Before discussing Wealthfront vs Betterment, let’s discuss Robo-advisors in general.

Robo-advisors are mainstream tools in the finance world – they serve as a quick and reliable source of financial advice for everyone. Robo-advisors also automate the management of investments by using computer algorithms.

With a growing number of available Robo-advisors, consumers are constantly bombarded with a ton of choices. To narrow it down, this article will be focused on two of the top choices: Wealthfront and Betterment.

This review puts the two platforms on a side by side comparison in order to help you determine which will best fit your financial needs. Everything from subscription fees and account types to goal setting and access to human advisors will be tackled in this review. Read on!

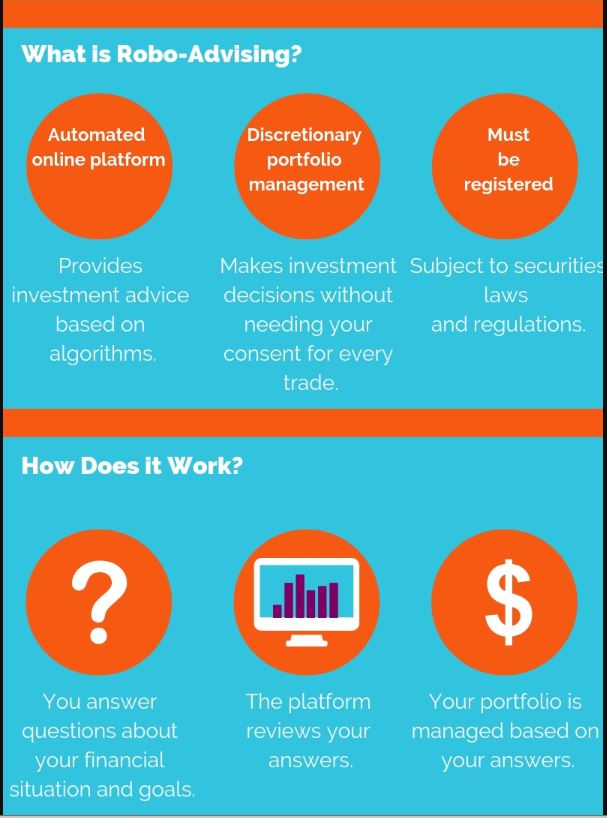

What is a Robo-advisor?

A Robo-advisor is an online financial service that focuses on automating investment management through computer algorithms. The job of a Robo-advisor is to build a portfolio for you and to manage your assets based on your set goals and risk tolerance.

The advancement of technology brought to rise the era of Robo-advisors. Back in the day, only human advisors could perform investment management, as computer programs were not yet advanced enough.

However, over the years, concepts in finance have been translated to algorithms that are efficiently utilized by computers in a faster and more convenient manner.

This led to the rise of Robo-advisors. The popularity of Robo-advisors is easy to understand- after all, they’re easy to use and usually have a lower price than a human advisor.

In comparison to a human advisor, Robo-advisors obey strict rules and have much fewer overhead costs. This allows you to invest with them at a much lower rate than if you were paying humans to invest your money for you.

The range of assistance a Robo-advisor offers extends from automatic rebalancing to tax optimization. These services require very little human intervention and therefore constitute a more seamless user experience.

In the simplest of terms, Robo-advisors can be thought of as a personal virtual finance assistant. They are a viable substitute to a human advisor or online brokerage, and they offer automation and flexibility for an incredibly low price.

If you’re interested in using a Robo-advisor, read on. If you’d rather actively trade stocks, check out this Webull vs Robinhood comparison and pick a zero-fee online brokerage to use.

Wealthfront vs Betterment: A Brief Background

0.25% Starting Annual Fee | 0.25% Fixed Annual Fee |

Support for Taxable Accounts, IRAs, and 401(k) | Support for Taxable Accounts, IRAs, 401(k), and 529 College Fund |

No Minimum Initial Deposit | $500 Minimum Initial Deposit |

Tax Loss Harvesting Available | Stock Level Tax Loss Harvesting Available |

Free Access to Human Advisors (Premium Plan) | No Access to Human Advisors (Except Technical Support) |

To level the playing field before a head to head comparison, it would be helpful to examine a brief background of both services being compared – Wealthfront and Betterment.

Wealthfront

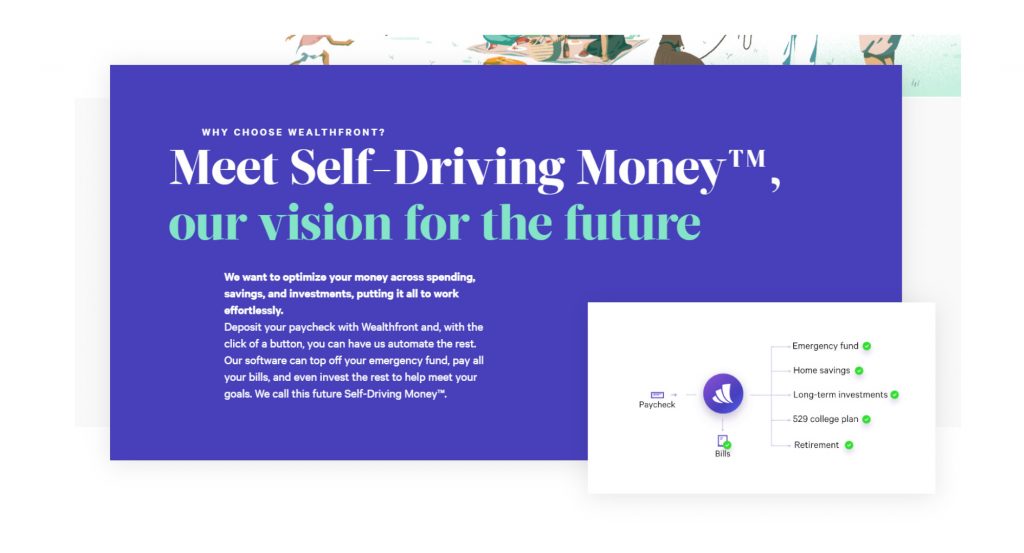

In 2008, Andy Rachleff and Dan Caroll founded KaChing!, a service intended to copy portfolios of stock professionals. KaChing! was rebranded to Wealthfront later in 2011, when the company took significant steps in realigning its mission.

Wealthfront went from being a streamlined service to an all-in-one financial solution. To this day, Wealthfront’s philosophy is to focus on three main pillars: free financial planning, lending, and investment management.

Wealthfront has been one of the industry’s leading Robo-advisors for a long time. The firm has a good track record and has pioneered many standard Robo-advisor features.

Betterment

Betterment was founded in 2008 by Jon Stein and Eli Broverman. As one of the first true Robo-advisors, the firm is known as the pioneer in the Robo-advisor industry.

Based on years of experience, Betterment edges out Wealthfront by at least three years. This is because Betterment has been a dedicated Robo-advisor since day one while Wealthfront didn’t become one until 2011 when they rebranded from KaChing!.

The basic idea behind Betterment’s business model is the creation of users’ portfolios based on their risk tolerance. The service uses this risk tolerance information for the asset allocation of exchange-traded funds (EFTs).

Currently, Betterment trails behind Wealthfront with just over $3 billion in assets under management. Nevertheless, Betterment has strong marks for its reputation and service. Both companies, Wealthfront and Betterment, are still on par in terms of functionality and pricing and are 2 of the best Robo-advisors available.

If a Robo-advisor sounds like something you will use, the next question is how you choose the one that will best suit your needs. If you’d like to go with a more hands-on approach, check out this article breaking down some of the top online brokerages available.

This head-to-head review will elaborate on the strengths and weaknesses of both Robo-advisor services based on several factors. In each of the following factors, the pros and cons of both Wealthfront and Betterment will be weighed and a recommendation will be made.

Interested? Check out this full, in-depth review of Betterment, or check out how Betterment compares to Acorns, another Robo-advisor. Or, read on and compare Betterment vs Wealthfront!

Wealthfront vs Betterment: Fees

As stated above, robo-advisors tend to have lower fees than human investors.

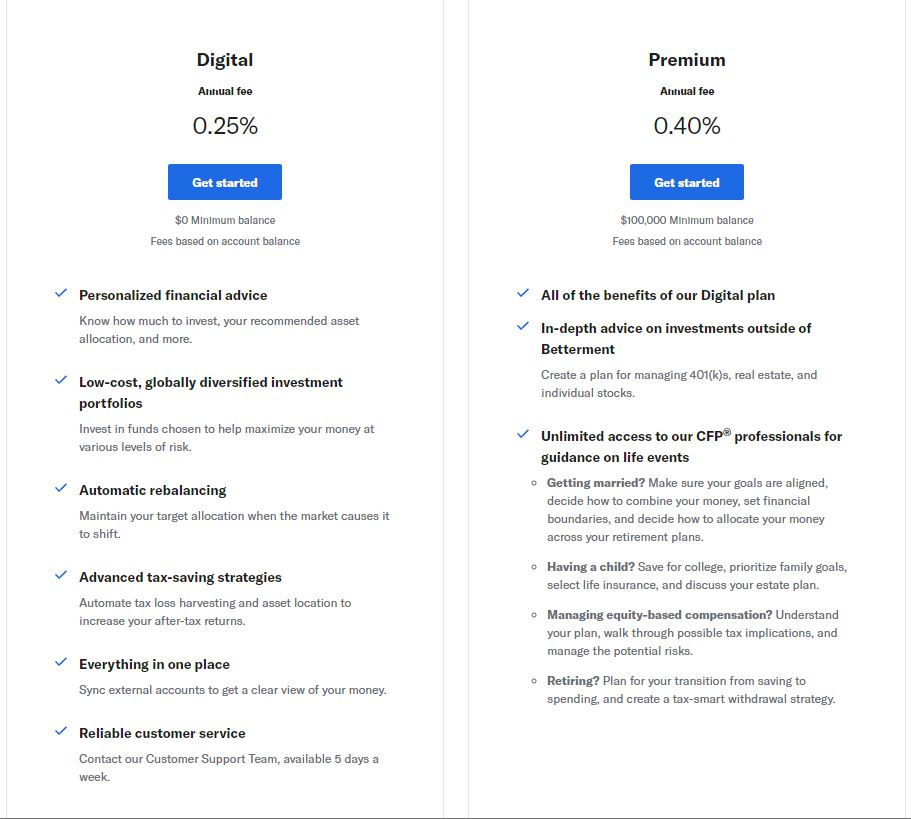

Both Betterment and Wealthfront start at a 0.25% annual fee. While Wealthfront only offers a single plan for their users, Betterment has a more flexible two-type plan.

Wealthfront

Wealthfront’s plan has a minimum deposit of $500. The larger your account is, the more of Wealthfront’s services become available to you.

For accounts over $100,000, eligibility for a stock-level tax-loss harvesting service is offered. Meanwhile, those having a balance of over $500,000 have the choice to sign up for the firm’s Smart Beta program.

Betterment

Betterment’s two plan options—Digital Plan and Premium Plan—offers more flexibility for the users, and access to real, human professionals. The Digital plan costs an annual fee of 0.25% and has a $0 minimum balance, while the Premium plan charges 0.40% annual fee and has a minimum balance of $100,000. Below is a screenshot from Betterment’s website showing exactly what each account offers.

These fees will be slowly taken out over time, instead of being paid all at once in a lump sum.

If you are planning to start an account without any minimum balance or you simply want a little bit of flexibility in terms of features and cost, then, right off the bat, you should be eyeing Betterment. Otherwise, both are very valid choices.

Wealthfront vs Betterment: Account Types

There are many different types of accounts you can invest in. Since everyone has different goals and priorities, providing access to as many accounts as possible is important.

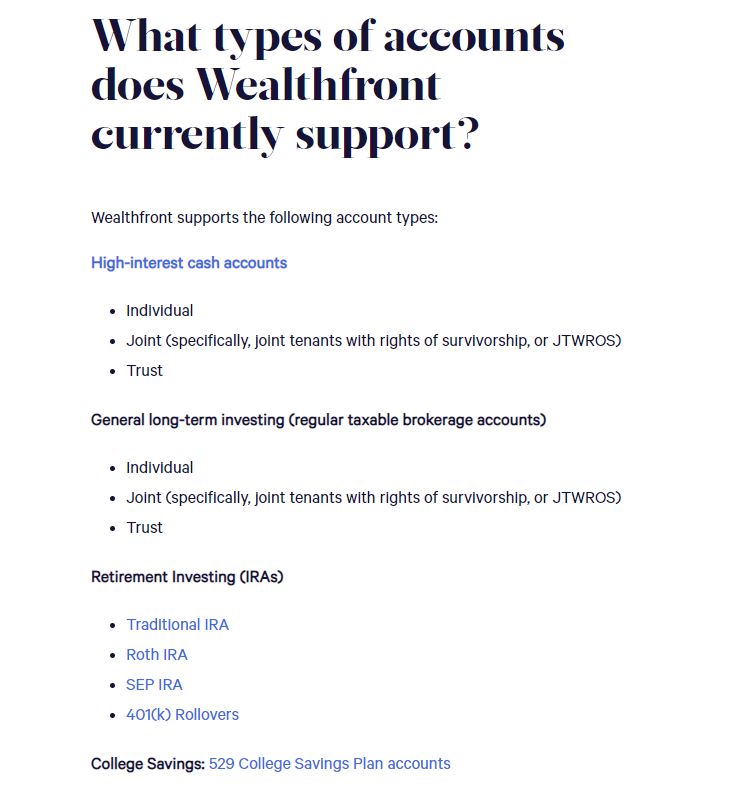

Wealthfront

The below screenshot comes straight from Wealthfront’s website, and lists all the different account types Wealthfront supports.

In terms of compatible accounts, Wealthfront has quite a long list. It supports taxable accounts (individual, joint, and trust) and non-taxable accounts (Traditional IRA, Roth IRA, SEP IRA, 401(k) and IRA rollovers, and 529 college savings plan).

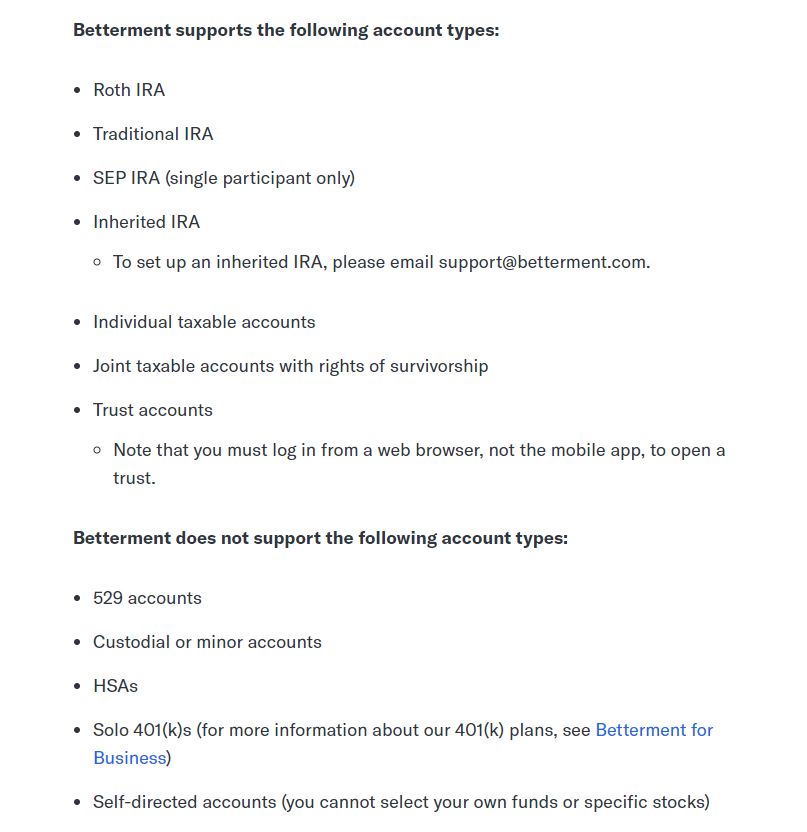

Betterment

As can be seen below, Betterment offers all these accounts as well, with 529 college savings plans being a notable exception. So, if you specifically want to use these accounts, you should go with Wealthfront.

Wealthfront vs Betterment: Goal Setting

Your financial goals are dynamic – they change from time to time. You may be trying to save up to buy real estate or a brand-new car at the moment, but in a year you might be preparing a college fund for your child. Regardless, you will need to be able to orient your Robo-advisor with your goals.

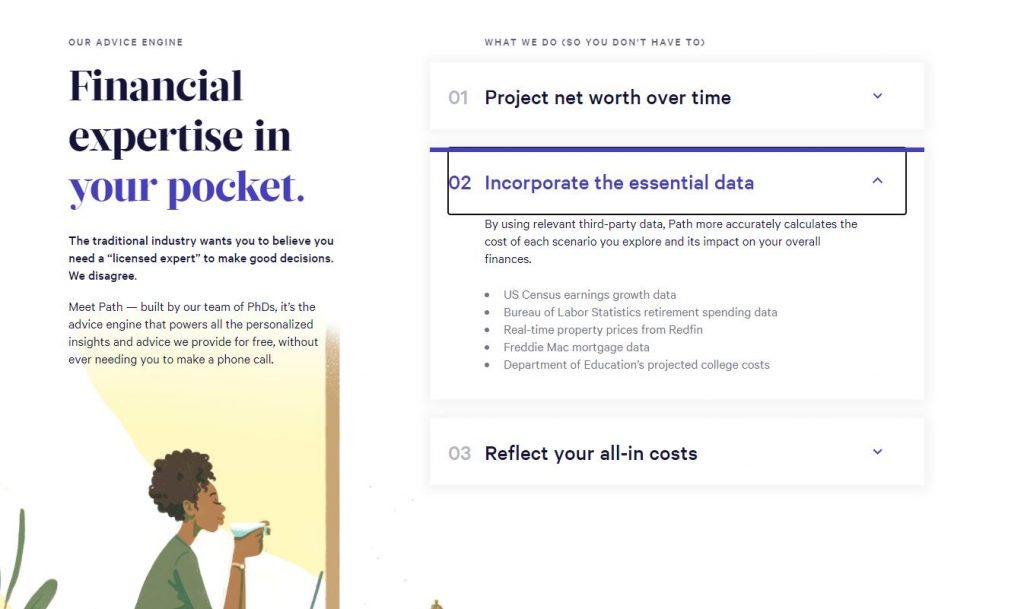

Wealthfront

Wealthfront has specific strategies for different set goals. Their service utilizes third-party resources such as Zillow and Redfin to forecast the appropriate cost of your set target.

If you are saving up for a college plan, for example, Wealthfront can dive into the details and project the cost of fees for thousands of universities. The service does this based on the data from the Department of Education.

Wealthfront then ties this information with your current assets and liabilities. The service then shows you, using their platform’s dashboard, your projected chances of reaching your set goals.

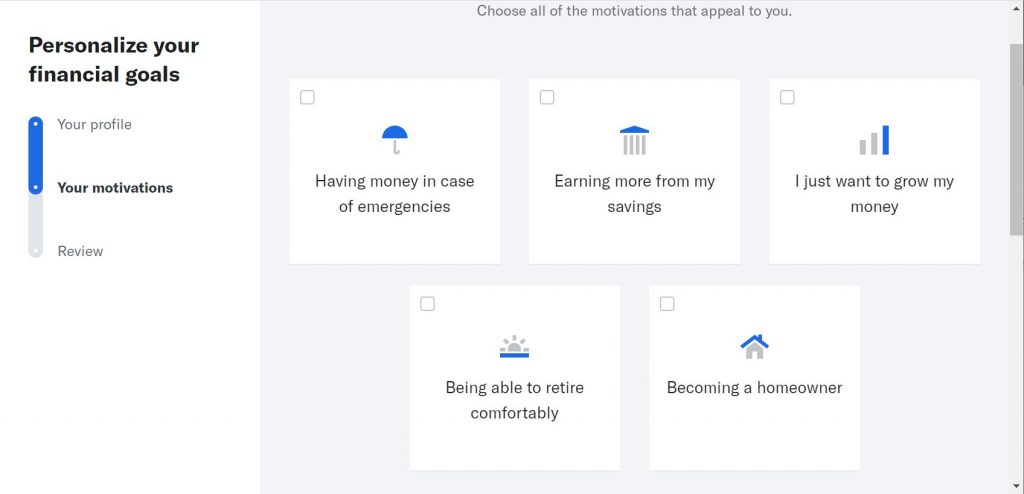

Betterment

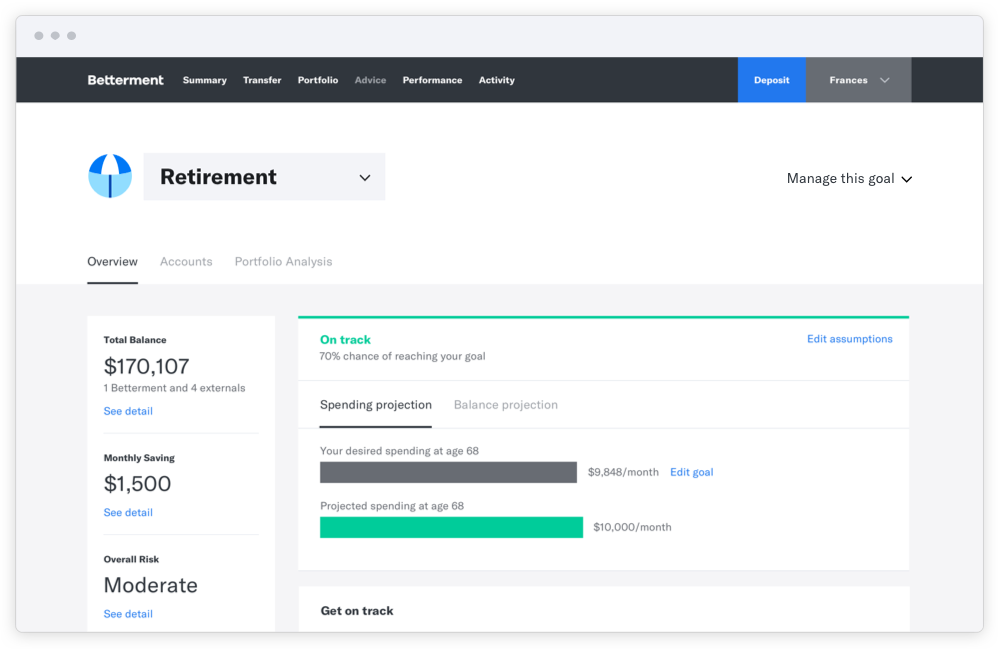

Betterment’s approach is less complex but effective as well. First, Betterment starts off by asking you some questions and letting you choose what goals you’re currently working towards. Then, they’ll offer personalized advice on what account types you should be using, as well as help you track your progress towards these goals.

The service displays your current assets and liabilities in a ring interface. Fixed income is shaded blue and equities are shaded green.

If the service’s assessment deems that you are lagging behind your goal, you will be advised to save more. This feature serves as a little nudge that prevents users from getting sidetracked.

Overall, both services provide ample goal-setting capabilities for their clients. Unless your goals involve college plans or IRA transfers you are good to go with either platform. Otherwise, take the Wealthfront route.

Wealthfront vs Betterment: Portfolios and Rebalancing

Portfolios are groups of financial assets. These include stocks, bonds, currencies, commodities, cash equivalent, and fund counterparts. Portfolios are managed by financial managers or Robo-advisors.

Portfolio rebalancing, on the other hand, is the process of acquiring or selling portions to revert the weight of each asset back to a pre-set normalcy. It is done in response to the changes in the market value of each security within your portfolio.

For example, let’s say you want to have 50% of your money in stocks and 50% in bonds. If the stocks grow faster than the bonds, eventually your portfolio will be mostly stocks. Rebalancing fixes that by periodically selling some stocks to buy bonds, and keeping you at the 50-50 ratio.

In short, portfolio rebalancing keeps risk levels in check. Its goal is to safeguard investors from unwanted risks. Rebalancing once a year is acceptable; however, a more frequent rebalancing is generally better.

Both Wealthfront and Betterment conform to a principle known as Modern Portfolio Theory (MPT). MPT serves as their guide in populating a diversified portfolio of ETFs from different classes.

When registering for either of the services, you will be asked to provide personal information regarding your attitude on managing risk and the chances of you pulling out money. Afterward, a portfolio is made for you prior to funding your account.

Wealthfront has a total of 11 asset classes that it uses in constructing your portfolio:

- U.S stocks

- Foreign Stocks

- Emerging Market Stocks

- Dividend Stocks

- Real Estate

- Treasury Inflation-Protected Securities

- Municipal Bonds

- Corporate Bonds

- U.S Government Bonds

- Emerging Market Bonds

- Natural Resources

Moreover, Wealthfront has a slight edge in terms of complete diversification, it offers two asset classes that Betterment does not—real estate and natural resources.

Each asset class Wealthfront offers has different levels of average performance and volatility. By combining these asset classes based on your goals and risk preferences, a portfolio can be created that both minimizes risk and maximizes performance for your specific situation.

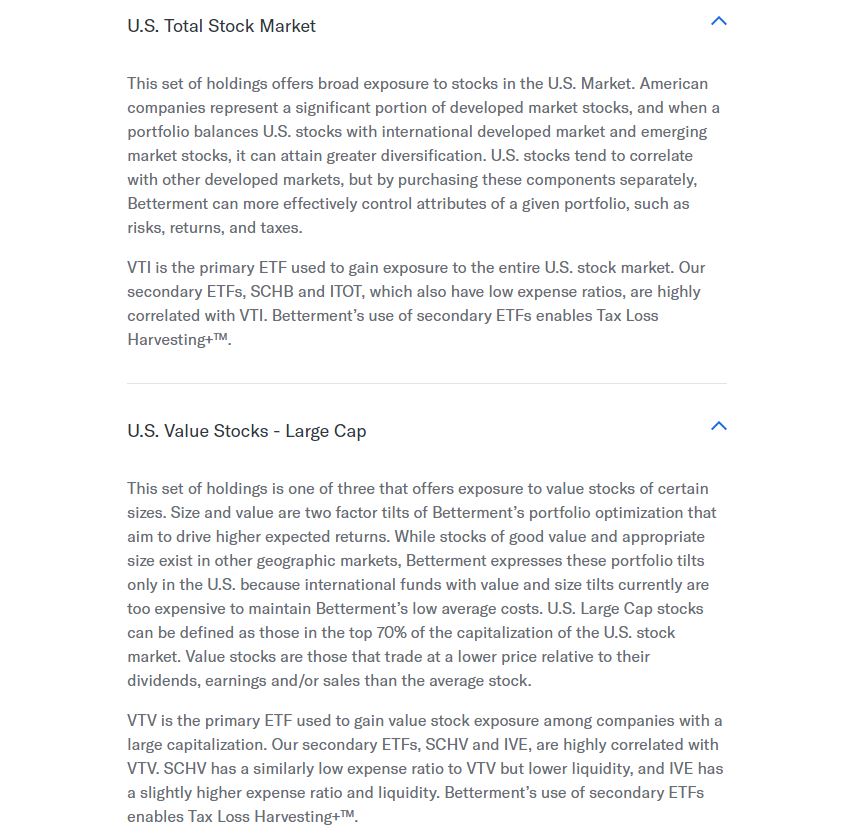

For Betterment, there is a total of 13 core, recommended ETFs – seven bond funds and six stock funds – where your money can be invested.

They also offer “secondary” ETFs that are similar to the core 13. These won’t be included in your portfolio initially, but if an opportunity for Tax-Loss Harvesting comes up, they may be swapped in.

The below screenshot shows an example – while VTI is the primary ETF for the U.S stocks asset class, Betterment may sell your VTI shares in order to buy SCHB or ITOT if there is an opportunity for Tax-Loss Harvesting (more on this in a bit). The 3 of these funds are extremely similar, and shouldn’t have much difference in performance or fees.

As stated before, while Betterment offers all the stock and bond-related asset classes that Wealthfront does, it does not currently offer Real Estate and Natural Resources, so the total diversification will be slightly lower than Wealthfront.

Betterment boasts that their portfolio recommendations are based on Nobel Prize-winning research. The service is committed to providing evidence-backed recommendations that will ultimately add value to its clients’ investments.

Both services have automatic rebalancing, and there is nothing an average investor should worry about in terms of portfolio management. As a recommendation, if you are looking to have more freedom in choosing a portfolio type, Betterment is the way to go.

However, Wealthfront is the more robust option in terms of diversification. This is based on Wealthfront’s natural resource and real estate availability.

Wealthfront vs Betterment: Tax-Loss Harvesting

Tax efficiency is a big factor to consider when choosing a Robo-advisor. Essentially, a tax-efficient Robo-advisor will increase your after-tax returns. However, be reminded that this only applies to taxable accounts and not IRAs.

Both Wealthfront and Betterment use a so-called Tax-Loss harvesting method. The way it works is as follows: if one of the ETFs in your portfolio loses value, the Robo-advisor will sell that ETF and use the money to buy a different, similar ETF.

Taxes are due when an ETF is sold. So, since you sold the first ETF at a loss, you will be eligible for a tax credit.

Assuming you’re depositing consistently every month or so, there will almost certainly be opportunities for Tax-Loss Harvesting due to how the market fluctuates. So, by letting your Robo-advisor lock in the losses as they happen, you’ll be able to save money on your taxes each year.

Wealthfront has a full whitepaper accessible to their clients or anyone who is trying to examine their methodology. The whitepaper is a comprehensive showcase of how their service deals with taxable events, and it contains over 15 sections that talk about allocating assets, expected returns, and more.

For clients who have at least $100,000 in their taxable account, they are eligible for Wealthfront’s PassivePlus feature which includes Stock Level Tax-Loss Harvesting (more on this in a bit). Wealthfront also has an annual report which summarizes its year-long tax-loss harvesting.

Betterment, on the other hand, takes a more basic approach. The service has a dedicated crash course on their tax-loss harvesting methodology which dates back to 2014; however, it is not as detailed as that of Wealthfront’s whitepaper.

Moreover, Betterment has a Tax-coordinated Portfolio service. The goal of this portfolio service is to allocate your investments in favor of increasing tax efficiency for both taxable accounts and tax-deferred accounts (whichever may apply to you).

By coordinating your accounts in such a way, Betterment can put the more volatile assets in your taxable account, which will lead to more opportunities for Tax-Loss Harvesting.

Both Robo-advisors perform tax-loss harvesting daily rather than just at the end of the year.

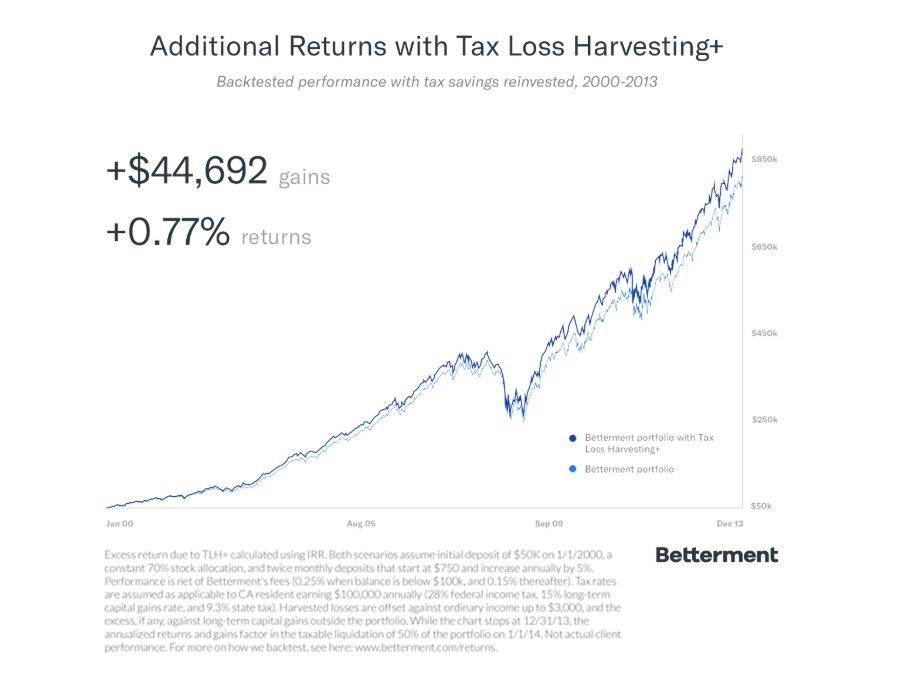

Even better, Betterment performed an analysis of how much Tax-Loss Harvesting can save the average user. The results? An increase of .77% in returns per year.

While this may not sound like much, remember that the average stock market gain per year is 7-8%, so Tax-Loss Harvesting increased yearly returns by about 10%. These extra returns are reinvested and compounded, so by the time you retire, you’ll have earned significantly more than you would have without tax optimization.

What is Stock Level Tax-Loss Harvesting?

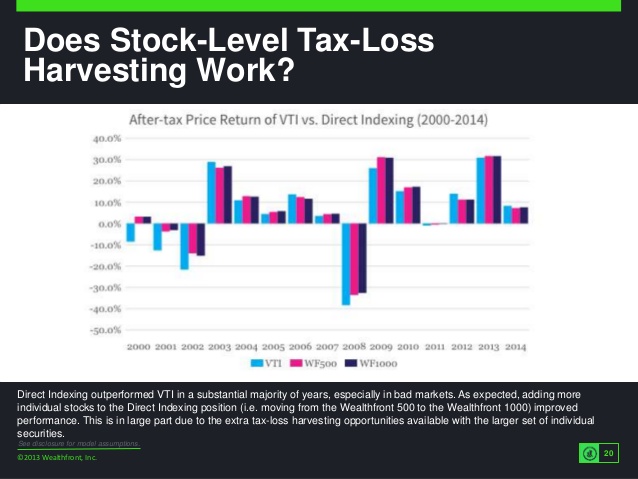

Stock level Tax-Loss harvesting is a feature unique to Wealthfront and deserves its own quick explanation.

As stated above, normal Tax-Loss Harvesting is done on the ETF level – when one of the ETFs in your portfolio loses value, that ETF will be sold and a similar ETF will be bought.

Wealthfront takes this one step further for clients who are eligible for stock level Tax-Loss harvesting. Instead of buying index funds, Wealthfront will buy hundreds of individual, diversified stocks. These stocks will approximate an ETF, which in turn approximates the market – so in general, stock performance will be the same.

However, because you now own hundreds of stocks instead of only a few ETFs, there will be many more opportunities for Tax-Loss Harvesting. ETFs only decrease in value when the entire market struggles, which means you’ll have a limited amount of days where you’ll see a big drop in value.

Almost every day there are individual stocks that see their price fluctuate. So, even on days when the market as a whole is strong, and your portfolio gains value, you are bound to have SOME stocks that lost value. These stocks can be sold and traded in for similar stocks, allowing for many more Tax-Loss opportunities.

Unfortunately, Wealthfront only offers this feature to accounts that have over $500k invested, so smaller accounts will have to stick with normal Tax-Loss Harvesting.

Access to Human Advisors

Access to human advisors is where Betterment edges Wealthfront by a huge margin. On Wealthfront’s official help center, they have stated that their services are exclusively delivered through software only.

Wealthfront employs experts in the field but they do not offer their clients access to human advisors. The only time you will be talking to an actual human employee on Wealthfront is when you are seeking technical support.

On the other hand, Betterment DOES offers access to human advisors. If you are on the less expensive Digital plan, you can pay a one-time fee to get access to a financial advisor.

This service is priced at $200-$300 per consultation. However, if you are on Betterment’s Premium plan, access to human advisors are at your fingertips at any time for no extra fees.

The choice here is obvious: if you would like to have access to a financial advisor, Betterment is the only way to go. However, if it does not matter as much to you then you can get away with Wealthfront as your Robo-advisor.

Wealthfront vs Betterment: Retirement Planning

In terms of retirement planning, both services offer similar capabilities. Both choices integrate your external accounts, and both can give advice to any of your retirement accounts.

For Wealthfront, social security projections are taken into account and the service shows you an overview of your current retirement plan status. As seen above, Wealthfront does this by comparing your recent spending habits with your savings in order to protect your retirement income in the future.

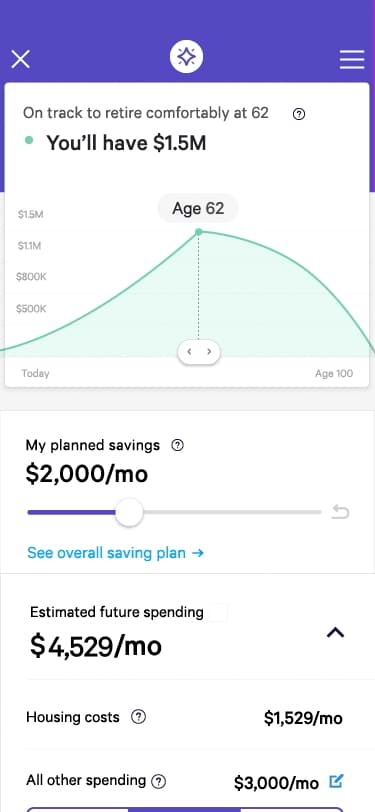

For Betterment, the same strategies apply, your connected accounts are also tallied to show you your projected retirement income. Betterment then looks at how much you’re investing per month, your current asset allocation, and current balance, and shows how much you’ll be able to spend at retirement age relative to your goal.

However, while Wealthfront does everything without human intervention on their end, Betterment’s clients have the option of consulting a financial advisor.

In fact, this is the only factor that differentiates the two platforms in terms of managing retirement accounts. As a recommendation, if you prefer consulting with a human advisor from time to time, Betterment suits you better.

However, if you are comfortable with a robo-advisor running fully computerized, then your retirement planning won’t have any issues with Wealthfront.

Wealthfront vs Betterment: Cash Accounts

Both services offer a cash account for their clients. A cash account is basically a savings account where your money can grow by a certain percentage known as an Annual Percentage Yield (APY). Generally, a higher APY is better.

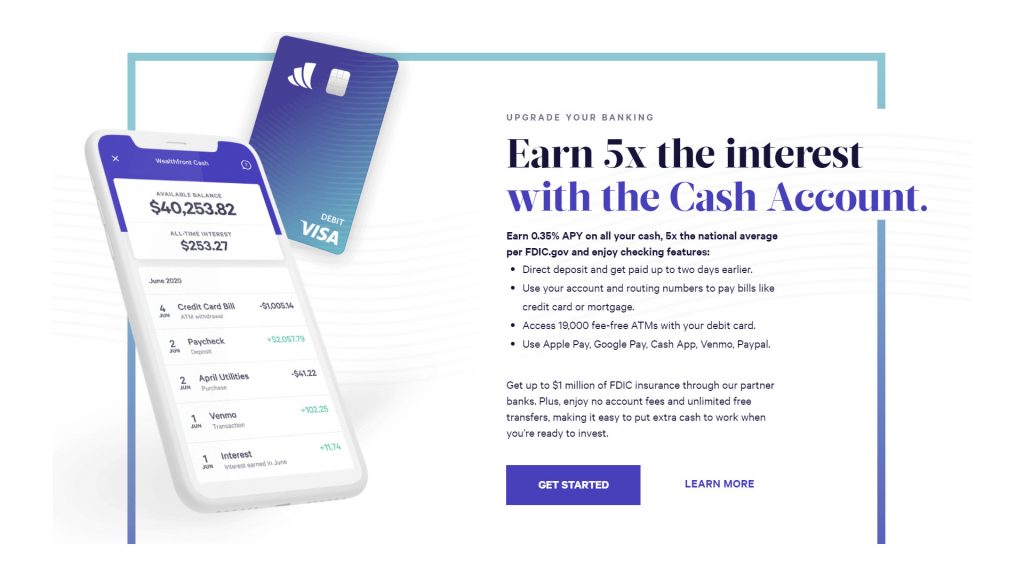

Wealthfront: Wealthfront’s cash account currently pays 0.35% interest. It is worth noting that all your money in your Wealthfront cash account will not be subjected to a management fee.

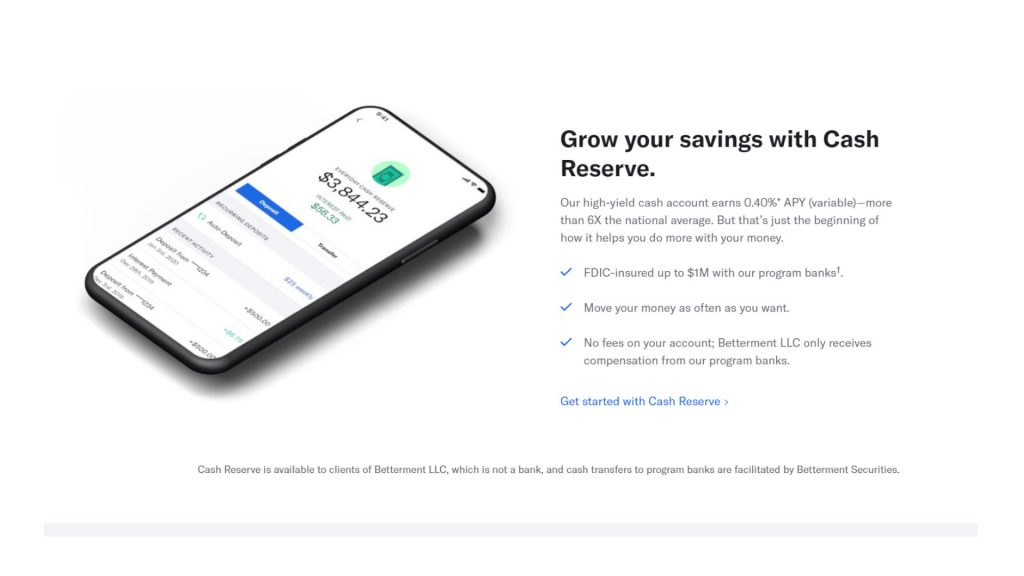

Betterment’s Cash account is known as “Cash Reserve” Currently, the company offers a higher APY than Wealthfront, as they offer a 0.40% APY with no minimum balance.

As a rule of thumb, if you are looking to utilize the savings account offered by your Robo-advisor, all other things considered, go with the one offering a higher APY.

Wealthfront vs Betterment: Customer Service

Both Wealthfront and Betterment are on par in terms of customer service. There is currently no option for online chat support or a face-to-face appointment. The only customer service option is through a phone line.

Wealthfront: Customer service is available on weekdays from 8 a.m. to 5 p.m. There is also a chance to get your quick queries answered by tweeting to their official Twitter handle which is @wealthfront.

Betterment: Betterment offers its customer service similarly, through a phone line. It is available on weekdays from 9 a.m. to 6 p.m.

If you are on Betterment’s premium plan, you have access to their human advisors any time, but if you are on the digital plan, it will set you back around $200-$300 for a single consultation.

If you are concerned with technical assistance alone, Wealthfront and Betterment are on fairly level grounds. However, you might want to lean on Betterment if you seek additional assistance which may require human intervention.

Wealthfront vs Betterment: Security

Wealthfront and Betterment have both stood the test of time in terms of service reliability. It is safe to say that both Robo-advisors are secure.

Wealthfront and Betterment are both part of the Securities Investor Protection Corporation (SIPC) which insures clients up to a maximum of $500,000. Each trade Wealthfront makes are cleared by RBC Correspondent, a company that serves as a wealth management checker specializing in comprehensive clearing, custody, and execution services.

In addition, Betterment‘s trades are also cleared through a third-party wealth management company—Apex Clearing Corporation. This provides an extra level of protection

Both Wealthfront and Betterment implement two-factor authentication for web logins and biometric logins in their mobile application. Each transaction that involves sensitive information is also guaranteed encrypted.

Moreover, Wealthfront and Betterment operate under a federal fiduciary standard. This means the company is legally bounded to pursue their clients’ best interest, this includes positive trades on their accounts as well as clients’ security.

Wealthfront vs Betterment: Overview

Wealthfront and Betterment are, more or less, on par with each other. For the average investor, either option is a good option.

In terms of Fees, both start out at the same price point. While Wealthfront will remain at .25%, Betterment customers can opt into a premium plan which will increase their fees to .4%.

For Account Types, Wealthfront supports a wider range of accounts, with 529 Savings Plans notably being absent from Betterment.

Goal Setting services are similar on both platforms, with Wealthfront offering the ability to pull third party data for more robust calculations.

In terms of Portfolios and Rebalancing, Wealthfront offers 2 asset classes that Betterment does not: Real Estate and Natural Resources. However, Betterment offers more ETF choices in the asset classes they DO have. Both use Modern Portfolio Theory to create their portfolios.

Regarding Tax Efficiency, both offer access to advanced Tax-Loss Harvesting. If you have over $500k in Wealthfront, they also offer stock level Tax-Loss harvesting, which can increase harvesting opportunities.

Retirement Planning and Cash Accounts with both services are very similar. Retirement Planning comes down to preference, while Betterment’s Cash Account is slightly superior due to offering a higher APY (.4% vs .35%).

Customer Service on both platforms is limited to phone lines. For Platform Availability and Features, both Wealthfront and Betterment are accessible on the web or through mobile applications. However, in addition to regular customer service, Betterment also offers consultations with real financial experts (though these have an additional fee).

Both firms have top-notch Security. They have military-grade encryption and operate under a fiduciary standard which makes them legally obligated to pursue their clients’ best interests.

Wealthfront vs Betterment: The Verdict

Wealthfront and Betterment are both top contenders in the Robo-advisor realm. Unless you are looking for something specific in a Robo-advisor, you should get away with either option seamlessly. However, there are a few key differences that make choosing which suits you better a bit easier.

Moneywise, if you are a new investor, go with Betterment. You will get access to a higher APY in the Cash Account, no minimum balance, and access to human advisors. Plus, the User Interface is simpler and easier to use.

But if you have more experience, and are ready to start with a higher balance, it may be wiser to start your investment with Wealthfront and take advantage of their advanced features. Just keep in mind that you are stuck with no access to financial advisors.

Recommended Reading

Acorns Vs Betterment: Robo Advisor Face-off

Ever wondered which Robo Advisor is the best fit for you? Here we compare Acorns Vs Betterment and try to decide which is the better option.

Webull Vs Robinhood: Choose an Online Brokerage

Ever wondered which Online Brokerage is the best fit for you? Here we compare Webull Vs Robinhood and determine which is the better option.

Webull Review: Choose This Online Brokerage?

Looking for a new, awesome brokerage to use for trading stocks? Check out this Webull Review and see all the amazing features they have to offer!

Blooom review 2022: Optimize for Retirement

Need help managhing your 401K or other retirement account? Check out this Blooom review and see how much money and time you can save!

Betterment Review 2022: The Best Robo-Advisor?

In this Betterment review, you'll see everything Betterment can do for you. Hop on board the Betterment Robo-advisor train now!

Vanguard vs Robinhood 2022: Best Online Brokerage?

Want to start investing, but not sure which service to use? Check out this guide comparing Vanguard vs Robinhood and decide now!