As you likely know, there are plenty of Robo-advisors to choose from. However, as you’ll see in this Blooom review, Blooom separates itself by streamlining its services into one specific niche: retirement account management.

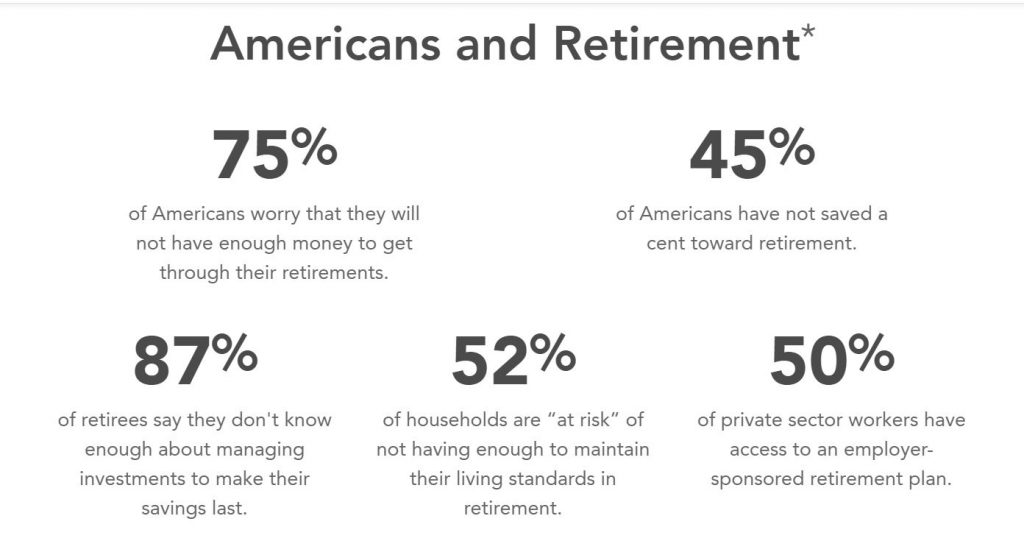

According to the 18th Transamerica retirement survey, 62% of American workers expect their standard of living to improve, if not stay the same, after retirement. If you are among this percentage and you also expect a similar post-retirement scenario, then it’s extremely important that you handle your retirement plans pretty well.

However, in case you are not confident managing your 401K, IRA, or other retirement accounts by yourself, or you simply would prefer to seek professional advice, then it might be a wise choice to take a closer look at Blooom.

This Blooom review dives into the details, tackling everything there is to know about the company and its services. If you are trying to pay closer attention to your future retirement funds or you are simply looking for ways to improve, take a few minutes to check out this Blooom review.

What is Blooom?

Blooom is an online finance company based in Kansas that offers professional management of retirement plans for everyone. Regardless of whether you have an employer-sponsored retirement plan (like a 401k), IRAs, or both, Blooom can have your retirement portfolio professionally managed.

Founded in 2013 by Chris Costello, Kevin Conard, and Randy Aufderheide, Blooom is currently the only registered Robo-advisor service that specializes in handling employer-sponsored retirement accounts. The service recently expanded, and they now handle IRAs as well.

Since they specifically specialize in retirement accounts, that means you’ll have to manage your taxable accounts yourself or use another provider. While not ideal, this allows Blooom to focus exclusively on retirement accounts, and make sure what they offer is top of the line.

Blooom is a solution to a problem most financial advisors fail to recognize. It handles retirement planning seamlessly for people who do not have the time and expertise, or for those who simply prefer to pay for a service rather than to do the tedious work themselves.

In terms of the company’s achievement status, Blooom currently sits on top of over $3 billion (and growing) worth of assets under management. Also, it has saved its clients a projected total of $1 billion in hidden fees.

How Blooom Works: A Quick Overview

Blooom is able to manage defined contribution plans such as 401(k)s, IRAs, 403(b)s, 457(b)s, and Thrift Savings Plan (TSP). For all of these plans, Blooom will make sure your earning potential is as strong as possible.

When first starting with Blooom, they will analyze your specific account and circumstances and make an initial recommendation, free of charge.

Then, if you’d like Blooom to handle your finances for you going forward, they will slowly start shifting your money into low-cost index funds and taking advantage of other investing strategies meant to approximate the market and maximize returns.

Initially, Blooom will sell the investments you have for cash. Afterward, they will proceed with buying their recommended investments.

For the individual stocks in your retirement plan, Blooom will either sell or relocate them to an appropriate fund. If not, they will move those stocks to a self-directed portion of your plan.

Self-directed portions of your plan are exactly what they sound like – the part of your plan managed by you. When starting with Blooom, you can select how much of your plan Blooom will select investments for, and how much will be done by you (Blooom will still provide recommendations for this part).

If you own company stock, Blooom will sell your allocation up to a point such that you are left with no more than 10% of the total value.

The rationale for this is similar to the reason why Blooom doesn’t like you to have individual stocks – doing so is risky, and Blooom doesn’t believe in trying to time the market. In addition, company stocks increase your risk, since both your salary and investments are tied to a single company.

Simply put, Blooom’s approach is similar to other Robo-advisor in such a way that it creates a portfolio allocation for you, automates the allocation management, and invests the dividends. The only difference is that other Robo-advisors usually do not focus on your employer-sponsored retirement plan, but Blooom does.

If necessary, Blooom rebalances your account every 90 days. This is how the service ensures that your accounts stay within the recommended allocation to achieve your retirement targets.

The services of Blooom come with a straightforward asking price. Regardless of the size of your account, a standard account in Blooom will set you back $120 a year, or $10 per month. Pay for a year upfront and the cost is reduced to $108 a year, or $9 per month.

In case you need a little bit of flexibility in terms of pricing and features, Blooom also offers two other account types: Essential and Unlimited (more on this in a bit). The two accounts are priced at $95 and $250, respectively.

In addition to managing your retirement account, Blooom also eliminates managed account services as well as target-date funds. These changes will help your portfolio become one with low fees and strong performance.

Reducing Fees

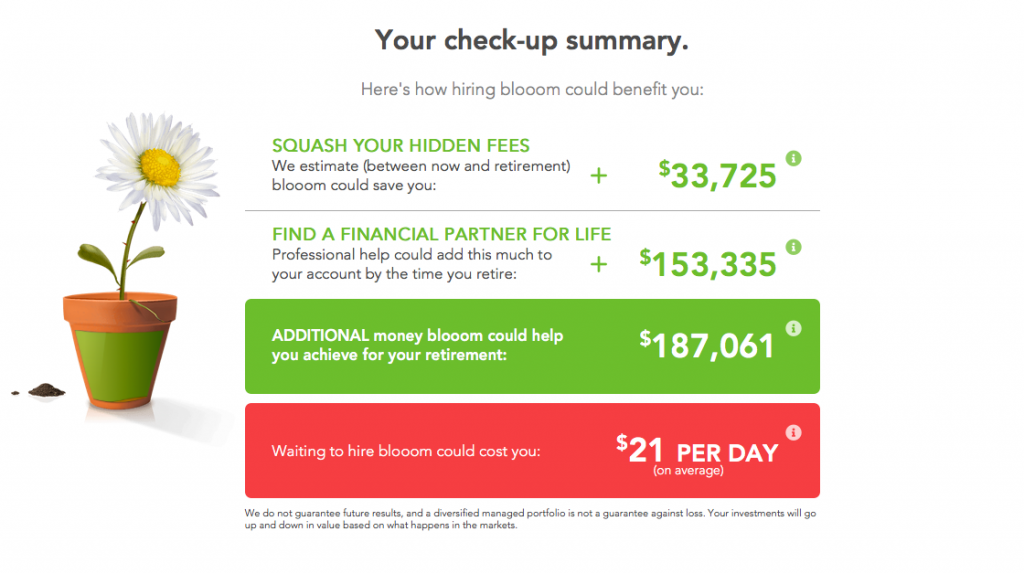

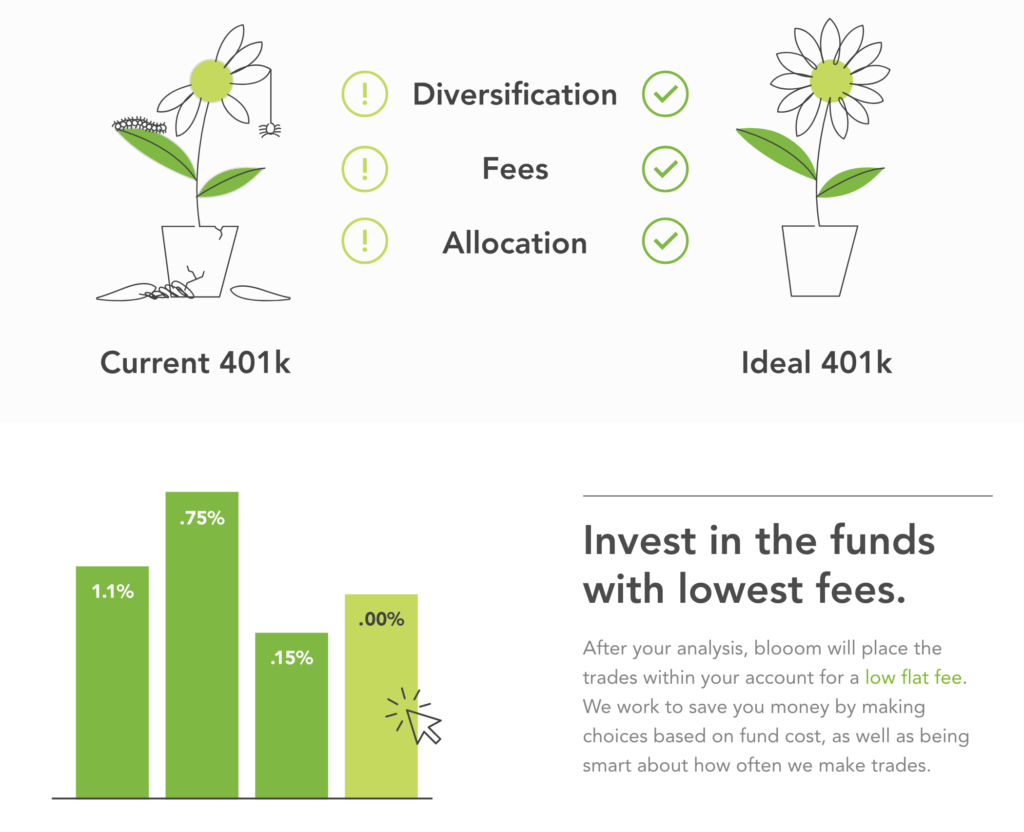

Along with doing all the investing work for you and improving your investment performance, Blooom really shines at being able to reduce the fees you’re paying with your current plan.

Most 401K accounts have a HUGE amount of hidden fees. Many funds you can invest in within the plan have fees ranging from 1-2% of your portfolio amount, which is insane over the long run.

In fact, due to compound interest, paying an extra 1% in fees can reduce your total earnings by up to 30%!

Blooom is excellent at finding opportunities to switch from high fee plans to plans with much more manageable fees. 401(k) plans are notoriously difficult to navigate, so finding which plans have low fees can be difficult. Luckily, Blooom does this for you!

Getting Started with Blooom

Hopping aboard Blooom’s services is easy, free, and completely online. You can head over to Blooom’s website to register an account.

You will be asked to identify yourself by providing basic information such as your name, date of birth, and expected age of retirement. Once you’re done with that, you can link your retirement accounts and immediately get Blooom’s investment recommendations, free of charge.

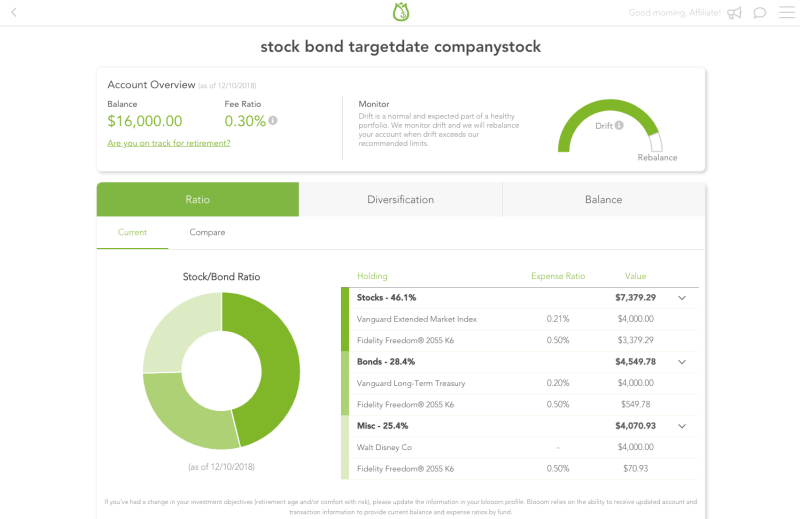

Blooom’s recommendations are comprehensive and easy to digest. Their report shows you, at a glance, how your asset allocation compares to their optimal findings.

By the end of the recommendations, Blooom sums up through a check-up summary their projected savings for your account. You can get valuable insights as to how much you can save, on average, if you start using Blooom’s services.

It is worth noting that your portfolio allocation is based on the information you provided (age, and retirement age) as well as your risk tolerance profile. Adjusting these values is possible later on within your Blooom account settings.

Once your account is active, there is an option to check your progress graphically in the form of a digital flower that fits Blooom’s digital design theme. The flower is supposed to provide a quick overview of your portfolio status based on whether it is currently healthy or withering.

Blooom Review: Pros

Here are some of the notable things Blooom can do for you.

1. Blooom lets anyone use its free analysis service

Again, Blooom is easy to hop on, and it is free to try. In fact, anyone with a 401(k)-retirement plan is eligible for Blooom’s free analysis service.

The process is fairly easy and would only require setting up a Blooom account and linking a retirement plan account. The service will calculate your current fees and expected returns, then show its recommendations on how to improve them.

Blooom offers a free trial period where you can see for yourself exactly what they offer. This is a good way to have a firsthand taste of Blooom, and the best thing about it is that you can do it without registering for a paid account.

2. Blooom will manage any type of retirement plan you have

In terms of compatibility with retirement plans, Blooom is a safe bet. Their services can manage a wide range of IRAs and employer-sponsored retirement plans.

The supported employer-sponsor plans are 401(k), 403(b), 457, 401(a), Thrift Savings Plan (TSP). While the supported IRA accounts are: SIMPLE IRAs, Roth IRAs, Spousal IRAs, Non-deductible IRAs, SEP IRAs, and Traditional IRAs.

3. Blooom has flexible pricing depending on your needs

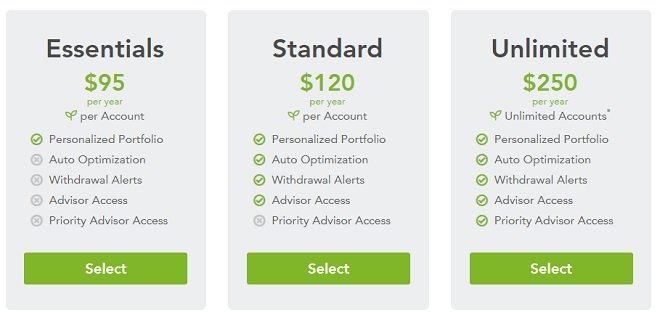

With Blooom, you will not be paying based on percentages. There is a flat amount to pay and there are three types of accounts (and fees) to choose from.

The first option is known as Essentials. This is the most affordable offering from Blooom at $95 per year. With this option, you gain the ability to personalize your retirement plan portfolio.

The second option is known as a Standard account, which costs $120 per year. With the slight increment in price, you get every feature Blooom has to offer other than their priority advisor access.

For most people who are availing of the service for an advisor, withdrawal alerts, and the ability to auto-optimize, a standard Blooom account will suffice. However, this account type does not support multiple 401k accounts.

If you are willing to pay $250 per year for a Blooom service, then the Unlimited option is what you should go for. This option has similar features with the Standard account but with added priority advisor access and support for multiple accounts.

If you cannot decide which plan to get, do not worry. Shortly after creating a Blooom account, you will be entitled to a free plan analysis that should ease you into a decision.

4. Blooom gives you access to financial advisors

If you have an account with Blooom, you receive access to Blooom’s financial advisors. This service is best to utilize for investment-related questions and discussions on your retirement plan.

Advisors will help you with any financial concerns you may have, such as saving for your children’s college fund, refinancing your mortgage, or anything else.

While your investments are run by a combination of humans and computers, Blooom’s financial advisors that provide feedback are actual employees from the company. This specific service does not rely on the use of an automated system in which your concerns are addressed by a computer.

For a price comparison, Blooom’s financial advisor services are included in your annual payment. This is a relatively big savings compared to paying a human advisor, which could cost up to about 1% of your total assets.

5. Blooom is non-intrusive and can work in conjunction with your existing plan

Blooom provides a non-intrusive way of managing your retirement plan. The service works as an account custodian for employer-sponsored retirement plans.

This simply means that you do not need to withdraw your current plan from whichever trustee holds it in order to avail of Blooom’s service. Blooom will make use of whatever investment options are available on your current retirement plan.

However, IRAs can be different – you may need to move it to one of Fidelity, Vanguard, or Charles Schwab. However, since these are 3 of the biggest IRA providers that exist, this shouldn’t be an issue.

Furthermore, since Blooom simply manages your account for you, you would not need to request permission from your employer to use Blooom. The service can be added to any plan entirely from the user’s end.

6. Blooom lets you know which investments have a low expense ratio

A part of Blooom’s job is to evaluate every investment option in your retirement plan. Blooom does this by segmenting the options into categories that they call “buckets.”

Afterward, the fund with the lowest internal expense ratio is chosen by the service. This is how Blooom can grow your funds, by redirecting money previously on fees towards investments.

7. Blooom can guarantee your safety

Safety is always one of the most important things to consider when trying out new platforms, especially those that will manage hard-earned finances. To get it out of the way, yes you are safe with Blooom.

On the technical side of things, Blooom uses 256-bit encryption along with secure servers and a third-party communication verifier. Also, Blooom is a fiduciary, meaning they are ethically and legally bounded to preserve customers’ interests.

To add to that, Blooom does not take full custody of your employer-sponsored retirement plans or IRA. Rather, the funds are held by a custodian that implements financial protection through SIPC.

A nifty little Blooom feature that alerts you regarding suspicious activities also acts as a safety measure. This is an underappreciated feature that will come in quite handy at times of fraudulent attacks.

8. Blooom makes it easy for you to cancel your account

In Blooom, there are literally no strings attached. If you choose to terminate your subscription, you can do so very easily.

Canceling your account will leave you with two viable options. The first one is to continue your subscription until it expires, and you can do this by simply turning off the auto-renewal feature in the settings.

The other option makes you eligible for a prorated refund. The refund you will be receiving will be based on the time you have left on your paid subscription.

Before being able to complete the cancellation, Blooom presents you with the eligible refund amount. This is a nifty option to have since it ensures that none of your money goes to waste.

Blooom Review: Cons

Despite its promising features, Blooom has a few caveats as well. The cons listed below are worth noting, especially when deciding whether Blooom is applicable to your needs or not.

1. Blooom cannot offer you face-to-face customer service

Having no physical offices works as an advantage for many online-only companies in terms of reducing the friction of getting more users on board. However, this is a double-edged sword.

To some people, face-to-face consultation with a customer service representative is unmatched. This is where an online-only company falls short.

Blooom, being one of those online-only companies provides their customer service through platforms such as email and live chat. Currently, there are no direct phone calls available.

Emails and live chats are entertained during weekdays from 10:00 a.m. to 6:00 p.m. (Eastern time) only. This limited service might be an issue for some people who prefer a more flexible schedule.

Also, live chats are only available to users who have Unlimited Plan accounts. Those who are paying less are stuck with emails for customer service.

2. Blooom’s IRA support is currently limited

If you are taking a look at Blooom because you want professional assistants to manage your IRA for you, take note that the available custodians are currently limited.

As of writing, the supported custodians for IRA plans are Charles Schwab, Fidelity, and Vanguard. You would need to have your IRA plans transferred to one of these custodians in order to use Blooom’s services.

In case you are willing to transfer your IRA plans to one of these supported custodians, it is also worth noting that these supported custodians are the three largest retirement trustees. In other words, other than the hassle of transferring accounts there is very little compromise in doing so.

3. Blooom might be a bad investment for small accounts

A smaller account makes the asking price for Blooom’s service extremely huge in terms of percentage. For example, if you have $4000 in your account balance, a yearly subscription to a standard Blooom account amounts to roughly 3%. Even for an essentials account, the management fee will be equivalent to 2.38%.

However, the bigger your account, the better Blooom is in terms of fee percentage. For example, if your account totals $100,000, you will be paying around .1% in fees, which is lower than almost every other option. As your account grows, the fee percentage decreases even further.

4. Blooom does not support family accounts

Since Blooom’s mechanics work based on individual user data (age, age of retirement), they do not have support for family accounts at the moment. Blooom recommends each family member set up individual accounts in order to use their service.

Blooom Review: Bottom Line

The question of whether you should use Blooom or not is dependent on your situation and the trade-offs you are willing to make. To make it easier for you to come up with a decision, here is what you should take away from this Blooom review.

If you are one of the people who lack the time or expertise to manage their retirement plans, and you are willing to spend money for professional assistance, then the answer for you is an easy yes. Hop on Blooom right away!

Similarly, if you are trying to find professional management for an employer-sponsored plan, you do not have much choice. Blooom is one of the only platforms that support (and specializes in) these kinds of plans, in addition to IRA support.

However, if you are looking to manage your IRA plan which is currently not on one of the supported custodians, and you’re not willing to make a switch, then Blooom probably won’t work out for you.

Also, if your account balance is relatively small it might not be a worthy choice to venture on Blooom. If this is the case, your effective percentage turns out to be very high.

As a rule of thumb, Blooom’s fees will be above average if your account balance is under $20,000, and below-average if your account balance is above $20,000.

So, for smaller accounts, only use Blooom if you have a strong need for their features, or think they can save you a lot of money on fund fees/make you a lot more money based on performance.

For bigger accounts, in addition to getting access to all their unique retirement features, you’ll also be saving money simply by having Blooom manage your money instead of a different service.

So, what are you waiting for? Try out Blooom today!

Recommended Reading

Acorns Vs Betterment: Robo Advisor Face-off

Ever wondered which Robo Advisor is the best fit for you? Here we compare Acorns Vs Betterment and try to decide which is the better option.

Webull Vs Robinhood: Choose an Online Brokerage

Ever wondered which Online Brokerage is the best fit for you? Here we compare Webull Vs Robinhood and determine which is the better option.

Webull Review: Choose This Online Brokerage?

Looking for a new, awesome brokerage to use for trading stocks? Check out this Webull Review and see all the amazing features they have to offer!

Wealthfront vs Betterment: Which Robo-Advisor is Best?

Deciding between Wealthfront vs Betterment? This review will help you decide which Robo-Advisor is the right choice for you!

Betterment Review 2022: The Best Robo-Advisor?

In this Betterment review, you'll see everything Betterment can do for you. Hop on board the Betterment Robo-advisor train now!

Vanguard vs Robinhood 2022: Best Online Brokerage?

Want to start investing, but not sure which service to use? Check out this guide comparing Vanguard vs Robinhood and decide now!