Comparing Vanguard vs Robinhood is difficult since the two popular online brokerages are similar in many ways. However, there ARE some notable differences. If you are contemplating which of these two services is best for you, then this guide is for you!

Here, we will put Vanguard vs Robinhood in a head-to-head comparison to see which one is the perfect fit for your needs. Before diving in, however, let’s first have a quick look at why an online brokerage is worth considering.

There are basically two ways to invest money in the stock market. The first one is by investing in index funds that rely on the returns of the overall stock market. This is typically done with the help of Robo Advisors.

This method is advisable for newbies because it is safe, automated, and less stressful. If you think that this way of investing is something you would prefer, have a look at this article instead: Wealthfront vs. Betterment

The second way to invest in the stock market is by picking and buying individual stocks that you think will outgrow the overall stock market. This is basically what an online brokerage is for.

This method of investment is advisable for experienced investors. If you enjoy day trading, or you are interested in the nitty-gritty of the stock market, then stick around because this guide is for you!

Vanguard vs Robinhood: A Quick Comparison

To simplify the comparison between Vanguard and Robinhood, this guide will take a look at the six important categories:

- Ease of Use

- Investment Options

- Fees

- Available Research Tools

- Customer Service

- Privacy and Security

First, let’s see a brief overview of each service.

What is Vanguard?

Founded by John Bogle in 1975, Vanguard is a client-owned mutual fund company. This firm prides itself as being one of the world’s largest investment companies.

To this day, Vanguard stands by its unique client-first business principle. In fact, this is what’s written on the first page of their website: “Vanguard isn’t owned by shareholders. It is owned by the people who invest in our funds.”

As of January 31, 2021, Vanguard’s global assets under management (AUM) is estimated to be over $7.2 trillion. Even more impressive, Vanguard serves nearly 30 million investors scattered across 170 different countries.

In terms of employees, Vanguard has a total of 17,300 employed workers. This number is both in the United States as well as abroad. The current chairman and CEO of Vanguard is Mortimer J. Buckley.

Simply put, Vanguard is a brokerage that has been around for nearly five decades. They are a sizable investment company that has quite a worldwide reach. Their incredible size and long track record serve as proof that they have what it takes to thrive in the investment business.

What is Robinhood?

Robinhood is a relatively new firm in the world of investment brokerages. Founded by Baiju Bhatt and Vladimir Tenev in 2013, Robinhood’s track record pales in comparison to Vanguard. However, Robinhood has a few things going for them despite this.

During its early years, Robinhood was a highly favored online brokerage. Their service was – and still is – the go-to for newer, younger investors. This is due to the simplicity of their app and the fact that Robinhood charges no trading fees—a feature that was unheard of during the time.

Robinhood’s other selling point is its ridiculously easy setup process. With just a few taps on their website, anyone looking to trade and invest is well on their way! Their offering requires no complicated requirements and no long waiting time.

Moreover, Robinhood was one of the first online brokerages to offer cryptocurrency trading—a feature Vanguard has yet to offer.

Currently, Robinhood’s assets under management (AUM) sits at an estimated $20 billion. This accounts for the assets owned by their 13 million customers all around the globe.

While their “numbers” don’t quite stack up with Vanguard, it is worth noting that Robinhood is less than a decade old but is growing at an incredible rate. If this continues, it’s conceivable that they could someday pass Vanguard!

Vanguard vs Robinhood: In-Depth Comparison

Now that we have learned a bit about the history of Vanguard and Robinhood, let’s have a look at how one compares to the other.

Ready? Let’s dive in!

Ease of Use

Any service that is difficult to use is practically useless. This applies to everything, even online brokerage platforms such as Vanguard and Robinhood. For this reason, this round in this comparison will be dedicated to answering the question: which service is more user-friendly?

Vanguard

When it comes to ease of use, Vanguard’s case is a bit of a mixed bag.

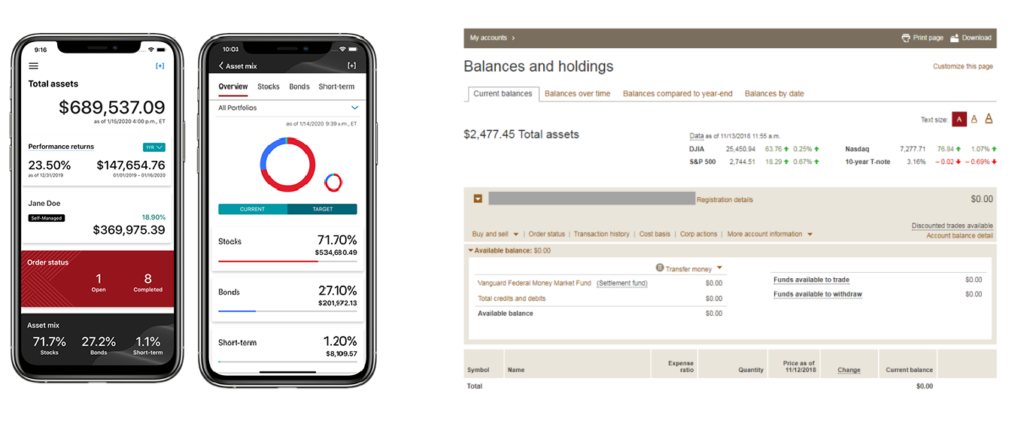

While their platform is available on both web and mobile, their design language and user interface are a bit old-fashioned. It seems as though their website and app have not received a revamp in the last few years!

Now, will this affect the usability of Vanguard to their customers? Definitely, but maybe only for the first few weeks of use. With a bit of getting used to, Vanguard’s service is manageable, to say the least.

Some argue that Vanguard purposely stuck with this kind of aesthetic as a symbolism for their long years of service. That said, whether you dig this old-fashioned feel or you despise it is entirely up to you.

Another thing to note about Vanguard is that its user verification process usually takes a few days. This is a major turn-off, especially when compared to other online brokers that offer verification in a matter of hours.

Robinhood

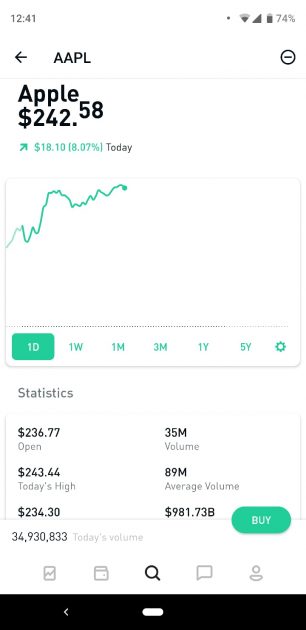

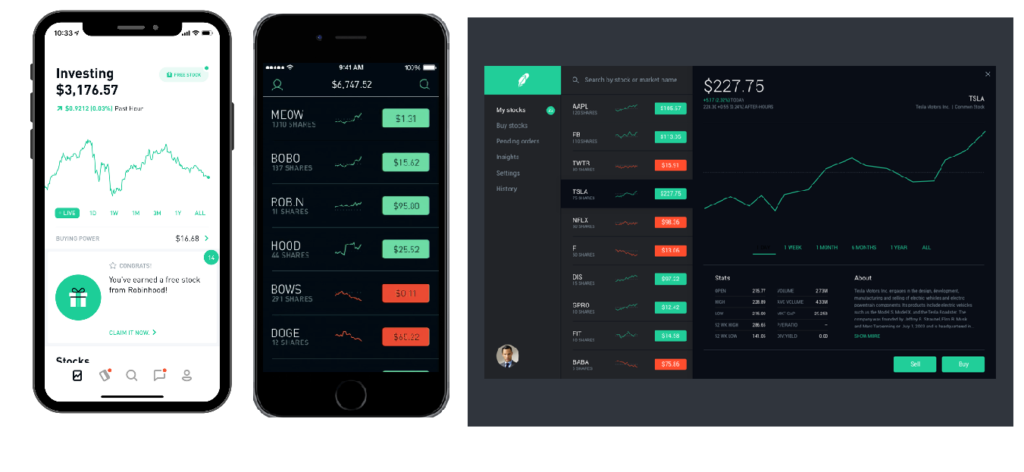

Robinhood’s approach is quite the opposite of Vanguard. Their design language is modern, simple, and inviting.

If you will be doing most of your trades on your smartphone, you will be pleased to know that Robinhood was specifically designed to work well on a mobile app – in fact, the app was originally the ONLY way to use Robinhood’s platform.

When opening Robinhood, you are greeted with big bold graphs showing the trend of your portfolio value. Robinhood also has a watchlist where you can see a list of your favorite stocks.

In terms of the verification process, Robinhood is blazing fast. New users can be verified in a matter of hours. However, if you are looking to use Robinhood to transfer funds larger than $1,000, then you will need to wait a few extra days.

In addition to the amazing mobile app, Robinhood also has a website version you can use. The website looks and feels extremely similar to the app, so you shouldn’t miss a beat regardless of what platform you’re using Robinhood on.

Winner: Robinhood

In terms of ease of use, Robinhood easily takes the crown. Its simplistic design language is more familiar to the modern investor. Moreover, the look and feel of Robinhood make navigating around the platform more seamless and intuitive.

Vanguard’s platform isn’t terrible. However, Robinhood’s platform is FANTASTIC, and one of the biggest reasons to choose Robinhood.

Investment Options

Perhaps one of the most important questions when choosing an online brokerage platform is this: What am I allowed to invest in this platform?

It is a waste of time to consider a platform that does not offer what you are looking for. So we’ll start the comparison by answering this exact question for both Vanguard and Robinhood.

While we’re at it, we will also take a look at the different account types for Vanguard vs Robinhood. This will give you an idea of what each service has in store for you.

Vanguard

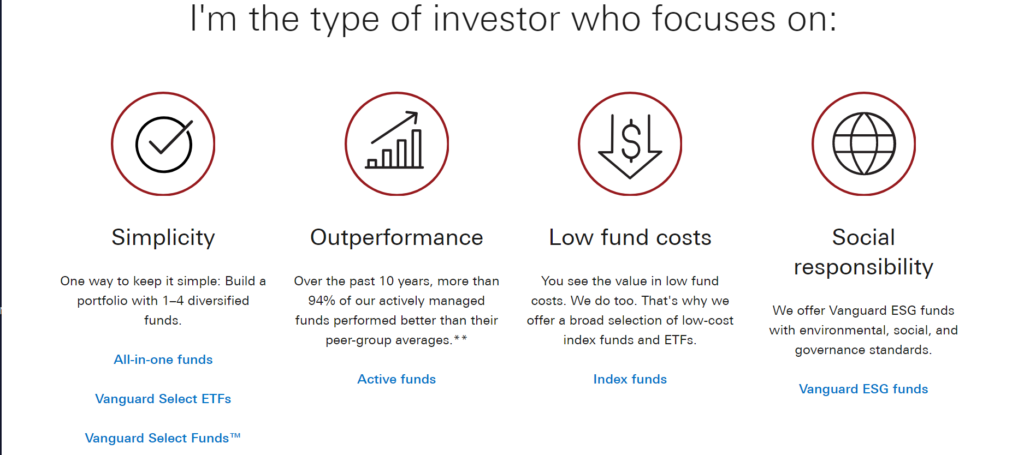

Vanguard offers a wide range of investment options. Their selection extends from ETFs and mutual funds to CDs & bonds and even other companies’ ETFs.

Moreover, Vanguard also offers commission-free trading whenever you buy or sell Vanguard mutual funds or ETFs. They also boast over 3000 different funds from other companies.

As of 2021, Vanguard customers can invest in the following:

- 3100+ mutual funds from other providers

- Cash Investments

- Bond Investments

- Stock Investments

- Hybrid Securities

- Mutual funds, ETFs, and Individual Securities

Despite this huge selection of investment options, there is one notable thing you will not be able to invest in Vanguard: cryptocurrency. Whether that will affect your decision-making process in choosing a broker depends entirely on if the ability to purchase Bitcoin and other Cryptos is something you’re interested in.

In terms of account types, Vanguard’s offerings are quite extensive. Here are the different account types you can have in Vanguard:

- Retirement Accounts: Roth & Traditional IRAs

- Advanced Retirement Accounts: SEPs, SIMPLEs & i401(k)s

- 529 College Saving Plans

- Individual Account

- Joint Account

Robinhood

When it comes to investment options, Robinhood’s offerings are narrower than Vanguard. While Robinhood offers crypto—a feature lacking in Vanguard—they lack a few industry-standard investment options – at least for now.

Robinhood’s main offerings include stocks and ETFs, cryptocurrencies, and ADR global stocks. They also offer options to invest in fractional shares, options, and recurring investments.

As of 2021, Robinhood customers can invest in the following:

- 5000+ U.S Exchange-Listed Stocks and ETFs

- Cryptocurrencies (BTC, ETH, and more)

- Options Contracts for U.S Exchange-Listed Stocks and ETFs

- 650+ Global Stocks through American Depository Recipients (ADRs)

A few things are noticeably lacking in Robinhood’s investment options: bonds and mutual funds. If you are an investor who’s looking to invest in these then you should cross Robinhood off your list of brokerage choices.

Robinhood is also lacking in the types of accounts you can open. Since Robinhood is focused on simplicity and ease of use, they only have a single account option: taxable brokerage accounts. If you’d like an IRA or any other tax-advantaged account, you’ll have to turn elsewhere.

Winner: Vanguard

While Robinhood is attractive for crypto traders, its investment options are narrower overall, as they lack bonds and mutual funds.

The same is also true when it comes to account types. Vanguard offers retirement accounts, college savings accounts, and individual & joint accounts. All of which are absent in Robinhood’s offerings.

That said, unless you are specifically looking at an online brokerage for crypto trading, Vanguard is a better bet. However, if you don’t mind the absence of bonds and mutual funds, you should stick around to see how Robinhood compares to Vanguard in other aspects.

Fees

The next thing to investigate when choosing an online brokerage platform is fees. In this part of the comparison, we’ll try to answer this question for both Vanguard and Robinhood: How much does it cost to use the service?

Most brokerages nowadays boldly advertise a $0 account minimum and a $0 charge for trading stocks and ETFs. While this is true for both Vanguard and Robinhood, you may still need to pay a price to access some of their services.

Vanguard

Vanguard has a $0 account minimum and there is a $0 charge for trading ETFs and stocks. This means that, other than the extremely small percentages taken by the mutual funds themselves, it is completely free to start using Vanguard. However, if you want access to other investment options offered by Vanguard, you need to shell out a bit of cash – although there’s usually a way to avoid even these uncommon fees.

Here are some highlights on Vanguard fees:

- $0 charge for buying and selling ETFs, stocks, and OTCBB trades

- $0 charge for account inactivity, account closure, and sending checks

- $0 commission on per-leg option trades

- $1 commission on per-contract option trades

- $20 annual account service fee (for accounts with less than $10,000 in Vanguard funds)

- $20 minimum fee per trade for Vanguard Live Broker

- $50 Mutual Fund commission for funds outside No Transaction Fee funds

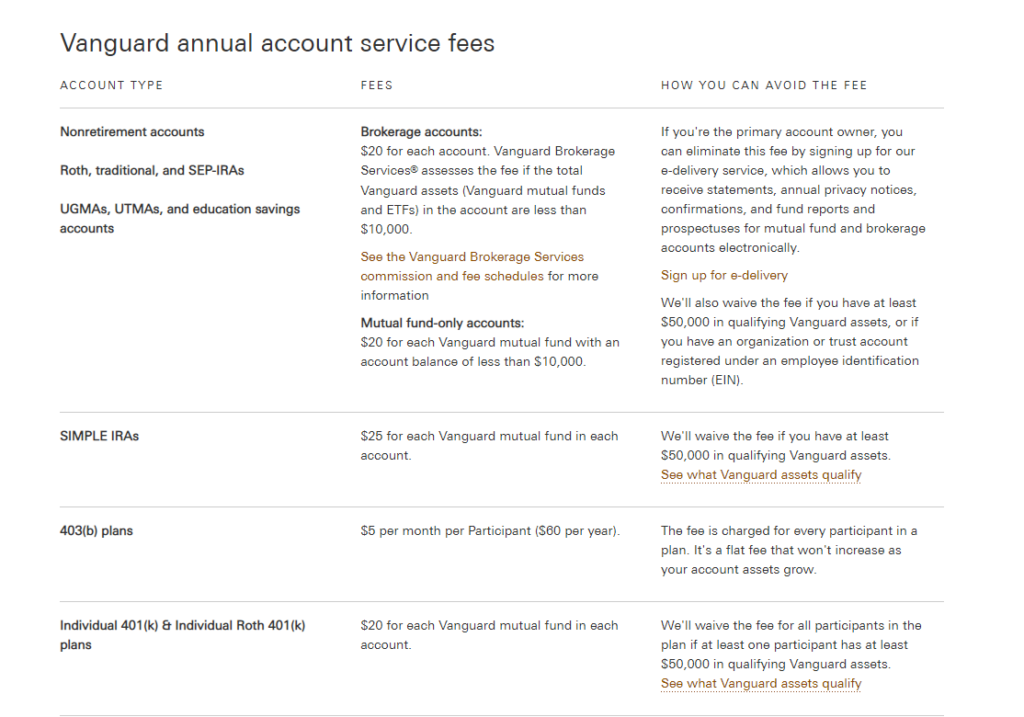

Moving over to account types and their respective costs on Vanguard, here are some things to take note of:

- $5 per month per participant in a 403(b) plan

- $20 for each mutual fund in a 401(k) plan

- $20 for each mutual fund in an Individual Roth 401(k) plan

- $20 fee for UGMAs, UTMAs, and education savings account

- $25 for each mutual fund in a SIMPLE IRA account

Robinhood

Similar to Vanguard, Robinhood also has a $0 account minimum and $0 charge for trading ETFs and stocks. That said, if you are willing to shell out some extra cash, you will have access to some paid features in Robinhood.

Here are some highlights on Robinhood fees:

- $0 charge on buying and selling stocks and ETFs

- $0 commission on per-leg options trade

- $0 commission on per-contract options trade

- $0 exercise and assignment fee

- $10 transaction fee for Robinhood Live Broker

- $25 minimum charge on wire fees (send or receive)

- $35 overnight domestic check fees

- $75 account transfer fee

Winner: Even

Vanguard was amongst the first innovators in offering mutual funds with cheap underlying fees during a time when paying high fees to a stock broker was commonplace. Similarly, Robinhood was amongst the first innovators in offering $0 trading fees during a time when trading fees were found on every brokerage.

As such, it’s clear that both of these services value their ability to offer you their services at as low a charge as possible. For that reason, this category results in a tie.

Available Research Tools

Now that you know about the investment options and fees on Vanguard and Robinhood, let’s compare the two in terms of some advanced features. For this part, we will try to answer this question: which service has a more complete and more useful set of tools?

If you are unfamiliar with research tools, they are basically investing-related tools such as screeners, calculators, and charting. While these tools are not necessary to make investments, they are essential for helping experienced traders beat the market.

Vanguard

Investment calculators and tools are features present in Vanguard. They claim that these resources are meant for both beginners and expert investors. However, this is not to say that their research tools are complete.

Here’s a list of the available research tools in Vanguard:

- Trading Ideas (provided by Argus Research and MarketGrader)

- Charting (with 15 technical indicators)

- News Feed (provided by Associated Press and MT Newswires)

- Fundamental Data

All of the tools mentioned above are industry-standard, meaning they are present in most online brokerages.

Possibly the biggest gripe one can have on Vanguard’s arsenal of research tools is that their charts are too basic. The number of available technical indicators is only 15.

Vanguard’s news feed is also average at best. While there is substantial information in their news feed, it is typically buried in boring blocks of text. There are no charts, pictures, or infographics on their feed.

Robinhood

Robinhood’s available research tools are very similar to Vanguard’s. That said, one thing that makes Robinhood’s research tools one step ahead is their user-friendliness.

Here’s a list of available research tools in Robinhood:

- Trading Ideas

- News Feed

- Fundamental Data

- Charting (with 5 technical indicators)

Trading Ideas, News Feed, and Fundamental Data are average at best on Robinhood. They serve their purpose just right but they are nothing special.

On the other hand, in terms of charting, Robinhood’s five technical indicators fall short compared to other brokerages. Their charts took a hit from their user-friendly approach in design. As you can see from the list above, Robinhood’s offerings are quite similar to Vanguard with the exception of their Professional Research tool.

Winner: Even

Neither of these platforms focuses too heavily on advanced tools, as their services are mostly geared towards newer investors. They each have the basics, but nothing beyond that, making this a draw.

Customer Service

Customer service is an aspect that should be highly regarded when choosing an online brokerage. A service with an accessible hotline or quick-response chat support will always be unbeatable. In this part of the comparison, we will be pitting Vanguard and Robinhood against each other to answer the question: which offers better customer service?

Vanguard

Vanguard’s customer service support is pretty solid overall, with both email and phone number options available. However, they currently lack a live chat option.

If you have some common questions in mind, Vanguard has a support page, where you can read some common FAQs, trending questions, and more. Pretty much the only form of support Vanguard lacks is a live chat feature.

Robinhood

Robinhood’s customer service is fine as well, but they lack a bit compared to Vanguard.

If you have a concern and need to talk to Robinhood’s customer service, you are stuck with emails. There is no 24/7 live chat support or even a telephone hotline to call. That said, at least Robinhood responds to emails quite quickly. Robinhood also has a support page similar to Vanguard. In there you can search for frequently asked questions as well as some articles on investing.

Winner: Vanguard

Between Vanguard and Robinhood, customer service is a bit better on Vanguard.

Despite lacking a 24/7 chat support feature, Vanguard offers both calls and emails as a medium of transaction for customer’s concerns, vs Robinhood offering email as the sole option.

Privacy and Security

Both Vanguard and Robinhood do not slack off when it comes to privacy and security, however, there are some differences worth noting. In this part of the comparison, we will try to answer the question: which service is safer to use?

Vanguard

Vanguard’s privacy and security measures are comparable to industry standards. Vanguard transactions, both through their website and through their app, are encrypted with a Secure Socket Layer (SSL) validation.

Moreover, they also offer options for easy yet secure authentication on their mobile app. This can be done via facial recognition or biometrics.

They also employ a “time-out” feature to automatically log out users after their accounts stay idle for a set amount of time.

In terms of the security of your investments, Vanguard is backed by excess SIPC insurance (this is different from standard SIPC insurance). This provides Vanguard clients with $49.5 million for securities and up to $1.9 million in cash limit for each client.

In addition to this, Vanguard is also a member of FINRA, a regulatory body for financial firms in the United States.

Robinhood

Much like the competition, Robinhood is on par with industry standards when it comes to privacy and security. All of their transactions are encrypted with a multi-layer SSL validation.

Similarly, Robinhood also offers authentication through biometrics and facial recognition on its mobile application. Also, as an added layer of protection, Robinhood encourages its users to use two-factor authentication.

This platform is also smart when it comes to dealing with logins on unrecognized devices. They avert data leakage and potential hacking by employing a six-digit code that is sent to a user’s contact number.

For the most part, Robinhood’s security is on par with Vanguard; however, this brokerage has one security feature that is missing: excess SIPC insurance. Nevertheless, Robinhood is still backed by standard SIPC insurance.

Winner: Even

As you have learned, Vanguard and Robinhood employ very similar tactics when it comes to protecting their users. The only major difference is the fact that it is backed by excess SIPC insurance. However, this difference won’t matter to anyone but the absolute richest investors, so this category ends in a draw.

Vanguard vs Robinhood Verdict: Which Should You Pick?

Vanguard and Robinhood are two compelling online brokerage platforms. While both have many similarities, each also has a handful of features that stick out.

That said, there will be no one-size-fits-all answer to this question. The platform you should pick is the one that suits your needs better.

Robinhood has the advantage when it comes to ease of use – their app and website are clean, smooth, and understandable even to the newest of investors, while Vanguard is a bit older and clunkier in comparison.

On the flip side, Vanguard has been around longer and offers more in terms of account and investment options. They also have a support phone number, something Robinhood lacks.

So, at the end of the day, both of these services are great. When deciding which one to pick, just look at the pros and cons listed above, and decide which are most important to you.

If I had to choose? Personally, I’m of the opinion that Robinhood is better for most users. The simplicity and ease of use is amazing for new and experienced investors alike, so unless you really need access to IRA’s or other account types, I’d stick to Robinhood.

Good luck on your investing journey!

Recommended Reading

Acorns Vs Betterment: Robo Advisor Face-off

Ever wondered which Robo Advisor is the best fit for you? Here we compare Acorns Vs Betterment and try to decide which is the better option.

Webull Vs Robinhood: Choose an Online Brokerage

Ever wondered which Online Brokerage is the best fit for you? Here we compare Webull Vs Robinhood and determine which is the better option.

Webull Review: Choose This Online Brokerage?

Looking for a new, awesome brokerage to use for trading stocks? Check out this Webull Review and see all the amazing features they have to offer!

Blooom review 2022: Optimize for Retirement

Need help managhing your 401K or other retirement account? Check out this Blooom review and see how much money and time you can save!

Wealthfront vs Betterment: Which Robo-Advisor is Best?

Deciding between Wealthfront vs Betterment? This review will help you decide which Robo-Advisor is the right choice for you!

Betterment Review 2022: The Best Robo-Advisor?

In this Betterment review, you'll see everything Betterment can do for you. Hop on board the Betterment Robo-advisor train now!