are taxed when you sell the bond/stock, so too are Capital Losses. These Capital Losses can be used to offset Capital Gains, and if your losses are more than your gains, up to $3,000 can be used to offset normal income. The rest can be deferred to future years.

What does that mean? Let’s go through an example.

Let’s say you invest $20,000 into VTI (the Vanguard Total Stock Market ETF), and VTI then decreases in price by 10% (so your VTI funds are now worth $18,000).

You have 2 choices: You can either keep holding on to the fund and hope it increases in value in the future, or you can sell now and create a $2,000 Capital Gains loss.

If you do sell, and you don’t have any other Capital Gains to offset with this loss, then that $2,000 can be subtracted from your normal income. This means, if your marginal tax bracket is 30%, then you’ll be saving $600 at tax time.

Even better, if you’d like, you can now take the money you got by selling your VTI shares and use it to buy a similar Index Fund such as SCHB (Schwab US Broad Market ETF).

This fund is very similar to VTI, which means that it will basically be like you never sold your VTI at all. However, for tax purposes, you DID sell, which means you can bank in your loss right now!

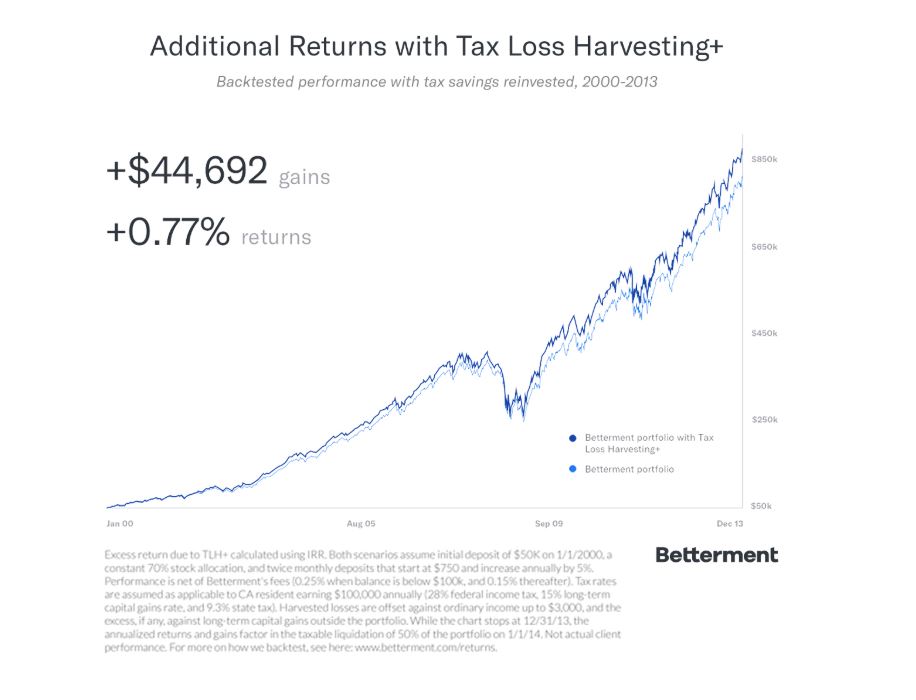

This is exactly what Betterment does for you if you opt into Tax-Loss Harvesting. If you’re depositing regularly (say, every 2 weeks), there are bound to be times where some of the funds they bought for you decrease in value over the short term. When this happens, Betterment will sell the ETF that declined in value and use the proceeds to buy a similar ETF, thus locking in a loss that you can use to offset your normal income.

Up to $3,000 in Capital losses can be used to offset normal income. So, if you’re able to harvest $3,000 in “losses”, then at a 30% marginal tax rate you can save an extra $900 per year!

Betterment Review: Fees

For most people, Betterment will cost .25% of your balance each year. This fee is higher than it would be if you just bought individual ETF’s yourself, but getting access to all of Betterment’s features makes this fee worth paying.

Additional Portfolio Strategies

As stated above, Betterment’s main portfolio strategy is based on Modern Portfolio Theory and Goal-Based Investing. You can move a slider to select how much risk you want, and Betterment will create a portfolio for you based on those guidelines.

However, there are 3 other additional portfolio types you can choose from if you’re unhappy with the default Betterment portfolios.

Socially Responsible Investing

This portfolio is for the people who want to make sure their investments align with their values. To that end, this portfolio focuses more heavily on buying stocks in companies that meet certain social, environmental, and governance criteria.

Goldman Sachs Smart Beta

This portfolio attempts to take on extra risk in order to increase return. Trying to beat market averages is always a risk, and oftentimes results in failure. However, if you’d like to try then this fund might be for you.

Blackrock Target Income

This portfolio is made up of 100% bonds and is therefore very low risk. For those looking for a safe, steady income, this fund may be for you.

Betterment Review: Retirement Features

We’ve already discussed how Betterment utilizes goal-based investing to help personalize their investment advice for you, but they go even further when helping you save for retirement. Not only will they tailor your portfolio to maximize returns by the time you retire, but they also provide a huge suite of tools to help you understand and plan for retirement effectively.

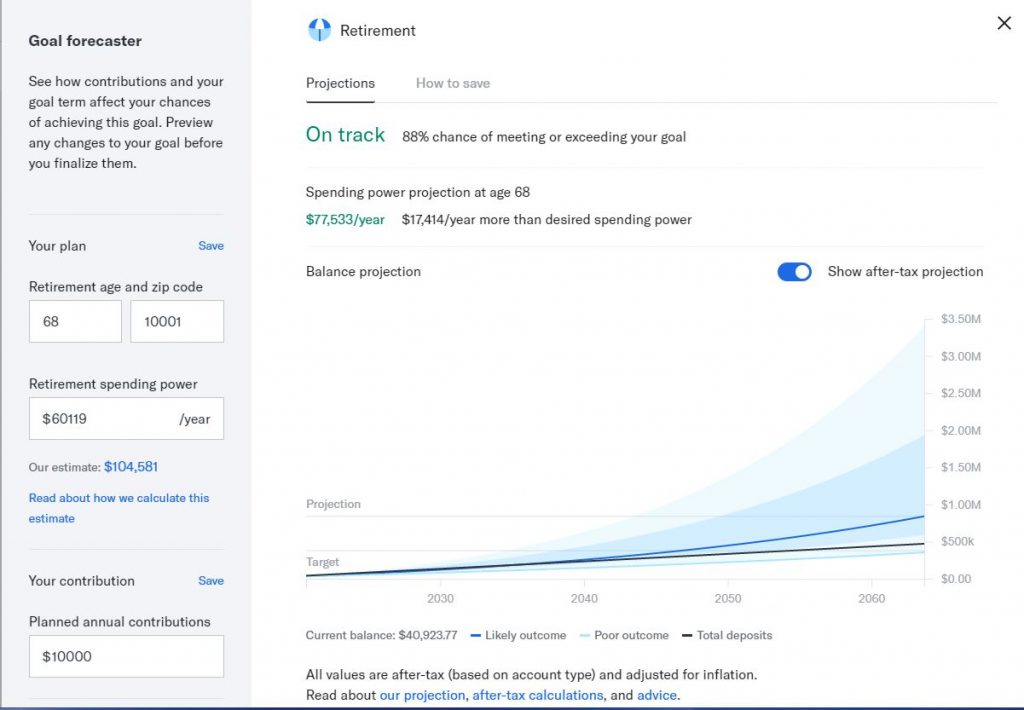

For starters, if you input details about how much you save, when you want to retire, where you want to live, etc., Betterment will calculate if your current path will likely lead to enough money when you’re ready to retire.

If you’re on target, great! If not, Betterment will offer suggestions on what you can change in order to hit your goal.

You can also play around with your targets, and see what would happen to your chance of meeting your goals.

Want to see what happens if you double your monthly investments? Just change the number on the bottom left of the screen and watch how your projections change.

Want to see if early retirement is possible? Change your desired retirement age and Betterment will tell you what you’ll need to do to make that happen.

While most retirement calculators take into account simple things like your current age and salary, Betterment goes above and beyond in what they look at.

The Betterment retirement calculator is one of the few retirement calculators that adjust their projections based on where you want to live, cost of living, and other important pieces of information that most calculators ignore.

It will also tell you exactly how much you can withdraw from your retirement accounts per year once you hit retirement age, which significantly decreases the stress of worrying about your balances when withdrawing.

Betterment Checking & Cash Reserve Review: Replace your Checking and Savings Accounts

While Betterment is primarily a Robo-advisor, it can also function as a replacement for your bank. Like most banks, Betterment offers 2 account types: Betterment Checking is their version of a Checking account, and Betterment Cash Reserve is their version of a savings account.

Betterment Checking:

- No ATM Fees

- No Foreign Transaction Fees

- No Account Fees

- No Overdraft Fees

- No Minimum balances

- FDIC Insured up to $250,000

- Tap-to-pay Debit Card

- Easy to use interface on both Mobile and Desktop

Betterment Cash Reserve:

- No Account Fees

- No Transfer Fees

- No Minimum Balances

- No limits on how often you can withdraw money

- Competitive APY (6x the national average, currently .4%)

- FDIC insured up to $1 Million

These accounts can be accessed from the same account as your investment and retirement accounts, making it easy to view your entire financial situation in a single place.

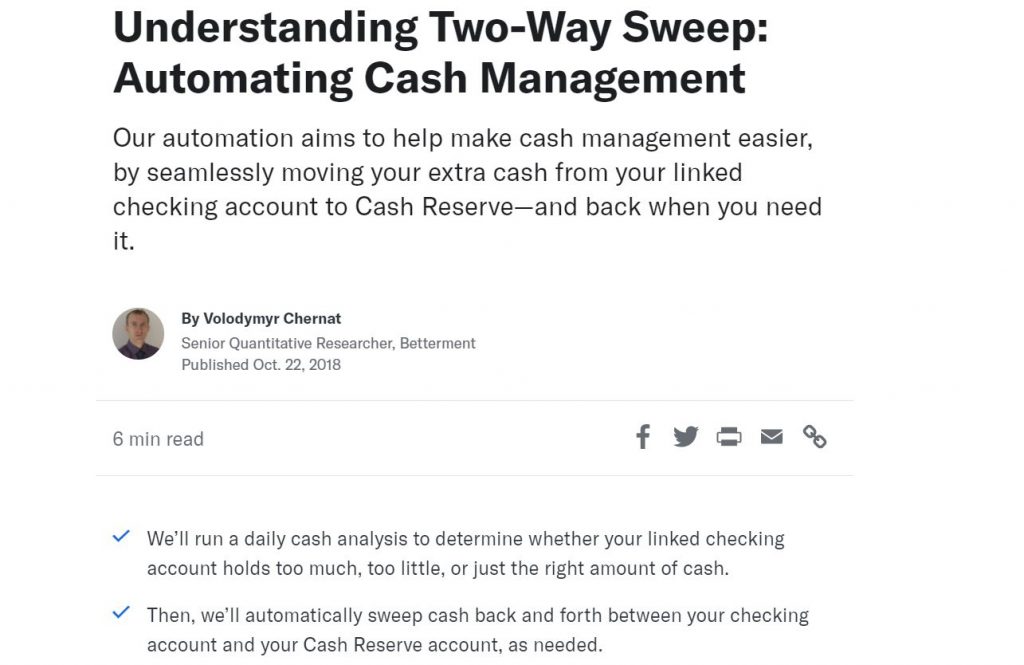

Cash Analysis & 2 Way Sweep

Betterment isn’t just a place to invest your money – it also acts as a Financial Advisor. This means that Betterment will proactively look for ways you can use your money to increase your returns.

An example of this is their Cash Analysis tool. With Cash Analysis, Betterment will analyze how much cash you have in your Checking account, and, based on your historic spending patterns, recommend that you move money from your Checking Account into an account that will make you money.

Betterment goes even further with their 2 Way Sweep feature. With 2 Way Sweep, Betterment will check if you have between 21 and 35 days worth of expenses in your Checking account based on historic spend levels.

If you do, then great – Betterment doesn’t need to do anything. However, if you have more than 35 days of expenses in your Checking account then Betterment will transfer the remainder to your Cash Reserve account, and if you have less then Betterment will transfer money from your Cash Reserve account into your Checking Account.

This ensures that you’ll always have enough money in your Checking Account, and also that you won’t have too much money sitting there and not earning you interest.

These criteria are adjustable – if you’d like Betterment to use different minimum and maximum bounds – say, 7 days and 42 days – then you can simply change the settings to reflect this. Plus, Betterment warns you before they make a transfer, so you can choose to cancel it if you’d like.

Give to Charity with Betterment

Did you know that if you give charity from a fund you’ve held for longer than a year, neither you nor the organization you’re giving to pays taxes on that money?

Betterment helps you take advantage of favorable tax laws regarding donations by keeping track of which funds you’ve held for longer than a year and helping to coordinate charitable donations from those funds.

Fun fact: in 2018, over 1 Million dollars was donated by Betterment customers. Let’s help raise that number in future years!

Speak to Real Humans

Even though Betterment is a Robo-advisor, that doesn’t mean they don’t have real people working there as well. As great as Betterment’s algorithm is, sometimes it’s just easier to talk to a real person – if that’s the case for you, then Betterment has a few options they can offer.

General customer service is available to everyone. You can call in anytime from 9 Am – 6 PM est Monday-Friday, or email them and usually get a response within a day.

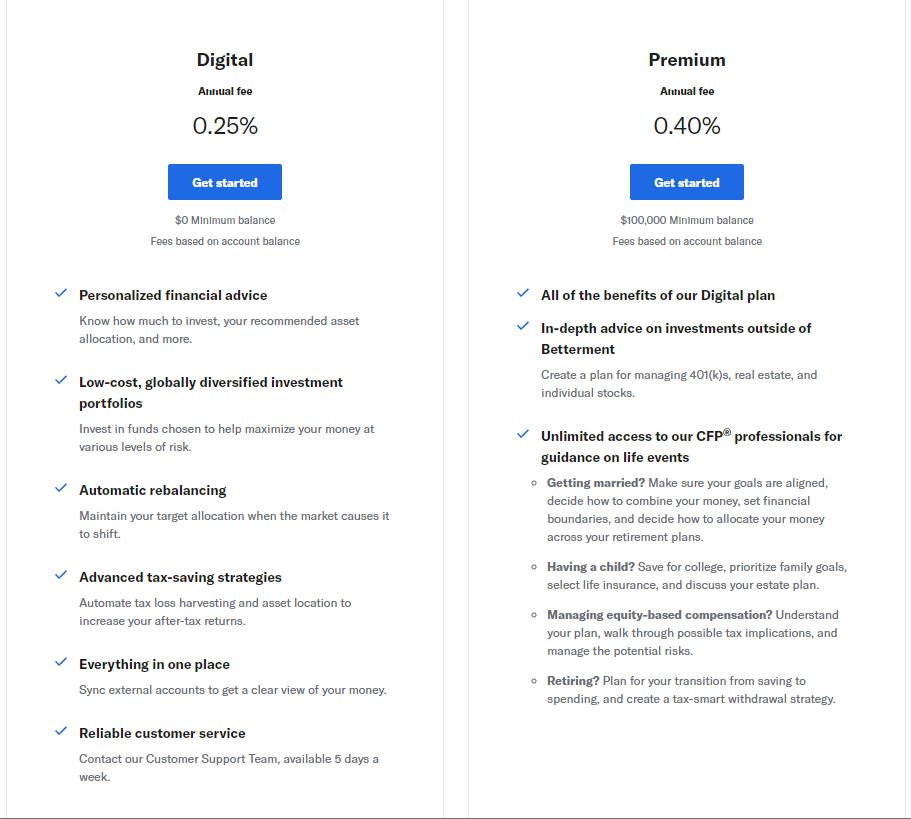

Betterment also has Certified Financial Planners you can speak to, but this will cost extra. Depending on the package you select, the extra fee can either be a one-time payment, or an increased fee from .25% to .4%. Here is a complete breakdown of the plans Betterment offers:

Betterment Review: Pros/Cons

After reading this review, you should have a solid sense of what Betterment can do for you. If you’d like a simple recap, here’s a list of pros and cons you can use while making your decision on whether to use this service.

Pros

Cheap Fees: At .25%, Betterment’s fees are very competitive, especially considering how they give you access to Tax-Loss Harvesting, automatic rebalancing, and dynamic, goal-based investing options.

Simple to use: Betterment is perfect for beginners who don’t have much experience investing. Their user interface is extremely simple and intuitive, and because they have no minimum balance their platform is open to pretty much everyone.

Cool and useful tools: With tools like their retirement suite, Checking/Cash Reserve accounts, Cash analysis, and 2-Way Sweep, Tax-Loss Harvesting, and more, Betterment has options for all types of investors.

Transparency: Unlike many financial advisors, Betterment is extremely upfront with how they are investing your money. They show you your exact asset holdings at all times, allow you to check what your historical returns would be with each of their portfolio options, and even compare those returns to the returns of popular indexes and money management options.

Cons

The Fee is higher than if you would buy funds yourself. If you don’t mind spending the time to rebalance, take advantage of Tax-Loss Harvesting, and diversify on your own, then it would be cheaper to do it that way without Betterment’s help. However, we don’t recommend that, and we think that paying Betterment’s small fee is more than worth it.

Only Stocks and Bonds are offered. While this is usually enough diversification, it would be nice if other assets were offered as well, such as Real Estate.

FAQ

Is Betterment Safe?

Your investments with Betterment is SIPC insured, which means your money is pretty much as safe as it can be.

Can you link your other accounts with Betterment?

Yes, you can. Simply enter the accounts information with Betterment, and Betterment will take those accounts into account when helping you plan for a goal or retirement.

What does Betterment invest your money in?

Betterment invests your money into ETFs for both Stocks and Bonds. Specifically, here are the different classes of ETFs they invest in:

- U.S Total Stock Market

- U.S. Large-Cap Stocks

- U.S. Mid Cap Stocks

- U.S. Small-Cap Stocks

- International Developed Markets Stocks

- International Emerging Markets Stocks

- U.S. High-Quality Bonds

- U.S Municipal Bonds

- U.S. Inflation-Protected Bonds

- U.S High-Yield Corporate Bonds

- U.S. Short Term Treasury Bonds

- U.S Short Term Investment Grade Bonds

- International Developed Market Bonds

- International Emerging Market Bonds

The breakdown of how your money is invested in these targets is based on your goals and desired stock/bond risk ratio.

Who is eligible to use Betterment?

Betterment currently only operates in the United States, and currently cannot accept customers residing outside the U.S.

All customers must be at least 18 years of age and have a permanent U.S. address, a U.S. Social Security Number or an ITIN, and a checking account from a U.S. bank.

Betterment supports residents in Puerto Rico and the Virgin Islands but does not currently support customers in Guam.

Betterment Review: Final Thoughts

Betterment is simple, cheap, performs well, and has tons of great optional tools you can take advantage of. What more is there to ask for?

With Betterment’s extreme transparency and commitment to providing you the best possible service, you can rest easy knowing that your money is in good hands.

For beginners especially, Betterment is a great option. With no minimum account balances, a really easy to use User Interface, and helpful articles/customer service, it’s hard to imagine a company being more newbie-friendly.

For more advanced investors, this platform is great as well. The performance speaks for itself, and features like Tax-Loss Harvesting and automatic rebalancing allow you to free up your time for other matters.

All in all, this platform is a fit for almost any type of investor. So, give Betterment a try and take control of your finances now!

Recommended Reading

Acorns Vs Betterment: Robo Advisor Face-off

Ever wondered which Robo Advisor is the best fit for you? Here we compare Acorns Vs Betterment and try to decide which is the better option.

Webull Vs Robinhood: Choose an Online Brokerage

Ever wondered which Online Brokerage is the best fit for you? Here we compare Webull Vs Robinhood and determine which is the better option.

Webull Review: Choose This Online Brokerage?

Looking for a new, awesome brokerage to use for trading stocks? Check out this Webull Review and see all the amazing features they have to offer!

Blooom review 2022: Optimize for Retirement

Need help managhing your 401K or other retirement account? Check out this Blooom review and see how much money and time you can save!

Wealthfront vs Betterment: Which Robo-Advisor is Best?

Deciding between Wealthfront vs Betterment? This review will help you decide which Robo-Advisor is the right choice for you!

Vanguard vs Robinhood 2022: Best Online Brokerage?

Want to start investing, but not sure which service to use? Check out this guide comparing Vanguard vs Robinhood and decide now!