Before reading this Webull review, ask yourself a couple questions:

- Am I sure I want to actively trade stocks?

- Am I a beginner trader, or a more experienced trader?

If your answer to question 1 isn’t “Yes, absolutely”, check out this article on Robo Advisors before reading the rest of this review.

Robo Advisors are fantastic options and should be the first choice for many people.

If the answer to question 2 is “beginner”, read on, and then check out this article comparing Robinhood and Webull if you’d like to see how Webull compares to other popular options.

If you’re sure you want to be actively investing in stocks, and you don’t consider yourself a beginner, Webull is a fantastic brokerage option.

And hopefully, this Webull review will explain why.

Webull History

Webull was founded in 2017 and only first announced its app in 2018, which makes them a newcomer to the online brokerage game. This doesn’t mean they aren’t reliable – Webull is regulated by both the SEC and FINRA, so you should feel comfortable trusting them with your money.

Following the trend set by Robinhood and other online brokers, Webull wanted their app to be accessible to everyone, and so did away with all trading fees.

However, most of the new, free brokerages that were popping up focused almost SOLELY on new investors. As such, most lacked any advanced trading or research features.

Sensing an opportunity, Webull made sure to launch with a robust suite of tools that would appeal to new and experienced investors alike.

While online brokerages like Robinhood focused their budgets on designing their offerings to be user friendly to new investors, Webull sacrificed some design simplicity in order to load their App with an impressive amount of useful tools, making them a top choice for any advanced investor that was sick of paying trading fees.

With both desktop and App versions available, Webull has done a great job finding their place in a crowded field of online brokerages.

How Long Does it Take Webull to Approve Your Account?

Creating an account with Webull is fast and simple, assuming you’re a United States resident. If not, you’ll have to look for another option.

There are only 4 criteria necessary to open an account:

- Be 18+ years old

- Have a valid SSN

- Have a legal and valid US address

- Have a U.S. citizenship, U.S. permanent residency card, or a valid U.S. visa.

If the above applies to you, you’re well on your way to creating your Webull account. Just click this link, follow the instructions, and you’re good to go!

(And, as a bonus, if you sign up through any of my links on this page, you get 2 free stocks. Who can say no to free money?)

All that’s left to do is let Webull review your information and approve your account. New accounts are normally approved within a day, but sometimes could take a couple more days, so don’t freak out if you haven’t heard back right away.

Once your account is approved, you’re ready to start trading! All that’s left is to put a deposit through – your full deposit will take a few days to go through, but you will get up to $2000 of instant cash to trade with.

There are a few things to keep in mind when creating a new account.

Webull Account Types

For starters, you have to make sure you select the correct account type. There are 2 options: Cash Accounts and Margin Accounts.

Most people will want to start with a Cash Account. Margin Accounts will be discussed later, but are usually reserved for more advanced investors.

There is no minimum deposit amount for a Cash Account, but Margin Accounts have a $2,000 minimum.

Who is Webull Best For?

Webull strikes an interesting balance as an option for both new and experienced investors.

With no commission or trading fees, the appeal to new investors is obvious. However, other options such as Robinhood are simpler to use, making them better options for absolute beginner level investors.

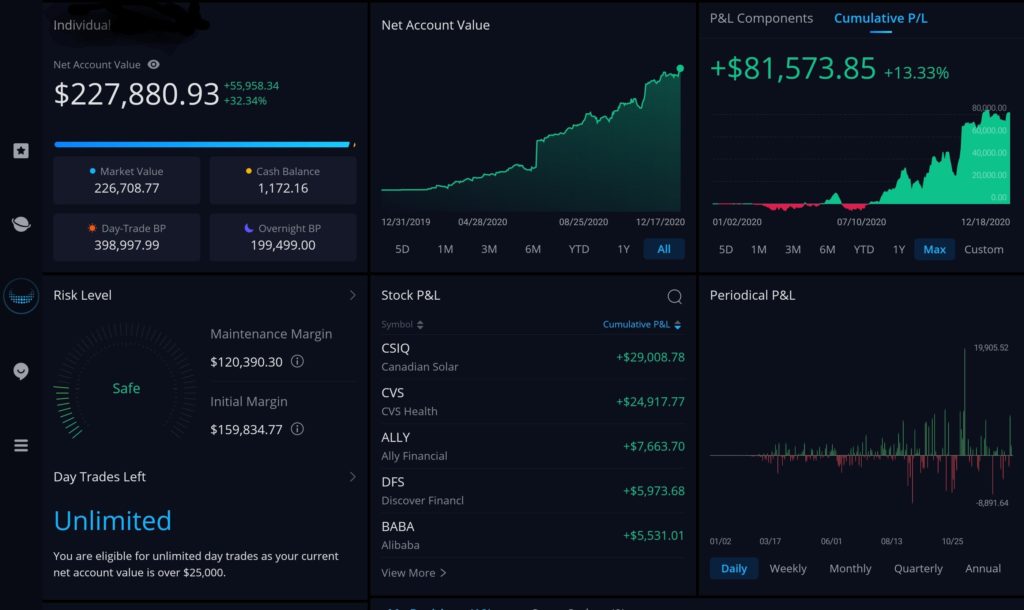

Where Webull shines is as an option for new/young investors that have a better understanding of the market or would like to gain that understanding.

Webull’s research tools and features aren’t quite as robust as what legacy options such as Fidelity or E-Trade offer, but within the newer, user-friendly online brokerage world they are unmatched.

So basically, if you are new and know nothing about the market? Get a Robo-advisor or use Robinhood.

If you’re more experienced? Use whatever option provides you with the research tools you need to succeed (whether this is Webull or another option).

If you’re somewhere in the middle? Webull is probably the best choice for you.

Deposit/withdraw from Webull

Transferring money in and out of Webull is simple as well.

2 deposit/withdrawal options are offered: ACH and Wire transfers.

Unlike wire transfers, ACH transfers are free, so they should be used whenever possible. However, there are some limitations.

The most obvious downside to ACH transfers is that they can take up to 5 business days for a deposit and 2 business days for a withdrawal, while wire transfers are usually completed within a day. Importantly, you do get access to up to $2000 of instant cash with an ACH transfer.

ACH transfers are also subject to a $50,000 limit, while wire transfers are not.

Webull Review: Advanced Features

The advanced features that Webull offers are probably the biggest reason to choose them over other zero-fee brokerages such as Robinhood.

As stated above, Webull offers a truly impressive amount of advanced features. While they won’t always match some of the features old heavyweight brokerages like E-Trade can boast, they are extremely competitive in the new age, low fee, simple to use world of online brokerages.

Here are some of my favorite features found on Webull:

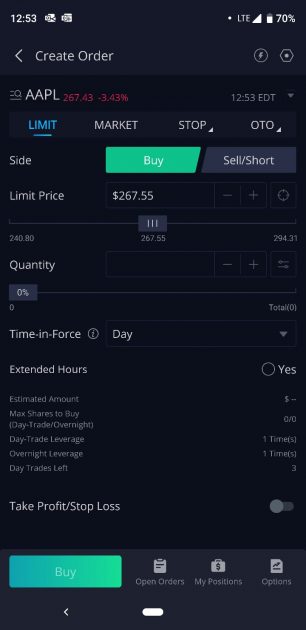

Multiple Order Types

Many order types are available. These include Limit orders, Market orders, Stop Loss orders, and One Trigger the Others orders.

Financial Metrics

TONS of metrics are available that can be used to evaluate stocks. Here a few of the metrics they show on their app:

- PE Ratio

- Return on Equity

- Return on Assets

- Earnings per Share

- Debt to Asset Ratio

- Net Margin

- Income by year

- Total Assets and Liabilities by year

- Cash Flow by Year

- Dividend Yield

- Volume

- And More

Each of these can be viewed directly in the App by clicking a stock, then scrolling to the “Financials” section.

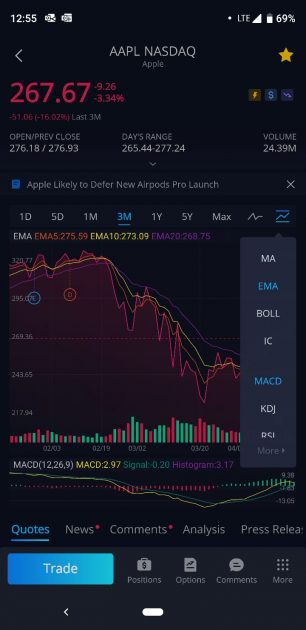

Charts

Webull Stock charts are extremely flexible. For starters, there are a lot of possible time horizons you can look at in their standard line chart: 1 day, 5 days, 1 Month, 3 Months, 1 Year, 5 Years, and Max.

If you prefer candlestick charts, Webull has that option as well. You can also choose to view this data charted by the minute.

Trading Simulator

Webull offers a Trading Simulator called “Paper Trading” that you can use to practice new stock strategies without risking any money.

This can be accessed directly from the app, allowing you to view your “practice” trades right along with your real trades.

There is a competitive aspect as well – a leaderboard is available within the Webull community showing the top gainers within the Paper Trading simulation.

Technical Indicators

If you’re a fan of looking at charts and using technical analysis to guide your trades, Webull has you covered. Here are some of my favorite indicators Webull displays on their App:

- Moving Averages

- Exponential Moving Averages

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

- Stochastics Oscillator (KDJ)

- And many more

These can each be viewed by clicking the button with 3 squares and a circle found at the top right of a chart and selecting “indicators”. The chart will then be updated to show your chosen indicator(s).

General Research tools

Webull has many tools that allow you to research specific companies beyond just looking at financials and charts:

- Recent news articles about the stock you’re interested in are available in the chosen stock’s profile under the “News” section.

- Expert Analyst predictions can be viewed in the “Analysis” section. This section includes buy/sell ratings, price targets, support levels, short interest, and more.

- Recent Press releases by the company in question can be viewed in the “Press Releases” section.

- General information about your stock industry is in the “Profile” section. This section also includes the names of all key executives at the company.

- The ability to store any stocks you’re interested in on a Watch List. Do this by clicking the star button at the top right of the app once you select a stock.

- The ability to set alerts when the price of a stock hits the desired level.

- General information about markets as a whole. This can be viewed in the “Markets” section of the app. Information such as overall market performance, Net Inflow, top Gainers and Losers, highest volume, and best performing industries can be found here.

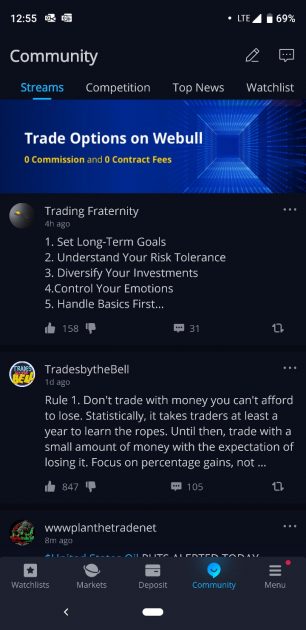

The Opportunity To Be A Part Of A Community

Webull has many options for people who want to interact with other stock pickers.

Clicking the “Community” button at the bottom of the app will grant you access to the Webull community.

Here, you can view the latest thoughts from other Webull users, share your own thoughts, see the top news articles pertaining to the market, and view the Paper Trading leaderboard.

You can also comment on specific stocks and vote “bullish” or “bearish” on stocks you like/don’t like from the stock’s page, and see predictions from other users as well.

There are other tools included in Webull as well, but the above are my favorites. The only way to see which tools you prefer is to try the App out yourself!

Webull Review: Available Investments

Webull doesn’t offer as many stock choices as some of the biggest players, but they do boast a fairly robust package of asset classes to trade, including:

- Over 5,000 U.S. Exchange-Listed Stocks and ETFs

- Options Contracts for U.S. Exchange-Listed Stocks and ETFs

- ADRs for over 250 Globally-Listed Companies

- Options trading

- Cryptocurrency

Webull occasionally adds to their offerings as well. For example, options and Cryptocurrency trading didn’t exist until 2020.

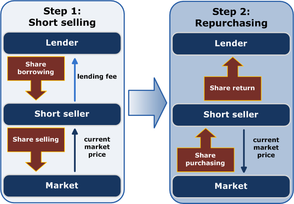

Can You Short Stocks On Webull?

Yes you can!

Shorting a stock basically means that you borrow money from the brokerage to buy a stock and instantly sell it, with the plan to buy it back at a later date. Consider the following example:

Stock A is worth $100, however, I think in a few months the value will decrease and the stock will only be worth $50. How can I use this prediction to make money?

Instead of buying a stock, you can essentially borrow a share of Stock A from the brokerage and sell it. You now owe the brokerage 1 share of Stock A and have $100 in your pocket.

If in a few months Stock A is only worth $50, you can buy a share of Stock A and return the share to your brokerage. However, since the stock only costs $50, you still have an additional $50 of profit that you get to keep (minus fees and interest).

Webull supports Short Selling – All you need is a margin account and at least $2,000 in your account.

While short selling can seem appealing, be cautious before deciding to utilize it. The stock market tends to go up over time, so by betting on a stock to go down, you’re in essence swimming AGAINST the current, whereas by betting on a stock to go UP, you’re swimming WITH the current.

Shorting a stock can occasionally work in the short term, but long term it’s usually a losing bet.

Is Webull Safe? Webull Review: Security

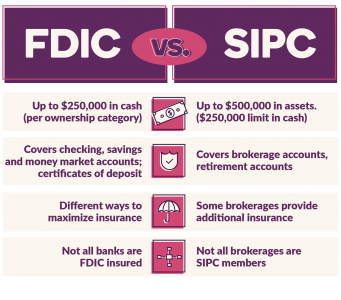

Webull is SIPC ensured. This means that your money is 100% ensured up to $500,000.

So, even if Webull goes bankrupt, you will still get your money back up to $500,000.

Even if you have more money than that in Webull, it shouldn’t be a problem.

SIPC also requires constant regulatory checks to ensure that Webull is keeping your invested money separate from company money.

As long as your money is kept separate, it will still be there even in the case of bankruptcy.

So, you shouldn’t have to worry about your money when it’s in Webull – even in the extremely low chance of bankruptcy, your money is either insured, or steps have been taken to make sure your money remains separate.

In addition, Webull’s clearing firm, Apex Clearing, purchased an additional insurance policy to protect your money even after the $500,000 that SIPC protects. This additional policy protects your securities up to 37.5 MILION.

While it’s extremely unlikely this will ever be necessary, having extra security is never a bad thing, especially since Webull will often appeal to bigger, more experienced investors who have more than $500,000 invested.

There isn’t much information about this additional policy on Webull’s website, other than the fact that it exists.

So, it’s tough to determine whether this policy can be trusted as much as SIPC, which is an official, federally mandated program overseen by the SEC.

However, at the very least it’s another layer of protection to help you sleep better at night.

In short: I’d trust my money with Webull as much as I would trust it with any other brokerage.

Webull Review: Privacy

Webull takes many preventative actions to help keep your information protected, but a lot of the responsibility falls to you.

Here are the features they offer:

- All passwords are encrypted

- Other information, such as Social Security numbers, is also encrypted

- Two-factor Authentication

However, none of this matters if you don’t take the necessary steps to protect yourself.

So, you can’t solely rely on Webull. Review your own safety procedures as well if you want to avoid cybercrime.

Having a strong password is the first step towards protecting yourself.

Two-factor authentication is also a great way to increase protection, as it forces cybercriminals to get through an additional layer of security.

Overall, if you’re careful to select a strong, unique password, use 2FA, and generally just practice common sense, you shouldn’t have any issues.

Webull Review: User Interface

Webull’s User Interface is… just ok.

The UI isn’t terrible. They have both an App and Desktop version, and both get the job done.

However, the more features packed into a single service, the harder it can be to navigate.

Webull attempts to pack TONS of research features into their offering. For more advanced traders, this is great: Advanced traders are comfortable with “trading lingo” and can comfortably navigate throughout the App to find the information they need.

For more beginning investors, seeing a bunch of indicators, different types of charts, and overall a lot of “noise” can get overwhelming. It can also make it difficult to find the more basic information that they really want within Webull’s UI.

Overall, I’d say you have to download the App and try it out before making a judgment. Everyone has different tastes and experience levels, so while some may get a bit overwhelmed, some may find that the UI suites them just fine.

If you find yourself struggling to understand what’s going on, Robinhood may be a better choice for you, at least initially.

Webull Vs Robinhood

Most people that are deciding whether to use Webull are choosing between Webull and Robinhood, 2 fairly similar options.

For a detailed breakdown explaining the differences between the 2 online brokerages, read this article.

If you’d just like a quick rundown, view the following table below:

Webull Review: Fees

Webull is famous for offering zero-commission trades. However, many others offer this and charge for other features: Robinhood Gold is a famous example.

Webull, on the other hand, doesn’t have a paid membership program, or anything like that.

However, there ARE rare times when you would have to pay for something. Let’s go through them now:

Margin Accounts on Webull

Trading in a Margin Account is a feature Webull offers where you can borrow money in order to buy stocks or ETF’s.

This increases the potential reward, but also the potential risk.

For example: Let’s say you have $10,000 in your account available to invest, and you’re EXTREMELY confidant that Apple’s stock (AAPL) will increase in value.

You can choose to invest a total of $10,000 into Apple, which is already extremely risky since you’re going all-in on a single stock. However, if you would like to invest even more than that, you can borrow money from Webull – say, another $10,000 – and invest the total $20,000 into Apple.

Let’s say Apple doubles in value. Your $20,000 has now become $40,000, and you can choose to sell the stock, pay back the $10,000 you borrowed from Webull (plus fees, which we’ll get to in a moment), and still be left with a $20,000 profit, vs the $10,000 profit you would have made if you didn’t borrow on margin.

However, let’s now assume Apple LOST 50% of its value. Your $20,000 in Apple stock is now only worth $10,000, and you still owe $10,000 (plus fees) to Webull to pay back the money you borrowed.

So, in this scenario, you are now left with nothing. If you hadn’t borrowed money, you’d still have $5,000.

So, Margin trading should be done very carefully, and you should never extend yourself too far.

When Margin trading on Webull, you must always have at least $2,000 in your account. If your balance falls below this, Webull will sell some of the stocks that you currently own in order to get back to the $2,000 threshold.

You are also limited in how much margin you can take out at a time: the limit is 4x the amount of money in your account.

So, if you have $10,000 in your account, you can take up to $40,000 in the margin at a time (note: I do NOT recommend this).

If you’re set on Margin Trading, interest fees will be charged based on how much you borrow. Here are the fees you’ll be paying:

- $0-$25,000: 6.99%

- $25,000.01-$100,000: 6.49%

- $100,000.01-$250,000: 5.99%

- $250,000.01-$500,000: 5.49%

- $500,000.01-$1,000,000: 4.99%

- $1,000,000.01-$3,000,000: 4.49%

- > $3,000,000: 3.99%

These fees are mostly in line with what you can expect elsewhere, with slightly high than average rates at the lower margin amounts, but slightly LOWER rates at the higher margin amounts.

As you can see, fees decrease the more you borrow. However, the more you borrow, the higher the risk you’ll lose everything, so again, just BE CAREFUL.

Wire Transfers Fees

Webull’s wire transfer fees are slightly higher than normal. Likely, most people won’t need to use a wire transfer very often, so these fees don’t often come into play.

Here is Webull’s fee breakdown for wire transfers:

- US domestic deposit: $8

- US domestic withdrawal $25

- Non-US deposit $12.5

- Non-US withdrawal $45

ACH deposits are free, so if possible, aim to avoid wire transfers and stick to ACH.

Transfer of securities Fee

In the rare case where you would like to transfer securities directly from Webull to another broker, Webull will charge you a $75 fee.

This is almost never necessary. Except in extreme circumstances, you should always be able to simply sell your equities, transfer the money to your bank, send the money to the other broker, and buy the stocks again.

Other than that, there are 0 fees associated with Webull. Everything else on their site is 100% free.

Webull Review: Customer Service

Webull offer’s a customer service phone number, email address, and numerous help articles across their site on many topics related to using Webull.

The phone support is great; with a platform slightly more complicated to use than would be ideal, having a person to call with your questions is very useful.

Quick note: Make sure to select option 4 once you hit the menu when calling Webull. That’s the only way to actually reach a real person; otherwise, you’ll just get an automated message.

Email support is good as well if you don’t like waiting on hold – during busy hours the hold times can get pretty long. However, email responses are pretty slow, so I wouldn’t rely on it if you need an answer right away.

Unfortunately, the help articles aren’t usually too helpful, in my experience. I’ve spent a lot of time trying to find articles about specific topics on their site, without much luck.

The layout is poor, certain topics aren’t addressed, and overall finding information from their site is just more difficult than it should be. In fact, it’s often easier to find information about Webull from third-party sources instead of directly from their site, which shouldn’t be the case.

Is there a bonus for signing up?

Yes, there is! If you sign up for Webull through any of the links throughout this Webull review, you’ll receive up to 2 stocks absolutely free!

The first stock you get just for making an account. This stock can be worth anywhere from $2.5-$250.

If you want the second stock as well, you’ll have to deposit at least $100.

This stock will likely be more valuable than the first one, as it can be valued anywhere from $12-$1400!

Webull Review: Pros and Cons

Pros

- No fees. This is the first reason to start using an online brokerage like Webull.

- Advanced Research Tools. Compared to their competition in the online brokerage world, Webull’s research tools and features are second to none.

- Many purchasing options. This includes stocks, ETF’s, Options Trading, Margin Accounts, and more.

Cons

- You have to make decisions for yourself. Webull isn’t a Robo-advisor – they’ll give you the tools to pick stocks on your own, but at the end of the day, it’s your responsibility to make sure you’re buying the right stocks.

- User interface. While not horrible, it isn’t quite as user friendly as other options like Robinhood.

Webull Review: Bottom Line

As I’m sure you’ve seen after reading this Webull review, for many people Webull is an extremely competitive option in the online brokerage world.

While zero-fee brokerages are quickly becoming commonplace, Webull fills a niche where it has more research tools than most new age, beginner-friendly online brokerages, while still being relatively friendly to new investors.

There’s a lot to like about Webull. In addition to offering 0 fee trading, the best part about Webull is all the research features they offer.

While still not quite reaching the levels of the big, legacy brokers, they just about packed as many features as they could into their app while still remaining relatively beginner-friendly.

Customer service is solid, your money is safe, competitive privacy features are offered, and enough equities are available to trade for 99% of investors.

In short? Webull is a great brokerage, especially for the intermediate investor.

Use them with confidence.

Recommended Reading

Acorns Vs Betterment: Robo Advisor Face-off

Ever wondered which Robo Advisor is the best fit for you? Here we compare Acorns Vs Betterment and try to decide which is the better option.

Webull Vs Robinhood: Choose an Online Brokerage

Ever wondered which Online Brokerage is the best fit for you? Here we compare Webull Vs Robinhood and determine which is the better option.

Blooom review 2022: Optimize for Retirement

Need help managhing your 401K or other retirement account? Check out this Blooom review and see how much money and time you can save!

Wealthfront vs Betterment: Which Robo-Advisor is Best?

Deciding between Wealthfront vs Betterment? This review will help you decide which Robo-Advisor is the right choice for you!

Betterment Review 2022: The Best Robo-Advisor?

In this Betterment review, you'll see everything Betterment can do for you. Hop on board the Betterment Robo-advisor train now!

Vanguard vs Robinhood 2022: Best Online Brokerage?

Want to start investing, but not sure which service to use? Check out this guide comparing Vanguard vs Robinhood and decide now!